VXX: Now's Time For Volatility To Shine, But Low Correlations Say Otherwise

Summary

- The VIX has remained low, with few instances of significant volatility spikes in 2023.

- I have a hold rating on the iPath Series B S&P 500 VIX Short-Term Futures ETF due to offsetting factors.

- VXX has risks associated with its construction amid the current VIX futures forward curve shape, while seasonality is bullish for volatility.

TERADAT SANTIVIVUT

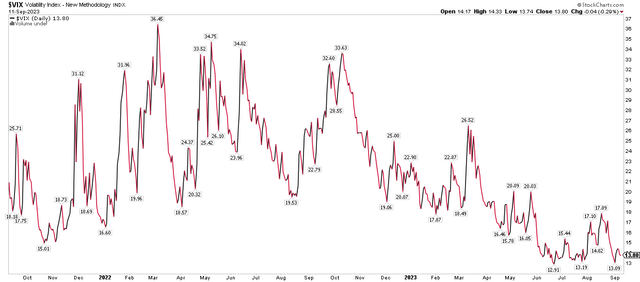

Does the VIX feel too low to you? Near 14 as of this writing, there have been just a handful of sessions in 2023 featuring a jump in the Cboe Volatility Index (VIX) to above 25. This comes after many strategists called for rises in S&P 500 implied volatility to above 40% following 2022’s bear market. Admittedly, I was among those expecting periodic bouts of elevated volatility during the back half of last year. While the VIX jumped in September and October 2022, the spikes were nothing like those endured over the first six months of last year.

I have a hold rating on the iPath® Series B S&P 500® VIX Short-Term Futures (BATS:VXX) ETF. We are entering a seasonal period where volatility tends to rise, so this is a short-term idea. Of course, VXX’s construction, in which it suffers from contango in the VIX futures market, almost always suggests investors should not take long-term positions. Also, low stock correlations today show few signs of reversing.

VIX: Stubbornly Under 20 After An Early-Year Rise

For background, VXX is an exchange-traded "note." That means it is unsecured debt based on the good faith of the issuer (Barclays). In the unlikely event of a severe financial or banking crisis, there is a potential risk that the note product could cease to exist, possibly coinciding with a surge in volatility. So there is some "wrong-way" risk here. The ETN has an investor fee rate of 0.89% per year, so you might be better off playing longer-term moves in volatility via VIX futures directly if you are well-versed in futures trading.

According to Barclays, VXX is designed to provide exposure to the S&P 500 VIX Short-Term Futures Index Total Return. The ETN is riskier than ordinary unsecured debt securities and has no principal protection. The index represents stocks of companies operating across sectors, and it contains volatile stocks of large-cap companies. The ETN will mature on January 23, 2048.

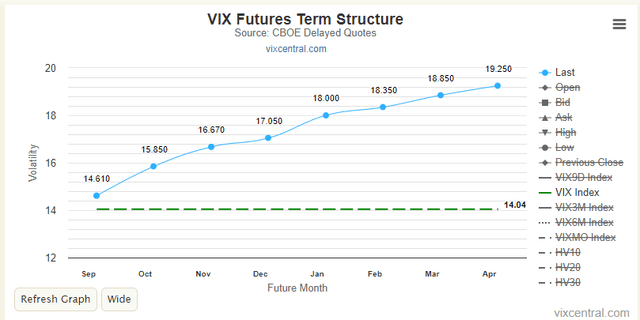

Here's a key risk: VXX periodically rolls out its VIX futures positions – meaning it sells near-dated contracts and buys later-dated contracts. When the VIX futures term structure is sloped down (backwardation), there is a positive roll yield, favoring VXX holders. When the opposite happens, when the futures curve is upward sloped, then it’s called contango, and VXX holders lose out. Bearish contango is the normal pattern, so that is why it’s often a poor strategy to own VXX for an extended period.

