Steven Madden Is Offering A Good Entry Point For Long-Term Dividend Investors

Summary

- Revenues are stabilizing at lower levels compared to 2022, but are expected to show growth by 2024.

- Inflationary pressures, supply chain issues, and now decreased volumes are causing a significant impact on the EBITDA margin.

- The balance sheet is very strong and the company remains highly profitable.

- The dividend is safe in the long run despite short-term risks, and share repurchases should cause steady declines in dividends paid (as long as no raises take place).

- This represents a good opportunity for long-term dividend investors.

ablokhin

Investment thesis

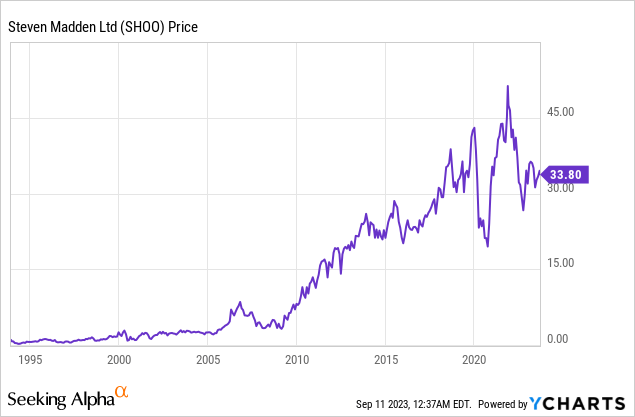

Shares of Steven Madden (NASDAQ:SHOO) have been subject to significant volatility since 2020. The coronavirus pandemic caused a 61.92% decline in the share price in March 2020 (compared to January 2020) as self-imposed restrictions to contain the coronavirus pandemic caused a significant decline in the company's revenues and profit margins, and although the share price marked a new all-time high in November 2021 as revenues increased to record-highs, the share price has declined again by 34.43% from that peak as inflationary pressures, labor shortages, and supply chain issues caused a significant impact in the EBITDA margin while customer destocking is reminding investors that high demand in 2021 and 2022 was exceptionally caused by an increase in customer inventories. To all this, we must add the growing fears of a potential recession caused by recent interest rate hikes.

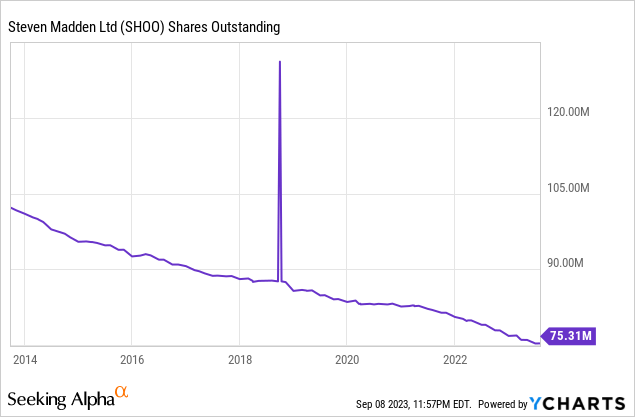

After the recent declines, the share price is currently at levels similar to those of 2018 as it has recently experienced periods of high volatility, but I would like this article to serve as a reminder of what Steven Madden really is: a highly profitable company that sells essential items under recognized brands and also supplies private labels. It has zero debt and a very strong balance sheet and has expanded its reach over the years thanks to marketing efforts and acquisitions. Furthermore, in addition to having paid growing dividends since 2018, it has managed to reduce the total number of shares by 26% over the last 10 years as the company performs regular share repurchases, which expanded shareholders' positions passively year after year. In this regard, I expect share repurchases to continue in the long term as the company has very high profit margins and no interest expenses to cover. Also, I strongly believe the recent decline in revenues represents a temporary headwind as they should pick up as customer inventories stabilize at healthier levels, and profit margin improvements should follow.

A brief overview of the company

Steven Madden, also known as Steve Madden, is a designer of branded and private-label fashion footwear, accessories, and apparel for women, men, and children. The company was founded in 1990 and its market cap currently stands at $2.55 billion as it employs over 3,000 workers. The company operates under the following brands: Steve Madden, Dolce Vita, Betsey Johnson, GREATS, Blondo, Anne Klein, Mad Love, Cejon, and Superga.

