Carrefour SA: Price Deflation And Brazilian Market A Potential Concern

Summary

- Carrefour SA has the potential for long-term upside, but a slowdown in the Brazilian market could be of concern.

- While like-for-like sales growth has continued, the potential for price deflation could place downward pressure on sales growth.

- I maintain my view that the stock can see longer-term upside, but take a more cautious view in the short to medium term.

Cristian Storto Fotografia

Investment Thesis: I take the view that while Carrefour SA (OTCPK:CRRFY) still has the potential for long-term upside, a slowdown in Brazilian growth as well as price deflation are potential risk factors in the short to medium-term.

In a previous article back in July, I made the argument that Carrefour SA could see further growth going forward, on the basis of continually strong growth in e-commerce sales.

Since then, the stock has descended to a price of $3.63 at the time of writing:

The purpose of this article is to assess whether Carrefour SA has the ability to see continued growth from here taking recent performance into consideration.

Performance

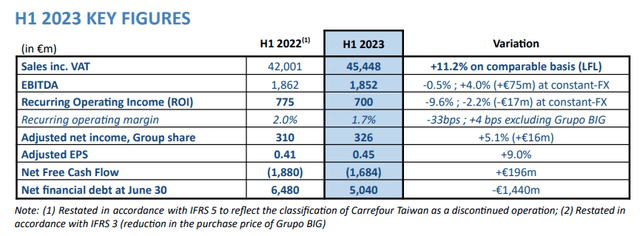

When looking at the H1 2023 earnings release for Carrefour SA, we can see that sales were up by 11.2% on a comparable (or like-for-like basis), while adjusted earnings per share saw growth of 9% as compared to the first half of 2022.

Carrefour Press Release: First Half 2023 Report

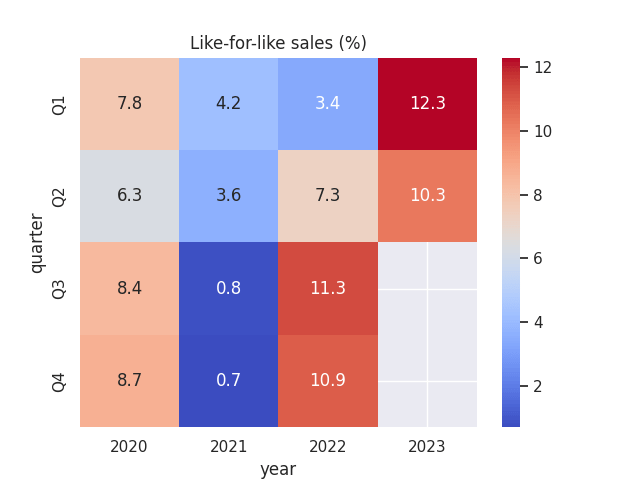

In my previous article, I made the argument that while growth in the company's like-for-like sales (that is excluding sales from stores that have opened or closed over the period), this has been driven at least in part by inflationary trends, i.e. price increases have significantly contributed to sales growth as opposed to simply growth in volume.

Figures sourced from historical Carrefour SA quarterly earnings reports. Heatmap generated by author using Python's seaborn library.

From this standpoint, I made the argument that while growth in like-for-like sales is encouraging, this is more likely to be well received by investors if we also see an improvement in the company's quick ratio. My reason for making this argument was that revenue growth as a result of rising prices alone may not be a compelling reason for investors to consider the stock.

With regards to short-term liquidity, we can see that the quick ratio of Carrefour SA (calculated as total current assets less inventories less prepaid expenses all over total current liabilities) has remained at a similar level as that of last December, with a ratio below 1 indicating that Carrefour does not possess sufficient liquid assets to meet its current liabilities:

| Dec 2021 | Dec 2022 | Jun 2023 | |

| Total current assets | 17785 | 23884 | 21444 |

| Inventories | 5858 | 6893 | 7047 |

| Prepaid expenses | 476 | 419 | 0 |

| Current liabilities | 22150 | 26907 | 24423 |

| Quick ratio | 0.52 | 0.62 | 0.59 |

Source: Figures sourced from Carrefour 2022 and 2023 Consolidated Financial Statements - quick ratio calculated by author.

From a longer-term standpoint, we can see that the company's long-term borrowings to total assets ratio has also remained at a similar level, with long-term borrowings showing a slight decrease from that of December:

| Dec 2021 | Dec 2022 | Jun 2023 | |

| Borrowings - portion more than one year | 5491 | 6912 | 6479 |

| Total assets | 47668 | 56551 | 54146 |

| Long-term borrowings to assets ratio | 11.52% | 12.22% | 11.97% |

Source: Figures sourced from Carrefour 2022 and 2023 Consolidated Financial Statements - long-term borrowings to assets ratio calculated by author.

Overall, a trend of revenue growth driven by price increases has been continuing - while the company's quick ratio and long-term borrowings to total assets ratio has remained more or less consistent from previous quarters.

My Perspective

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, I continue to take the view that the stock could see long-term upside from here if strong e-commerce growth continues.

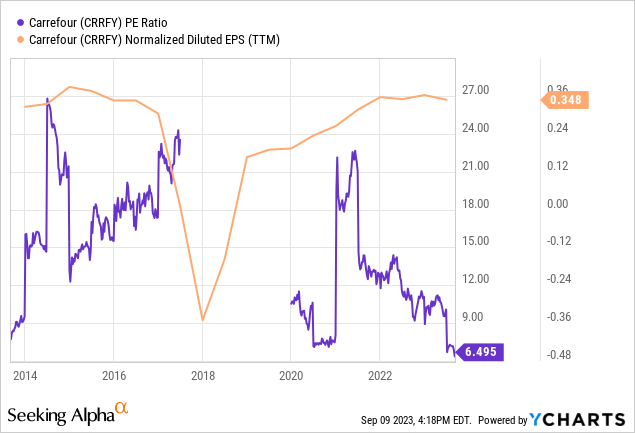

I had previously pointed out that Carrefour could be undervalued on the basis of the P/E ratio trailing near a 10-year low while earnings per share remains near a 10-year high. This trend continues to hold:

ycharts.com

From this standpoint, I take the view that further earnings growth has the potential to push the stock higher over the longer-term.

Risks

In terms of the potential risks to Carrefour SA at this time, I had previously remarked that growth in the Brazilian market - specifically for Brazilian supermarket chain Atacadão having previously benefited from strong growth in e-commerce gross merchandise value (GMV) - recent price deflation in agricultural commodities had affected sales across cash and carry stores for the brand. Moreover, falling prices have also resulted in customers postponing purchases across the BtoB business - with sales down by 4.3% on a like-for-like basis over the quarter.

There are two risks in this regard. One is the risk that price deflation could result in a significant slowdown in the growth that we have been seeing across the Brazilian market. The second, more broad risk - is that potential price deflation across other major markets such as the French market could significantly affect sales growth - as customers start to delay purchases in anticipation of further price decreases. With like-for-like sales for Q2 down by 2% on that of the previous quarter, this could be a risk factor going forward.

Conclusion

To conclude, Carrefour SA has seen continued sales growth and I maintain my view that the stock could see longer-term upside going forward. However, I am more cautious in the short to medium-term on account of a potential slowing of growth in the Brazilian market and the potential impact of price deflation across sales growth more generally.

In this regard, I will be looking for evidence of a rebound in growth across the Brazilian market as well as evidence that sales growth can remain robust regardless of price fluctuations to justify further upside in subsequent quarters.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written on an "as is" basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.