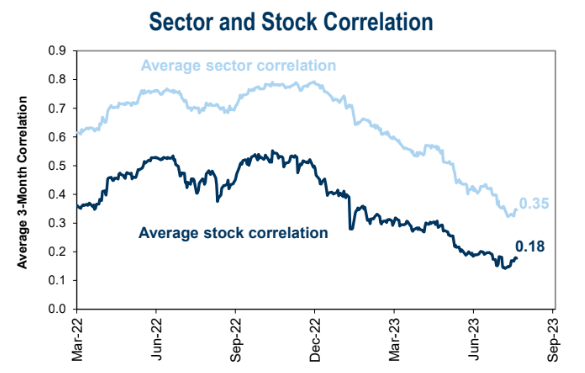

And another problem: Something depressing about the VIX (and VXX) today is the reality that stocks are simply not as correlated as they were during the throes of the bear market. Goldman Sachs reports that single-stock correlations are near the lowest values in years, while sector correlations are likewise on the decline.

When this happens, it means that some equities are zigging, while others are zagging. For a diversified portfolio, like the S&P 500 (on which the VXX is based given its ownership of VIX futures contracts), the natural result is lower overall volatility. I would like to see correlations climb in order to buttress a long VXX argument.

Stock Correlations Remain Very Low, Bearish For Volatility Bulls

Goldman Sachs

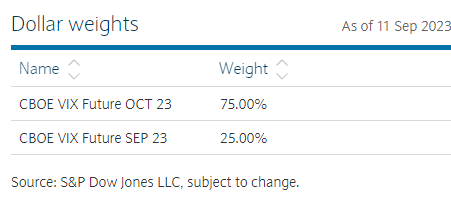

VXX has less than $360 million in assets under management as of September 11, 2023, and it does not pay a dividend. Currently, the fund holds September and October VIX futures contracts, and these will roll out to later months over the next several weeks.

VXX Holdings: Two Near Months, Mainly October 2023

Barclays

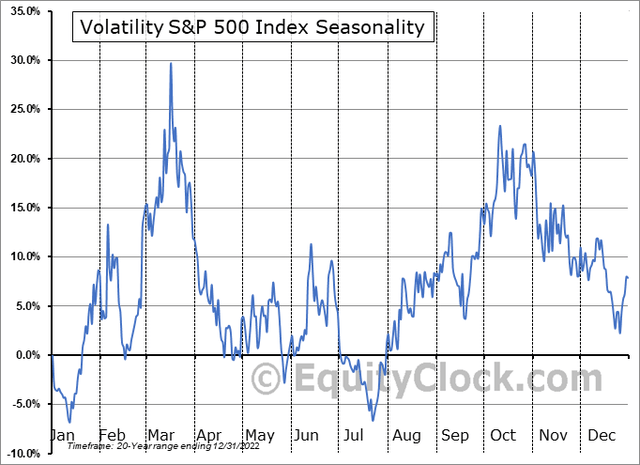

Why don’t I have a sell rating? Seasonality is quite bullish volatility right now. Notice in the chart below from Equity Clock that the VIX Index tends to jump from mid-September through the first week of October. This augers for a tactical long play in VXX.

Cboe VIX Seasonality: Bullish Mid-September Through Early October

Unfortunately, traders are not yet seeing volatility in the offing. The below look from VIX Central illustrates that VIX futures are indeed in bearish contango, which asserts that now is a bad time to be long VXX. So, we have some offsetting factors at play if you are an active investor. Keep in mind that the VIX's long-term average is in the 18 to 20 range.

