This Golden High Yield Opportunity May Not Last Long

Summary

- Rising interest rates have created numerous attractive buying opportunities in the high yield equity corner of the market.

- We share one of the sectors that offers the most promise right now.

- We also share our top pick in that sector at the moment that we are buying aggressively.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

Seiya Tabuchi/iStock via Getty Images

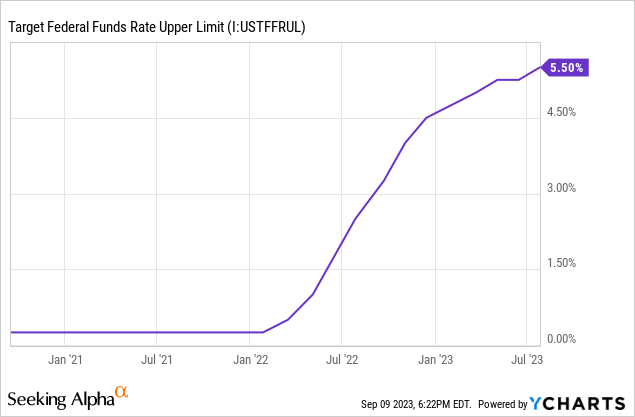

It is no secret that interest rates have soared since early 2022 as the Federal Reserve has sought to combat multi-decade high inflation:

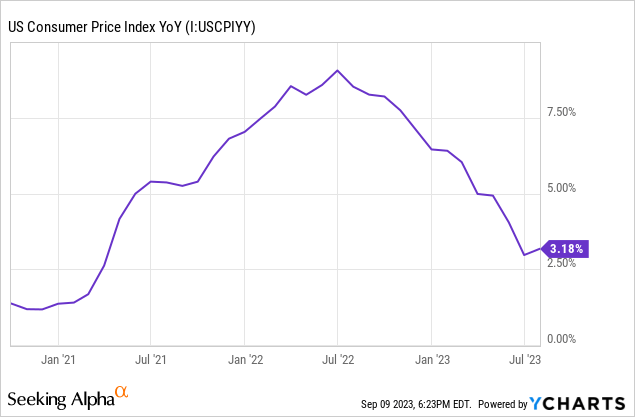

While the Fed's war on inflation has met with some success in bringing down the CPI from its July 2022 peak, it still has a small ways to go:

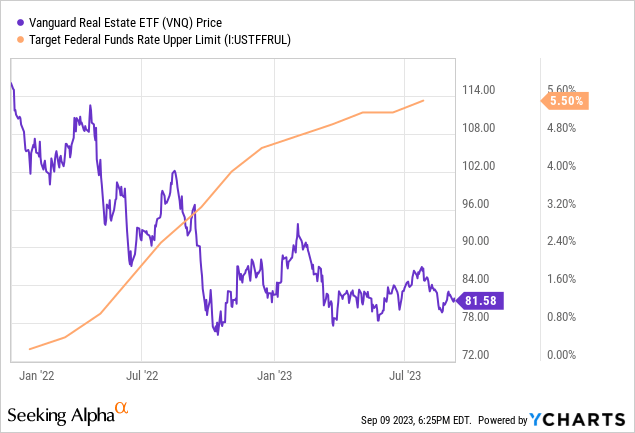

Moreover, the rapid increase in interest rates has hit certain sectors of the stock market extremely hard, including real estate investment trusts (i.e., REITs) (VNQ). As the chart below shows, REIT prices have tumbled relentlessly at a rate that has a clear correlation with the pace of interest rate hikes by the Fed. The Fed's initial brisk pace of hikes led to very steep declines in REIT prices. Lately, as the Fed has only inched rates higher, REIT prices have stabilized to some degree:

This pattern largely reflects what Berkshire Hathaway's (BRK.A)(BRK.B) Warren Buffett has said about interest rates and equity valuations:

Interest rates are like gravity in valuations. If interest rates are nothing, values can be almost infinite. If interest rates are extremely high, that's a huge gravitational pull on values.

REITs in particular are interest rate sensitive investments because:

- They are viewed primarily as income instruments, thereby placing them into competition with bonds for capital from income-oriented investors. Therefore, when interest rates rise, income-oriented investors expect a higher yield from REITs as well, compressing valuations in turn.

