WestRock And Smurfit Kappa Make A Good Package Deal

Summary

- Smurfit Kappa Group Plc and WestRock Company have announced a merger, valuing WestRock at nearly $20 billion.

- Shares of WestRock rose 2.8% in response to the news, while Smurfit Kappa shares fell 8.3%.

- The combined company will have revenue of $34 billion and is expected to achieve $400 million in annual synergies.

- This is a logical deal and it offers a tremendous buying opportunity because of the spread for WestRock.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

onurdongel

For the past couple of days now, there have been some rumors circulating that Smurfit Kappa Group Plc (OTCPK:SMFTF) might be about to merge with U.S. based competitor WestRock Company (NYSE:WRK). While not every rumor that circulates on the market turns out to be correct, this one was. Before the market opened on September 12th, the management teams at both firms announced the merger, in a deal valuing WestRock at nearly $20 billion on an enterprise value basis. In response to this news, shares of WestRock rose and, as of this writing, are up 2.8%.

At the same time, units of Smurfit Kappa have taken a beating and are currently down 8.3%. Even after seeing these share price movements, there is a roughly 13.1% spread between the price that WestRock is being absorbed for and the price that shares of that business are currently trading at. Based on my own review, the transaction makes a great deal of sense and, absent anything on the regulatory front bubbling up, I see no reason why investors shouldn't be bullish on this scenario.

A logical move

According to the press release issued by WestRock that covers the details of the merger between it and Smurfit Kappa, shareholders of WestRock will receive one unit of Smurfit Kappa for each unit of WestRock that they currently own. In addition to this one-for-one swap, they will also receive $5 in cash per share upon closing. Based on the prices that both companies closed at on September 11th, this would translate to a price per share for WestRock of $43.51. This works out to a market capitalization for WestRock of $11.2 billion. But when you factor net debt into the equation, we get an enterprise value of $19.9 billion.

While shareholders of WestRock are reasonably pleased with this maneuver, market participants don't seem to have a lot of hope that the deal will be approved. Meanwhile, investors in Smurfit Kappa are anything but happy, as evidenced by the 8.3% decline in price that its units experienced. Even with this change in pricing, there does exist a 13.1% spread between the price at which WestRock is trading and the price that shareholders would receive if the deal closed today.

Truth be told, there will be some risk on the regulatory front and that is something that no analyst can provide a high degree of certainty regarding. But when it comes to the fundamental side of the picture, I am perplexed as to why the market is so unhappy with Smurfit Kappa at this time.

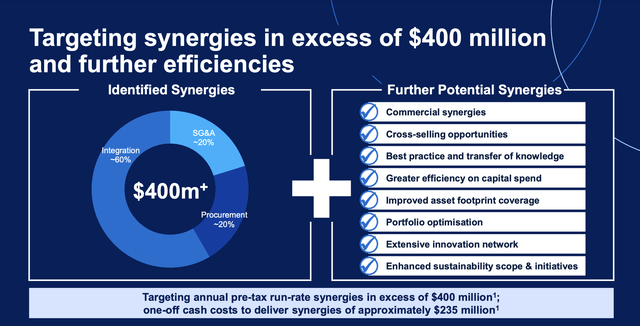

Using the exchange rates assumed by the management teams at both WestRock and Smurfit Kappa, the combined company should generate annual revenue of about $34 billion and it should see EBITDA of roughly $5.5 billion. This excludes the $400 million in annual run rate synergies that the companies expect to be achieved at cash costs of only $235 million. About 60% of these synergies will be generated by cost cutting during the integration process. This could mean real estate consolidation in areas where the two companies might have a shared physical presence. It could also mean the sale of other assets based on geography or improvements associated with core operations. Another 20% of synergies will come from cost cutting on the side of selling, general, and administrative costs, while the remaining 20% will be on the procurement side.

Management believes that there could be additional synergies beyond this point, such as those centered around portfolio optimization, greater efficiency from a capital spending perspective, cross selling opportunities, and more. But they do not have an estimate that is public that covers this.

