TORM: The Company Has Strong Financials And Market Outlook For H2 2023

Summary

- TORM plc, a leading tanker operator, has benefited from high utilization rates and improved financials despite geopolitical events and OPEC+ production cuts.

- The company's EBITDA jumped by 53% in the recent quarter, leading to a decline in leverage ratios and improved balance sheet strength.

- TORM has generated its highest free cash flow in recent years and plans to pay a dividend, demonstrating its ability to generate stable distributions.

moisseyev/iStock via Getty Images

Introduction

As a leading global operator of tankers, TORM (NASDAQ:TRMD) transports refined oil products. As you may know, geopolitical events during the last year brought severe insecurities in the energy market and caused higher prices. However, notwithstanding the distractive effects of war, some well-performed shipping companies like TORM could benefit from the high utilization rates of their fleet and boost their financial statements. By the end of the first half of 2023, TORM company made several sales and deliveries of vessels and ultimately ended a fleet of 87 vessels by the end of June 2023. Albeit OPEC+ decisions to cut oil production caused higher prices for refinery products during the recent months, the company’s financial condition is still promising and is likely to bring more benefits for its investors.

TORM financials and business outlooks

In my last update on TORM, I mentioned that the company’s financials and capability to pursue good performance in the future will put it in the position of a profitable investment decision for investors. It is worth noting that the OPEC+ agreement extended output cuts by 1.4 million barrels a day into Opec+ to extend cuts in oil output into 2024 as prices flag, which is equivalent to about 3.7% of global demand. Consider that the approximately 1 million reduction was on top of their previous plan of production cut by the end of 2023, thereby leading to cutting 2 million barrels per day by the end of 2023. These oversupply concerns caused TORM’s stock price to plunge. However, it brings an appropriate entrance position for investors, in my opinion, because the company’s strong financial conditions provide growth potential.

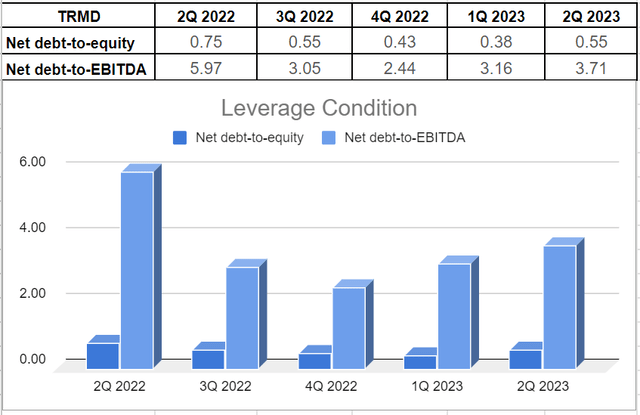

By the end of the second quarter of 2023, TORM could sustain its balance sheet strength and even improve it year over year compared with the last year. In minutiae, the management was fair about asserting they hit their best second quarter in their history as the EBITDA jumped by approximately 53% to $233 million in the recent quarter versus $152 million in 2Q 2022, also 17% higher than the first quarter of 2023. This surge in EBITDA level, coupled with lower net debt, led to a considerable decline in the leverage ratio: their net debt-to-BEITDA dropped to 3.7x versus 5.9x at the same time in 2022. The company has improved its leverage condition in the case of other ratios. Their net debt-to-equity level is at 0.55x, which shows a 26% decline from 0.75x in the second quarter of 2022 (see Figure 1). In addition, their net Loan-to-Value (LTV) ratio has a desirable amount of 29%. LTV ratio illustrates the assets that are considered more desirable as collateral. These assets are more stable in value and have higher liquidity potential. As a result, the higher the LTV ratio, the easier debt financing for the company because lenders would trust their financial strength more.

Figure 1 – TRMD’s leverage condition

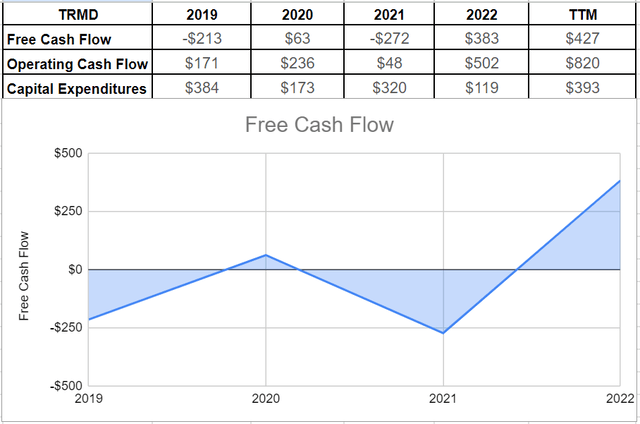

To support the company’s capability of higher growth and shareholder returns, it is worth noting that TORM has reached its highest free cash flow in recent years. The company’s cash from operations surged to circa $820 million in TTM versus $502 million at the end of 2022, which aligned with $393 million of capital spending resulting in approximately $427 million of free cash flow. This improvement demonstrates the management’s capability of generating stable distributions even in times of higher commodity prices (see Figure 2). Moreover, TORM is going to pay a dividend payment of $1.5 per share, and based on their 82,500,000 outstanding shares, it will lead to approximately $124 million of distribution payment, which is easily self-funded by their free cash flow.

