EFR: Leveraged Loan Fund For A Soft Landing, 10% Yield

Summary

- The Eaton Vance Senior Floating-Rate Trust is a fixed income closed-end fund that invests in floating rate leveraged loans.

- The fund has a high yield of 10.8%, which is fully supported.

- The CEF is an appropriate vehicle to monetize the market views on higher for longer rates and a soft landing scenario.

- The fund comes with a -7% discount to NAV, but expect the discount to persist until the Fed starts aggressively cutting rates.

Henrik5000

Thesis

The Eaton Vance Senior Floating-Rate Trust (NYSE:EFR) is a fixed income closed end fund. The vehicle comes from the Eaton Vance family, and benefits from the research and analytics platform provided by Eaton. With rates higher for longer and with many analysts now expecting an economic soft landing, EFR might be an appropriate vehicle to take advantage of this view. The fund is composed of floating rate leveraged loans which have a very short duration, with the only notable risk being credit risk. The potential lack of a recession should therefore mitigate any notable widening in credit spreads.

The fund's primary objective is to provide a high level of current income, and it achieves said objective via a leveraged portfolio of floating rate loans:

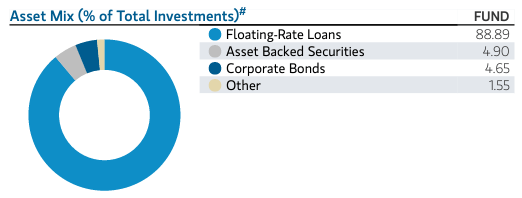

Sectors (Fund Website)

The fund has two very small sleeves containing asset backed securities and corporate bonds, while the bulk of the fund is composed of loans. The fund currently yields 10.8%, and achieves this level with a 34% leverage ratio.

In the case of an economic soft landing, expect a nice total return profile here, with the fund taking advantage of higher rates, while at the same time not experiencing a credit spread event.

In this article we are going to have a look at the state of the leveraged loan market, we are going to explore EFR's collateral and analytics and derive an opinion on utilizing this investment vehicle.

Analytics

- AUM: $0.35 billion

- Sharpe Ratio: 0.6 (3Y)

- Std. Deviation: 6.8 (3Y)

- Yield: 10.8%

- Premium/Discount to NAV: -7%

- Z-Stat: 1.1

- Leverage Ratio: 34%

- Composition: Fixed Income - Lev Loans

- Duration: below 0.32 yrs

- Expense Ratio: 1.37%

State of the Leveraged Loan market

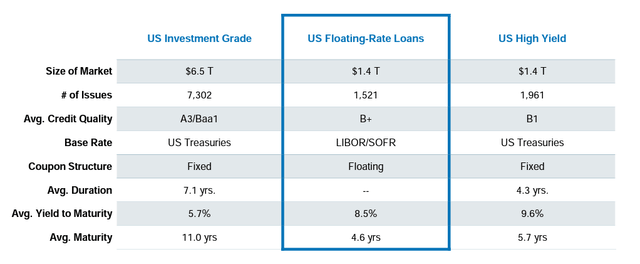

The leveraged loan market is now equal in size with the fixed rate high yield bond market:

Market Compare (LSTA)

This translates into a higher liquidity for leveraged loans and related instruments that package these securities. The market has successfully transitioned to SOFR, after a very long delay in implementation, and historically has a high recovery rate.

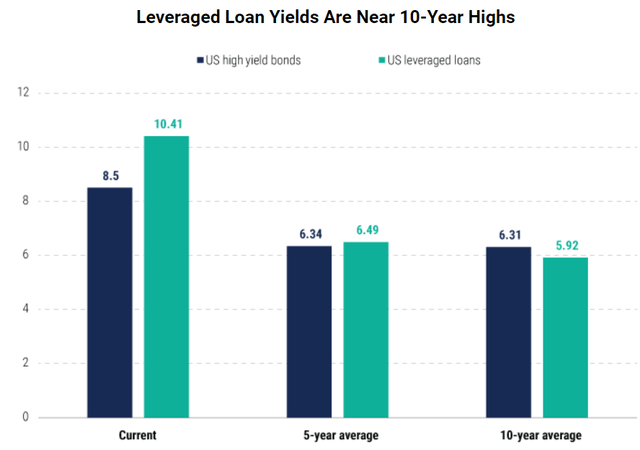

Given the unprecedented increase in rates, leveraged loans now have some of the highest yields in the past decade:

All-in Yields (Pinebridge)

The current average yields for leverage loans hoover around 10.4% versus 8.5% for high yield bonds. In real dollar terms, these are very high levels, however the current and projected default rates are very muted:

Trailing-12-month defaults reached a two-year high of 1.71% for the Morningstar LSTA US Leveraged Loan Index in June,2 and despite the likelihood for further increases, we believe defaults over the next year will stay within the vicinity of the 3% long-term average.

Source: Pinebridge

Even if annual defaults spike to 4% or 5%, considering a historic 60% to 70% recovery rate in leveraged loans, the drag to the yield provided by the fund should be small.

