Qualcomm Stock: Buying Hand-Over-Fist, Especially After Recent Apple News

Summary

- Qualcomm stock hit a three-year low, failing to benefit from the recent AI hype like Nvidia.

- Concerns arise about the potential loss of important customers such as Apple and Huawei.

- From my point of view, it is mainly the shaky hands that are selling.

- For long-term investors, I believe this is a great time to add Qualcomm stock to your portfolio.

AutumnSkyPhotography

Qualcomm (NASDAQ:QCOM) shares are currently trading lower than they have been in three years. Unlike high-flyer Nvidia (NVDA), for example, the stock has not been able to benefit from the recent AI hype. Compared to the high from last year's beginning, the stock is more than 40% underwater.

Investors appear concerned that important customers like Apple (AAPL) could churn and competitors like Huawei could take market share from them, especially in the low-price segments.

Operational performance stalls

In addition, the operating business has flattened out somewhat in recent quarters. For example, sales in the QCT segment fell by more than $2 billion in the last Q3, from $9.2 billion to $7.1 billion. Sales in the high-margin QLC segment also fell by $300 million to $1.3 billion. For the 9-month period, the YoY revenue decline was more than $5.5 billion. EBT decreased in Q3 in the QCT segment from almost $3 billion to $1.7 billion. This represents a decrease of more than 40%. In the QTL segment, EBT fell nearly 20% from $1 billion to $811 million. On a 9-month view, the EBT decline was almost 50%. Over the last three quarters, the QLC segment EBT margin decreased by five basis points from 74% to 69%.

The poor development in the QCT segment was mainly due to lower chipset shipments due to reduced demand from customers, who mainly reduced their inventories. Over the last nine months, handset sales decreased by $4 billion.

I am optimistic

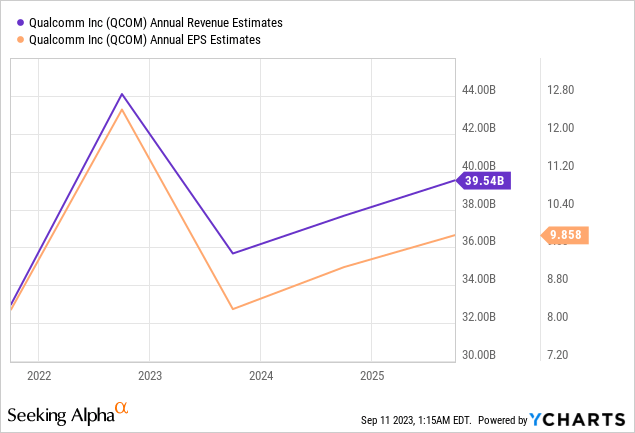

Overall, however, I am still optimistic. For example, we see typical cycles in chipset shipments in particular. Qualcomm's revenue and profit development has never been straight. And while the stock price is traveling toward 2020 and further into the past, revenue, and profit are still far higher than in the past. For example, analysts expect FY 2023 revenue to be around $36 billion. That's nearly $13 billion above 2020 revenue. Regarding EPS, the end-of-year result of circa $8.2 should also be nearly double the 2020 result.

In addition, a very promising diversified business is growing in the shadow of the traditional modem (3G/4G/5G) business. One example is the automotive sector. Sales in the last nine months amounted to $1.3 billion, an increase of almost 30% YoY. CEO Cristiano Amon rightly emphasized this performance in the last earnings call.

This quarter also marked our 11th straight quarter of year-over-year double-digit percentage growth in QCT Automotive revenues.

However, it should be noted that the growth momentum has slowed somewhat, and we will have to see how the business unit develops in the coming quarters. So, the Q3 2023 revenue for Automotive was below the Q1 2023 revenue.

And even though there was a revenue decline in IoT from $5.3 billion to $4.5 billion in the last nine months, this business area is very exciting. The use cases mentioned in the earnings call show the potential.

In Consumer IoT, the recently announced Meta Quest 3 is the first virtual and mixed reality headset to be powered by a next-generation Snapdragon XR platform developed in collaboration with Meta. The Quest 3 features 2x the graphical performance, higher resolution and a slimmer, more comfortable form factor than the Quest 2. We're also helping to drive the growing ecosystem of VR and MR developers in China. Oppo recently announced their Oppo MR Glass Developer Edition, powered by Snapdragon XR2+.

In industrial IoT, we launched a video collaboration platform suite, which provides OEMs choice and flexibility for the design and deployment of immersive video conference devices across conference rooms, health care settings and at home video calling with friends and family.

We also launched the QCS 8550 and QCS 4490, our first software-defined IoT solutions at Hannover Messe. These solutions enable next-gen smart cameras, drones, robotics, cloud gaming, industrial handhelds, panels, point-of-sale devices and more.

