EOI: Compelling SPY Alternative At A Discount, 8% Yield (Rating Upgrade)

Summary

- The Enhanced Equity Income Fund is an equity closed end fund that falls in the 'buy-write' category.

- EOI closely tracks the S&P 500 performance from a total return perspective, and represents an attractive way to extract dividends from the asset class.

- EOI writes covered calls on roughly 50% of the collateral pool, thus being able to extract dividends by shorting volatility.

- The fund is finally trading at a discount to net asset value, after a number of years spent at a premium.

G0d4ather

Thesis

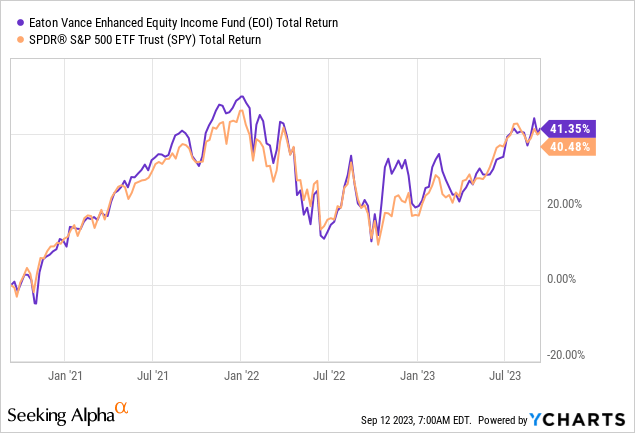

The Enhanced Equity Income Fund (NYSE:EOI) is an equity closed end fund. The vehicle falls in the 'buy-write' category. We have covered this name before and actually own it. As per our prior articles, this CEF closely tracks the S&P 500 performance from a total return perspective, and represents an attractive way to extract dividends from the asset class:

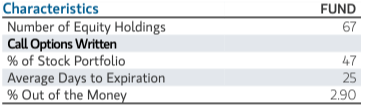

The fund achieves this feat by investing in a small pool of securities that are found in the S&P 500, namely 67 equity names. Furthermore, the CEF writes covered calls on roughly 50% of the collateral pool, thus being able to extract dividends by shorting volatility. With an 8% dividend yield the CEF represents a robust way to extract monthly income from the S&P 500, while maintaining a very similar total return profile.

In this article we are going to explore the reasons why EOI represents a compelling alternative over the SPY at this juncture, and articulate the reasons why this CEF makes sense for investors looking to add equity exposure to their portfolios.

State of the Equity Market

2023 has been nothing short of breathtaking. We started the year with most market analysts calling for a deep correction in Q1, only to get a regional banking crisis instead. Surprisingly for everybody, the market kept grinding higher as the year went on, with market participants helping the move by closing large short positions.

As a retail investor one needs to understand that timing the market is quasi-impossible. Even large players such as hedge-funds have an astonishingly hard time to do that. What an investor can do is allocate a portfolio to an extent that it is favorably set-up for prevailing conditions. To that end, if one just held a higher than normal cash balance in 2023, they would have done just fine.

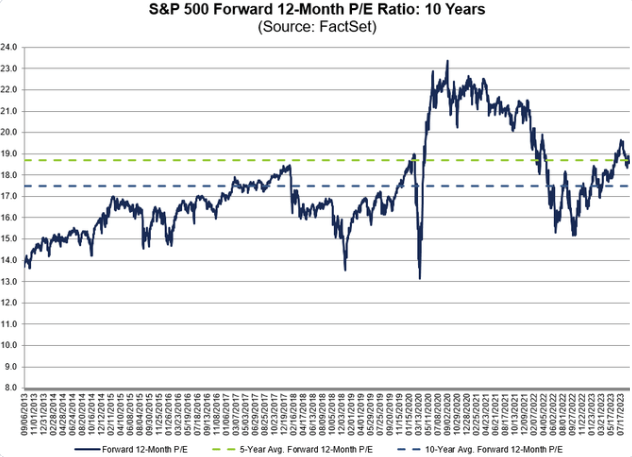

Which brings us to the current market levels - by traditional valuation metrics the market is fairly expensive:

S&P 500 Forward P/E (FactSet)

The forward 12-months P/E Ratio is at 19x, which is at the 5-year average, but above the 10-year one. We can see how valuations became extremely stretched during 2020 and 2021 due to the zero rates environment.

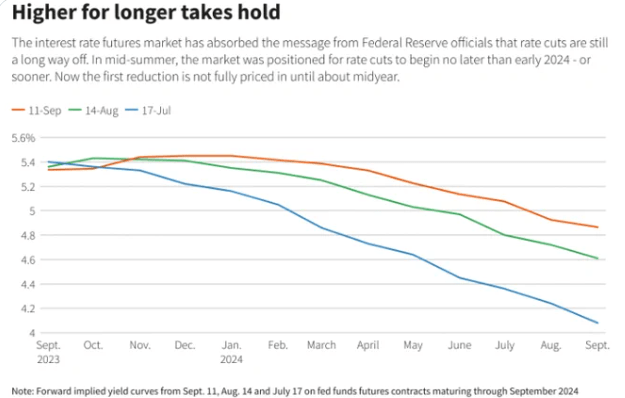

That was the intent engineered by the Federal Reserve, which wanted investors to stimulate the economy by giving them no other alternatives outside equity and debt investments. Hence the TINA acronym during those days. The opposite is occurring as we speak, with Federal Funds above 5%, and expected to stay there well into 2024:

FedFunds Forward (Reuters)

We can see how the forward market is pricing Fed Funds at 5.4% through at least March of next year now.

