Groupon: A Deep Dive Into Business Viability

Summary

- Groupon is struggling to maintain customer engagement and revenue.

- Based on DCF analysis, GRPN stock appears overvalued, suggesting that now may not be the ideal time to invest.

- Despite cost-saving measures, financial woes like negative free cash flow and an upcoming large loan payment are concerning.

- Given the red flags surrounding the key metrics of Gross Billings and Units Sold, my investment recommendation at this time is a "Sell" until the company shows signs of reversing these declining trends.

naphtalina/iStock via Getty Images

Thesis

Groupon Inc. (NASDAQ:GRPN), a well-known online platform connecting consumers with various types of businesses, has faced considerable challenges, including decreasing revenue, customer engagement, and more. Despite reorganization plans and cost-saving measures, significant concerns exist about the company's long-term viability. Investors must be cautious, as my Discounted Cash Flow analysis indicates that the stock is currently overvalued.

Overview

Groupon is an online platform that operates globally. It connects regular people looking to buy things with businesses wanting to sell them.

Business Structure

Groupon has two main business regions: North America and International. They focus on selling three things: Local services, Physical products (Goods), and Travel packages.

Company Goals

Groupon wants to be the first place people think of when buying local services and experiences. They aim to form strong relationships with local businesses to offer a better variety of items. They're also working to make buying on their platform a smoother experience to keep customers returning.

How Groupon Makes Money

Groupon earns money by taking a portion of each sale on its platform. These sales often involve services or goods from other businesses. They calculate their earnings by taking the total money collected from customers and subtracting the amount they owe back to these businesses. When customers use digital coupons from Groupon to buy items, Groupon also takes a share of that sale.

Cost Savings and Reorganization Plan

In August 2022, Groupon started a plan to save money, which aligns with its future business goals. The company's leaders okayed reorganising on August 5, 2022, to cut about 1,000 jobs worldwide. Most of these job cuts will happen by March 2023 and the rest by the end of that year. The estimated cost for this reorganization is between $20 million and $27 million, mainly for severance pay. As of now, they've already spent $19.1 million on this plan. In July 2023, a third phase of job cuts was agreed upon, estimated to cost around $3.6 million in severance pay.

Takeaway

While Groupon's recent reorganization plan aims for cost savings and aligns with its broader business goals, investors should be cautious. The company is taking considerable risks in cutting jobs, which could affect its operations in the short term. Furthermore, the reorganisation cost is substantial, impacting the company's financials.

Given the company's current focus on restructuring rather than growth and the incurred and upcoming expenses related to the reorganization, investors may want to hold off on buying Groupon stock for now. Monitoring the company's performance in the coming quarters will offer insights into whether these structural changes lead to a more profitable and efficient business model.

Operating Metrics

Understanding a company's operating metrics is crucial for making informed investment decisions. For Groupon, key metrics such as Gross Billings, Revenue, EBITDA, and Active Customers provide a window into the company's financial health.

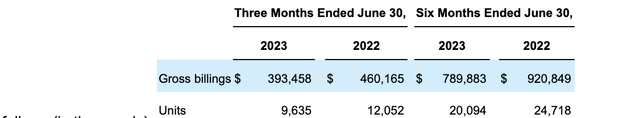

The company defines "Gross Billings" as the total amount of money customers spend on its platform. They arrive at this number by deducting any refunds given to customers, any discounts offered, and any taxes related to the sales. Gross Billings gives the company a sense of how much money is moving through its sales platforms and how well the business is doing.

Gross Billings and "Revenue" are not the same. Revenue is the money that remains after the company gives a portion of the sales to the merchants who sell the goods or services. Gross Billings helps the company understand how much money they'll eventually keep after paying these merchants.

The company's main financial goal is to increase EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). The company don't count sales that use digital coupons from their website or app in their "Units" number.

"Active Customers" are individuals who have purchased in the past year either directly from the company's platforms or through a seller who pays a fee to the company. This metric is important because it shows whether more or fewer people shop through their platforms. Note that a single person might have multiple accounts, leading them to be counted more than once in the "Active Customers" metric. People who only use digital coupons or buy from other sellers collaborating with the company are not considered "Active Customers."

