Wave Life Sciences: Excellent Early Data, Major Collaborations, Needs Cash

Summary

- Wave Life Sciences Ltd. develops stereopure oligonucleotides targeting disease-causing genetic mutations.

- The company has lead assets in phase 1/2 trials for Duchenne muscular dystrophy and Huntington's Disease.

- Wave has collaborations with GSK and Takeda, with the GSK deal potentially worth up to $3.3 billion in milestone payments.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

anusorn nakdee/iStock via Getty Images

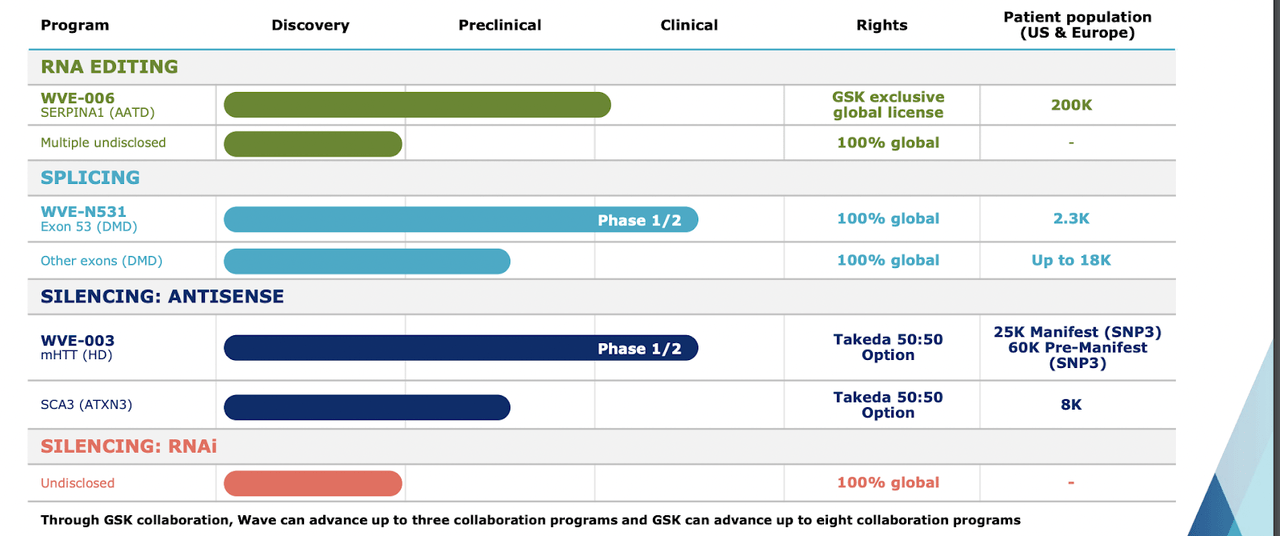

Wave Life Sciences Ltd. (NASDAQ:WVE) develops stereopure oligonucleotides using its PRISM platform to target disease-causing genetic mutations. This is its pipeline:

Lead assets are WVE-N531 targeting exon 53 skipping DMD, and WVE-003 targeting Huntington's Disease in phase 1/2 trials. WVE owns the first molecule globally, while Takeda has a 50/50 option for the second one. There’s a third molecule in the clinic, owned by GSK globally, which is WVE-006 targeting Alpha-1 antitrypsin deficiency (AATD). Other assets are in preclinical stages.

