Royal Bank Of Canada: An Undervalued Banking Star

Summary

- Royal Bank of Canada is one of the country's largest banks, serving 17 million customers across 29 countries.

- The bank's financial performance is solid compared to the largest North American banks, with a strong return on assets and return on equity.

- RY's stock is currently undervalued, with the stock's fair value close to $126.

JulieAlexK/iStock via Getty Images

Investment thesis

The current challenging environment in the Canadian economy weighs on the stock prices of its largest banks. While revenues are surging due to the elevated benchmark interest rates, the softening economy weighs on the quality of the banks' credit portfolios and capital markets activity. But these are temporary difficulties due to cyclical shifts in the economic cycle, and definitely not secular. Royal Bank of Canada (NYSE:RY) is one of the largest banks in the world and is leading the Canadian banking industry across multiple traditional metrics. From the secular perspective, the bank's massive scale and diversified set of offerings to customers allows it to maintain stellar profitability metrics and allocate a substantial portion of profits to stock buybacks and dividend hikes. The recent weakness in the stock price provides investors with a handsome 4.4% forward dividend yield. Moreover, my valuation analysis suggests the stock is about 40% undervalued. All in all, I assign RY the "Strong Buy" rating.

Company information

Royal Bank of Canada is one of the country's two largest banks, together with Toronto-Dominion Bank (TD). The bank serves 17 million customers across 29 countries.

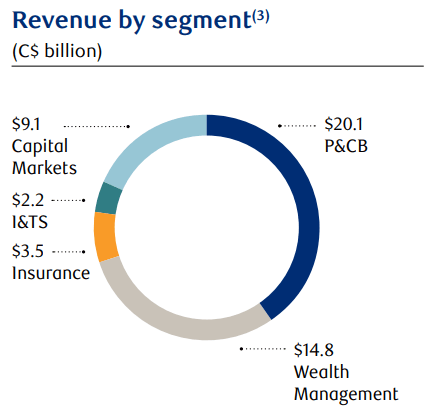

The bank's fiscal year ends on October 31 with the following business segments: Personal & Commercial Banking [P&CB], Wealth Management, Capital Markets, Insurance, and Investor & Treasury Services [I&TS]. According to the latest annual report, P&CB revenue contributed more than 50% to the total revenue. The bank generates about 62% of the total revenue in Canada and about 20% in the U.S.

RY's latest annual report

Financials

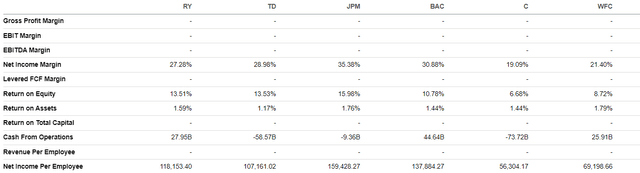

The bank's financial performance and profitability metrics look solid compared to its biggest rival in Canada and the U.S. "Big Four" banks. Regarding return on assets and return on equity, RY is not very far from JPMorgan Chase (JPM), the biggest and most profitable bank in the U.S. Net income per employee also looks strong among the largest banks of the two countries.

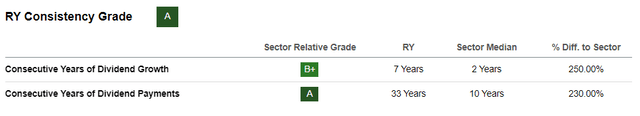

Stellar profitability allows the bank to keep shareholders happy with consistent dividend payouts and massive stock buybacks. For example, in fiscal year 2022, RY repurchased stocks worth $8 billion. The figure is substantial compared to the total annual revenue of below $36 billion. It is also important to highlight RY's stellar dividend history, with 33 consecutive years of dividend payouts and seven years of consistent growth. The current forward dividend yield is very attractive at 4.43%. The balance sheet is strong, with a robust 12.6% common equity Tier 1 ratio. Given the company's consistently high profitability metrics and strong financial position, I have high conviction that the dividend is safe.

The latest quarterly earnings were released on August 24, when the bank topped consensus estimates. Revenue demonstrated strong growth momentum with a 14% YoY growth. The adjusted EPS followed the top line and expanded from $1.97 to $2.09.

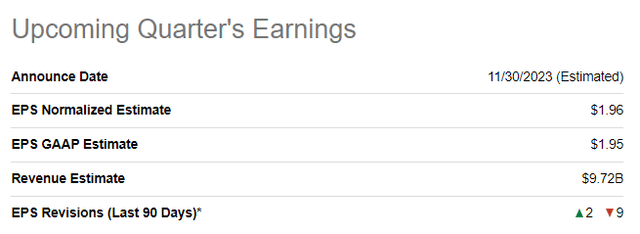

The upcoming quarter's earnings are scheduled for release on November 30. Consensus estimates forecast quarterly revenue at $9.72, which indicates an expected 4% YoY growth. The adjusted EPS is expected to shrink YoY from $2.07 to $1.96. The growth in revenue is likely to be offset by greater credit loss provisions and softening capital markets activity. But I consider these challenges for the bottom line as temporary and not secular.