Performance Overview For 2023 vs. 2022

Groupon Quarterly Results

The company experienced a decrease in Gross Billings, sold fewer items (Units), and had fewer active customers in the first half of 2023 compared to the same period in 2022. For example, the number of active customers leading up to June 2023 was 21,068, while it was 17,488 for the same period in 2022. The declining Gross Billings and Units Sold in H1 2023 compared to H1 2022 pose significant concerns about Groupon's financial health and future growth prospects.

Key Drivers

The company aims to continue attracting and keeping local businesses as partners. These local businesses can stop collaborating with the company at any time. Their decision to stay or leave is influenced by how beneficial the company's platform is for them. Retention becomes a challenge when the platform's appeal diminishes. There's an urgent need for the company to turn around its declining metrics to remain attractive for these local businesses.

The company is keen on enhancing its platform to improve it for all parties involved: themselves, the local businesses, and the customers. To achieve this, they explore strategies like introducing new deals and offers. They aim to encourage customers to visit more frequently and make more purchases. To make this happen, the company focuses on expanding its product range (inventory), enhancing the shopping experience, and building trustworthy customer relationships.

Takeaway

The company's strategies, like introducing new deals and expanding inventory, are a step in the right direction. However, given the widespread declines in key metrics, one questions whether these initiatives will be enough to spur a turnaround. These are long-term strategies, and the company doesn't have the luxury of time.

Groupon 10-Q

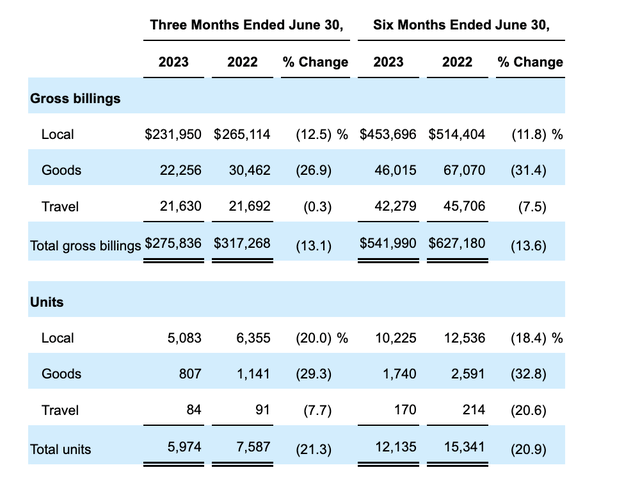

Deteriorating North American Business

The company's business in North America has performed worse this year than last in revenue and sales volume. Customer interest in products and local services has declined, leading to fewer people using the platform. As a result, the company sold fewer items and earned less money over the past six months, negatively affecting revenue and profit.

Groupon 10-Q

In both the three-month and six-month periods, the North American part of the company experienced a drop in revenue, cost of making sales, and overall earnings. This happened mainly because fewer people were using their online platform, which led to less money coming in from sales. The company sold fewer items and consequently lower revenues. The problem worsened over the six months compared to the three months, showing things going downhill.

Takeaway

North America was a sore spot for the company. The decline in revenue and sales volume indicates that customers are losing interest. This troubling trend is not just a blip; it's worsening over time, specifically in the past six months compared to the last three months. This downward trajectory could indicate a fundamental issue with the company's value proposition in this critical market.