If investors zoom out a bit from the current macroeconomic environment, the outlook for Qualcomm is extremely bright. The rollout of 5G and the new opportunities for data transmission and processing that come with it put Qualcomm at a table richly set.

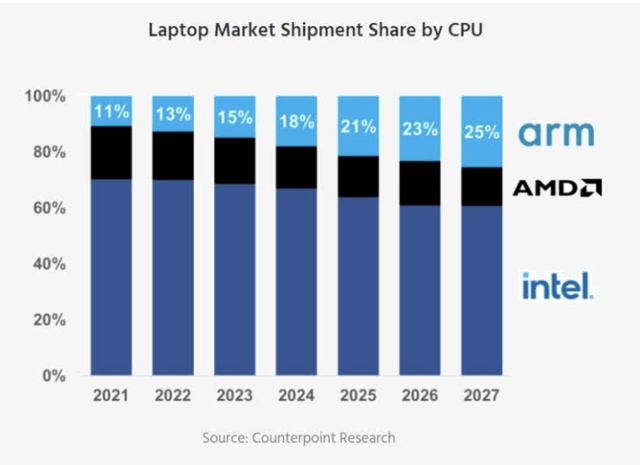

And then there's the fantasy around Nuvia. There are new rumors of an entry into the Windows market here. Qualcomm wants to launch the Snapdragon 8cx Gen 4 chip on Arm design basis at the beginning of next year. Thus, Qualcomm could enter a market early enough, which will be completely turned upside down in the next few years.

Laptop market shipment share by CPU (Counterpoint Research)

Yes, customers like Apple may drop away. And as a Qualcomm shareholder, I, too, would prefer Qualcomm to keep the 20% or so of revenue it generates from Apple. In the meantime, however, the topic has been widely publicized and made a big deal. On the one hand, the downside is limited, and on the other hand, Apple only purchases a slimmed-down solution from Qualcomm anyway, which is not as high-margin:

Apple purchases our MDM (or thin modem) products, which do not include our integrated application processor technology, and which have lower revenue and margin contributions than our combined modem and application processor products.

And just as I'm writing this article, the news pops up that Apple has extended its contract with Qualcomm until 2026 about the supply of 5G Modem‑RF Systems. This shows all the more how excellently Qualcomm is positioned, and Apple still does not manage to develop competitive modems despite the acquisition of Intel's (INTC) mobile division.

Fundamental perspective

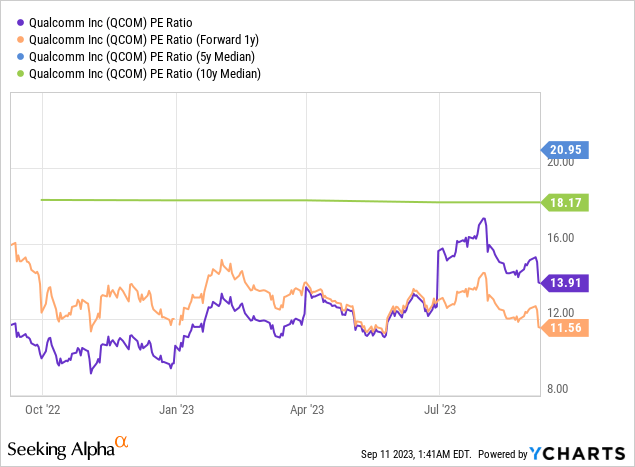

Qualcomm is currently extremely favorably valued. With a PE ratio (forward 1y) of just 12, the stock is a bargain, especially compared to its historical valuation.

The stock also offers a dividend yield of almost 3%. The last time investors received such a yield was in 2020. With a payout ratio of 32% on earnings and 50% on FCF, the payouts are also secured. With earnings picking up in 2025 and 2026, I think annual increases in the high single digits or low double digits of 8-10% are realistic.

Conclusion and risks to my thesis

The recent revenue declines and the known risks around Apple put pressure on Qualcomm stock. From my point of view, it is mainly the shaky hands that are selling. The latest news also shows there is no way around Qualcomm for now. So, overall, this is a great time for long-term investors to add Qualcomm stock to your portfolio. The stock is cheaper than it has been in years. Conversely, the company is now much more broadly positioned and looks to escape a potential supercycle with 5G with multiple use cases.

Investors should still factor in a few risks. For one, the global macroeconomic situation may persist longer than anticipated, further depressing sales. In addition, Qualcomm has a relatively high China exposure. For example, the company generated $28 billion (total: $44 billion) of its 2022 revenue in China. This is probably also since many OEMs to which Qualcomm supplies produce in China but are not necessarily Chinese companies. Nevertheless, Qualcomm is highly dependent on China as an industrial location.

In the end, however, the opportunities clearly outweigh the risks in my view. Therefore, I rate Qualcomm stock with a clear buy rating.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)