JD.com: Why I'm Buying For The Long Term

Summary

- JD.com's revenue growth is set to accelerate.

- Margins continue to expand and are set for high single digits.

- The stock can achieve a 19% CAGR in share price over the next five years, making it a good investment in the Chinese e-commerce market.

FangXiaNuo

In this article I will discuss why I am assigning an initial buy rating for JD.com (NASDAQ:JD) for long-term investors. I think JD can offer investors a 19% CAGR over the next 5 years.

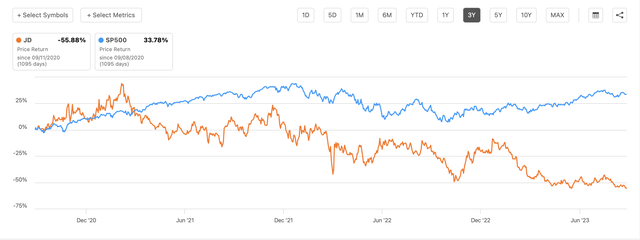

3 year stock price JD vs S&P 500 (Seeking Alpha )

Over the past 3 years JD's stock has been under significant pressure as investors have sold in droves over macro worries, this extreme pessimism has caused the stock to decline 55% vs the S&P 500's increase of 33%. This has continued beyond the last quarter's earnings report despite Revenues starting to once again accelerate. I think this provides a good opportunity for long term investors to buy.

I believe there are 2 reasons JD will outperform the S&P 500:

- EPS growth faster than the S&P 500 driven by a combination of Revenue growth and margin expansion.

- A significant valuation discount that I believe is unjustified and over time I expect to close.

1. Revenue Growth

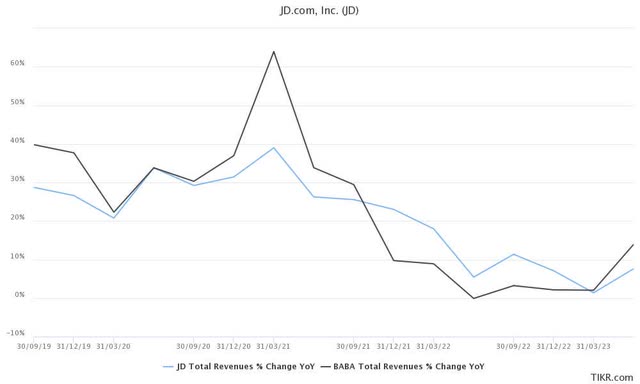

Quarterly Revenue growth comparison of JD & BABA (Tikr Terminal )

Over the past 3 years JD's revenue growth rate has been slowly decreasing from the 20-30% range down to the mid single digits, I think JD ($JD) is poised for accelerated revenue growth in the low double digits 12%+. My argument is based on several factors, including an improving macroeconomic environment, self-inflicted revenue slowdown trends subsiding, and strategic market expansion. These growth factors will benefit all three of JD's major segments; 1P, 3P and Logistics.

The Macroenvironment: A Slow but Steady Recovery

The Chinese economy has faced challenges in recent years, impacting JD's growth. Factors such as the COVID-19 pandemic, a sluggish economy, and issues in the housing sector contributed to weakened consumer sentiment. JD's focus on high-ticket items intensified this slowdown as cost-conscious consumers extended replacement cycles for expensive electronics. However, signs of economic recovery are emerging, albeit gradually. Government stimulus measures are rebuilding consumer confidence, starting with services. It's important to acknowledge that I think JD's growth acceleration may trail behind lower-ticket rivals as consumers will take longer to resume spending on these high-ticket items. I believe that the long term secular growth trends of a more affluent Chinese middle class and increasing consumerism remain intact and will allow JD to resume a high growth rate driven by the increasing demand for JD's 1P, 3P and logistics services. Patience will be key in this recovery.