Steve Madden (Investor.stevemadden.com)

The company operates under three main business segments: Wholesale Footwear, Wholesale Accessories/Apparel, Direct-to-Consumer, First Cost, and Licensing. Under the Wholesale Footwear segment, which generated 56% of the company's revenues in 2022, the company designs, sources, and markets its brands and supplies private labels. Under the Wholesale Accessories/Apparel, which generated 19% of the company's total revenues in 2022, the company designs, sources, and markets branded and private label handbags, apparel, small leather goods, belts, soft accessories, fashion scarves, wraps, gifting, and other trend accessories. Under the Direct-to-Consumer segment, which generated 25% of the company's revenues in 2022, the company operates retail stores, outlet stores, and e-commerce websites.

Currently, shares are trading at $33.80, which represents a 34.45% decline from all-time highs of $51.56 reached in November 2021. After strong optimism in 2021 and 2022 due to strong demand caused by the reopening of the world economy, sales are beginning to stabilize at levels below recent record highs as customers are emptying their higher-than-usual inventories. Furthermore, the EBITDA margin has been negatively affected by, in addition to lower volumes, the current complex macroeconomic context marked by inflationary pressures, supply chain issues, and increased transportation costs, and this has caused significant pessimism among investors, which I consider a good opportunity for long-term investors as current headwinds are likely of a temporary nature as they are linked to the current macroeconomic landscape. Furthermore, the company has managed to expand over the years through marketing efforts and key acquisitions.

Recent acquisitions

The company has made acquisitions periodically over the years, although it has done so carefully as the balance sheet always remained debt-free.

In August 2014, the company acquired Dolce Vita for $62 million, and in December of the same year, it also acquired SM Mexico, the distributor of Steve Madden products in Mexico, for $23 million.

A year later, in January 2015, the company acquired Blondo, a fashion-oriented footwear brand specializing in waterproof leather boots, from Regence Footwear, for $9 million, and in June 2016, the company also acquired the remaining minority interest in Madlove, which was formed in 2011. One year later, in January 2017, the company acquired Schwartz & Benjamin, a designer, and seller of licensed and private label footwear that distributes its fashion footwear to wholesale customers, for $37 million.

After a significant pause in M&A activities, in August 2019, the company acquired 90% of the outstanding common stock of GREATS, a pioneering digitally native sneaker brand, for an initial payment of $12.33 million and a contingent payment of $5 million based on performance. During the same month, it also acquired BB Dakota, a contemporary women's apparel company, for an initial payment of $24.57 million

More recently, in April 2021, the company announced the acquisition of the remaining 49.9% stake in its European joint venture, which was formed in June 2016 and distributes Steve Madden-branded footwear and accessories to most countries throughout Europe, for $17 million. Later, in June 2021, it also acquired the remaining 49.9% non-controlling interest in its South African joint venture, which was formed in 2014 and distributes Steve Madden-branded footwear and accessories/apparel throughout South Africa, for $2.26 million (but later sold it to a third party for $1.02 million to form a new joint venture). And finally, in December 2021, the company acquired the rights for Dolce Vita Handbags for $2 million, which include trademarks and all internet domain name registrations.

Revenues are stabilizing after two strong years

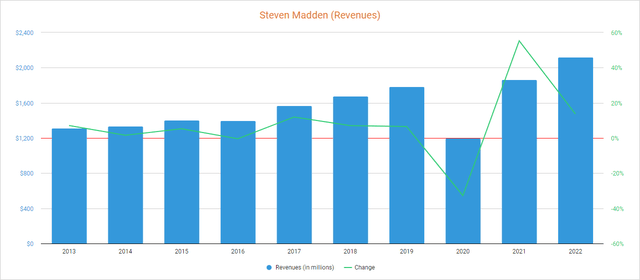

The company has managed to increase its revenues over the years thanks to acquisitions and marketing efforts, and although they declined by 32.75% in 2020, they reached new record highs in 2021 as they increased by 55.28% (compared to 2020), and increased by a further 13.71% in 2022.

