The AI Boom May Not Help Lift Taiwan Semiconductor's Stock

Summary

- Taiwan Semi's stock has fallen 18% from its peak. An options trader is betting on a further decline.

- TSM shares are expensive in the US.

- Revenue and earnings estimates have been revised downward by analysts.

- Looking for more investing ideas like this one? Get them exclusively at Reading The Markets. Learn More »

JHVEPhoto/iStock Editorial via Getty Images

Taiwan Semiconductor's (NYSE:TSM) shares have recently fallen back to their pre-AI boom levels in May, experiencing a roughly 18% decline from their peak on June 13. An options trader is betting that Taiwan Semi's stock will decline further by mid-October.

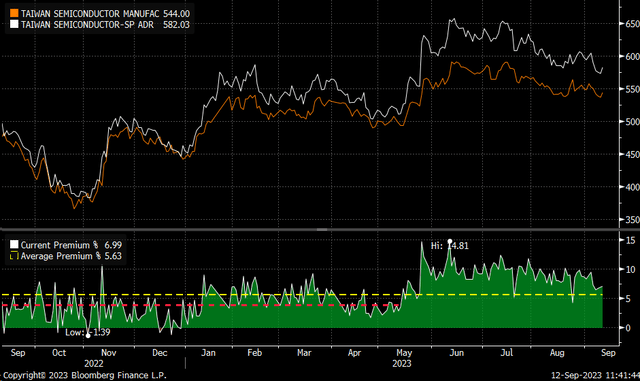

Shares of Taiwan Semi are trading at a larger than normal premium than the shares that trade locally in Taiwan. It could be that the options trader is anticipating either a contraction of this premium or ongoing challenges in the company's fundamental performance.

From October 2022 to May 2023, the average premium between Taiwan Semi's local shares and American Depositary Receipts (ADR) was approximately 3.9%. As of today, that premium has risen to around 7%. Assuming this spread will revert to its pre-AI boom norm, the stock could decline from its current price of $91.03 to approximately $85. This projection is based on the current Taiwan Dollar spot rate of 32.03 and the fact that 1 ADR share is equivalent to 5 local shares, with the price of the local shares 2330 trading at 544 TWD.

Additionally, revenue estimates for 2023 and 2024 have been revised downward recently. Interestingly, the stock's decline preceded these lowered revenue forecasts and may have been more severe than warranted. Specifically, the stock dropped to a valuation of just four times the 2023 sales estimates. That valuation is near the lower end of the historical range for Taiwan Semi since 2013.

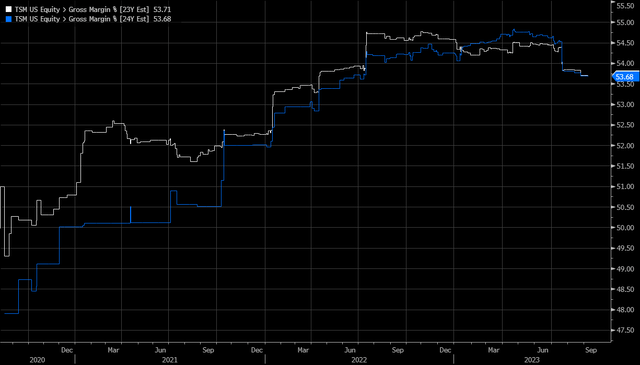

However, the stock has seen a significant rally since hitting its low point in October. It appears that the ongoing AI boom, which has buoyed many stocks in recent months, isn't poised to improve Taiwan Semi's prospects in 2024 - as sales estimates continue to trend downward. Furthermore, even gross margin estimates have been revised downward since July and are expected to remain flat in 2024. Consequently, despite Taiwan Semi's role as a key supplier for companies like Nvidia and AMD, it's not anticipated to reap the same benefits that have boosted Nvidia's performance up to this point.

The data suggests that much of the stock's recent surge may lack a solid foundation. Although the stock appears cheaper on a price-to-sales metric compared to its 2021 levels during the COVID bubble, it's not necessarily cheap from a historical perspective. This observation could motivate a trader to place a bearish options bet with an Oct. 20 expiration date. According to data from Trade Alert, open interest for the $65 and $70 puts increased by around 12,000 contracts each. The data indicates these puts were purchased at the asking prices of $0.13 and $0.24 per contract, respectively.

While the total premiums paid amount to less than $500,000 - a relatively small trade - it appears more like a directional bet on the stock's downward movement. The premiums on these puts could start to rise if the stock continues to fall, allowing the trader to sell the puts well before reaching the strike prices on the puts.

Technically, the stock is at an interesting juncture, hovering around a support level of $89 with a significant gap still to close around $87. There's no substantial support until the stock hits $83. The Relative Strength Index shows that momentum is not positive, suggesting further room for decline may exist. If the stock fails to breach the $89 support level and instead moves above $93, it could pave the way for the shares to climb back to around $97.

The persistent downward revisions to Taiwan Semi's outlook are certainly not encouraging, particularly in the context of the general enthusiasm surrounding the potential benefits of AI. Valuation wise, the stock isn't cheap on a price-to-sales basis, and it appears to be trading at a larger-than-normal premium compared to its local shares in Taiwan. Furthermore, technical indicators suggest that the stock's support levels may be on the verge of breaking down. All these factors make a compelling case for the trader's bearish bet on Taiwan Semi, providing a well-reasoned basis for their position.

This article was written by

I am Michael Kramer, the founder of Mott Capital Management and creator of Reading The Markets, an SA Marketplace service. I focus on long-only macro themes and trends, look for long-term thematic growth investments, and use options data to find unusual activity.

I use my over 25 years of experience as a buy-side trader, analyst, and portfolio manager, to explain the twists and turns of the stock market and where it may be heading next. Additionally, I use data from top vendors to formulate my analysis, including sell-side analyst estimates and research, newsfeeds, in-depth options data, and gamma levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.