Euroseas: Not A Buy, But Better Placed Than Its Peers

Summary

- Euroseas Ltd is a global ocean-going transportation service company specializing in feeder and intermediate containerships.

- Supply-demand dynamics within the containership industry aren't too positive, but ESEA is better placed to cope with these pressures.

- Relative to its own history, ESEA's forward valuations look pricey, but compared to its peers, the situation is a lot more palatable, particularly considering the EBITDA growth outlook for FY24.

- The risk-reward on the charts looks unappealing at this juncture.

shaunl/E+ via Getty Images

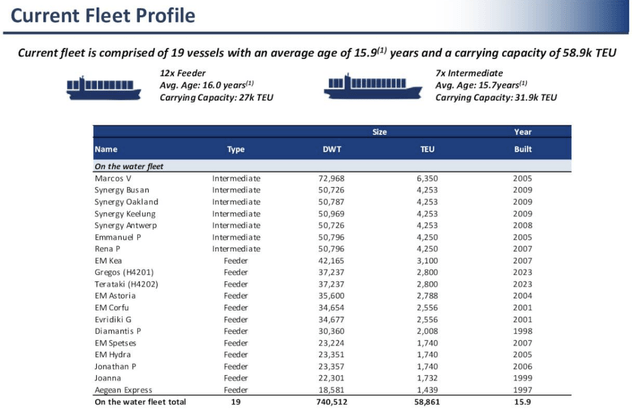

Company Profile

Euroseas Ltd (NASDAQ:ESEA), is a global ocean-going transportation service company, that has been in existence for close to 19 years now. Whilst ESEA previously did enjoy some exposure to the dry-bulk market, over the last five years or so, it has pivoted to becoming a pure containership entity, with expertise in feeder (ships with carrying capacity of 300-500 TEU, accounting for 63% of the existing fleet) and intermediate containerships (36% of the existing fleet). Its fleet is involved in the transportation of mainly manufactured goods and perishables via refrigerated and dry containerized cargoes.

The Containership Industry Isn't Best Placed, But ESEA Is In A Slightly Better Position

Higher cost of living challenges and a relatively more heightened interest rate regime around the world have largely knocked the stuffing out of the global containership industry. After a strong base year in 2021, 2022 was always going to be difficult to replicate, from a growth perspective, but even in the current year, containerized trade will only grow at an unremarkable pace of 1% p.a. (These forecasts may well need to be scaled down, as, in volume terms, global trade is down by -0.8% in Q1, and -0.3% in Q2, so one is asking for a big step-up in H2 which doesn't look likely given the macro environment). These pressures are expected to linger, well through H1-24, and it's probably only in H2-24 that one begins to see some tenuous signs of resilience.

In addition to a subdued demand-side environment, port congestions which were a lingering theme for much of 2021 and 2022, seem to have abated in a big way, boosting the available capacity. Given these unfavorable dynamics, investors would do well not to expect a significant improvement in the global container freight index.

