EOG Resources: A Dividend Grower Fracking Its Way To Higher Margins

Summary

- EOG Resources is a well-managed oil company that has been an industry leader in cutting costs, expanding margins, and prioritizing shareholder interests.

- The company consistently outperforms expectations and has a strong track record of rewarding shareholders through extreme cycles and crises.

- EOG's quality-first approach and focus on innovation supports its generous capital return policy and make it less exposed to industry cyclicality.

- The firm has had healthy price appreciation but is still undervalued and can be a nice portfolio addition to those concerned about rising energy prices.

grandriver

The best business in the world is a well-run oil company. The second-best business in the world is a badly run oil company.

John D. Rockefeller

EOG Resources (NYSE:EOG) is one of the finest companies in the US Energy Complex. It has been a leader in cutting costs in shale production and helped make the United States a net energy exporter. The firm's management has prioritized the interests of shareholders over the long term, and the firm showed it could handle a crisis during the extraordinary events in the oil market in April 2020. Of course, the company also pays a respectable dividend, which adds to the margin of safety.

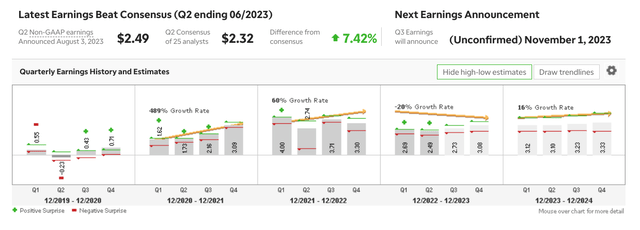

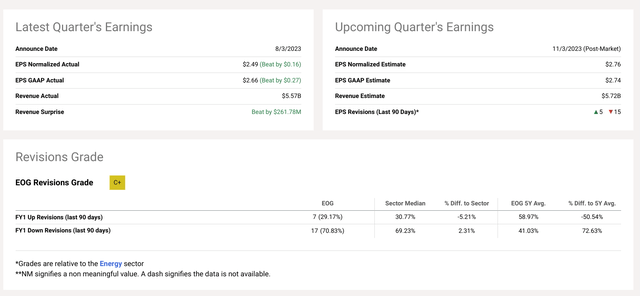

The company recently outperformed earnings expectations on August 4th. But there are a few reasons why owning this stock seems like a complete no-brainer to me.

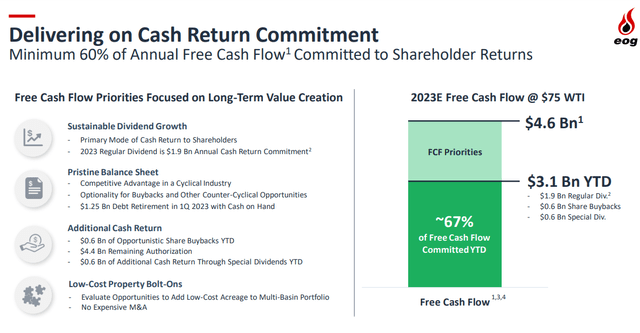

- The firm is continually outperforming its expectations. It's ahead on both volume and returning capital to shareholders this year.

- The management has shown itself capable of rewarding shareholders through cycles and crises. They have never suspended the dividend and treated it as sacrosanct.

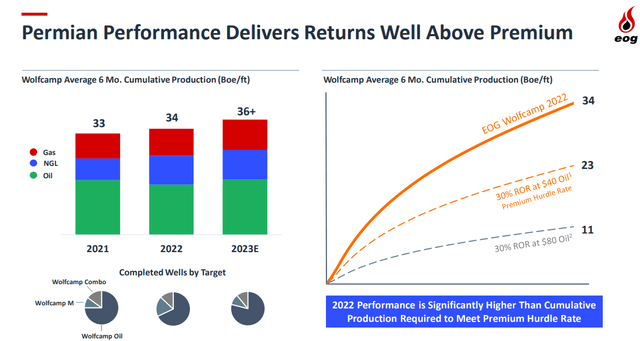

- The firm is less exposed to the inherent cyclicality of the industry because of a quality-first approach. EOG uses the best equipment and the best people.

- EOG continues to be an industry leader in innovation that significantly lowers production costs. This backdrop supports the generous capital return policy.

I first recommended the stock two months ago, on July 7th, 2023. The company has increased about 14.5% since then, but I am confident that the firm remains a bargain. The latest results have encouraged me that the firm is more than capable of continuing to outperform expectations.

