Geron Corporation: The FDA, Catalysts And New Competition From Old Drugs

Summary

- GERN's New Drug Application for imetelstat in lower-risk myelodysplastic syndromes has been accepted for standard review by the FDA.

- The FDA's approval of Bristol-Myers Squibb's Reblozyl as a first-line treatment in lower-risk MDS may impact the positioning of imetelstat.

- Another imetelstat competitor, decitabine/cedazuridine is being evaluated as a potential treatment for lower-risk MDS and could pose a challenge to imetelstat.

- GERN has plenty of cash to make it to an FDA decision on imetelstat and launch the drug, if it is approved.

deliormanli/iStock via Getty Images

Geron Corporation (NASDAQ:GERN) is currently awaiting FDA approval, or rejection, of its New Drug Application (NDA) for imetelstat in lower-risk myelodysplastic syndromes (MDS). When I last wrote about GERN, I noted the already approved competitor drug, Reblozyl (luspatercept), from Bristol-Myers Squibb (BMY), but felt imetelstat had some differentiation and would be approved. I rated GERN a buy at that time, as I liked the run of upcoming catalysts such as the acceptance of the imetelstat NDA for review, the potential for priority review of that NDA, and a readout from a clinical trial of imetelstat in myelofibrosis due in late 2023. This article takes a look at another competitor and the developments for the company since.

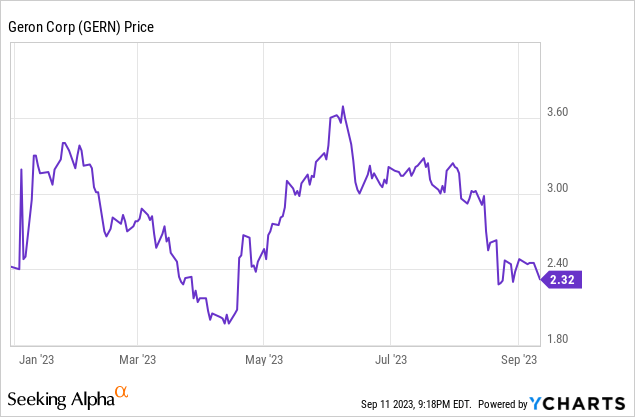

The NDA is accepted but no priority review

GERN's NDA for imetelstat for the treatment of lower risk MDS was accepted for substantive review, which GERN announced on August 21. At that point a priority review of six months or a standard review of 10 months was possible. Unfortunately, an August 22 press release confirmed a standard review with a Prescription Drug User Fee Act (PDUFA) action date of June 16, 2024. Further, GERN disclosed that the FDA was planning to hold an advisory committee meeting. Holding a meeting doesn't mean a drug won't be approved, and I still expect approval of the drug, but a four month delay isn't a positive. Unsurprisingly, the stock slipped in August with the news.

Figure 1: Year-to-date trading of GERN.

One possibility is that the FDA wants to discuss where imetelstat fits in, now that BMY's Reblozyl is on the market. Indeed on August 28, the FDA approved a label expansion for Reblozyl, with the drug now approved as first-line treatment in lower risk MDS. BMY's COMMANDS study showed that Reblozyl was a very competitive option in eryhthropoiesis stimulating agent (ESA) naive, lower-risk MDS patients. In that study, 58.5% of Reblozyl-treated patients achieved the primary endpoint, 12-weeks of transfusion independence with a concurrent increase in hemoglobin of 1.5 g/dL within the first 24 weeks. For those treated with an ESA, epoetin alfa, 31.2% achieved the primary endpoint (p<0.0001 for the comparison of the treatment groups).

The superiority of Reblozyl to an ESA in the first-line setting changes the treatment landscape of lower-risk MDS. Imetelstat's phase 3 work was in patients who were refractory to, or ineligible for, ESA's. Perhaps a more relevant trial now would be in patients refractory to or ineligible for luspatercept. GERN doesn't have much data in patients refractory to luspatercept, so the FDA may want to discuss this.

Another competitor worth considering

A four month delay caused by a standard rather than a hoped for priority review isn't the end of the world. Still there are other competitors in the pipeline and regulatory delays can help them come up. In this article I wanted to discuss a type of drug called a hypomethylating agent (HMA's, so called because they inhibit an enzyme that methylates DNA). GERN already acknowledges the existence of these competitors in its corporate presentation, as HMA's have been on the market for years, and represent a minor market share, they aren't a major concern for GERN's revenues. The problem is, optimization of these HMA's could see them regain ground.

