Village Super Market: Navigating The Grocery Industry Impeccably

Summary

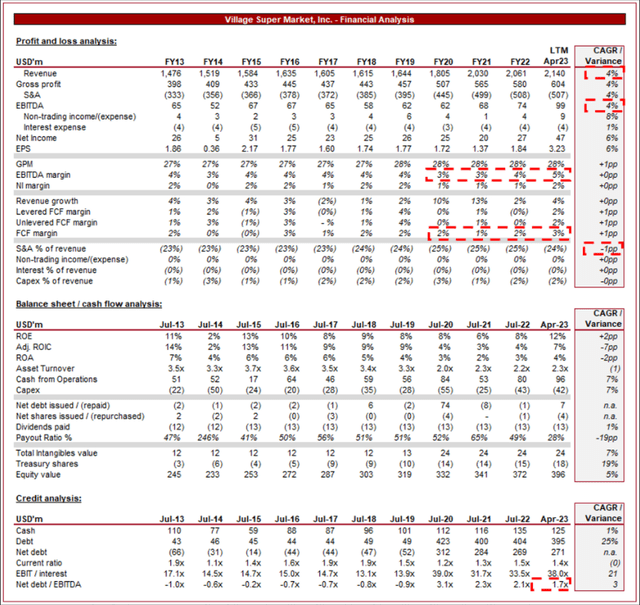

- Village’s revenue has grown at a CAGR of 4% during the last decade, driven by economic development and expansion of its services.

- Management is actively seeking growth, currently renovating its locations with the view to opening new stores in the coming years.

- Village’s margins are respectable, with an improvement during the LTM period. Even when compared to its significantly larger peers, Village performs well.

- Village holds a significant amount of cash (38% of MC), reducing any downside risk.

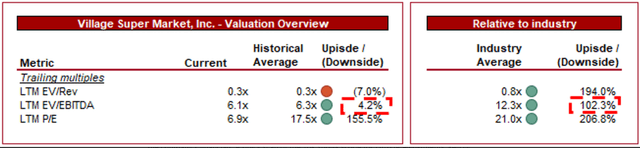

- Village is trading at a discount to its historical average and a peer group, which appears to imply upside in our view.

Hispanolistic

Investment thesis

Our current investment thesis is:

- Village is performing well, with respectable growth and resilient margins despite competition from larger businesses. We suspect its current performance is maintainable.

- The company’s performance is comparable to significantly larger peers, underpinning its quality operations. Downside risk is protected by its substantial cash balance.

- Village appears undervalued, particularly compared to its historical average given the small improvements made.

Company description

Village Super Market, Inc. (NASDAQ:VLGEA) is a family-owned supermarket chain operating stores under the ShopRite and Gourmet Garage banners. Founded in 1937 and headquartered in Springfield, New Jersey, the company has a rich history in the grocery retail industry. Village Super Market serves communities in New Jersey, Pennsylvania, and Maryland, offering a wide range of products, including groceries, fresh produce, meat, bakery items, and more.

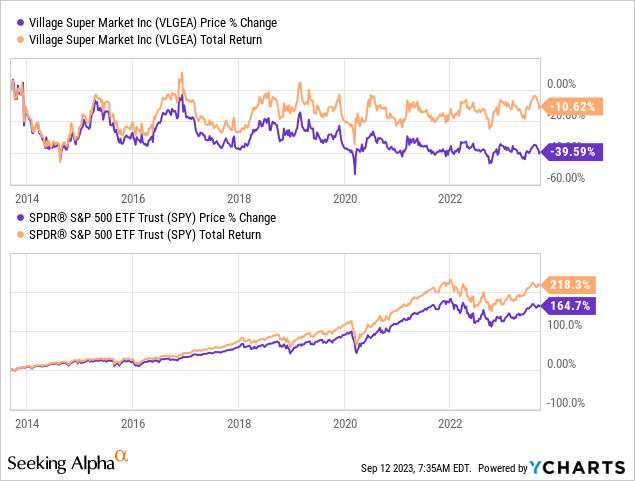

Share price

Village’s share price performance has been disappointing, losing over 30% of its value at a time when the wider market has performed exceptionally well. This is difficult to reconcile given the broadly positive financial performance and commercial development.

