Perpetua Resources: Conditions For Strong Business Amid Bright Gold Prospects

Summary

- Perpetua Resources Corp. is recommended as a Buy due to its potential for profitable gold production in Idaho and the positive outlook for gold prices.

- Economists predict a recession between late 2023 and early 2024, which would increase demand for gold as a safe haven and drive up its price.

- Perpetua Resources Corp. shares have a strong positive correlation with changes in the price of gold, presenting a major opportunity for significant growth.

monsitj

A Buy Recommendation for Perpetua Resources Corp.

The stock represents a company with significant growth potential as it is on track to achieve profitable gold production in Idaho in the future. Should this scenario of production occur, it is important to know that the outlook for the gold price is currently very positive. Gold prices could start this promising future with a strong rise if economists' predictions of a recession between late 2023 and early 2024 prove correct. The recession is likely to lead to strong bullish sentiment towards gold as the precious metal is seen as a safe haven against the headwinds of a deteriorating cycle. On top of this, a strong positive correlation with changes in the price of the yellow metal represents a major opportunity for Perpetua Resources Corp. (NASDAQ:PPTA) (TSX:PPTA:CA) shares to take an incredible leap forward from current levels.

The Expected Recession in a Few Months is Likely and Here's Why: The Upward Catalyst for Gold Prices

The latest quarterly earnings reports from online retailers Chewy (CHWY) and Target (TGT), which admittedly capture discerning behavior taking hold in consumer shopping activity (as seen in this Yahoo Finance article), suggest that consumption of households without a high income is under pressure due to the following well-known factors.

These essentially consist of prices for goods and services significantly above pre-COVID-19 virus pandemic levels and increased borrowing costs to bring the annual inflation rate down to 3.2% in July 2023 from the 40-year peak of 9.1% in June 2022. Together, these two factors form a very harmful combination that erodes purchasing power and undermines household finances.

The current situation cannot inspire optimism among consumers about the economy's growth prospects, and this is not a trivial matter, as the spending put off by consumers today will not immediately lead to an imploding economy but will most likely be felt in a later stage. That is, it will take some time before the deterioration in consumer demand fully translates into lower sales and will force companies to cut on personnel (costs) in a bid to maintain profitability, as labor is the most important expense item in corporate budgets.

The cycle is likely just at the beginning of what markets may mistake for a soft landing. Therefore, this analysis suggests that we continue to focus on the consequences of the most drastic monetary tightening by the Federal Reserve since the 2008 financial crisis. This policy of increasing interest rates on federal deposits is intended to combat the highest inflation (price increase rate) in more than 40 years, which was reached 14 months ago.

The negative dynamics in the business cycle caused by the US Federal Reserve's recession signals, which Yahoo Finance says: "begin to stunt spending power" (note of the author of this analysis for Seeking Alpha: emphasis on 'begin'), are now having an impact as the central bank has achieved its main goal: to awaken/strengthen people's sense of an unstable future.

Purchasing power influences economic growth, since almost 70% of the US gross domestic product, which is practically the consumption component (as Y-Charts reports), depends primarily on its health status.

Here's what consumer sentiment might look like right now. To borrow the phrase from Joanne W. Hsu-director of consumer research at the University of Michigan-in her commentary on August 2023 consumer confidence data: "tentative about the outlook ahead", (Trading Economics reports), that's how consumers may perceive it today.

And if consumers have every reason in the world to feel that way, why wouldn't we expect an impact on US-listed stocks then?

The recession is coming according to economist David Rosenberg (see this Business Insider article), Duke professor and Canadian economist Campbell Harvey (see Yahoo Finance article), and chief financial officer of the U.S. Federal National Mortgage Association Chryssa Halley (see this article from Yahoo Finance).

To protect against the adverse effects of the economic downturn on the value of US-listed assets, investors should consider investing in gold or securities that track the price of gold.

As the yellow metal is seen as a safe haven against the various headwinds that the next recession is sure to bring, investors will drive greater demand for it to protect the value of their portfolios. This dynamic will put strong upward pressure on the price of the yellow metal.

Gold's Rise as a Safe Haven Bodes Well for Perpetua Resources Corp.