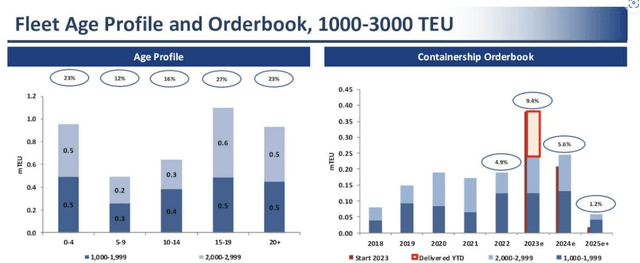

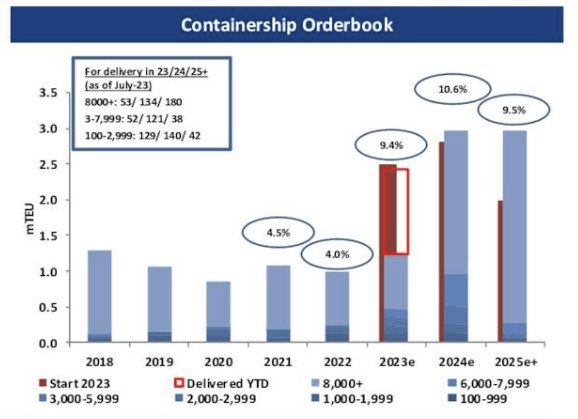

What is also likely keeping a lid on charter rates, is the likely ramp-up in new deliveries of containers this year. Already as of July 2023, the industry had seen 960000 TEU of new capacity come into the system (which is more than what was seen across the whole of 2022); expect this theme to be a dominant talking point all through 2025 at least. Basically, the ratio of new deliveries as a function of the existing fleet which only stood at the 4% levels last year, is expected to cross double-digits next year. Yes, more stringent regulations may help speed up the demolition of old vessels, which could abate some pressure coming from the new adds, but that will likely be a drop in the ocean.

Q2 Presentation

Amidst this damp backdrop, we think Euroseas is better placed because it dabbles in the smaller feeder and intermediate containership space (mainly ships in the 1000-3000 TEU bracket, which also only accounts for just 8% of the total capacity in the system) where the headwinds from new orders is less pronounced. The order book share as a function of the existing fleet for the 1000-3000 TEU bracket is expected to slide to 5.6% next year and drop even further to 1.2% putting less pressure on the capacity. Crucially, around 50% of the existing fleet is already quite aged (meaning over 15 years). All in all, this scenario would benefit operators of younger fleets such as ESEA, whose average age of its entire fleet is less than 16 years. Expect the overall age to dip even further, as next year ESEA will see seven new feeder ships with a carrying capacity of 16000 TEU come into its network.

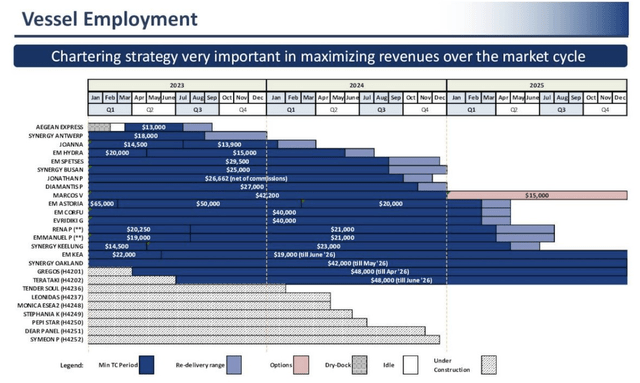

Another reason why investors don't need to overly fret is that ESEA is not susceptible to the vagaries of the spot market (as of March 2023, all their vessels were employed under time charter contracts), and as a result of this set-up, one gets better revenue visibility over time. For context, note that as of August 2023, the company had already locked in close to two-thirds of its charter rates for 2024.

The visibility that comes from contracted revenue through the next 12-18 months, adds a degree of confidence to the company's ability to service its attractive yield, currently estimated to be at an attractive 7.65%, around 550bps higher than the 4-year average. ESEA Management has also mentioned that based predominantly on the charter adjusted market value of their fleet, the NAV of this business is around 50% higher than the current share price. To help reduce this gap, share buybacks are expected to be a dominant theme of the ESEA story, and may help support the share price. For context, note that at the end of Q2, ESEA still had around 40% of its $20m worth of share buybacks that are yet to be deployed.