Figure 2 – TRMD’s free cash flow (in millions)

Notwithstanding a healthy financial position, the company expects to generate lower earnings at the end of the third quarter versus the second quarter. In other words, by mid-August, they covered 74% of the third quarter at $30,534 per day, which shows lower rates than the second quarter “as a result of refinery maintenance, product stock draws and slightly lower demand for products. [However], we expect the markets to recover, and we expect a stronger fourth quarter.” The management asserted.

Recently, the import levels of Europe have decreased, partially because they provided some part of their demand by stockpiles instead of by imports. However, the stockpiles have dropped to lower-than-average levels, thereby resulting in higher import demand and, hence higher demand for product tankers. Moreover, in spite of lower diesel stocks, Europe’s demand for diesel will incline more as it gets closer to the winter and colder weather. On the one hand, this higher seasonality demand for diesel consumption will fuel the market, thereby boosting ton-miles. On the other hand, China has increased its diesel exports to Europe; it will cater to further upside to the market. All in all, increased product flows in the second half of 2023 will likely lead to the rebounding of the product tanker market in the coming months.

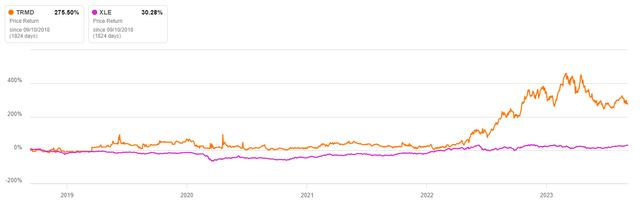

Furthermore, Figure 3 illustrates the return of TORM stock in comparison with the Energy Select Sector SPDR Fund (XLE), which is an index to represent the energy sector of the S&P 500 index and provides companies in the oil, gas, consumable fuel, energy equipment, and services industries. Thankfully, TORM company has outperformed its broad energy peers in the last five years.

Figure 3 -

TRMD stock valuation

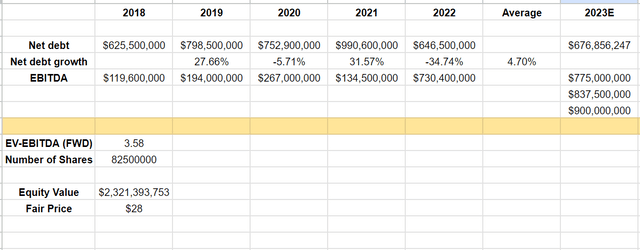

After analyzing TORM’s cash and leverage conditions, we realize that the company is in a healthy position to perform well even in periods of volatile commodity prices. Albeit the management declined their EBITDA generation guidance from $750-1,100 million for the end of 2023 due to the current fleet size, including published acquisitions and divestments of vessels, their stock valuation is still undervalued. As Figure 4 demonstrates, even if TORM company generates an EBITDA of $837 million, which is the middle of their expected range, their fair value would reach $28 per share. It is worth mentioning that during the last five years, the company’s net debt level grew by 4.7% on average. However, as they have generated a good amount of free cash flow in the first half of 2023, their net debt level might decrease more if the management decided to direct the free cash flow to pay back its net debt.

Figure 4 – TRMD stock valuation

Risks related to TORM’s investment

It is crucial to note that a high portion of TORM’s revenue is from its product tanker fleet. As a result, even small volatility in supply and demand in this market and their impact on freight rates may significantly affect the company’s cash flows and operations. Moreover, TRMD employs the majority of its vessels on spot voyage charters on short-term charters. As a result, it generates a significant portion of its revenues from the spot market. Therefore, the company needs to receive profitable spot charters, while the spot market is too volatile. Therefore, a sudden decrease in spot charter rates may adversely affect the company’s profitability and ability to meet its obligations.

Conclusion

OPEC+ announcement regarding production cuts and its impact on higher commodity and refined products prices caused TORM stock price decline in the previous months. However, TORM’s strong financial condition and stability protect the company from the volatility of commodity prices to a great extent. In addition, Europe’s lower stockpile from their average levels and higher seasonality demand will bring upside to the product tanker market in the second half of 2023. Ultimately, even if TORM company generates an EBITDA of $837 million, which is the middle of their expected range, their fair value would reach $28 per share. When all is said and done, I believe that TORM stock is still a valuable investment decision.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)