Academy Sports and Outdoors: Still A Rational Buy In A Tough Market Environment

Summary

- Academy Sports and Outdoors has outperformed the market and is a standout in the retail industry.

- The company's valuation is cheaper compared to DICK'S Sporting Goods, despite similar gross margins.

- Academy's revenue growth, earnings per share, and returns on invested capital make it an appealing investment option.

Yagi Studio

Investment Thesis

Academy Sports and Outdoors (NASDAQ:ASO) remains a cheap, quality stock in an otherwise tough market environment. The industry troubles surrounding leader DICK'S Sporting Goods (DKS) have not seemed to translate over to the company yet, and the recent earnings report was encouraging, with revenues coming in line and EPS surpassing estimates. Full-year guidance was also raised, and the results confirmed that shrinkage was not as bad as feared, with margins holding up and earnings staying strong. Expansion of store count over the last few years has been going quite well, and at just a 7x forward earnings multiple, Academy still seems cheap given the recent expansion with profitable growth continuing as the company hits its targets.

Introduction

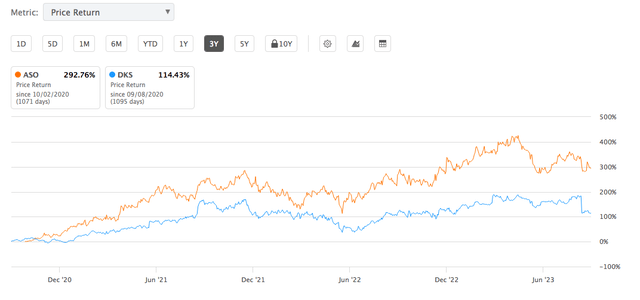

I first wrote about Academy Sports and Outdoors in 2021 after stumbling upon the stock during my research into the outdoor retail and leisure industry and found it cheap on an earnings basis and also noticeably cheap compared to DICK'S Sporting Goods, which is the market leader in the same industry. Academy's growth is impressive, and the company is poised to continue earnings growth which the market does not reward with a high multiple, at least not yet. Since that initial article, the stock has quietly outperformed DKS as well as the broad market over the same time period and remains a good value even now. 2022 was not a great year for the broad market, but diversifying into stocks like Academy helped investors cushion the blow from a rising interest rate environment and a re-rating of many high multiple stocks held in index funds.

While many retail stocks have been getting hit lately due to margins, shrinkage, and profitability, Academy is bucking the competition and proving to be a standout in the industry. The outdoor and leisure sector looks especially interesting, considering that DICK'S Sporting Goods has been dealing with issues surrounding theft and inventory shrinkage, bringing margins down and making profitability more of an issue. Academy is not dealing with the same issues as DICK'S, but has its own challenges which separate it from the competition.

In this article, I will further discuss the valuation of ASO compared to DKS, and offer insights on why the company could be a better investment going forward.

Strong Margins, Ability To Outperform

Academy Sports and Outdoors has recently been experiencing strength in margins, which is in contrast to DICK'S Sporting Goods. The recent quarter showed an improvement in gross margin to 35.6% and operating margins of 13.3%, compared to just 9.7% operating margins for DICK'S. Before the earnings report was out, the market had already reacted strongly to comments DICK'S made about theft and shrinkage, which is something that is becoming more of an issue for many retail businesses as of late. However, Academy's financial results do not seem to indicate that theft is a major problem, at least not yet. The company is continuing on a path of profitable growth, opening new locations and expanding the market's awareness of the business.

The profitable expansion phase of a business is something that is prime investing for those with a long-term mindset, and if you can manage to own a piece of a business which is experiencing this, the results can be extraordinary. Impressive growth combined with strong profit potential can create an environment for self-funded growth, which tends to lead to outperformance against other companies in the same sector.

ASO compared to DKS (Seeking Alpha)

As seen in the chart above, Academy has handily outperformed the industry leader, DICK'S, in terms of share price return since going public in late 2020. The market reaction to the recent earnings report provides a rational buying opportunity for long-term investors who wish to add to a position here. DKS is also not what I would call "expensive" at the moment, but the company is having some issues related to margins and shrinkage, which makes the 10x earnings multiple high compared to Academy's at just 7x.