Steven Madden revenues (Seeking Alpha)

As for 2023, revenues declined by 17.13% year over year during the first quarter, and by 16.76% year over year during the second quarter as customers are currently emptying their inventories, but this represents a headwind that is expected to eventually normalize as revenues are expected to decline by 7.55% in 2023 but to increase by 5.61% in 2024. Also, we should not forget that 2022 was a very strong (and unusual) year, so some stabilization was to be expected and should not worry investors as revenues were actually 18.76% higher in 2022 compared to 2019, so it is actually not a catastrophic decline but more of a revenue stabilization after higher-than-usual demand in 2022.

Now, the management's plan is to increase its direct-to-consumer reach, expand into categories outside of footwear, and expand in international markets where the company has very limited reach, and in the meanwhile, investors should continue benefiting from dividends and share repurchases. Using 2022 as a reference, 84% of the company's sales are generated by operations within the United States, which means geographical diversification is actually quite limited at the moment.

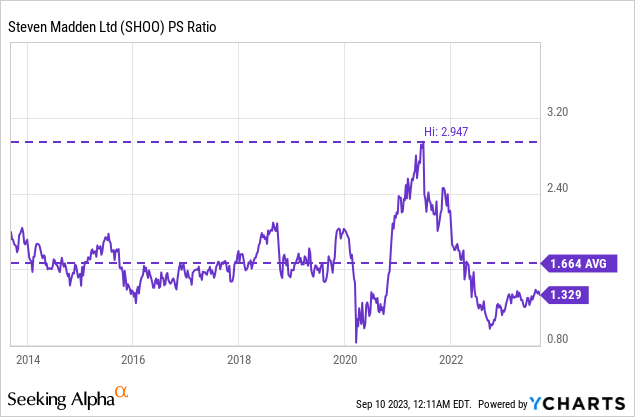

Thanks to record-high revenues and the recent share price decline, the price-to-sales ratio has plummeted and currently stands at 1.329, which means the company generates annual revenues of $0.75 for each dollar held in shares by investors.

This ratio is 20.13% lower than the average of the past 10 years and represents a 54.90% decline from decade highs of 2.947 reached in 2021, which reflects growing investors' pessimism as they are placing significantly less value on the company's revenues, and this is due, in my opinion, to three main factors. Firstly, in the short and medium term sales are expected to remain weak, secondly, recent interest rate hikes could cause a global recession, which would certainly have a significant impact on the company's operations and, finally, the EBITDA margin has continued to deteriorate as volumes have recently declined.

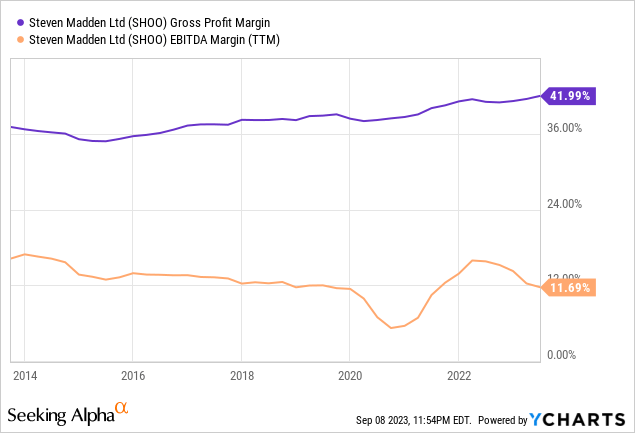

Gross profit margins are improving, but the EBITDA margin is suffering

As I mentioned before, Steven Madden is a highly profitable business as its trailing twelve months' gross profit margin stands at 41.99% and the EBITDA margin at 11.69%. Still, the EBITDA margin has suffered a significant contraction in recent quarters due to inflationary pressures, labor shortages, and supply chain issues.