A higher price per ounce which analysts at Trading Economics forecast at $2,013.36 in 12 months compared to the current $1,923.45/oz will trigger a quick recovery in the share price of those US-listed gold stocks that show the highest positive correlation with the yellow metal.

Against this background, retail investors now have the opportunity to benefit from the likely next rise in the price of the gold commodity, which will be caused by the expected recession, via US gold stocks or Canadian-listed gold stocks.

Perpetua Resources Corp. (PPTA) (PPTA:CA) seems to be a valid vehicle to ride the golden wave.

Perpetua Resources Corp., based in Boise, Idaho, is engaged in the acquisition of precious metal minerals in the United States for the purpose of developing and converting them into producing mines.

Subject to redevelopment and restoration permits, Perpetua Resources aims to achieve its mineral target and convert the Stibnite gold project into an operational mine in central Idaho.

From a geolocation perspective, the future gold mine is located 40 miles east of McCall Town, 10 miles east of Yellow Pine (a historic mountain community in eastern Valley County), and 100 miles northeast of Boise City (the Capital of Idaho).

It is possible that the Stibnite gold project can produce silver and antimony in addition to gold, but the yellow metal will be the main source of income, since the price of gold, according to the technical report (published in early 2021) containing the economic feasibility concept of the project, will determine at least 95% of Perpetua Resources business in Idaho.

Perhaps the reader is not aware of antimony. Antimony is a metal, rare in its original state, obtained from various minerals. It does not change when it comes into contact with air and is used in both hard and fusible alloys. Its compounds are several and are used in medicine, in dyeing, in the enamel and glass industry, and also in the paint and varnish industry. Antimony is also used by the defense industry to make ammunition.

In fact, the name of the project comes from stibine, meaning raw antimony, a natural antimony trisulphide that is melted and cast into blocks.

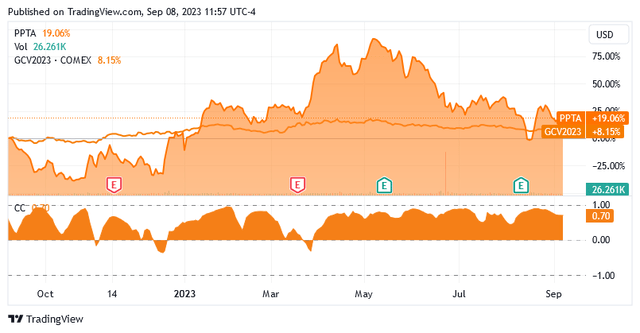

Given the Stibnite Gold Project's future high dependence on gold prices, Perpetua Resources shares are positively correlated with the price of the yellow metal, already in a strong way, as reflected in the next two charts from Seeking Alpha.

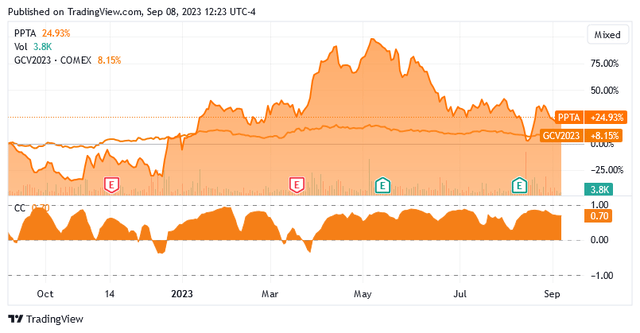

This applies to the stock listed on the US NasdaqCM market and to the stock traded on the Canadian Stock Exchange in Toronto.

The strong positive correlation of the US-listed stock (PPTA) and gold futures (GCV2023) is illustrated by the yellow area chart below, which has been above zero for most of the past year, with the coefficient of correlation currently at 0.7.

The strong positive correlation of the Toronto-listed stock (PPT:CA) and gold futures (GCV2023) is illustrated by the yellow area chart below, which has been above zero for most of the past year, with the coefficient of correlation currently at 0.7.

Therefore, if gold prices are on an uptrend mode due to fears of a recession, Perpetua Resources shares are likely to follow the same path. This analysis also estimates how much Perpetua Resources stock price could benefit if the gold experiences a bull market.