Valuations and Financial Outlook

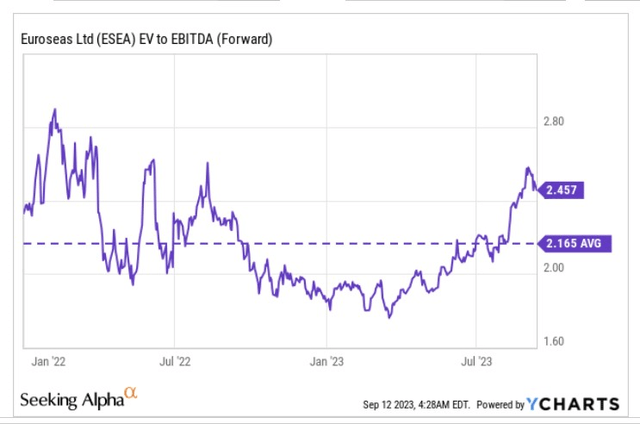

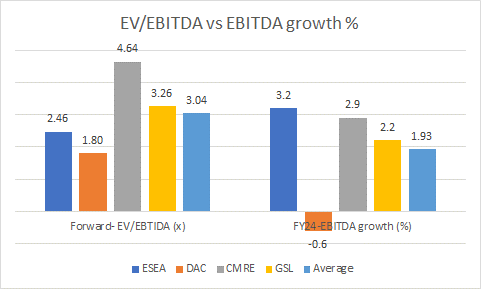

At the start of the year, the ESEA stock was trading at a huge discount to its historical average, but that narrative is no longer in play. For further clarity, note that the stock is currently trading at a forward EV/EBITDA of 2.46x, which translates to a double-digit premium over the 5-year average multiple.

However, let's also try and look at this multiple from a different viewpoint. For instance, if one brings some of ESEA's closest publicly listed containership peers into the mix, such as Danaos Corporation (DAC), Costamare (CMRE) or Global Ship Lease (GSL), the valuation picture doesn't look overly prohibitive. In fact that sub 2.5 EV/EBITDA multiple actually works out to a 20% discount to the peer-set average.

YCharts

More crucially, consider the relatively superior quantum of EBITDA growth that ESEA will likely deliver next year. YCharts estimates point to estimated EBITDA growth of 3.2% next year, which is not only around 125bps higher than the peer-set average EBITDA growth, but it is also the best EBITDA growth on offer in this space.

Closing Thoughts - Technical Considerations

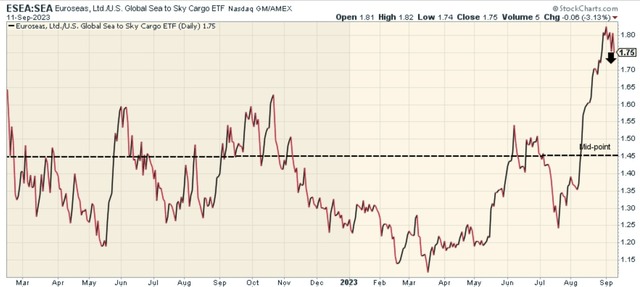

When it comes to the charts, we're afraid the reward-to-risk equation for a long position isn't too supportive at this juncture. The chart below provides some insight into how ESEA's stock is positioned relative to its global peers from the sea shipping and air freight industries. The takeaway here is that the ESEA stock looks rather overbought, with its relative strength (RS) ratio currently trading around 20% higher than the mid-point of its long-term range. Because of the overextended nature of the RS ratio, it is unlikely to benefit from rotational momentum within the sea and air freight universe.

If we switch our attention to ESEA's own price imprints over the last two years or so, we can see that this stock has tended to oscillate within a certain range (the two black lines roughly around the $17-$30 levels). In March this year, we saw the stock form a double bottom around the $17 levels, an area it had last revisited in July 2021, and from thereon until August, we saw a fairly healthy uptrend take place within a reasonable ascending channel (two red lines). However, since August, we've seen some huge candles break past this channel, only to lose momentum over the last two weeks. Don't be surprised to see the price drop back into the channel.

All in all, considering where the price is currently perched in the context of the 2-year trading range, we feel the reward-to-risk equation is quite unappealing at less than 0.5x (you ideally want to pursue long positions when the R:R is over 1x).

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)