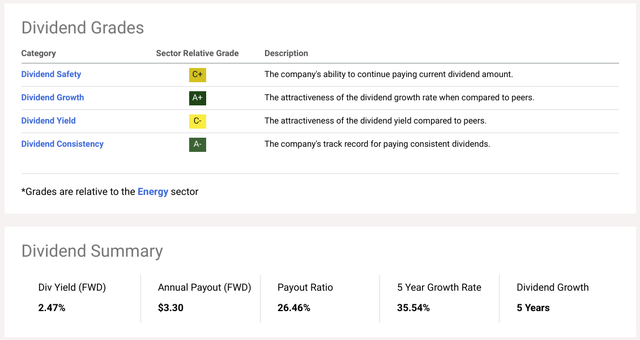

The dividend isn't as strong as some peers. However, EOG is a "grower, not a shower." Given the continually improving financials at the company and the fantastic cash flow growth, this dividend growth presents a major opportunity for long-term shareholders. There hasn't been the best activity on revisions, but the persistent economic strength and building strength in oil and natural gas prices should support the medium-term outlook for EOG.

The three following factors are supporting oil prices going into the end of the year:

- Strong inventory draws are suggesting demand is picking up.

- Refinery utilization is still very high and supportive of strong demand at the end of the year.

- Currently, it looks as if OPEC Plus will follow through with their production cuts, which should also support the short and medium-term price.

Natural Gas has been having a prolonged period of low prices after the considerable spikes in the wake of the Ukraine War. However, some reasons should support natural gas demand in the short and medium term:

- The price has been firming and is coming off a long period of consolidation.

- Because of this, supply is correcting, and less drilling is going on in response to prolonged low prices, which should help restore a balance.

- Natural Gas is a crucial part of the energy transition and will continue to be prized as we progress closer to net zero climate goals.

- The winter is coming in Europe, which could lead to elevated demand. Escalation in the economic standoff between Russia and the world could worsen supply shortages.

Furthermore, EOG is a cash flow machine; if you are a shareholder in the company, you will participate. They are ahead on their goals for the year, which gives management some flexibility as we wrap up 2023 and oil prices firm up. The firm's quality assets and premium drilling innovation continue to deliver value to shareholders. I am very comfortable with the firm's strategy, and I think this stock is excellent to own for those seeking compounding.

This firm demonstrates that its value proposition works, but it has also bought itself staying power by being such a leader in cost-cutting technology. Furthermore, Natural Gas's leading role in this firm's economics makes me optimistic as this fossil fuel will play a central role in the Energy transition.

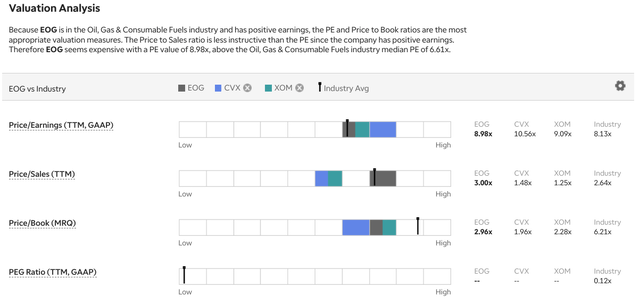

Valuation

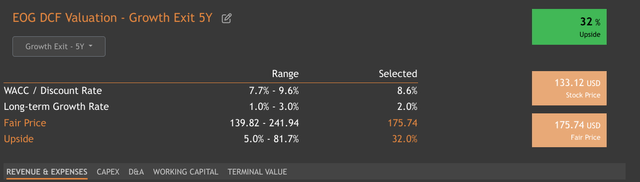

The deep discount compared to implied intrinsic value initially attracted me to EOG Resources in July. As you can see below, a lot of upside was implied when I recommended the stock two months ago. Of course, there has been a solid earnings report between now and then.

ValueInvesing.io (July 7th, 2023)

But, there is still much room for the upside for this industry leader. Even though the stock has increased 14.5% since then, the upside remains significant because of the recent earnings beat. The firm's cash flow is ahead of schedule. Also, the firm has a rule of returning at least 60% of capital to shareholders. So far this year, it is well ahead of that goal, having returned two-thirds of capital so far.

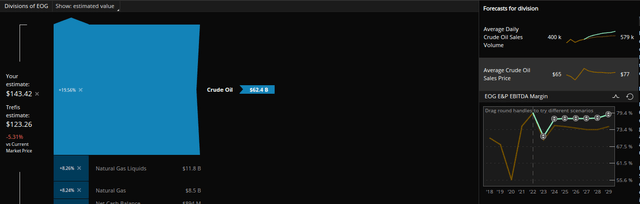

ValueInvesting.io (September 6, 2023)

As you can see, there is still a comparable amount of upside implied by the Growth Exit 5Y DCF model. The strength of the company's approach and strict capital discipline is becoming apparent over time. I think the excellent strategy and management team of proven executors will dovetail nicely with persistent economic strength and a supportive demand environment in oil and natural gas.