Yet the equity market has been staunchly resistant, with the S&P 500 up over 17% this year. Not all stocks are equal though, with most of the returns this year driven by only a handful of names.

How much higher can this market go? Is this the start of a new bull run? All good questions where market participants differ. A good indicator of a true new bull run is breadth. And while breadth has been improving over the past couple of months, it is astounding to see the equal weight S&P 500 fund Invesco S&P 500 Equal Weight ETF (RSP) up only 4.8% this year.

We feel inflation will be stickier than thought, and that rates will stay higher for much longer than previously anticipated. That will ultimately result in another risk-off event, but the main question is 'When'.

The market does not like to tread water, at least not in 2023, so if it decides that the news reel is not bad then it will probably move further up until December. To that end we are presenting investors with a smarter alternative than just buying the SPY at this stage.

Why EOI looks better than SPY at this stage

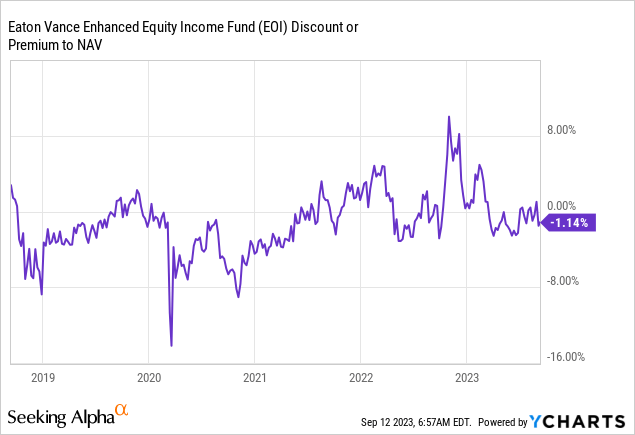

EOI is a closed end fund, and structurally it is finally trading again at a discount:

During the past few years the fund has been trading at small or large premiums to net asset value. The CEF is now finally in discount territory, and it basically represents a more advantageous alternative to purchasing the SPY outright.

The reason for the discount is the short volatility position the fund takes via its call writing:

Characteristics (Fund Fact Sheet)

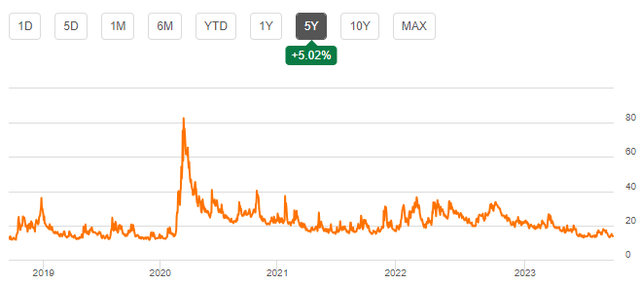

Currently 47% of the portfolio is overwritten with calls that have a 25 day average maturity, and a 2.9% 'out-of-the-moneyness'. This structural feature can add additional income if the market does not move up by more than 2.9% during that time-frame. However, the market is currently punishing buy-write funds such as EOI due to the very low VIX levels in the market:

The VIX is back at pre-2020 levels, which makes call-writing less profitable. Writing options results in a premium paid to the fund. The higher the VIX, the higher the premium paid to the CEF. Conversely, when the VIX is low, the CEF makes less of a premium. The market is now arguing the premium is too low for the upside given up.

However, as a retail investor we should like the small discount that has opened up in EOI since it provides with a cheaper entry point into the index. We do not know the market's next move, but we do know that if a new cyclical bull is entered than the CEF will yet again move to a premium to NAV, whereas during a next risk-off move, the fund will have some sort of premium to make up for the underlying equity losses.

Conclusion

2023 has been a very hard year to anticipate. Despite market-wide expectations for a significant leg down in Q1, we did not experience that. As the year progressed, the market grinded higher, with many investors covering short positions.

EOI is an equity closed end fund that falls in the buy-write category. The vehicle has written calls on roughly 47% of its portfolio, and gives up any upside above 2.9% increments over 25 days. The market is punishing short vol funds across the board, and this CEF is now finally trading at a discount to NAV again.

We do not know what the future will hold for the SPY, but given the close return correlations between the CEF and the S&P 500, it is a better risk/reward proposal at this stage to buy the index via EOI, given its discount to NAV. If a bull cycle comes next we expect EOI to move back to a premium to NAV, while in a risk-off environment the fund should have a similar drawdown as the index with some premium compensation. We are not advocating buying the market here. However, we hold this name and have been dripping into it, and believe it is a smarter way to increase the equity allocation of a portfolio rather than buying the index outright at this juncture in the cycle.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EOI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.