Building on a linear relationship where the last 52 weekly returns of gold futures represent the input and the last 52 weekly returns of the Perpetua Resources stock represent the output, the model shows that a change in the price of gold averages a 1.6x change in PPTA share price and 2.1x change in the PPTA: CA share price. This means that if the gold price rises because gold is in high demand due to its safe haven against recession headwinds, Perpetua's share price could potentially rise 1.6x on the US stock market and 2.1x on the Canadian stock market. However, these estimates should be viewed with caution as the coefficient of determination is low, and the share price may therefore be affected by other market factors.

What Perpetua Resources is Targeting in Central Idaho

Perpetua Resources has a 100 percent interest in the Stibnite project where the company aims to redevelop a top-grade gold deposit while providing, the company reports, the US and its allied forces - from ground to round - with the key munitions component of antimony under an agreement struck last month through the Defense Department's Munitions Technology Consortium. All costs of demonstrating the feasibility of the project will be borne by the US Department of Defense.

The project includes the restoration of an abandoned brownfield site.

According to the Feasibility Study Report, the Stibnite Gold Project aims to produce precious metal through conventional open pit mining techniques, and the ore that will be mined from 3 primary deposits (Yellow Pine, Hangar Flats, West End) will be transported and delivered at a rate of 22,050 short tons per day to the crusher. In addition, approximately 2.7 million tons of historical waste will be processed and prepared for the grinding cycle in a nearby facility. During the first four years of operation of the plant, miners will operate in a manner that avoids duplication of costs associated with the processing of the mineral material.

After processing and grinding the raw material from blasting/excavation, the subsequent phase of flotation and hydro-metallurgical operations will recover antimony and produce gold and silver bars.

In terms of annual production, the Stibnite Gold Project will then provide 297,000 ounces of payable gold for approximately 14-15 years of production.

Over its lifetime, the site will produce a total of 4.2 million ounces of payable gold, approximately 968,000 ounces of payable silver (approximately 68,000 ounces per year), and 78.44 million pounds of payable antimony (approximately 5.5 million pounds per year).

Production will be mined utilizing the Stibnite Gold Project's proven and probable mineral resources of 4.82 million ounces of gold at an average grade of 1.43 grams of gold per tonne of ore; about. 6.43 million ounces of silver at an average grade of 1.91 grams of silver per tonne of ore; and 148.69 million pounds of antimony at a grade of 0.064%.

In terms of measured and indicated mineral resources, the Stibnite Gold Project has 6.04 million ounces of gold at 1.42 grams of gold per tonne of ore; about 8.82 million ounces of silver at 2.07 grams of silver per tonne of ore; and 205.9 million pounds of antimony at a grade of 0.07%.

The Possible Value of Production

To give you an idea of the current value of Perpetua Resources' future production, at the time of this writing, the gold price in the futures market is $1,942.70 per ounce and the silver price in the futures market is $23.177 per ounce.

According to this July 25, 2023 article from Rock Chasing, the price of antimony has recently fluctuated between a low of $2.72 per pound and a high of $6.80 per pound. The spike likely reflects increased demand from the defense industry, strongly amplified by the recent rise in geopolitical tensions between a bloc of Western countries plus Japan/South Korea/Australia and an Eastern bloc of countries including Russia, China, and North Korea.

In terms of the cost of producing the main output, i.e., gold, the economic feasibility study assumes that the Stibnite gold project will produce the yellow metal enduring, net of by-product credits, total cash costs of $571 per ounce and all-in sustaining costs [AISC] of $636 per ounce.

Compared to Metals Focus's Gold Focus 2022 estimates (reported by cmegroup dot com in this article), which saw gold mining as a highly profitable activity in July 2022 with gold cash costs of $768/oz and a gold AISC of $1,068/oz, Perpetua Resources must have at least the same conditions for very profitable operations as the Stibnite gold project's costs are 25-40.5% below that estimate. Plus, at the time of the estimate, the price of gold was around $1,730/oz, while currently, it is at $1,942.70/oz and bound to trade well above the five-year average of $1,718.38/oz due to the 2 factors, mainly: a) heightened risk of supply-side shortages as resources become scarce in the future, and b) gold safe haven against potential headwinds in an increasingly uncertain global outlook triggered by geopolitical tensions.