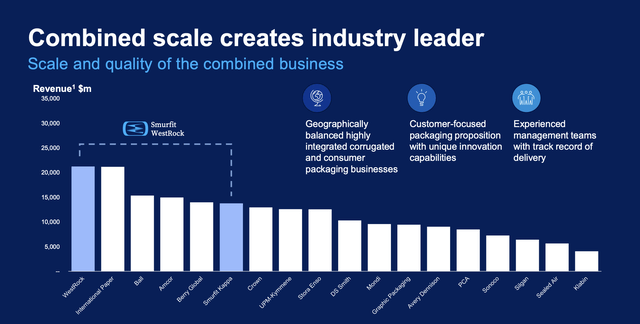

Upon closing of the transaction, the combined company is expected to be significantly larger than most of its peers. Operationally, the firm will have business activities in no fewer than 42 countries, with roughly 500 converting operations and 67 mills interspersed throughout said countries. Approximately 85% of the company's revenue will come from products like corrugated paper, other types of paper, and other related packaging. This kind of packaging is used for things like cereals, snacks, consumer chemicals, display items, health and beauty products, and more. The remaining 15% of sales will fall under the consumer packaging category like beauty and personal care products, beverages, healthcare products, and more.

In terms of geography, about 54% of the company's revenue will come from North America. This is a stark change compared to what shareholders of WestRock might be used to. And that is because, as of the end of the most recent quarter, 80.4% of the company's revenue came from that region. So geographically speaking, those who hold on to their stock will have part of a more diverse operation, with Latin America accounting for 12% of revenue and Europe, combined with all other regions, accounting for the remaining 34%.

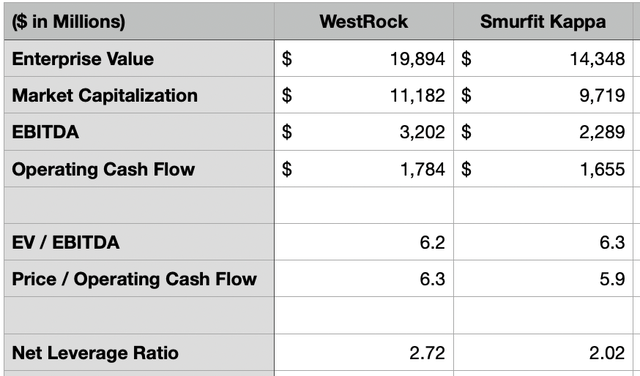

As I mentioned earlier in this article, it is clear that shareholders of Smurfit Kappa are unhappy with this maneuver. I assume that they believe that they should have ended up with more than the 50.4% of the combined company that they are slated to receive. However, I would argue that this transaction seems appropriate. Using the most recent data available, Smurfit Kappa is capable of generating about $2.29 billion worth of EBITDA during the year, with operating cash flow totaling $1.66 billion. By comparison, WestRock generates $3.20 billion of EBITDA and $1.78 billion worth of operating cash flow.

At first glance, it might seem as though WestRock should actually receive the larger portion of the pie. But the ownership percentages that have been agreed upon do not account for the fact that shareholders of WestRock are receiving the $5 per share that they are slated to receive. This translates to nearly $1.30 billion in cash that will be paid out as part of the transaction. When we add that on to Smurfit Kappa as net debt, and we price the companies, the picture changes. At the moment, WestRock is trading, based on the agreed upon purchase price, at an EV to EBITDA multiple of 6.2 and at a price to operating cash flow multiple of 6.3. For Smurfit Kappa, these numbers are 6.3 and 6.2, respectively.

As part of my analysis, I kicked around the idea of interest rates. The debt with the highest interest rate on Smurfit Kappa’s books right now is 7.5%. That would result in $96.4 million worth of interest expense annually if the new debt being taken on has a rate that matches that. I also, in my analysis, did not include synergies. But that is because those are uncertain, and many companies that proclaim they will achieve synergies failed to deliver the full magnitude of their cost savings. At a minimum, I would assume that the synergies would be enough to take care of the extra interest expense that I activated, and even if they come in above that level, the roughly even distribution of the combined company between existing shareholders on both sides means that, relative to one another, the companies will still be priced at almost identical levels. That doesn't change the fact that shares are priced similarly enough the claim that the deal seems perfectly fine, and it would only make shares of these cheap companies look even more attractive to prospective shareholders. And as a conservative, value oriented investor, I would prefer to err on the side of caution.

Takeaway

Based on the data provided, I must say that I view the transaction between Smurfit Kappa and WestRock as a fine move by both companies. If synergies can be realized, the upside for shareholders in the combined business could be even more appealing. But even without synergies, both companies look fundamentally attractive and the deal appears solid.

As for rating the companies individually, I would say that Smurfit Kappa is a solid "buy" at this point in time. But because a nice spread exists between the price at which it is acquiring WestRock and the price that WestRock is currently trading for, I would have to rate that business a "strong buy."

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.