Financial analysis

Village Super Market Financials (Capital IQ)

Presented above are Village's financial results.

Revenue & Commercial Factors

Village’s revenue has grown at a CAGR of 4%, with extremely consistent growth YoY, barring a single period of negative growth. This is a reflection of the company’s consistent development.

Business Model

Village operates a network of retail supermarkets, predominantly located in the northeastern United States. These supermarkets offer a wide range of grocery products, including fresh produce, meat, dairy, bakery items, and non-perishable goods. The company operates as an alternative to the traditional US supermarkets, in many regions which lack easy access to these businesses.

The company follows a franchise model, partnering with Wakefern Food Corporation, a retail cooperative, to operate its stores under the ShopRite brand. Village is the second-largest member of Wakefern Food Corporation (and owns 12.5%), the largest retailer-owned food cooperative in the U.S. This partnership gives Village access to cost-saving benefits, advanced retail technology, and marketing advantages typically found in larger retail chains.

The company continues to enhance and grow its supermarket chain through a program that involves both renovating existing stores and acquiring new ones. During these renovations, Village aims to maximize selling space whenever feasible, learning from the techniques developed by its larger counterparts.

Village places a strong emphasis on customer service and satisfaction. It aims to create a positive shopping experience, offering competitive prices, a clean shopping environment, and personalized customer service.

Like many supermarket chains, Village offers a range of private label or store-brand products. This is possible due to the wider ShopRite (and Gourmet Garage) brands. These products often provide higher profit margins compared to branded goods, while also enhancing choice for consumers.

The company is deeply involved in the communities where its stores are located, supporting local initiatives and charities. This engagement helps build brand loyalty and goodwill.

Supermarket Industry

The supermarket industry, particularly in the northeastern U.S., is highly competitive and saturated. This saturation has limited the opportunity for significant store expansion and growth.

Further, this has contributed to supermarkets typically operating on thin profit margins. This can make it challenging to achieve outsized growth or to “shake up” the status quo. Investors must appreciate that they are buying what they see and likely not significantly more or less.

Village has adapted to changing consumer preferences by offering online ordering and delivery services, enabling customers to shop conveniently from home. This has reduced the threat faced by delivery apps and larger alternatives, positioning the business for continued success.

While the company has a strong presence in the northeastern U.S., its geographic reach is limited compared to some larger national supermarket chains. This can limit growth opportunities given the lack of brand awareness beyond this specific region.

The implementation and promotion of its customer loyalty programs are beneficial as they allow the business to retain existing customers and encourage repeat business. This allows for an enhanced experience relative to convenience stores.

Expanding and renovating existing stores, as well as opening new locations, can require significant capital investment. Slim margins make this difficult to achieve, although Management communications imply this is a target, which is positive.

Economic & External Consideration

Current economic conditions are encouraging consumers to trade down, with high inflation and elevated rates contributing to a rapid rise in living costs. We see this as an opportunity for Village, as the essential nature of food makes demand resilient. Further, this creates the opportunity for greater private label sales, supporting margins.

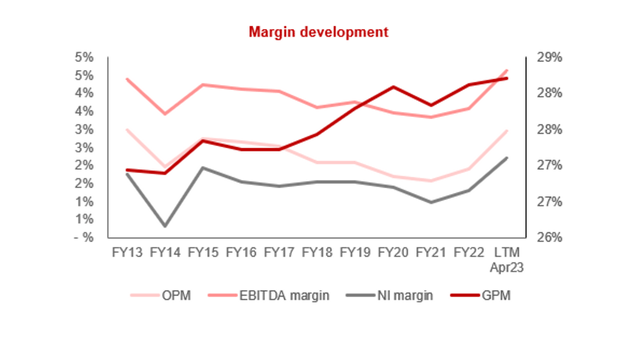

Margins

Village’s margins have been broadly flat over the historical period, with slight improvement during the LTM period. This is a reflection of the competitive nature of the industry, with saturation restricting any scope for improvement.