I like how the bank navigates the uncertain and challenging environment with solid profitability metrics. RY's large-scale and diversified customer offerings allow it to be very efficient in its operations. Having a comprehensive portfolio of offerings makes it a strong choice for people who seek a "one-stop shop" for financial services, which helps the bank to maintain its massive scale and leadership in Canada across multiple traditional banking metrics: number of customers, assets under administration and management, number of credit cards issued. Being a one-stop shop also means that RY is able to enjoy substantial cost advantages over smaller rivals because the bank has opportunities to cross-sell its banking products, which significantly drives down the cost of customer acquisition.

It is also important to emphasize that the Canadian regulation related to its financial services sector also favors the country's largest banks. According to Thomson Reuters, the Bank Act prohibits foreign banks and entities associated with a foreign from engaging in or carrying on business in Canada, directly or through a nominee or agent. There are minimal exceptions to this rule. That said, the market share of the largest Canadian banks is protected by local legislation. That is why the country's financial sector is considered an oligopoly, where the most significant five banks hold about 80% of the market share. Therefore, I believe that RY's massive scale, diversified offerings, and local legislation provide the bank with a vast moat and make its market share and long-term profitability prospects safe.

Valuation

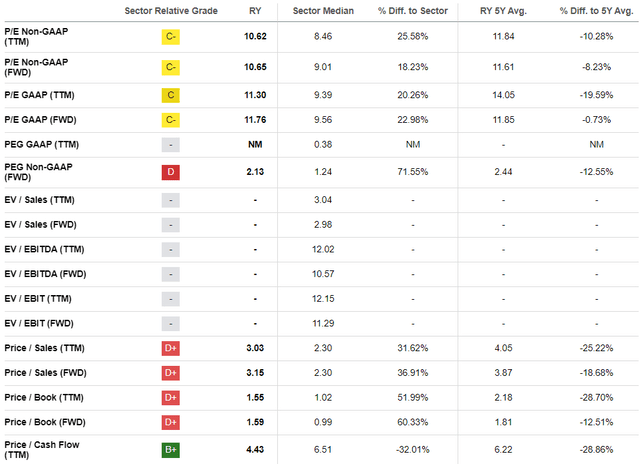

RY demonstrated a 4.5% share price decrease year-to-date, underperforming the broader U.S. stock market. The stock also notably underperformed the Financial sector (XLF) this year. Seeking Alpha Quant assigns RY an average "C" valuation grade, meaning the stock is approximately fairly valued. RY's price-to-book ratios are more than 50% higher than the sector median but substantially lower than the bank's five-year averages.

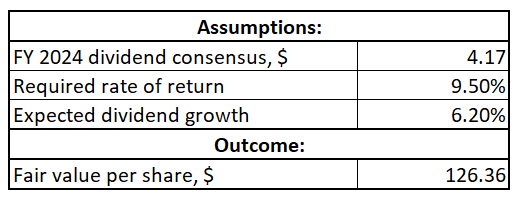

I want to proceed with the dividend discount model [DDM] to gain more valuation confidence. I use a 9.5% WACC for the required rate of return. Consensus dividend estimates forecast an FY 2024 payout of $4.17. I use 6.2% for dividend growth, a slight round-down for the last five-year CAGR.

Author's calculations

According to the DDM formula, the stock's fair value is close to $126, representing a 40% upside potential for the share price.

Risks to consider

The banking industry is a highly regulated and complex web of laws, rules, and policies. RY's operations are subject to thorough scrutiny as one of Canada's largest banks. Changes in regulations can affect the bank's operations and profitability. Failure to comply with evolving regulations may result in penalties, fines, and legal action. This could adversely affect the bank's financial performance and reputation. Regulatory changes may have an impact on the cost side if new procedures or increased reporting requirements are introduced.

As a bank, RY is exposed to significant macroeconomic risk. The bank's profitability, credit quality, and overall stability are closely tied to the general economic conditions in North America. Potential economic downturns and recessions are highly likely to pressure the bank's revenue sources and loan portfolio. Individuals and businesses experience financial difficulties during economic turmoil, resulting in higher loan defaults. Lower demand due to high-interest rates also negatively impacts a bank's growth prospects. In addition, unexpected changes in interest rates lead to increased market uncertainty and volatility and affect investor sentiment toward RY stock.

Bottom line

To conclude, RY is a "Strong Buy". While the stock price experienced difficulties this year due to the overall pessimistic sentiment caused by the harsh macroenvironment, the forward dividend yield is increasing. My valuation analysis also suggests that the stock is about 40% undervalued. At the same time, the bank's revenues are surging, and profitability is still stellar despite headwinds, including increasing credit loss provisions and softening capital markets activities. RY has a wide moat thanks to its vibrant history, massive scale, and its strong positioning as a one-stop shop for financial services. That said, I believe the bank's market share is safe and so are the profits, which will ultimately result in consistent stock buybacks and dividend hikes.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in RY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.