Chico's FAS: Pressure On Profitability Continues

Summary

- Chico's FAS' revenue decreased by 2.4% YoY, while operating margin reached 8.5%.

- The decrease in traffic in the chain stores due to macro headwinds continues to have a negative impact on comparable sales.

- I expect pressure on revenue growth and margins to continue in the coming quarters.

- Despite the attractive valuation, I would like to maintain my hold recommendation for CHS stock.

OKrasyuk/iStock via Getty Images

Introduction

Chico's FAS (NYSE:CHS) stock has fallen 7% YTD. Since my post arguing that it's still not a good time to go long despite attractive valuations, stocks have fallen 12% while the S&P 500 has gained 9%. In my article, I would like to analyze current trends and update my view on the company’s shares.

Investment thesis

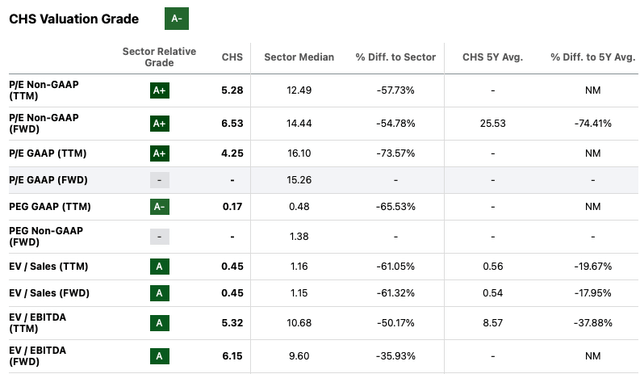

On the one hand, the company's shares continue to attract investors' attention with a relatively high discount to the sector average, while the company continues to demonstrate relatively stable operating and financial performance in the face of macroeconomic uncertainty. However, on the other hand, I would like to point out the fact that the company has been trading relatively cheap for quite a long period of time, while I do not expect that financial results in the coming quarters will serve as catalysts for a revaluation of the shares in the coming quarters.

Company overview

Chico's FAS company sells clothing, shoes and accessories for women. The company's main brands are Chico's (50% of revenue), White House Black Market (28% of revenue) and Soma (22% of revenue). As of 2Q23, the company operates 1,258 stores in the United States and operates 58 franchise stores in Mexico. The company was founded in 1983.

2Q 2023 Earnings Review

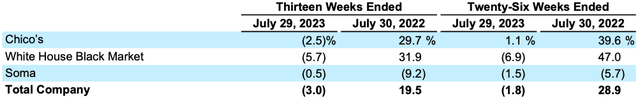

The company's revenue decreased by 2.4% YoY. The largest contribution to the decline in revenue was made by the White House Black Market (WHBM) and Chico's segments, where sales decreased by 5.4% YoY and 2.7% YoY, respectively, due to a decrease in comparables sales by 5.7% YoY and 2.5 % YoY respectively, while the Soma segment showed sales growth of 2.1% YoY. You can see the details of changes in comparable sales for each segment in the graph below.

Comparable sales (Company's information)

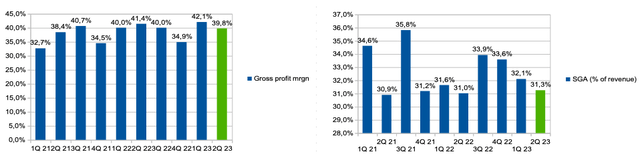

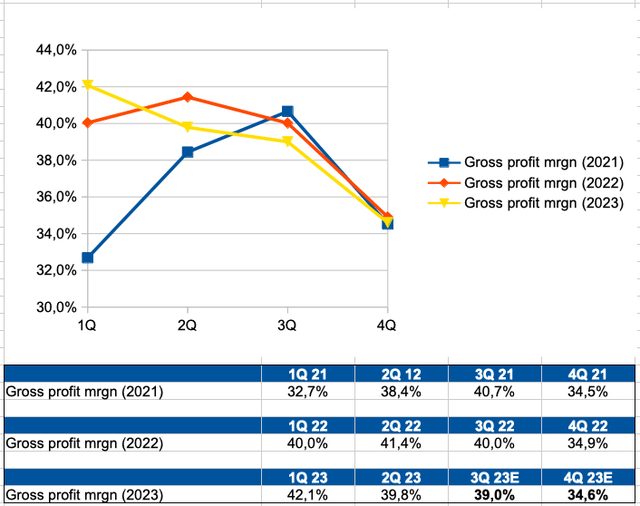

Gross profit margin decreased from 41.4% in Q2 2022 to 39.8% in Q2 2023 due to increased rental costs and investments in stores. SGA expenses (% of revenue) increased slightly from 31.0% in 2Q 2022 to 31.3% in 2Q 2023 due to lower economies of scale.