Balance sheet & Cash Flows

Village’s balance sheet is relatively clean, with conservative debt usage and a healthy cash balance (38% of market cap). This provides the business the optionality to grow through greenfield or acquisition projects, with Management currently focused on renovations/remodels.

Industry analysis

Hypermarkets and Supercenters industry (Seeking Alpha)

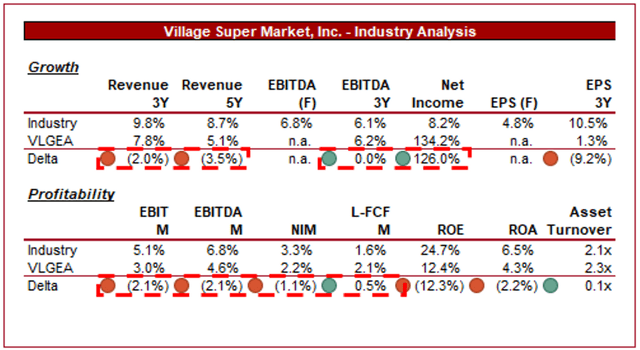

Presented above is a comparison of Village's growth and profitability to the average of the Hypermarkets and Supercenters industry (10 companies).

Village lags the industry in growth, although not to a significant level. This is comparable to Walmart (WMT) and Carrefour (OTCPK:CRRFY), while outperformed by low-cost alternatives and bulk-sellers. Further, Village’s margins are slightly below the average, although this gap disappears on an FCF basis and is minimal at an NIM level.

Village’s performance is respectable when contextualized. The company is compared to significantly larger peers, many of whom operate nationally, if not internationally. With that comes significant economies of scale and brand value. Given the small difference, we consider this a job well done by Village.

Valuation

Village is currently trading at 6x LTM EBITDA. This is a discount to its historical average.

Before diving into Village’s valuation, it is worth discussing briefly the investor community around Village. The business is family-owned and run, with no sell-side analysts covering the stock. This means little objective scrutiny of Management and borders on significant oversight concerns. This is due to its size, of course, not for any nefarious reason but is a warning to any investors considering this stock.

As we discussed previously, industry dynamics mean material positive or negative development is unlikely. This said, the company is still trading at a discount to its historical average, which implies upside.

Beyond this, however, we believe the company is trading at a discount to its true “fair value,” owing to the lack of sufficient information about the business to help investors make informed decisions (sell-side analysts would help). At a 100% discount to the peer group discussed previously, the business appears cheap. It is generating comparable FCFs while growing at a slightly lower level.

Not only this but the valuation is likely better than it currently appears, given the lack of analysis on the company’s financials. A quick scan of the 10K shows the scope for EBITDA adjustments. Fellow contributor “Lowcountry Nest Egg” conducted a fantastic deep dive into Village’s valuation, which we will not do ourselves as it will inevitably fall short. Find the link here.

Key risks with our thesis

The risks to our current thesis are:

- Oversight. As discussed in detail already, the biggest risk with Village is oversight. Owner-run businesses come with some risks as it is but this is compounded by the lack of analysis.

Final thoughts

Village is a solid business. The industry is boring and the scope for significant deviation from its current position is limited. This said, so long as people need food to eat and the US economy grows well, Village is positioned to benefit.

The company has a good business model, scope for new locations, a strong relationship that protects its margins, and a valuable regional brand.

We are concerned by the lack of oversight but the stock does appear clearly undervalued. The hope is that through contributed growth, there can be coverage provided.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)