Fund Holdings

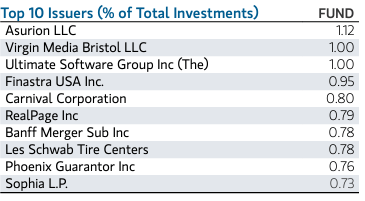

The fund built is very granular, with over 300 names in the collateral pool, each with a very small weighting:

Top Issuers (Fund Fact Sheet)

As an investor you want to see figures sub 1.5% in this table, especially in the leverage loan sector. The fund delivers on the granularity front, with the vast majority of the portfolio under 1% of the collateral pool. As discussed above, what an investor wants to mitigate is unforeseen defaults.

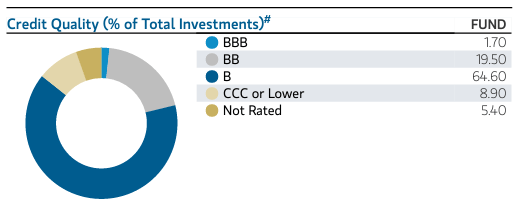

The fund is overweight single-B credits:

Ratings Matrix (Fund Fact Sheet)

Single-B names make up 64% of the collateral pool, while the CCC bucket is fairly small at 8.9%. This collateral slice is the riskiest one and subject to the most default risk in a true recessionary environment.

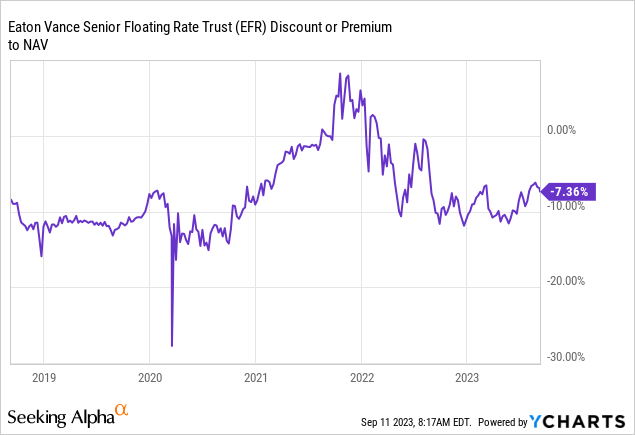

Premium / Discount to NAV

The fund historically trades at a discount to net asset value:

We can observe a tight historic correlation between the fund's discount to NAV and the overall interest rate environment. During a low rate environment the CEF trades close to its NAV. Outside that period the CEF usually trades around the -10% discount level, with a low beta to market conditions. The low beta is positive for holders, since it should not exacerbate risk-off moves in the fund shares.

Distribution

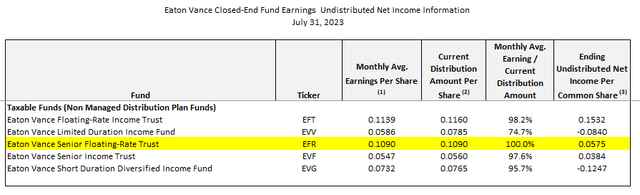

The closed end fund disburses what it makes on the underlying collateral:

Distribution Coverage (Fund Website)

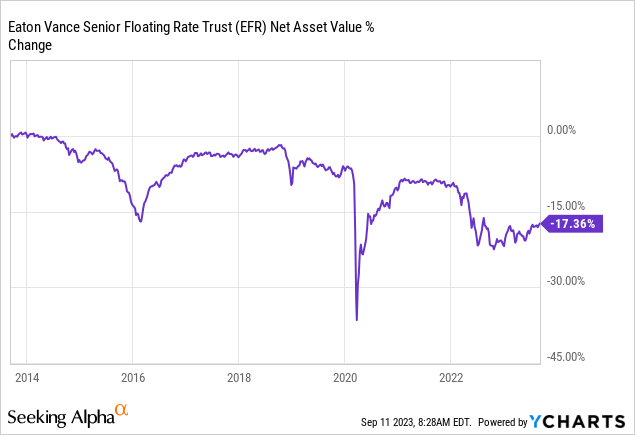

We can observe from the above table that the CEF has a 100% coverage for its distribution. There are many cases of CEFs using unsupported yields just to garner investors' cash. Not here. Given the very high levels of all-in yields for leveraged loans, the fund is able to fully support its dividend. Historically, the CEF does a good job of not overdistributing:

The above graph is a decade long one highlighting the performance of its NAV. If we take out the mark to market moves in the past year and a half, we can observe very small annual reduction in the NAV of around -1%. CEFs which consistently overdistribute have a descending line in terms of NAV, irrespective of overall market conditions, and average NAV reductions in the -2% to -4% range.

Conclusion

EFR is a fixed income closed end fund. The vehicle focuses on floating rate leveraged loans, securities which are senior in the capital structure and have very high historic recovery rates. The fund currently yields 10.8%, level which is entirely supported by the cash generated by the collateral pool. The fund is helped by decade-long highs in the all-in yields paid by leveraged loans.

With the market now expecting a higher for longer rates environment and a soft landing, EFR is an appropriate tool to take advantage of that view. The fund passes to investors those high risk free rates, while at the same time sitting in the most senior tranche of the high yield space. The only risk factor here is a widening of credit spreads, factor which should see a temporary move down in the mark to market for the CEF. From a fundamental standpoint, the fund will easily overcome any increase in default rates via the high recovery rates for the collateral and large portfolio yield. While the future is always uncertain, we can always trade the market in front of us. High rates are here, and the leveraged loan asset class is an ideal one to take advantage of this state of affairs. A soft landing is debatable, but should favor a fund like EFR. We are therefore a Buy for this name here.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.