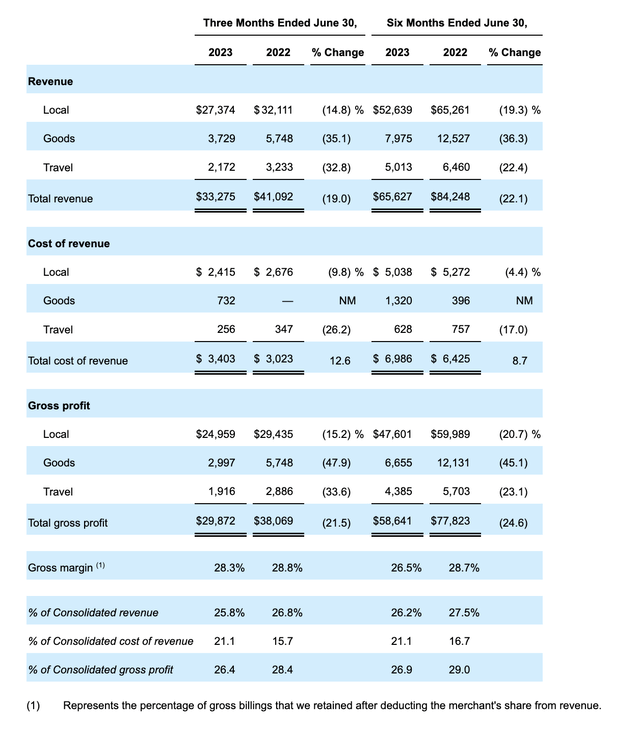

Disconcerting Trends in "Contribution Profit"

The company calculates "contribution profit" by subtracting the "gross profit" and subtracting what it spends on marketing. During the three and six months, the company cut back on marketing spending. In the three months, they spent less on employee salaries, had fewer people visit their website, and lowered their online ad costs. In the six months, the cuts were mainly due to fewer people visiting the website and less money spent on online ads. Even though they spent less on marketing, the "contribution profit" still decreased over both time frames, mainly because their overall earnings were lower.

Groupon 10-Q

Takeaway

Groupon tried to mitigate losses by reducing marketing and operational expenses. While spending less is generally positive for profitability, the "contribution profit" declined. This means the cuts were not enough to offset the revenue losses, raising concerns about the efficiency of their operations and the scalability of their business model.

International Woes Add to the Worry

The company's earnings and profits from its international operations decreased compared to three-month and six-month periods from the previous year. Over six months, the company made $18.6 million less in sales and $19.2 million less in profit compared to last year's time frame. The main factors behind this drop are the company's decision to focus on selling less profitable items and giving less emphasis to their Goods category. Additionally, for those six months, fluctuations in currency values in different countries negatively impacted the company's earnings and profits.

Takeaway

If North America wasn't bad enough, the international segments also saw sales and profits decline. With a loss of $18.6 million in sales and $19.2 million in profit over six months compared to last year, currency fluctuations and strategic missteps only worsened the situation.

Liquidity Position

Groupon 10-Q

The company mainly depends on cash reserves and loans to maintain smooth day-to-day operations. It collects customer payment before paying its third-party sellers, which could help manage cash flow. Throughout the year, the company's cash balance has varied widely for several reasons, including total sales, the timing of seller payments, and the types of sales they conduct, such as goods or local services.

The company has consistently been spending more cash for daily operations, as indicated by growing negative numbers from 2022 to 2023. Its free cash flow is also negative, meaning there's no surplus cash left after covering all significant expenses. This could become a problem if it continues over the long term. Additionally, a large loan payment is due in 2024, which increases financial strain. Given the high spending and upcoming debts, it's uncertain whether the company can continue operating in its current manner. The company is considering options to improve its cash situation and reduce expenses, but no decisions have yet been finalised.

An Uncertain Path Ahead

On the surface, Groupon has an intelligent cash management strategy: it collects customer payments before paying its third-party sellers. This approach can aid short-term cash flow. However, relying heavily on cash reserves and loans for daily operations is not sustainable, particularly when those cash reserves are dwindling.

Given these financial strain indicators, there is genuine concern whether the company can sustain its operations. While it's considering various options to better its cash situation and cut costs, the absence of a finalized strategy only compounds the uncertainty.

Valuation

Financial Analysis

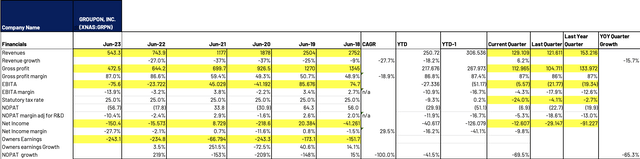

Trailing Decline in Sales

Groupon has been unable to break its negative sales growth trend for the past five years. The decline in sales has been so significant that it marks a Compound Annual Growth Rate of a whopping -28%. While it generated $2.75 billion in 2018, by 2023, revenue fell to just $543 million. Fewer transactions on the platform are to blame for this severe decline.