The Profitability Metrics for the Stibnite Gold Project in Central Idaho and the Financing of Ongoing Activities

In terms of the key measure of profitability for the Stibnite Gold Project in central Idaho, the after-tax net present value [NPV], calculated at a 5% discount rate and assuming a $1,600/oz gold price, yields $1.32 billion.

The NPV/share is $20.89 compared to the current share price of $3.27 for PPTA stock and to the current share price of CA$ 4.48 (about $3.28) for PPTA:CA stock. The after-tax internal rate of return [IRR] is 22.3%, but there are many projects in the industry with an IRR above 25% and this may be diverting investor attention from the Stibnite Gold Project for the time being.

Instead, the time it will take for the Stibnite gold project to recoup its capital costs once production is operational and metals are delivered is estimated to be between 2.5 and 3 years.

Here the retail investor must pay attention to the risk involved: There is no doubt that the difference between the present value of the project, which many usually consider as the intrinsic value of the stock, and the market price of the stock is very attractive. And now the strong positive momentum for antimony puts even more spotlight on this margin. However, if the market had stuck to this value instead of pursuing value by taking advantage of the opportunities that arise with commodity price cycles, the share price would have held near the present value of the project pending first production instead of tracking the gold price action. This is not to say that the NPV is an unlikely valuation for this stock, but such a wide margin between the NPV and the share price carries a risk that the retail investor, by being overly enchanted, will build up such positions that are difficult to relieve when the trend in the price of the commodity requires it. This is because the stock is not very liquid in terms of the volume of shares traded on the stock exchange: the stock consists of 63.17 million shares outstanding and its free float, 33.19 million ordinary shares, is almost 73% in the hands of institutional investors, so difficult to reach via trading on the stock exchange. Furthermore, the stock has very low trading volumes: Avg Volume is 208.49k over the past 3 months and Avg Volume is 95.16k over the past 10 days per PPTA, according to Yahoo Finance, while Avg Volume is 11.9k over the past 3 months and Avg Volume is 10.3k over past 10 days for PPTA:CA, according to Yahoo Finance.

Investments of approximately $500,000, roughly in line with previous periods, were made in the last 12 months through Q2-2023, according to Seeking Alpha. With cash of $14 million and zero debt as of June 30, 2023, the company intends to support ongoing operations focused on further development of the environmental permit for the Stibnite Gold Project.

The regulator will publish the final environmental impact statement by the end of this year and a final record of the decision by early 2024, according to the Q2-2023 Highlights of the company via Seeking Alpha.

Preparatory work for the start of construction of the mine will be covered by a fund of approximately $25 million under the agreement with the US Department of Defense, as the site is a potential producer of critical antimony for ammunition, according to the Q2-2023 Highlights of the company via Seeking Alpha.

Due to antimony's strong momentum in the current war situation (increasing arms race due to the conflict in Ukraine and heightened global geopolitical tensions), the company can obtain non-repayable financing for the construction of the antimony mine and, most importantly, for the construction of the gold mine.

There is no exact information on when gold production will begin, but the rapid arms race makes it possible to believe that the initial production cannot be that far away from now.

The Stock Valuation

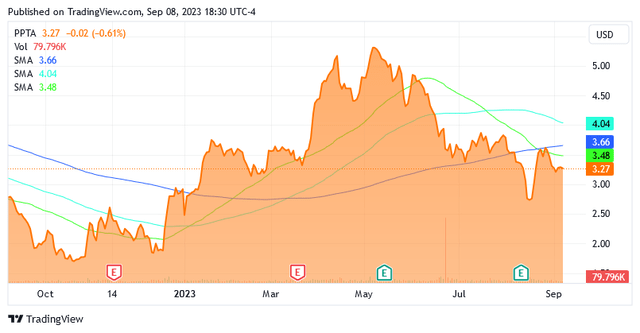

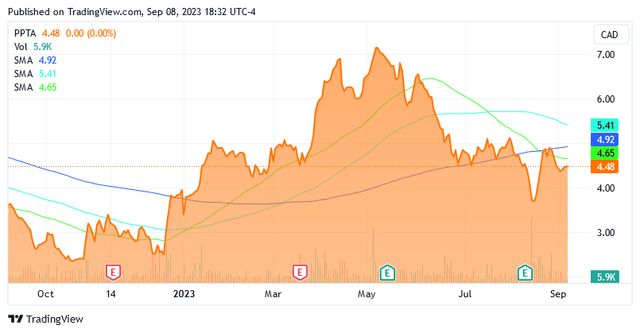

As of this writing, Perpetua Resources Corp. (PPTA) (PPTA:CA) shares are trading below 200-, 100- and 50-day simple moving averages, the charts below from Seeking Alpha indicate.