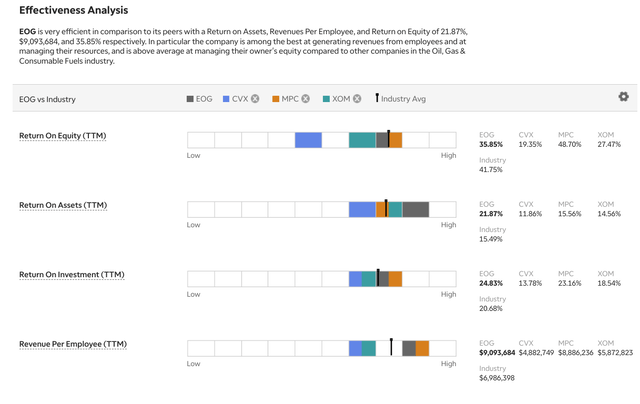

When moving to relative valuation, it is clear that EOG enjoys a premium compared to some peers. However, its strong management and proven strategy justify the company's premium. And while the company is undoubtedly immense, it also is particularly effective compared to peers, which usually results in a premium valuation.

Despite a strong price performance over the past two months, I am confident this stock has a significant margin of safety. It is undervalued by virtually every intrinsic measure, and I think it is a relative bargain compared to peers when you consider recent strength in earnings.

EOG is particularly exposed to the oil price if it increases. Crude makes up 80% of the company's intrinsic value, although it has a vibrant natural gas segment and has been improving its product mix toward more profitable liquids. While the Trefis model shows the stock slightly overvalued, if I make slightly more favorable assumptions in E&P margins and crude price, the intrinsic value of each share increases significantly.

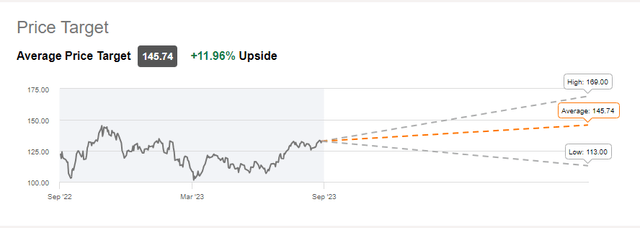

Furthermore, the analysts' targets give it a good upside at a current price of $130. I think this stock is a good way for investors to get exposure to the oil price and natural gas with a growing dividend that has proven resilient through cycles. This stock also makes a significant counterweight to a portfolio too heavily allocated to growth.

Risks and Where I Could Be Wrong

There are always going to be ample risks in drilling holes in the ground as a way of making ends meet. Of course, one of the main risks for any Energy company is the growing regulatory risk around emissions, climate change, and exploration. While it is likely recent actions by the Biden administration were a sacrificial lamb in an election season, regulation and hostility toward the Energy sector from the government may become worse.

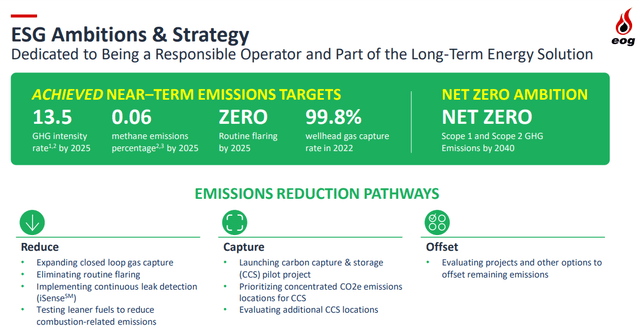

A major relative strength of EOG is its impressive ESG characteristics and goals. I think this company demonstrates that ruthless efficiency and cost-cutting that was already an acquired skill in the Energy industry isn't as bad at dovetailing with climate goals as the acrimonious discussion around Energy would indicate.

However, it is always important to remember that despite the acrimonious tenor of discussions around Energy policy, I don't think President Biden wants higher gas prices either. A more significant direct risk for EOG than any political or regulatory risk is that economic activity slows and oil prices collapse. Any of the following risks could result in this outcome:

- Escalation in Ukraine or Taiwan.

- Fed Policy Error.

- Banking Issues Worsen.

- Return of Inflation.

- CRE meltdown.

- Write-downs of Private Assets.

Of course, there are idiosyncratic risks to EOG's portfolio. It derives a lot of value and total production volume from the Delaware Basin. The firm derives roughly half of its crude production from this area, so any idiosyncratic risks or state/local political problems could have an outsized impact.

Conclusion

EOG Resources is a premier Energy company that is still undervalued despite a recent price appreciation. If you are looking for an excellent stock to act as a hedge in case the oil price increases, I think this is a great pick. I also think that this has the potential for long-term capital appreciation. I would recommend holding the stock for a longer time horizon for the maximum potential of the name, adding to your alpha.

Pulling oil and natural gas out of the ground is a real business very much grounded in the physical world. Ultimately, prowess in this core function will determine the profitability and resilience through cycles of an Energy company. Ultimately, this company uses the best equipment, the best people, and leading engineers, leading to consistent efficiency that rewards shareholders. EOG Resources is a well-run oil company.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.