Ansys: Robust Growth And Profitability, Eyes Future Growth And AI Transformation

Summary

- Ansys has delivered impressive Q2 results with 6% growth in ACV and substantial growth in sectors like Aerospace and Defence, High Tech, and Automotive.

- The company's strategic positioning in the A&D sector and focus on AI showcase its adaptability to evolving industry landscapes.

- ANSS's diverse product portfolio, including its GPT-based customer support initiative, positions it for long-term success, but the current high valuation suggests that much of its potential is already priced in.

your_photo

Overview

My recommendation for Ansys (NASDAQ:ANSS) stock is a hold rating as I believe the current high valuation remains high despite the robust growth and profitability. Note that I previously rated hold rating for the same reason (high valuation).

Recent results & updates

ANSS has once again proven its capacity to thrive in an uncertain environment by delivering impressive results in Q2. The growth in Annual Contract Value [ACV] reached 6%, with namely Aerospace and Defence [A&D], High Tech, and Automotive, demonstrated substantial growth at 20%, 10%, and 10%, respectively. ANSS’s robust financial performance can be attributed to its widespread expansion across different regions and industries. This success was primarily fuelled by a high demand for its products and services within the aerospace, automotive, and electronics sectors.

Looking ahead, I anticipate that the robust ACV growth will continue to be a driving force for the company's success. My analysis of the smoothed-out metrics for ACV growth during the quarter, with a focus on key geographies such as EMEA and Asia Pacific, and thriving sectors like aerospace, automotive, and industrial equipment, especially in Europe, materials, and chemicals, suggests a promising trajectory. Furthermore, ADSS’s strong performance in North America, characterized by significant orders, notably the $57 million multi-year agreement secured in the A&D sector, underscores its ability to excel in competitive markets. Additionally, its small and medium-sized accounts have experienced impressive growth, further solidifying its market presence. Considering these favourable trends and ANSS’s strong 2Q performance, I am confident in the company’s prospects for the future. As a result, I am optimistic about its ability to surpass its ACV guidance, building on the momentum generated in 1Q.

In addition, in my opinion, ANSS has strategically positioned itself in the A&D sector, illustrating the evolving landscape of ANSS software. The company consistently expands its product portfolio to tackle increasingly intricate challenges, fostering greater utilization across the entire product lifecycle. This industry is presently in the midst of a notable transformation, encompassing shifts in fuel sources, the adoption of various take-off methods [like vertical take-off vs. short take-off], and the transition from traditional motors to electric propulsion. ANSS's focus extends beyond major players in the A&D sector. They also acknowledge the significant presence of smaller companies within the aerospace supply chain. These smaller entities actively seek opportunities in the evolving aerospace landscape, presenting ANSS with potential customers.

Lastly, ANSS recognizes the impact of artificial intelligence [AI] on end markets, with a pronounced effect on high-tech and semiconductor industries. Prominent companies like NVIDIA leverage ANSS technology to push the boundaries of physical design, risk management, and overall product development. Additionally, firms like Cerebras utilize ANSS software for their wafer-scale engines, with a primary focus on the AI market. ANSS plays a vital role in addressing challenges related to mixed-signal power integrity and electrostatic discharge in this context.

And so, we have customers like NVIDIA for example, they're taking advantage of our technologies to be able to pursue the physical design limits, be able to manage risk as they start to use RedHawk, Raptor all of our products to improve their design. From: 2Q2023 earnings call

You look at Cerebras for example, they're using RedHawk-SC for their Wafer-Scale Engine, which is really focused on the AI market and they're helping, we're helping them with challenges of mixed signal power integrity with electrostatic discharge and things of that nature. From: 2Q2023 earnings call

It's important to note that industries such as aerospace and automotive typically feature longer development cycles compared to traditional high-tech sectors, as such the financial benefit will not appear in the near-term, which I expect the market to discount as it is hard to model. Nonetheless, I see AI as a long-term driving force, as customers explore a wider spectrum of design possibilities using AI techniques. More on AI, recently, ANSS introduced a GPT-based product in beta, facilitating 24/7 customer access to support and information. I expect this initiative to enhance customer convenience and reduces their reliance on conventional support channels.

Net-net, in my opinion, ANSS stands out in the simulation market with the most comprehensive range of solutions and the largest market share. The company's specific strengths in electrification, electromagnetics, and computational fluid dynamics position it for organic growth in the double-digit range for ACV, with acquisitions contributing to this growth while maintaining impressive profit margins in the software industry. However, I continue to maintain my hold rating on the stock because I believe the current valuation is still excessive.

Valuation and risk

Author's valuation model

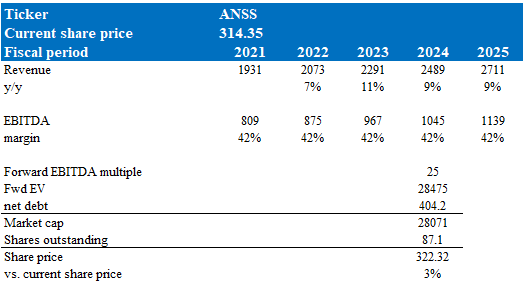

I anticipate that ANSS will sustain its top-line revenue growth, aligning with consensus expectations. This positive trajectory is underpinned by the company's robust performance, its ability to thrive amidst uncertain conditions, and the continuation of favourable trends in ACV growth across various geographical regions and industries. Additionally, ANSS's strategic positioning in the A&D sector, coupled with its focus on AI, further bolster its growth prospects. Furthermore, ANSS exhibits an exceptionally strong EBITDA margin, currently standing at an impressive 42%. I expect this strong margin performance to persist well into the foreseeable future, reflecting the company's operational efficiency and profitability.

However, it's essential to note that ANSS's current valuation, trading at 25 times forward EV/EBITDA, is relatively high. Comparatively, its peer, Autodesk, is trading at 24 times forward EV/EBITDA, and Dassault Systemes is trading at 22x forward EV/EBITDA., despite having similar expected growth rates. This discrepancy suggests that the market has already factored in ANSS's strength and growth potential, leading to a premium valuation.

At the current valuation of 25 times forward EV/EBITDA, my target price for ANSS is $322, implying the stock is fair valued. Given these considerations, I reiterate my hold rating on ANSS.

Summary

ANSS has demonstrated robust growth and profitability, driven by impressive results in Q2, with strong performance in sectors like Aerospace and Defence, High Tech, and Automotive. The company's strategic positioning in the A&D sector and its focus on AI showcase its adaptability to evolving industry landscapes. ANSS's diverse product portfolio, including its GPT-based customer support initiative, positions it for long-term success. However, the stock's current high valuation, trading at 25 times forward EV/EBITDA, suggests that much of its potential is already priced in. While I anticipate sustained growth and strong EBITDA margins, the premium valuation leads me to maintain a hold rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.