Alibaba: The Ugly Truth (Ratings Downgrade)

Summary

- In my first bullish article about Alibaba's stock, I significantly underestimated the effect of geopolitical tensions between the U.S. and China.

- On the contrary, my expectations of the Chinese economy's post-COVID recovery were too optimistic.

- While the valuation might look attractive, the discount looks fair given all the headwinds the company is poised to experience in the near term and in the long run.

Michael Loccisano

Investment thesis

My first investment thesis about Alibaba (NYSE:BABA) stock did not work well. While the stock price declined insignificantly by 1.25% during the last quarter, I have conducted a more extensive analysis to find out what are the reasons why attractively valued BABA stock is not moving toward its fair price. While I have updated my analysis, I have realized that red flags outweigh the gap between the business's fair value and the current market cap. While recent financial performance has been robust, I think that near-term and secular trends are unfavorable for the company. Escalating geopolitical tensions between the U.S. and China also does not add optimism for the stock. I think that all the risks and uncertainties outweigh the upside potential and assign the stock a "Sell" rating. I might look inconsistent to Seeking Alpha readers since my first call was a "Strong buy", but I have to admit that I was wrong by underestimating geopolitical risks and overestimating the effect of the Chinese economy's post-covid rebound.

Recent developments

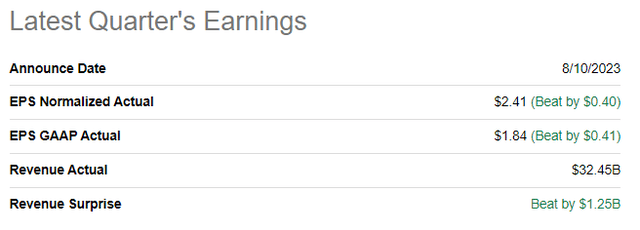

Alibaba released its latest quarter's earnings on August 10, when the company topped consensus estimates. Revenue rose 6.5% YoY, and the adjusted EPS expanded notably, from $1.74 to $2.41.

Profitability metrics followed the top line with notable improvements. The gross margin expanded to 39%, and the operating margin demonstrated almost a seven percentage point improvement to 19%. However, I do not like that the notable part of the operating margin's expansion occurred at the expense of innovation, with the R&D to revenue ratio shrinking from 6.9% to 4.5%.

The upcoming quarter's earnings are scheduled to be released on November 17. Quarterly revenue is expected to drop sequentially to $31.2 billion but to demonstrate a 7.8% YoY growth. The same dynamic is expected for the adjusted EPS: a sequential drop but a YoY expansion.

While the current performance might look promising, I also see multiple unfavorable factors for the stock, which I want to highlight. First, I have underestimated the geopolitical factor the last time. Recent news suggests that tensions will continue to escalate as the world's two largest economies are in a tough battle for global technological leadership. For example, after the recent Huawei 5G chip debut, U.S. lawmakers called for tighter export controls. China, in turn, plans substantial iPhone usage bans for governmental bodies and state-owned firms. These steps from the world's two superpowers do not help to ease geopolitical tensions. That said, investors are likely to continue waiting on the sidelines before relationships between the U.S. and China improve. It would be difficult for the stock price to climb up without demand to buy it. Apart from risks to the stock price, geopolitical tensions also might be bad for Alibaba's operations. With the increasing industrial espionage fears, the U.S. might continue banning exports of some of the most sophisticated products, limiting Alibaba's ability to invest in innovation and improve its processes.

Apart from geopolitical factors, Alibaba faces some apparent unfavorable macro factors. In early 2023, there was a lot of optimism regarding the Chinese after-COVID economy reopening with expectations that it would boost the global economy. In reality, the recent economic data suggests that expectations were too optimistic. Consumer spending is weak, and the Q2 GDP growth was slow at 0.8% QoQ. A below 1% sequential growth suggests that post-COVID economic recovery is losing momentum, a significant near-term headwind for Alibaba's business.

Near-term challenges due to the soft economy are not the only unfavorable factor I see for Alibaba. The weaker-than-expected macroeconomic data is not a secular headwind since it is subject to cyclicality, and more robust expansion will obviously occur again. But, I see another solid secular headwind, which might limit the extent or postpone the timing of this expansion. The reason is a surging unemployment rate among young adults under 24 in urban areas. As of May 2023, China's youth unemployment surged above 20%, a dramatic increase from 15.4% two years earlier. It is obvious that digital-native young people are the most important audience for e-commerce companies like Alibaba. According to Shopify (SHOP), consumers aged 18 to 34 have become the dominant e-commerce demographic. Having more than a fifth of young people in the country unemployed means that the major e-commerce age group is financially weak and possesses less money to spend on e-shopping. That is a huge secular headwind for Alibaba.

