Lancaster Colony: Will This Beaten-Down Stock Bounce Back?

Summary

- The food product industry is expected to grow to $204.06 billion in 2026, with a CAGR of 5.1%.

- The company has shown strong growth through organic and inorganic strategies, with sales increasing by 9% in FY-2023.

- The retail segment generated 53% of revenue, with retail channel sales from Walmart contributing 18% and McLane Company 11% in FY-2023.

PixelsEffect/E+ via Getty Images

Investment Thesis

Shares of Lancaster Colony (NASDAQ:LANC) have remained under pressure, hovering around a 52-week low at $161 a piece on the NASDAQ on concerns over revenue growth and operational efficiency. The in-depth analysis reveals that LANC is operating in an industry with positive growth in the addressable market. It is poised to outperform due to sustainable long-term revenue growth, operating margin enhancement, management of capital structure and better operational performance compared to peers.

Lancaster Colony Corporation is a manufacturer and marketer of specialty food products for the retail and foodservice markets. Top brands include Marzetti, New York Brand Bakery, and Sister Schubert's.

Revenue Growth through Organic and Inorganic Strategy

The global specialty foods market is expected to grow to $204.06 billion in 2026 at a CAGR of 5.1% from $159.01 billion in 2021. The key negative catalyst for this industry was the Russia-Ukraine war that has led to inflation in goods and services due to commodity prices and supply chain disruptions.

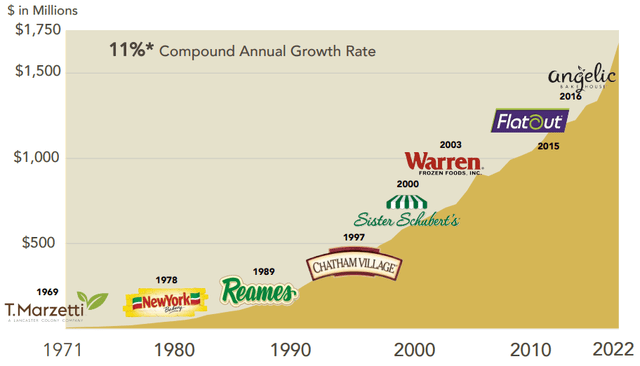

Company Presentation, Revenue Growth

The company has shown strong growth over the last five decades through organic and inorganic strategy by growing ~11% CAGR between 1972-2022. In FY-2023, the sales increased 9% to an all time high of $1,823 million compared to previous year sales of $1,676 million, due to higher sales in both segments driven by pricing to offset inflationary costs. During FY-2023, the food product industry faced continued industry-wide cost pressure due to inflation for commodities, ingredients, packaging materials, oil prices, transportation and labor.

Outperformed Peers In The Retail Channel For Both Dollar Sales Growth and Unit Sales Growth

Compound Annual Growth Rates Calendar Year 2019 to 2022 | Dollar Sales CAGR | Unit Sales CAGR |

| Lancaster Colony | 14.5% | 8.8% |

| B&G Foods, Inc. (NYSE:BGS) | 9.7% | 2.2% |

| Campbell Soup Company (NYSE:CPB) | 9.5% | 2.0% |

| J&J Snack Foods Corp. (NASDAQ:JJSF) | 7.9% | -1.8% |

| McCormick & Company, Inc. (NYSE:MKC) | 7.3% | 0.2% |

| Post Holdings, Inc. (NYSE:POST) | 6.6% | -0.1% |

| The Hain Celestial Group, Inc. (NASDAQ:HAIN) | 4.1% | -1.1% |

Based on the table above, we can conclude that Lancaster has performed better than peers in terms of CAGR growth between 2019-2022. In a nutshell, the company has recovered from the Covid impact at a faster pace compared to its peers driven by product diversification, product launch and, most important licensing program.

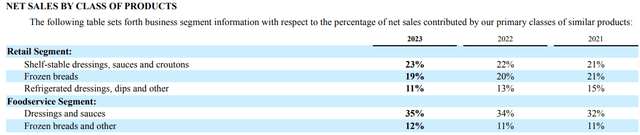

10K,2023-Sales by Product

In the above table, we can see the sales by product between the Retail Segment and the Foodservice segment. In FY-2023, the retail segment generated 53% of revenue and remaining through the Foodservice Segment.