Decitabine/cedazuridine (ASTX727 or Inqovi)

While the HMA decitabine (Dacogen) can be used in MDS, its activity is limited by metabolism by an enzyme called cytidine deaminase and it is used intravenously. A combination of decitabine with the cytidine deaminase inhibitor called cedazuridine (also known as E7727) allows oral dosing. The combination is sometimes referred to as ASTX727 in the literature but the drug is already approved in the US with the trade name Inqovi, and is marketed by Taiho Oncology. Astex, Otsuka and Taiho are all members of the Otsuka (OTCPK:OTSKF, OTCPK:OTSKY) group of companies. The current approval of Inqovi is for MDS (intermediate-1, intermediate-2 and high risk groups). Since the intermediate-1 risk group of MDS patients is included in trials of lower-risk MDS, there is technically an existing competition with imetelstat in lower-risk MDS.

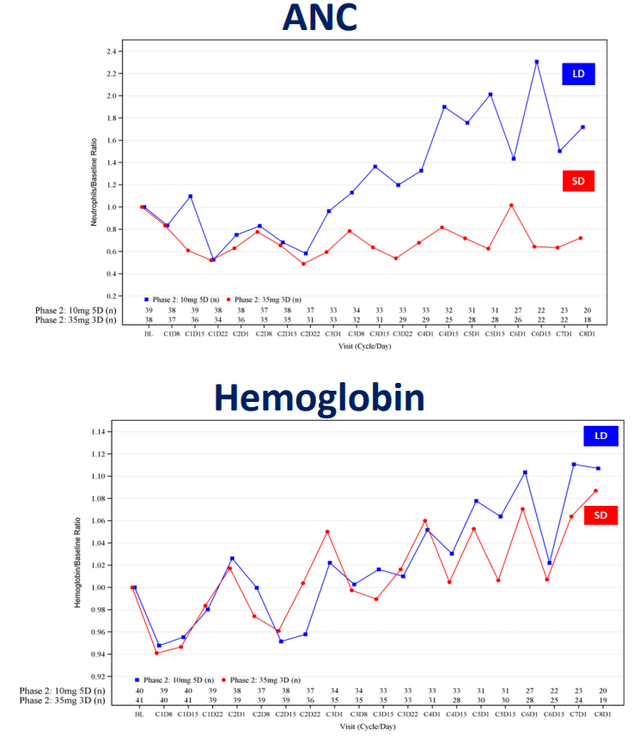

Outside of the existing approval in MDS, ASTX727 is in a whole host of clinical trials across various cancer types and MDS. For example, Astex has been evaluating optimal dose ratios of decitabine/cedazuridine in lower risk MDS (low risk and intermediate-1 risk groups). Results from an interim safety analysis of a phase 1/2 study of ASTX727 were presented at the Society of Hematologic Oncology (SOHO) 2023 annual meeting, held from September 6-9, 2023. The phase 1/2 data showed 10 mg decitabine and 100 mg cedazuridine for five days, every 28 days could be an optimal regime in lower risk MDS in terms of side effects. A standard regime of 35 mg decitabine and 100 mg cedazuridine for three days, every 28 days, produced more neutropenia (a reduction in neutrophil counts) and so was less tolerable. By comparison, the lower dose regime resulted in an increase in neutrophil count over time.

Figure 2: Absolute neutrophil counts (ANC) and hemoglobin concentration across two regimes of decitabine/cedazuridine. Low dose (LD, blue line) 10mg/100mg for 5 days, or standard dose (SD, red line) 35mg/100mg for 3 days. Note that both regimes achieve increases in hemoglobin, but the low dose regime produces higher neutrophil counts, rather than a reduction in neutrophil count. (Astex Pharmaceuticals Poster Presentation (Abstract MDS-641) at SOHO Annual Meeting, September 6-9, 2023.)