High Operating Costs: The SG&A Problem

While the gross billings (or money flowing through the platform) are decreasing, the company's Sales, General, and Administrative (SG&A) expenses haven't followed suit. The disproportionate ratio between revenue and SG&A has culminated in negative Earnings Before Interest, Taxes, and Amortization (EBITA) for the last two years. In layman's terms, the company is spending more than it's earning, a recipe for disaster.

No Clear Path to Recovery

Alarmingly, Groupon hasn't articulated a clear strategy to turn around its sales. Instead, its focus seems to be on cost-saving measures and debt refinancing. While this might improve liquidity (or the ability to cover short-term expenses), it's akin to applying a band-aid on a bullet wound when it comes to long-term viability.

The Debt Trap: Rising Costs and Negative Book Value

The company's debt situation is concerning. With a high cost of debt at 15.2% and a market debt-to-equity ratio of 25%, the cost of obtaining capital is a steep 11.87%. Coupled with a negative book value of $25 million due to past years of negative net income, the company is stuck in a financially difficult cycle.

Key Takeaways:

- The company has been on a downward trajectory regarding revenue and activity on the platform.

- There's no plan to improve platform engagement; instead, the focus is on cost-saving and debt management.

- Financial indicators like negative book value and high cost of capital signal financial strain.

- All things considered, this is not a company you'd want to bet on, at least not until there's evidence of a sustainable turnaround strategy.

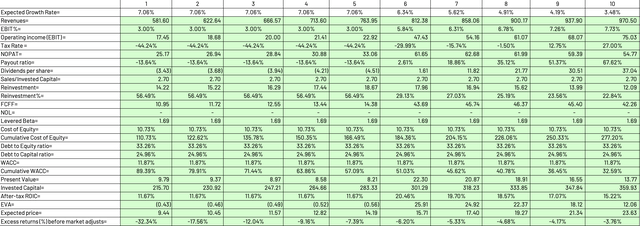

In my Discounted Cash Flow analysis, I'm optimistic that the company's restructuring efforts will pay off, leading to a revival in growth. I predict the company will experience a 7.05% growth rate for the next five years. After that, the growth rate will stabilize to a risk-free rate of 3.48% in the terminal year.

A Positive Turn for EBITA Margins

Thanks to the cost-saving plans, I anticipate the company's EBITA (Earnings Before Interest, Taxes, and Amortization) margin will turn positive. It will reach 3% in 2024 and eventually align with the industry average margin of 7.73%.

Capex and Working Capital: Efficiency is Key

Capital expenditures are expected to remain low. Why? Because the company doesn't have many high-return opportunities, that would make the Return on Invested Capital exceed the Weighted Average Cost of Capital (WACC).

In addition, the company is good at managing its working capital. It typically collects payment from customers before needing to pay its third-party sellers. This negative cash conversion cycle is advantageous for short-term liquidity.

High Capital Turnover

The company's capital turnover ratio last year was 2.7, meaning that for every dollar invested, the company generated $2.7 in sales. This high turnover ratio is expected to continue, adding another layer of efficiency to its operations.

Key Assumptions:

- The company's restructuring efforts are expected to result in a growth turnaround.

- EBITA margins are projected to become positive and align with industry standards.

- Low capital expenditures are anticipated due to limited high-return growth opportunities.

- The company is efficient in working capital management, and a high capital turnover ratio is expected to continue.

DCF Valuation

Based on these factors, I calculate the stock's true worth or intrinsic value to be $8.52. However, the stock is currently being traded at $9.85. So, I believe the stock is priced too high and overvalued.

Conclusion and Investment Recommendation

Given the company's declining performance and financial strain, investing in Groupon Inc. appears risky. My DCF analysis also indicates that the stock is overvalued. Therefore, my investment recommendation would be to Sell or Avoid buying shares now.

Key Takeaways:

- Groupon Inc. is struggling to maintain customer engagement and revenue.

- Despite cost-saving measures, financial woes like negative free cash flow and an upcoming large loan payment are concerning.

- Based on DCF analysis, the stock appears overvalued, suggesting that now may not be the ideal time to invest.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.