Valuation update

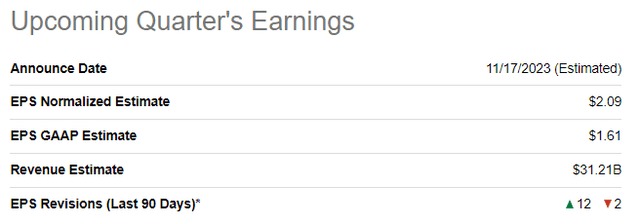

The stock demonstrated a 3.5% year-to-date price decline, significantly underperforming the broader U.S. market. Still, BABA's performance was slightly better than the iShares MSCI China ETF (MCHI). Seeking Alpha Quant assigns the stock a decent "B" valuation grade, meaning the stock is attractively valued.

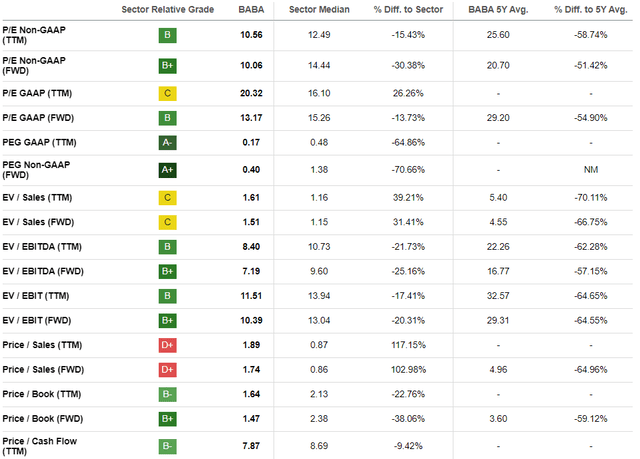

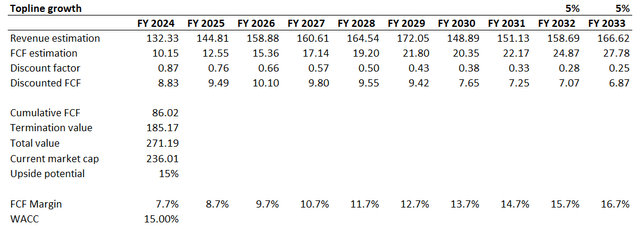

I want to proceed with a discounted cash flow [DCF] simulation for my valuation analysis. Due to the risks inherent in investing in Chinese companies, I use a 15% WACC for discounting. The TTM FCF margin is 7.7%, which I use for my base year and expect a 100 basis points yearly expansion. I also have long-term revenue consensus estimates, which I consider fair for my DCF simulation.

My updated valuation analysis suggests the business's fair value is approximately $271 billion, which indicates a 15% upside potential for the stock price. I do not give my target price expectations because risks and uncertainties are vast, which I discuss in my article's next section.

Risks to my bearish thesis

There are a couple of significant risks to my bearish thesis. First is the fact that the Chinese central bank has eased its monetary policy by cutting the benchmark interest rate. Raise cuts are generally suitable for businesses because they make credit more affordable, which, in theory, is likely to boost consumer spending. The effect of monetary policy easing will be lagging and is unlikely to affect spending rapidly. Still, the central bank might continue easing rates and introduce more rate cuts, which might add substantial optimism for investors in Chinese stocks. This will boost the demand for Chinese stocks and will highly likely positively affect BABA's price.

Another potential good news might come from the geopolitical field. While I do not believe the world's two superpowers will stop their fierce competition for global economic and technological leadership, the "cold war" cannot escalate infinitely. Recent visits of Bill Gates and Elon Musk to China might mean that relationships between China and the U.S. are not that bad. It is also expected that Blinken will host one of the highest Chinese governmental officials by the year-end. While I do not expect major positive shifts in the geopolitical situation between these two countries, the stock market might overreact positively even on slightly positive news.

Bottom line

To conclude, Alibaba's stock is a "Sell". Geopolitical tensions between China and the U.S. are unlikely to ease, which will not add optimism to potential investors in Chinese stocks. Apart from that, there are multiple unfavorable factors for Alibaba inside China. The near-term economic prospects look cloudy while skyrocketing youth unemployment looks like a massive secular headwind. The valuation might look attractive, but I do not think that the upside potential outweighs the potential risks and uncertainties.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)