Astex then can likely go ahead with phase 3 work on this optimized dosing regime of ASTX727, provided subsequent longer-term phase 2 efficacy data shows the new dosing regime offers similar efficacy to the standard regime in MDS. At the time of the presentation at SOHO, longer term efficacy results weren't available, but the phase 2 portion of the trial already had data from 80 patients having received a median of 4.5 treatment cycles (so about 4-5 months of data). Based on the efficacy data so far, such as hemoglobin changes over time, it appears that the same increase in hemoglobin is seen with the lower dose regime as the standard dose regime.

Financial overview

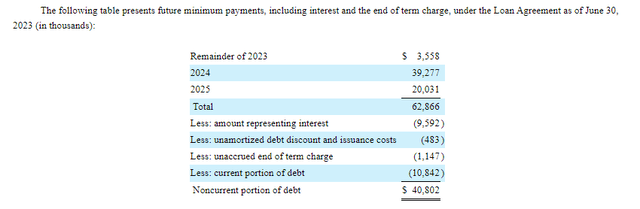

On August 3, 2023, GERN announced financial results for Q2'23. The company had $400.2M in cash, cash equivalents, restricted cash and marketable securities at the end of the quarter. Net loss was $49.3M for the quarter, with R&D expenses of $35.5M and G&A expenses of $16.5M. Net cash used in the first six months of 2023 was $76M and so GERN certainly has the funds to make it to the PDUFA action date for its imetelstat NDA in June 2024. At the current rate, GERN would be left with ~$250M in cash when it gets there, with which to launch the drug if the NDA is approved. GERN does have $40.8M in noncurrent debt outstanding as part of its loan agreement with Hercules and Silicon Valley Bank.

Figure 3: Payments due as part of GERN's loan agreement. (GERN 10-Q for Q2'23.)

GERN believes its cash, plus revenues from imetelstat and the exercise of warrants will be sufficient to fund its operations through the end of 2025. I don't find this guidance as useful because while I predict approval, it isn't guaranteed.

As of July 27, 2023, there were 523,370,675 shares of GERN's common stock outstanding corresponding to a market cap of $1.22B ($2.34 per share).

Conclusions and risks

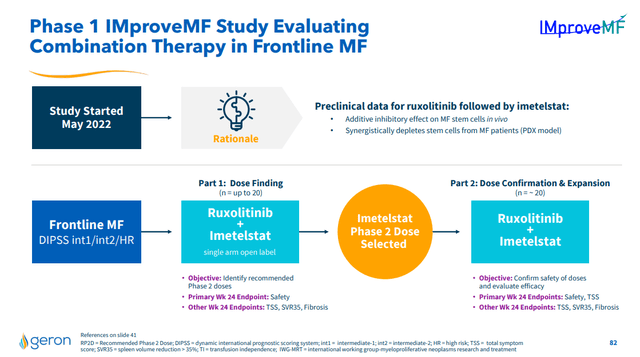

I still rate GERN a buy as while the company did not receive a priority review for its NDA, I still believe the NDA will be approved. Indeed, the four month delay is built into the stock price now, as it has traded down on the news, whereas approval isn't certain so I don't view it as built in. Further, in the near-term, there is a catalyst with results from a combination study (IMproveMF) of ruxolitinib with imetelstat. Notably, imetelstat has demonstrated activity in relapsed/refractory myelofibrosis in the past. As such, I view the probability of imetelstat working in combination with another drug in the frontline myelofibrosis setting as high.

Figure 4: Overview of GERN's IMproveMF study, a readout from which represents a potential near-term catalyst for the stock. (GERN September 2023, Corporate Presentation.)

Since the IMproveMF study should produce some results prior to the FDA advisory committee and approval or rejection of GERN's imetelstat NDA, those results are also a near-term risk. GERN has previously guided to preliminary data from IMproveMF by the end of 2023, so those results would need to be delayed by six months to come after the FDA decision on the imetelstat NDA. Any delays in the study, or disappointing results, such as activity, but problematic toxicity, could cause the stock to trade down, especially since imetelstat is in other myelofibrosis trials, so the performance of the drug in myelofibrosis could be questioned.

Further out, the advisory committee could come with critical remarks from members of the panel, which could see GERN stock fall, as it would raise concerns the drug might not be approved.

Lastly, if the imetelstat NDA is not approved in June, and GERN has to run additional studies, I think the stock would fall pretty heavily. Even a simple, single-arm, study of imetelstat in luspatercept-refractory patients would take some time to run, so that would bring about a sizable delay in getting imetelstat to market.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.