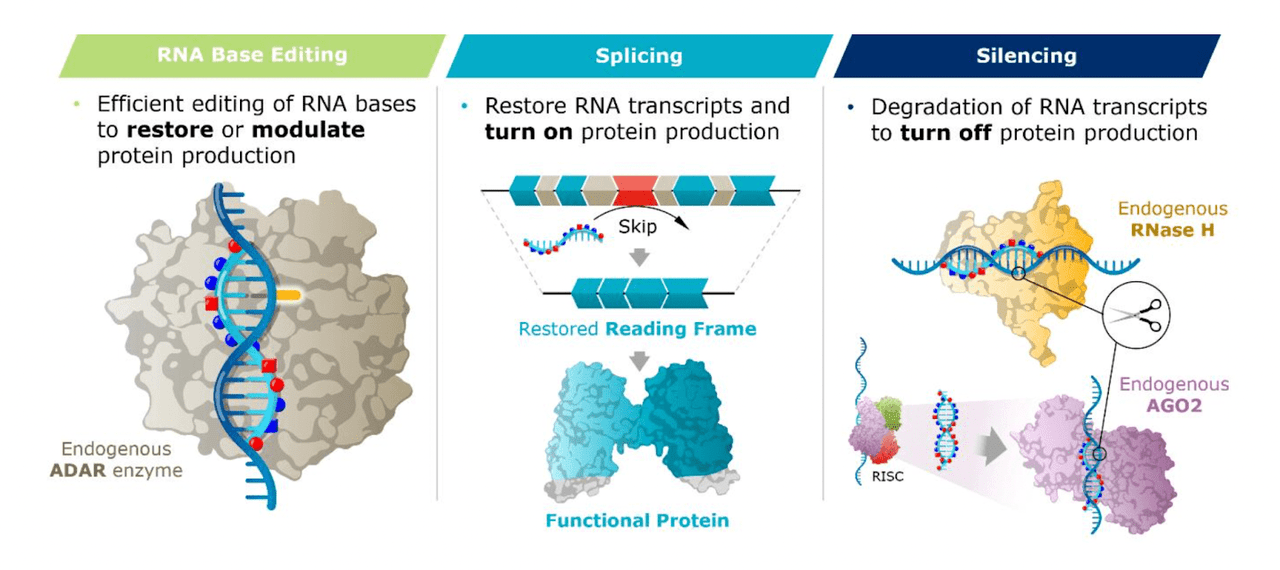

The company’s technology provides for three things - RNA editing, splicing and silencing.

Thus, each of the three molecules in the clinic represents one of these three technologies. WVE-N531 uses RNA splicing, WVE-006 uses base editing, and WVE-003 works through gene silencing.

The base editing they use is from adenosine to inosine, or A-to-I, the most common form of RNA editing. The technology uses oligonucleotides (“AIMers”) for the editing, and the company claims that this gives them “access to areas of disease biology that are not viable for other therapeutic modalities.”

The company has two major collaborations, with GSK plc (GSK) and Takeda (TAK). The GSK deal was stuck in December 2022 and here are the details of payments:

Under the terms of the GSK Collaboration Agreement, we received an upfront payment of $170.0 million, which included a cash payment of $120.0 million and a $50.0 million equity investment. In addition, assuming WVE-006 and GSK’s eight collaboration programs achieve initiation, development, launch, and commercialization milestones, we would be eligible to receive up to $3.3 billion in cash milestone payments…

The Takeda program is older, from 2018, and the terms are as follows:

In April 2018, the Takeda Collaboration became effective and Takeda paid Wave $110.0 million as an upfront payment. Takeda also agreed to fund our research and preclinical activities in the amount of $60.0 million during the four-year research term and to reimburse Wave for any collaboration-budgeted research and preclinical expenses incurred by us that exceed that amount.

The Takeda deal was foundational, but the GSK deal is potentially huge. Under this deal, GSK has an exclusive global license to WVE-006 for AATD. GSK can advance up to eight collaboration programs, while WVE up to 3 collaboration programs using GSK’s genetic “insight.” The lead indication under this deal is WVE-006, targeting AATD, which is “designed to correct mutant SERPINA1 transcript to address both liver and lung manifestations of AATD.” In preclinical testing, WVE-006 was seen to decrease lobular inflammation in the liver, and also reduces PAS-D globular size, where Periodic Acid-Schiff (PAS') with diastase (PAS-D) is a stain used to detect AATD.

WVE’s proprietary lead molecule is WVE-N531, which is targeting the rare exon 53 skipping DMD, which makes up some 8-10% of the already rare DMD population. Whichever exon you skip, the ultimate goal is to produce functional dystrophin, and the FDA considers this as an adequate surrogate endpoint for accelerated approval. In preclinical trials with nonhuman primates, WVE-N531 was found to attain high concentration in the heart and diaphragm, and lead to 71% restoration of dystrophin.