- REITs typically make us of leverage in their investments. As a result, when interest rates rise, it can compress their investment spreads and profitability since interest expense may outpace increases in rental income.

In this article, we will look at these considerations and compare them to the state of REITs right now to show that the market is being far too bearish on REITs right now. As a result, we think that REITs offer investors a golden opportunity that may not last much longer.

#1. REIT Yields Are Being Unfairly Compared To Interest Rates

While the market may have put REITs in the penalty box due to rising interest rates, avoiding REITs solely because they offer lower dividend yields than money market funds is short sided in our view. It is important to keep in mind that REITs are not fixed income investments and - as common equity investments - are ultimately total return investments, with dividend yield being just one component. REITs often retain a substantial percentage of their cash flow (often termed "Funds From Operations" or simply "FFO") and reinvest it into their businesses to generate further per share cash flow and ultimately intrinsic value growth.

Moreover, many REITs - such as triple net lease stalwarts Realty Income (O) and W. P. Carey (WPC) - have contractual rent escalators, enabling them to generate steady organic growth on top of their retained and reinvested cash flow. As a result, over a long-term investment horizon, REITs often deliver total returns that significantly outpace just their dividend yield. Moreover, they also tend to grow their dividends over the long-term, meaning that their yield on cost tends to increase significantly over time.

#2. REIT Valuations Are Likely To Soar

Another important consideration for investors who are comparing bond yields to REIT yields is the impact of high interest rates on REIT valuations. When buying a blue-chip REIT with a very safe dividend, investors are effectively locking in that yield on cost - plus any future growth - forever. In contrast, bonds have maturity dates, so when they mature, investors will have to redeploy the proceeds at the prevailing interest rates available at that point in the future.

Given that inflation seems to have peaked and is likely headed lower in the coming months due to the lag in how the housing component of CPI is calculated, it is very likely that the current elevated state of interest rates is just temporary and interest rates will likely decline in the not-too-distant future. Given that REITs are trading at historically low valuations, REITs enjoy a significant margin of safety and offer very attractive risk-reward, with potential for significant upside when interest rates decrease.

Investor Takeaway

REITs offer a considerable growth component to them that is currently being underappreciated by the market in our view and they also stand to benefit immensely from falling interest rates in a way that bonds cannot match given the permanent nature of their cash flows in contrast to the term-limited contractual nature of bond yields. As a result, it stands to reason that buying REITs whose stock prices have crashed despite their underlying fundamentals holding up well in the rising interest rate and high inflation environment is a compelling bargain.

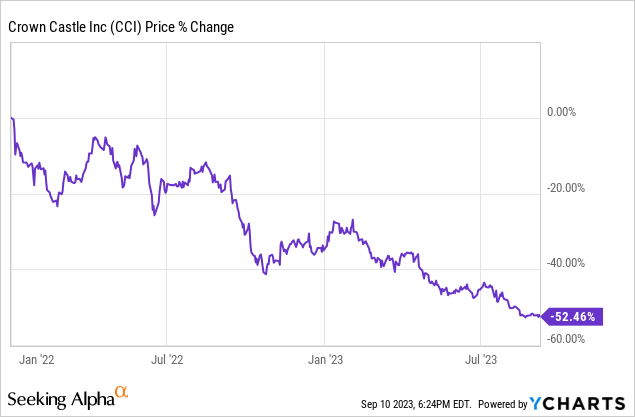

Given this assessment, our favorite REIT - though we like several - that we think is particularly attractively priced at the moment is Crown Castle Inc. (CCI). It is a blue-chip recession-resistant telecommunications infrastructure REIT that offers a very attractive and safe dividend yielding 6.3% at the moment. Long-term, management expects the dividend to grow at a mid to high single digit CAGR, and the stock price has literally more than halved since the beginning of 2022 despite the company retaining strong fundamentals, though near-term growth prospects have taken a bit of a hit from lease cancellations from T-Mobile's (TMUS) recent acquisition of Sprint.

As a result, over the past week we have begun buying CCI and other REITs at a rather aggressive clip and plan to continue doing so as long as valuations remain suppressed at bargain basement levels as part of building a well-diversified high yielding portfolio.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Investor for a 2-week free trial

We are the #1-rated high-yield investor community on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WPC, CCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

But O, WPC, and CCI have no growth expected in the coming years.