Academy enjoys a trifecta at this fork in the road - good margins, good growth, and good profitability to match. The retail presence is growing rapidly, as the company has now expanded from the southern US and more north, into the Midwest and Indiana. Compared to DICK'S Sporting Goods store count, the company is still much smaller, with room to expand over the next several years. While competition could still be seen as a risk, the business results have stayed strong during a time when many other retailers have stumbled and run into big issues with profitability, inventory management, and shrinkage. While these developments are short-term focused, a buying opportunity could come for patient investors who are determined to weather the storm in retail stocks.

Valuation Metrics - PE, EV/FCF, and ROIC

Academy is a cheap stock by nearly all valuation metrics; the FWD price-to-earnings ratio is only 7x and given the company's earnings growth, there is room for future multiple expansion. The current market environment seems to be discounting retailers across the board, as DICK'S continues to trade for around 10x earnings, but the premium valuation still holds up for the company. In this regard, Academy still seems like the cheaper stock with better underlying fundamentals.

The EV/EBITDA ratio for Academy is also glaringly low at just 5x, and the EV/FCF metric is low at 11.4x, making the stock increasingly attractive on an earnings and free cash flow basis. Since my original article on Academy, the price-to-book value ratio has become even better, going from 2.7x book to 2.4x. This is a good sign, as the stock has actually outperformed peers and the broad market as well while becoming quantitatively cheaper on these valuation metrics. DICK'S Sporting Goods trades at a price-to-book ratio of 3.6x, indicating that the market is still willing to give the market leader a premium valuation.

While the market reacted strongly to DICK'S recent earnings report, the sell-off in Academy (in sympathy) seems largely overdone. Taking advantage of market overreactions and adding to positions while valuations are low is one of the best ways to boost long-term returns in a given stock, considering that the company is continuing to execute well and has a low valuation. Academy is certainly continuing to execute well, as evidenced by the recent earnings beat and expansion into new markets with strong profitability.

In addition, Academy's returns on invested capital have continued to hold up, which makes the stock a standout in a tough market environment. Returns on invested capital are great, with ROIC coming in above 15% consistently since 2021, and several quarters even approaching the 19-21% range. Return on equity is also very good, but is more similar to DICK'S and has been trending lower since last year.

Risks To A Bullish Thesis

Academy is facing increased competition, which is a major risk to keep in mind, and a potential economic recession would impact results negatively. Given that this company is a retailer, a decrease in consumer spending would hurt more than other stocks in different industries. While theft and shrinkage are not hurting the company much as of right now, this could increase in the years ahead and cause issues with margins and profitability, as is the case with DICK'S Sporting Goods right now.

Inflation is also coming down compared to prior years, but persistently high-interest rates to combat this are something that the market is still getting used to. I believe that issues related to inflation, uncertain consumer spending, and shrinkage all contribute to the risk profile, but this is largely reflected in the company's current valuation already. While Academy recently raised full-year guidance with EPS estimates between $6.95 and $7.65, the market seems to be discounting these earnings already, as evidenced by the reversal from the earnings pop from August 30th to 31st.

ASO Earnings Reaction (Google)

After a nearly 10% correction since the earnings report, the stock is trading at a favorable valuation and represents a good buy for long-term investors, despite doubts about future profitability. While there are many risks to retailers in the current market environment, Academy is a company that has done a fantastic job managing this environment and beating estimates while continuing profitable growth.

Conclusion

Academy Sports and Outdoors remains a rational buy in a tough market environment for retailers. The stock is quality - with great returns on equity and returns on invested capital, and is noticeably cheap on nearly all valuation metrics, despite strong execution and continuation of profitable growth. With intentions to continue expansion and enter new markets, there is a possibility for future multiple expansion as revenues and earnings increase. While DICK'S Sporting Goods is facing issues related to margins and shrinkage, the company's stock continues to trade at a premium to Academy's on a P/E and Price-to-Book value basis. This makes Academy an exceptional value stock at this moment in time, as operating margins have held up compared to DICK'S in recent quarters. With a forward P/E multiple of just 7x, Academy still appears to be the better pick in the outdoor and leisure sector of the market. I currently view ASO as a rational Buy in a tough market environment.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ASO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.