Last year, in December, WVE provided positive proof of concept data from the initial cohort of the Phase 1b/2a proof-of-concept study of WVE-N531 in three boys with Duchenne muscular dystrophy ("DMD") amenable to exon 53 skipping. From our TickerBay software, here’s the data:

The efficacy data from the Phase 1b/2a proof-of-concept study of WVE-N531 in three boys with Duchenne muscular dystrophy (DMD) amenable to exon 53 skipping are as follows: - Mean exon skipping of 53% (range: 48-62%) was observed after three consecutive doses of WVE-N531. - Mean dystrophin production was measured to be 0.27% of normal as measured by Western blot. However, it was below the level of quantification (BLQ: 1%), indicating that dystrophin protein production was very low. - Muscle concentrations of WVE-N531 were high, with a mean tissue concentration of 42 micrograms/gram (6.1 micromolar). - RNAscope results indicated that WVE-N531 is reaching the nucleus in muscle cells. It's important to note that these results are from an initial cohort and represent early evidence of WVE-N531's efficacy. Further research and longer exposure will be needed to confirm the promise of these early data.

The company is now initiating part B, a potentially registrational phase 2 trial. Data is expected in 2024.

For the third candidate, base editing molecule WVE-003 targeting Huntington's Disease, preclinical proof of concept data was published in Nature in March last year. Here’s the abstract:

Technologies that recruit and direct the activity of endogenous RNA-editing enzymes to specific cellular RNAs have therapeutic potential, but translating them from cell culture into animal models has been challenging. Here we describe short, chemically modified oligonucleotides called AIMers that direct efficient and specific A-to-I editing of endogenous transcripts by endogenous adenosine deaminases acting on RNA (ADAR) enzymes, including the ubiquitously and constitutively expressed ADAR1 p110 isoform. We show that fully chemically modified AIMers with chimeric backbones containing stereopure phosphorothioate and nitrogen-containing linkages based on phosphoryl guanidine enhanced potency and editing efficiency 100-fold compared with those with uniformly phosphorothioate-modified backbones in vitro. In vivo, AIMers targeted to hepatocytes with N-acetylgalactosamine achieve up to 50% editing with no bystander editing of the endogenous ACTB transcript in non-human primate liver, with editing persisting for at least one month. These results support further investigation of the therapeutic potential of stereopure AIMers.

Data showed that AIMers were present in NHP liver by day 50, and there was substantial and durable, and highly specific, editing in vivo. The company plans to produce more clinical data this year and take the discussion with Takeda to their next steps.

Financials

WVE has a market cap of $465mn and a cash balance of $170mn. Research and development expenses were $33.3 million in the second quarter of 2023, while general and administrative expenses were $12.3 million. That gives them a runway of 4-5 quarters.

WVE stock is substantially held by institutions and other smart money players, with retail holding being at 5%. Key holders are RA Capital, GSK PLC and Shin Nippon. Insider transactions are almost all sell transactions.

Risks

WVE’s cash balance is low, and given the early stage of development, they will need more funds. While GSK is funding some of their R&D, they will still need to raise funds very soon - and it may not all be non-dilutive.

The other risk is the early stage of the pipeline. While there is clinical DMD data, and arguably, DMD trials are usually small because of the rareness of the disease, yet, all they have is data from 3 patients.

Earlier this year, the stock crashed after an asset called WVE-004 failed a Phase 1/2 trial for certain patients with amyotrophic lateral sclerosis (ALS) and dementia, where it was unable to beat placebo.

Bottom Line

I found WVE interesting. These gene editing companies have a tough time ahead of them managing unwanted side effects and so on. But this is the future of medicine, and WVE seems to be creating some of it. I will stay interested.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important: My Hold rating only means "I will not Buy now." I am not telling *you* to hold, because I see some risks here. But I am also not telling you to *sell*, because, a) the risks are not insurmountable, and b) you may have bought at such a low price that your risk-benefit ratio is acceptable to you. Thus, my “Hold” is a bearish rating, but it is not as bearish as a “Sell” rating.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.