Retail Segment Growth Is Driven by Pricing Actions

The Shelf-stable dressings, frozen breads and refrigerated dressings are the primary retail products manufactured and sold by the company. The company has a strong association with retailers and the top five retail customers accounted for 59%, 57% and 55% in 2023, 2022 and 2021, respectively. From the total sales generated from retail customers, Walmart (NYSE:WMT) contributed 18% and McLane Company 11% in FY-2023. Chick-fil-A, Inc. contributed a significant portion of total sales as well. In a nutshell, the company has a strong presence in the retail space and to some extent this can be economic moat, in my view.

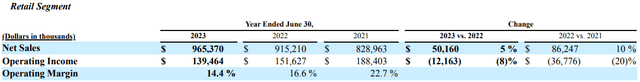

10K, 2023 - Retail Segment

In FY-2023, net sales increased to a record level at $965.4 million compared to the previous year of $915.2 million, a 5% Y/Y increase due to the favorable impact of pricing actions. However, the topline was negatively impacted by advance orders, accounting for an estimated $11 million. In terms of volume (measured in pounds shipped ), sales volumes reduced by 4% in the current year compared to a 2% increase in FY-2022. The decline in sales volumes was primarily due to the negative impact of the advance ordering, price elasticity and product line rationalizations that were initiated in FY- 2022.

The operating income decreased 8% to $139.5 million due to higher impairment charges totaling $25.0 million and cost inflation. On an adjusted basis by normalizing impairment charges, the operating income amounted to $164.5 million with a 17% operating margin. The operating income was positively impacted by pricing actions.

The management expects an increase in sales volume driven by a licensing program. Furthermore, the revenue will increase supported by incremental growth from the new products, flavors and sizes introduced in FY-2023. In addition, the company will add Texas Roadhouse steak sauces to the licensing program and is expecting continued positive momentum for New York brand Bakery frozen garlic bread products. In a nutshell, the revenue momentum will continue and translate to improved operating margin due to anticipated decrease in inflation compared to the previous year.

Record Sales and Operational Efficiency Of Foodservice Segment

The majority of foodservice products are sold through private label to restaurants. Dressings, sauces and Frozen Breads are the primary foodservice products sold by the company. The top five direct customers accounted for 58% of foodservice sales in FY-2023. The direct customers are distributors that distribute products mainly to foodservice national restaurant chain.

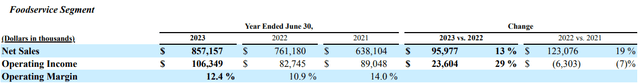

10K,2023 - Foodservice Segment

The sales increased by 13% to a record $857.2 million from the FY-2022 sales of $761.2 million due to inflationary pricing and volume gains. However, the sales were negatively impacted by advance orders accounting for an estimated $14 million. In terms of volume (measured in pounds shipped ), sales volumes were reduced by 5% in the current year. The decline in sales volumes was primarily due to the negative impact of the advance ordering and the decision to discontinue non-performing SKUs in FY-2022.

The operating income increased by 29% to $106.3 million due to pricing actions which offset inflationary costs. The operating income margin increased to 12.4% from 10.9% in the previous year, an increase of 150 bps. This improvement is driven by a stable operating environment, continued manufacturing efficiencies and the decision to discontinue non-performing SKUs.

The company expects sales volumes to be driven by growth from select quick-service restaurant customers through national restaurant chains. Moreover, external factors like U.S. economic performance and changes in consumer sentiment, may impact demand. In FY-2023, the sales are expected to continue to benefit from the pricing actions.

Strong Balance Sheet

The company maintained fundamental financial health in FY-2023 with $88 million in cash, shareholders' equity of $862 million and no debt. In terms of liquidity, it has a credit revolver of $150 million which can be expandable up to $225 million and expires in March 2025. In this situation, the company has strong leverage to invest in existing business, continue with an inorganic strategy and regular dividends. The investors should note that the dividend yield (fwd) is 2.10%.

Investment Risk

Inflation Risk: The Food retail industry is highly sensitive to commodity prices. Hence, any significant increase in inflation will impact the performance of the company.

Russia-Ukraine Conflict: The margins of the company are already stressed due to ongoing conflict. Any further escalation will impact commodity prices and supply chain disruption which will adversely impact the company.

Final Thoughts

The company has grown sales continuously in the last 5 decades. The key investor takeaway is that Lancaster is a financially healthy company with projected growth in the addressable market. It is poised to outperform due to sustainable long-term revenue growth, operating margin enhancement, better management of capital structure and better operational performance compared to peers. However, investors have to watch closely the impact of the ongoing Russian-Ukraine conflict on revenue growth and margins. In a nutshell, Lancaster is hovering around a 52-week low at $161 despite improving financials, and has a potential upside.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.