Self-Inflicted Revenue Slowdown: Setting the Stage for Long-Term Growth

I believe JD has taken steps that have temporarily hindered revenue growth but are strategically aligned with long-term success and will lead to an accelerated revenue growth rate in all 3 business segments once these self-inflicted headwinds subside. Historically, JD has been synonymous with low prices and top-notch service, but this focus wavered in recent years. The company recognised the need to realign with its core philosophy:

relentlessly strive for lower cost, higher efficiency, and superior customer experience. - Lei Xu, CEO

In 2022 and the first half of 2023, JD has implemented measures to enhance competitiveness which I believe pave the way for higher revenues.

One significant move involved shedding non-core businesses like its Southeast Asia retail operations and JD Industrial, which had diverted management's attention from its core retail operations, Restructuring retail units to grant more autonomy to frontline workers aimed at improving customer service. Additionally, JD introduced various discount programs especially on its 3P platform, including consumer discounts, free shipping, and reduced take rates on merchants. These initiatives are showing early promise, demonstrated by JD doubling the number of 3P merchants y/y. Daily active users increasing by a mid-teens percentage, purchase frequency increases, and average revenue per user continuing to rise. JD Plus subscribers also grew to 35 million, up 20%, reflecting the growing value and loyalty of JD's consumers to the service. Higher Net Promoter Scores (NPS) over the past year also validates the progress they are making in developing a healthy ecosystem and culture for everyday low prices for Consumers and Merchants alike.

I believes JD's decision to reduce fees on its 3P platform has hidden the progress they have made in attracting new merchants, over time JD is poised to reap benefits from the doubling of new merchants in the form of increased CRM revenue, advertising spend, and the use of its logistics network for third party orders as merchants integrate more and more of their business into JD's platform. I believe this influx of new merchants will lead to higher market share and a rebound in revenue growth over the next couple of years.

Market Expansion: Seizing New Opportunities

I think JD can drive significant revenue growth through its continued expansion into general merchandise. Leveraging its extensive logistics infrastructure, JD is diversifying its offerings into healthcare, sports, and outdoor merchandise. The introduction of its private label brand, Jing Zao, has proven popular with a growth rate of 60% in 2022, with a quarter of JD Plus members becoming loyal purchasers. The General Merchandise segment, which includes these new categories has faced declining revenue growth over the last couple of quarters due to the dominance of the supermarket business within the segment. Essential items have become less critical this year with the reopening of restaurants and services after Covid lockdowns, supermarket growth has therefore tapered off which is hiding the market share gains JD has made in these newer segments mentioned earlier. Over the next few years I anticipate JD will be able to stabilise growth and subsequently achieve a mid-teens growth rate for the Supermarket segment as demand normalises and JD continues its expansion, this stabilisation will shed light on the progress made in other categories within the segment, leading to positive revenue growth before the rebound of the Supermarket segment. Overall I think this segment can be a significant driver of Revenue over time.

Margins

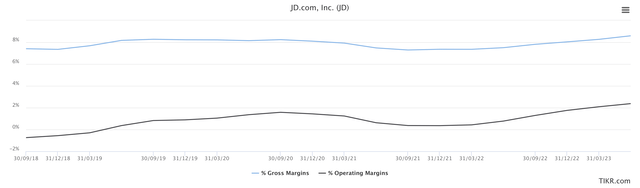

JD gross and operating margins (TIKR terminal )

Over the past several years, JD has managed to continue increasing gross & net margins despite the Covid headwinds, regulatory scrutiny, increased competition and business slowdowns, I think this is a very impressive accomplishment given the difficult operating circumstances. As I mentioned earlier I expect these headwinds to subside over time and I think this will show the true progress that JD has made on its margins during this period thanks to the cost optimisation efforts and increased logistics capabilities, over the longer term I expect net margins to increase from the low single digits that they are today to a base case of 5% and a bull case of 8%. I think the main driver of this to be the shift from a 1P to 3P driven business model. As 3P sales continue to outpace that of 1P sales margins will follow suit. 3P sales is inherently better margin revenue as it consists of transaction revenue, CRM and advertising all of which don't require the fulfillment of goods by JD and therefore cost far less. Other drivers of margin expansion include JD logistics, 2022 was the first breakeven year for the logistics segment, this was driven by cost efficiencies and the first signs of operating leverage through economies of scale. While 1P, 3P and external sales all continue to increase I expect the logistics business to demonstrate higher profits over the next several years I believe that logistics margins could reach low to mid single-digit percentages even while JD continues to reinvest to enhance its competitive advantage.