As of this writing, the PPTA stock has a share price of $3.27 vs. 200-, 100-, and 50-SMA lines of $3.66, $4.04, and $3.48.

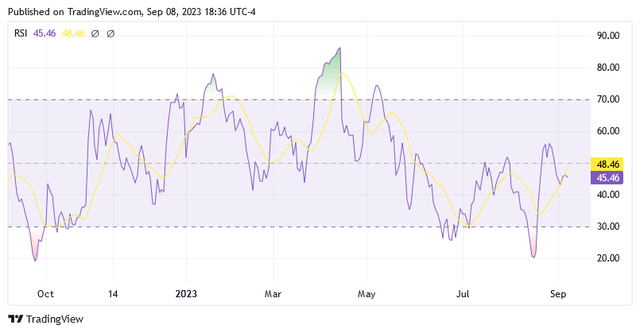

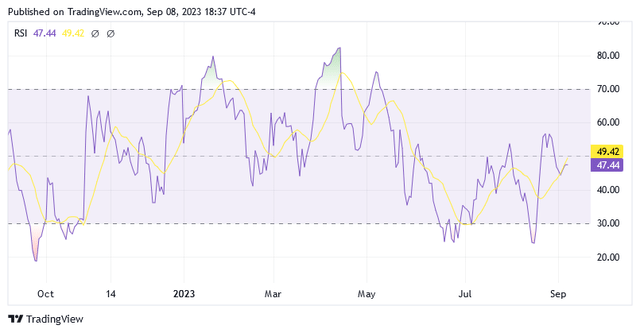

The stock price has a 52-week range of $2.64 to $5.01 and the stock has a market cap of $206.77 million. The RSI suggests that shares may trade lower from this level under the pressure from the Fed wanting to keep interest rates high for some time, which does not bode well for gold prices in the near term. The opportunity cost of holding bonds and other fixed-income assets instead of gold is attractive at the moment and could become even more attractive if monetary policy tightens further with the FOMC meeting on November 1st. According to interest rate traders reported by the CMEGroup website, there is a chance. The stock could get cheaper so investors may want to wait a little longer before implementing a buy recommendation.

The stock is a buy because the company has the growth potential to achieve profitable gold production in Idaho in the future, coupled with a promising gold price outlook. Gold prices could enter this promising future with a sharp rise in a few months if economists' predictions of a recession between late 2023 and early 2024 prove correct.

As previously mentioned, a recession would create headwinds that strengthen demand for gold as a safe haven. In this suddenly very favorable environment for gold, shares of Perpetua Resources have a great opportunity to take an incredible leap forward thanks to the positive correlation with changes in the price of precious gold.

The same considerations also apply to the stock traded on the Toronto Stock Exchange. At the time of writing, PPTA:CA stock is trading at CA$4.48 against the 200, 100, and 50 SMA lines of CA$4.92, CA$5.41, and CA$4.65.

The stock price has a 52-week range of CA$2.34 to CA$7.32 and the stock has a market cap of CA$282.98 million.

The 14-day RSI indicator of 47.44 suggests plenty of room to the downside for shares to become usefully cheaper for the investor interested in buying the stock.

Conclusion

This analysis mentions prominent economists who predict a recession between the end of 2023 and the first quarter of 2024. Should this downturn in the business cycle occur, demand for gold as a safe haven to protect the values of US portfolios will flourish, and so the price per ounce is likely to rise significantly in response.

However, the outlook for gold prices remains upbeat as the risk of supply shortages increases as resources continue to deplete and investors increasingly turn to safe-haven amid the uncertainty about the global outlook.

Thanks to their positive correlation with the yellow metal, shares of Perpetua Resources Corp. (PPTA) (PPTA:CA) are poised to make an incredible jump from current levels.

Moreover, shares of this company with significant growth potential, embedded in the project of profitable gold production in Idaho, may become cheaper under the pressure of the tight monetary policy by the Fed.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.