VIX Futures Forward Curve: Bearish Contango In Place

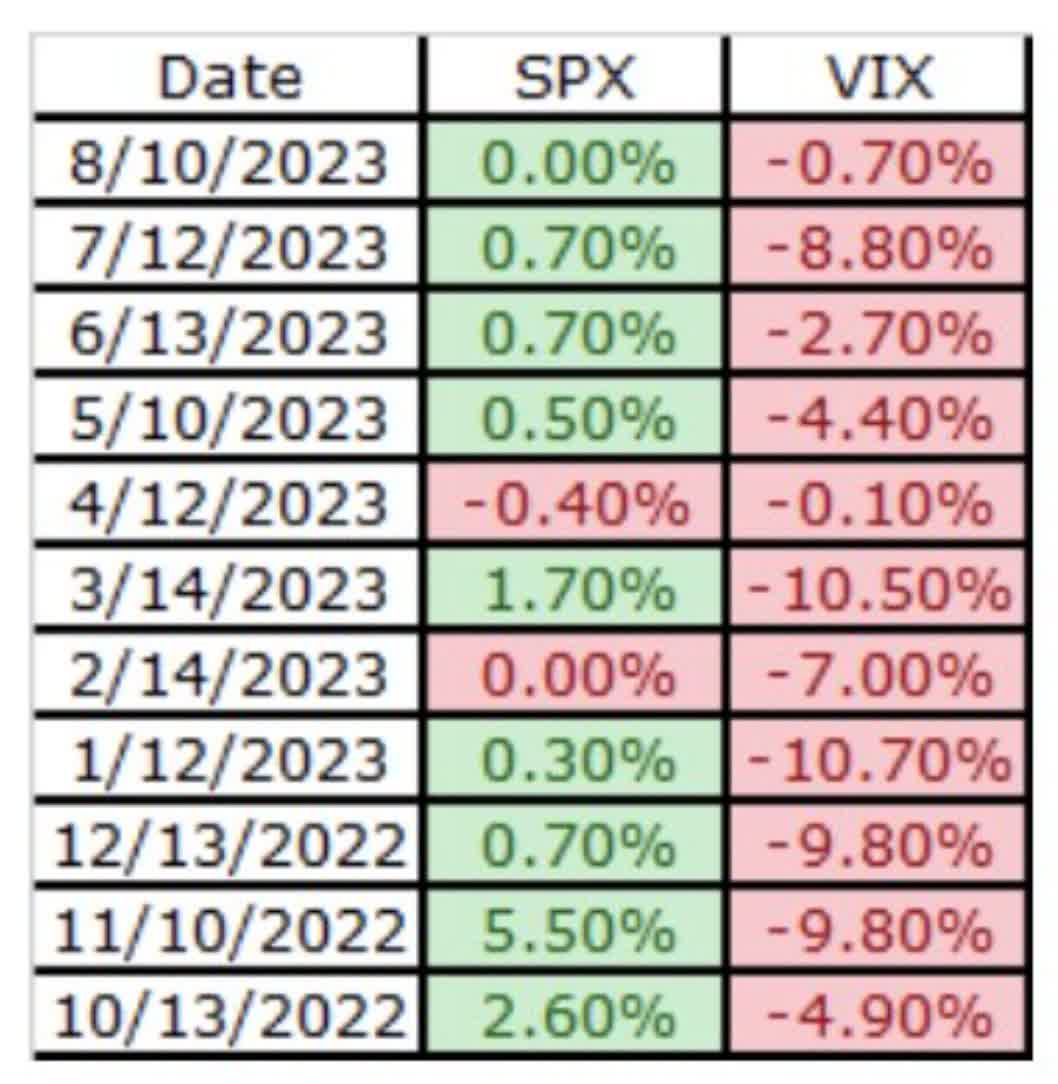

Finally, the VIX tends to drop post-CPI, but this is somewhat deceiving since there is a natural difference between the VIX Index and VIX futures. Still, a soft CPI print would likely result in tempered volatility outlooks through early October, all else equal.

Bearish Volatility Risks Post-CPI

BofA

The Bottom Line

I am a hold on VXX. I like the seasonals right now, but there are just not enough signs that volatility is going to surge enough in the short term to warrant a buy rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.