2. Valuation

I believe JD merits a higher valuation multiple, backed by its transition to higher-quality revenue streams from the third-party (3P) business, robust cash generation, and market dynamics. This analysis highlights that JD.com is currently trading at a substantial discount, presenting a compelling investment opportunity.

5 year Price - sales ratio of JD (Seeking Alpha )

Valuation Metrics

Traditionally I would have valued JD on a price-to-sales (P/S) basis, however JD is undergoing a transformation that I believe warrants a higher multiple. Factors supporting this transition include the company's shift towards value-added services like customer relationship management (CRM) and advertising revenue. Additionally, JD's consistent cash generation capabilities justify a discounted cash flow (DCF) valuation.

Historical P/S Ratio vs. Current Valuation

Over the past five years, JD maintained an average P/S ratio of 0.5x. Presently, the company is trading at a significantly lower P/S ratio of 0.25x. This substantial discount suggests that JD's undervaluation give it an upside of 100% to get back to average.

My Key Assumptions

Revenue Growth: JD has a history of delivering robust revenue growth, and I expect this to persist with long-term growth of at least 8-9% to be conservative. I discussed the Key drivers earlier include the expanding Chinese consumer market, JD.com's increasing market share, and self-inflicted headwinds subsiding.

Expanding Margins: I anticipate JD's margins to shift from low single digits to mid- to high-single digits over the long term. This will be driven by the transition to higher-margin 3P revenue and the realization of economies of scale and increased efficiency in logistics.

Share Dilution: Historically, JD has increased shares outstanding by 2% annually. While this assumption holds, Recent share repurchases at attractive levels could provide additional value if they were to continue.

Valuation Multiple: Given JD's strong competitive advantages, focus on high-quality operations, and expanding margins, I assign a target valuation of 15x Free Cash Flow (FCF). Currently, the company trades at a price-to-FCF ratio of 13.4x, excluding cash, or 7x FCF when including cash, which falls below my target valuation.

Financial Strength

JD enjoys a robust financial position with a net cash position of $36.89 billion, equivalent to $23 per share (70% of market capitalization). This financial fortitude offers a substantial margin of safety and the flexibility to invest in growth initiatives or return capital to shareholders, which they have been doing recently and what I expect to continue over time through mainly dividends and opportunistic buybacks.

Financial Projections

I forecast a conservative 12% compound annual growth rate (CAGR) in FCF over the next five years, driven by 8% revenue growth and modest margin expansion. This trajectory would result in year-5 FCF per share of $4.15, compared to the current $2.61 today.

Assuming JD.com trades at a multiple of 15x FCF in five years, I think the potential share price is $85, including $23 of net cash added back. This represents a potential Compound Annual Growth Rate (CAGR) of 19% or 142% upside from today's levels.

Investor takeaway

In conclusion, I think JD stands as an enticing long-term investment opportunity, underpinned by its strong track record of growth and well-positioned strategies. Despite recent revenue challenges, JD's resilience positions it to outperform competitors in my opinion. The company's focus on realising economies of scale and diversification into value-added services positions it to improve margins. With headwinds from the Chinese economy subsiding, JD is poised to maintain and expand its market share. As a result, I anticipate JD's potential to deliver a compelling 19% Compound Annual Growth Rate in share price over the next five years, making it an attractive choice for investors seeking sustained growth and value. This is why I'm a buyer at today's levels.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.