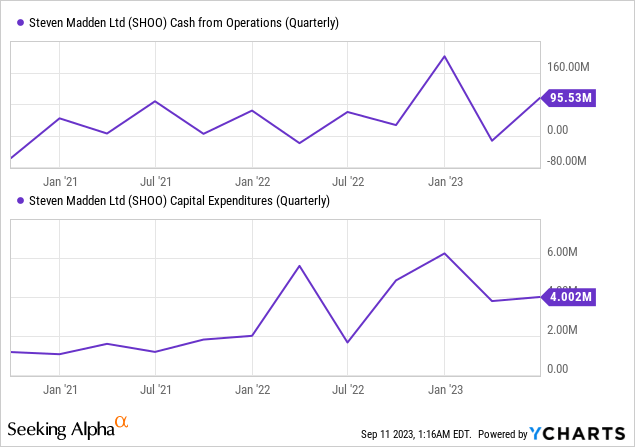

As for the second quarter of 2023, the gross profit margin has continued improving as it stood at 42.64%, which represents an increase of 190 basis points compared to the same quarter of 2022 boosted by a significant decline in demand for private-label products (which are less profitable) and cost-control initiatives amidst current inflationary headwinds. Nevertheless, the weakness of the EBITDA margin has continued to accelerate as it stood at 10.76% during the second quarter of 2023 as declining volumes are now adding up to the current headwinds caused by the current macroeconomic context. Fortunately, the company's operations continue to have a positive impact on its balance sheet, despite the headwinds, as cash from operations is significantly higher than capital expenditures, and the company reports positive net income quarter after quarter as it reported net income of $34.5 million during the second quarter of 2023.

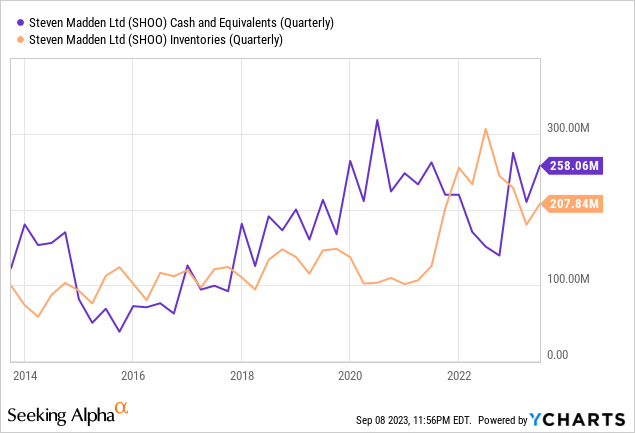

Furthermore, the balance sheet is very robust as cash and equivalents and inventories are very high, giving the company plenty of margin of maneuvering that should allow it to continue navigating current headwinds and even a potential recession for a very long period of time, so what is required of investors is not so much a high degree of risk tolerance, but enough patience to wait for the company's prospects to improve in the long term as headwinds ease.

A very strong, debt-free balance sheet significantly reduces risks

The company's cash position is currently very strong at $258 million as inventories declined by $98.7 million during the past 12 months, and cash from operations is expected to remain strong in the short to medium term as inventories are still very high (compared to past years) at $208 million.

In this sense, I could say that the company is sitting on a mountain of cash as annual capital expenditures are below $20 million and the annual dividend is around $64 million. In addition, the company does not have the need to make use of its resources to continue operating in the current landscape, so the balance sheet is expected to continue improving with the passing of the quarters (as long as the current headwinds do not worsen or a new headwind takes place).

The dividend safety is (increasingly) in question, but I don't see a significant problem in the long run

The company initiated a quarterly dividend in the first quarter of 2018, and excluding a suspension announced in March 2020 that was lifted in February 2021, the dividend has increased by 58% since then from $0.133 to $0.210 per quarter and share.