Gross profit margin & SGA (% of revenue) (Company's information)

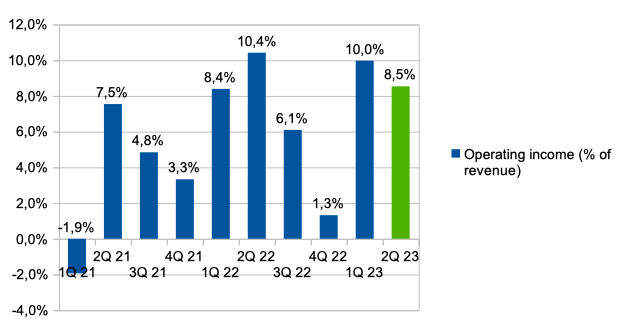

Therefore, operating margin decreased from 10.4% in Q2 2022 to 8.5% in Q2 2023.

Operating income mrgn (Company's information)

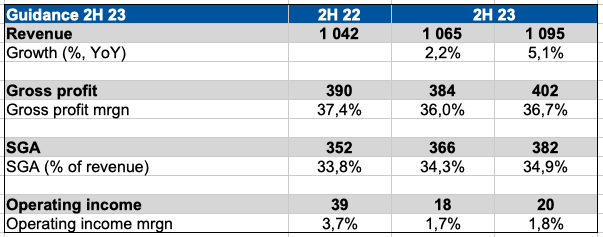

In addition, the company published guidance for 2023. Thus, management expects revenue growth to be 0.1%-1.5% by the end of 2023, which implies that the company will return to positive revenue growth in the second half of 2023. You can see the details in the graph below.

Guidance (2023) (Company's information)

My expectations

The company's published guidance for 2023 implies that revenue growth in the second half of 2023 amounted to 2.2%-5.1%. On the one hand, I like the fact that management expects revenue growth in the face of declining consumer activity and traffic in the chain's stores, however, on the other hand, the current guidance seems too optimistic to me. First, I do not expect that we will see a rapid recovery in consumer spending as consumers continue to face relatively high inflation and increased day-to-day expenses.

Guidance (2H 23) (Company's information)

Additionally, despite management's fairly optimistic comments regarding trading trends, market share gains, favorable product mix, etc., I think the business's profitability will continue to be under pressure in the coming quarters because: 1) I assume the company has limited the potential to pass on increased inflation to the end consumer, because this can lead to additional pressure on traffic and a decrease in market share 2) low revenue growth rates can lead to a deleverage effect due to reduced economies of scale, since a high share of operating expenses is fixed ( shop rent, salary).

Separately, I would like to note that the company continues to face pressure on gross margin. If we look at the historical level of gross margin and current expectations, we can see that pressure will continue in the coming quarters.

And for the year, we are now seeing flat to low single-digit top line growth and moderate gross margin contraction, along with some SG&A deleverage

Gross profit margin trends (Company's information)

Risks

Margin: investments in prices, reduced economies of scale, increased marketing costs due to increased competition may have a negative impact on the level of operating profitability in the future.

Macro (general risk): a decrease in real consumer incomes due to high inflation may lead to a decrease in consumer spending in the discretionary segment, which may contribute to a slowdown in revenue growth in the following quarters.

Valuation

Valuation Grade A-. According to P/E (FWD) and EV/EBITDA (FWD) multiples, the company is trading at 6.7x and 6.2x, respectively, which implies a discount to the sector median of about 54% and 35%, respectively. I believe that investors should not make a decision to buy shares based only on a relatively low valuation in accordance with multiples, because the company's shares may trade at a discount for an extended period of time in the absence of growth drivers/catalysts (recovery in consumer spending and traffic, improvement profitability).

Multiples (SA)

Conclusion

Despite the attractive valuation of the business, stable trading trends and limited downside potential, I would like to maintain my hold recommendation because I expect pressure on both the business's revenue growth and operating margins to continue in the coming quarters. Thus, I do not see additional growth drivers that could contribute to the revaluation of shares.

I like the company's business model and current stock valuation, so I will happily change my recommendation to buy when I see signs of normalization of consumer demand and a recovery in traffic, as well as a recovery in business profitability.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.