In my opinion, this is a significant increase for such a short time span, and if we add the recent share price decline, we have a dividend yield of 2.49%, which I consider quite generous if we take into account that the low historical cash payout ratio has allowed (and should continue allowing) the company to continuously reduce the total number of shares outstanding. In the table below, I have calculated the historical sustainability of the dividend by calculating what percentage of cash from operations has been allocated each year to cover the dividend and capital expenditures in order to assess the sustainability of the dividend through actual operations.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Cash from operations (in millions) | $152.3 | $136.0 | $153.6 | $157.9 | $154.4 | $233.8 | $44.2 | $159.5 | $267.9 |

| Dividends paid (in millions) | $0 | $0 | $0 | $0 | $47.3 | $48.4 | $12.5 | $49.2 | $66.0 |

| Capital expenditures (in millions) | $18.3 | $19.5 | $15.9 | $14.8 | $12.5 | $18.3 | $6.6 | $6.6 | $16.4 |

| Cash payout ratio | 12% | 14% | 10% | 9% | 39% | 29% | 28% | 35% | 31% |

As one can see, the cash payout ratio has historically been very low, which explains the company's capacity to perform acquisitions and aggressive share repurchases without using debt. Approximately, capital expenditures and dividends paid represent an item of slightly over $80 million, and cash from operations was $267.9 million in 2022. Still, this figure was unusually high as demand was very strong during that year and inventories declined by $26.4 million while accounts receivable also declined by $105 million and accounts payable by just $6.3 million.

As for the past quarter, the company reported cash from operations of $95.5 million, and although inventories increased by $27.9 million, accounts receivable declined by $32 million while accounts payable increased by $28.7 million, which despite reflecting current margin weakness, still allowed for a net income of $34.5 million. In this regard, the dividend should continue to be covered with the current state of operations, and the evolution of its sustainability will ultimately depend on whether inflationary pressures intensify in the coming quarters or if a recession finally takes place. Still, margins remain strong despite current headwinds and the company has a very strong balance sheet thanks to very high cash and equivalents and inventories, which should allow it to continue making share buybacks at lower share prices and thus reduce dividend expenses without touching the dividend payout per share.

Share buybacks expand investors' positions passively

The company is a steady performer of share repurchases. The total number of shares outstanding declined by 26.28% during the past 10 years, and the company bought back $25.8 million worth of shares during the second quarter of 2023 ($64.2 million if we add share repurchases carried out also during the first quarter), so share buybacks remain in force.

This means that shares represent a growing portion of the company as metrics are calculated among fewer (and fewer) shares, which allows the cost of covering the dividend to be reduced without the need to cut the dividend payout. This is why I consider that the risk of the current quarterly dividend of $0.21 per share is poised to be reduced as more shares are taken out of circulation as the company will pay less and less for the same dividend per share.

Risks worth mentioning

In the long term, I consider Steven Madden's risk to be quite limited thanks to a completely healthy balance sheet, a very robust cash position, and a highly profitable business model. Also, I consider current headwinds to be of a temporary nature due to their direct link to the current macroeconomic landscape. Still, there are certain risks that I would like to highlight, especially for the short and medium term.

- If inflationary pressures intensify again, the EBITDA margin could continue deteriorating.

- Recent interest rate hikes to moderate high inflation rates could cause a recession, which could have a significant impact on volumes and profit margins.

- If demand slows, the company could have a difficult time converting its high inventories into actual cash.

- Although I believe that the current situation should not force the company to cut the dividend, the management could decide to do so in order to preserve as much cash as possible, especially if headwinds intensify, or to use that cash to buy back more shares at lower prices.

Conclusion

The recent share price decline reflects a deterioration in Steven Madden's operations as the EBITDA margin is suffering and, with it, the company's ability to generate cash. Also, revenues have stabilized at lower levels (compared to 2022 ) in recent quarters. The company has significantly reduced its inventories, which has offset margin and demand weakness, but it will soon stop being able to do so as inventories have already shown a large reduction in recent quarters and are becoming increasingly scarce.

Even so, I strongly believe that the recent 34.45% share price decline represents a good opportunity for long-term dividend investors as the dividend yield currently stands at 2.49%. After all, the company has a very strong balance sheet and demand is expected to start stabilizing in the foreseeable future. Although the risk profile of said dividend has increased in the short and medium term, share buybacks are poised to gradually reduce the cost that the current dividend per share represents for the company, which should allow it, in the long term, to continue reporting very low cash payout ratios, as it is used to. That allow the company to continue investing in marketing efforts and acquisitions, as well as repurchasing more shares in order to further reduce the total number of shares outstanding - which should ultimately lead to wealth creation for shareholders in the long run.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.