ETW And ETV: A Look At Their Options Writing Strategy

Summary

- Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV) and Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund (ETW) offer exposure to equity positions and write index options.

- ETV benchmarks against the S&P 500 and Nasdaq 100, while ETW incorporates the MSCI Europe Index, resulting in a more global portfolio.

- Both funds use call-writing strategies to potentially generate gains and mitigate downside risk, but losses for their options can also occur during strong market years.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

Olivier Le Moal

Written by Nick Ackerman, co-produced by Stanford Chemist.

Eaton Vance Tax-Managed Buy-Write Opportunities Fund (NYSE:ETV) and Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund (NYSE:ETW) offer investors exposure to a basket of equity positions while the fund's write index options. While the fund's names are quite similar and take somewhat of the same approach, they aren't exactly the same.

ETW Basics

- 1-Year Z-score: -1.23

- Discount: -10.75%

- Distribution Yield: 8.85%

- Expense Ratio: 1.11%

- Leverage: N/A

- Managed Assets: $959 million

- Structure: Perpetual

ETW will "invest in a diversified portfolio of common stocks and write call options on one or more U.S. and foreign indices on a substantial portion of the value of its common stock portfolio to seek to generate current earnings from the option premium."

The tax-managed focus comes in with the "fund evaluating returns on an after-tax basis and seeks to minimize and defer federal income taxes incurred by shareholders in connection with their investment in the Fund." The investment policy is designed to achieve its main objective; "to provide current income and gains, with a secondary objective of capital appreciation."

ETV Basics

- 1-Year Z-score: -0.98

- Discount: -3.51%

- Distribution Yield: 9.02%

- Expense Ratio: 1.08%

- Leverage: N/A

- Managed Assets: $1.4 billion

- Structure: Perpetual

ETV's investment objective is to "provide current income and gains, with a secondary objective of capital appreciation." To achieve this, the fund will invest "in a diversified portfolio of common stocks and writes call options on one or more U.S. indices on a substantial portion of the value of its common stock portfolio to seek to generate current earnings from the option premium."

How Are ETV and ETW Different?

Both of these funds will target an overwrite of 100% of the notional value of their underlying portfolios. However, ETV will benchmark itself against the S&P 500 and Nasdaq 100. This often leads to the fund having a tilt towards a more tech-oriented portfolio. It also sees the fund write index options against the S&P 500 and Nasdaq 100.

For ETW, they benchmark against the S&P 500 but then also incorporate the MSCI Europe Index. This is what leads to the portfolio having a global tilt. It actually writes options against a broad mixture of global indexes such as the Nikkei 225, SMI, FTSE 100 and Dow Jones Euro Stoxx 50 Index - in addition to the S&P 500 and, interestingly, the Nasdaq 100 Index.

This is interesting because the fund isn't quite as overweight tech as its ETV cousin. That's sometimes where index writing funds can run into issues when their portfolio isn't necessarily positioned efficiently. Index call writing options have one huge difference between writing covered calls, and that is you can't own an index directly. Therefore, these contracts are cash-settled, and you have to generally offset the losses that can take place by having a portfolio that will mostly mimic the indexes it's writing against.

A mismatch between the index writing and the underlying portfolio could lead to a situation where both sleeves of the strategy falter. One of the ways that can happen is when the tech-oriented index performs quite strongly when a more S&P 500 Index-oriented portfolio would languish. Fortunately, the S&P 500 has become quite concentrated in tech now, too, and that hasn't been too much of a problem for ETW.

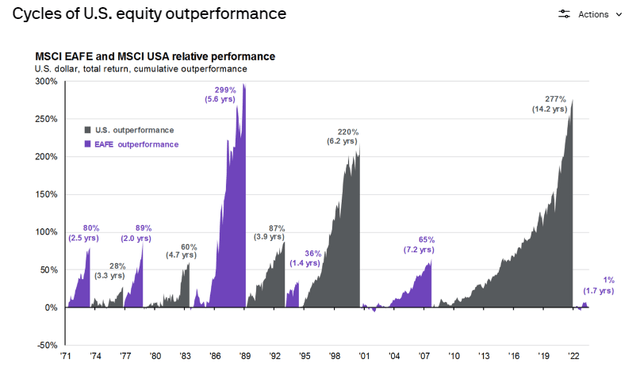

If we were to put these funds up against each other directly, ETV would have been a much stronger performer over the long term. Its U.S.-based portfolio was driving this. International investments have really been the laggards now for a considerable period of time.

Ycharts

However, not all hope is lost for global funds. The U.S. market hasn't always been so dominant, and there have been periods where the reverse is true, with global stocks outperforming U.S. equities. In fact, this chart shows that was starting to be the case fairly recently too.

International Vs. U.S. Equity Performance (JPMorgan)

A Benefit Of Call Writing? And Also A Downside

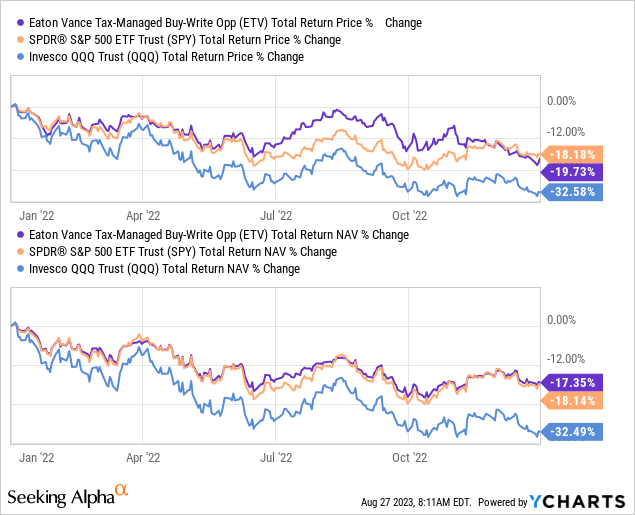

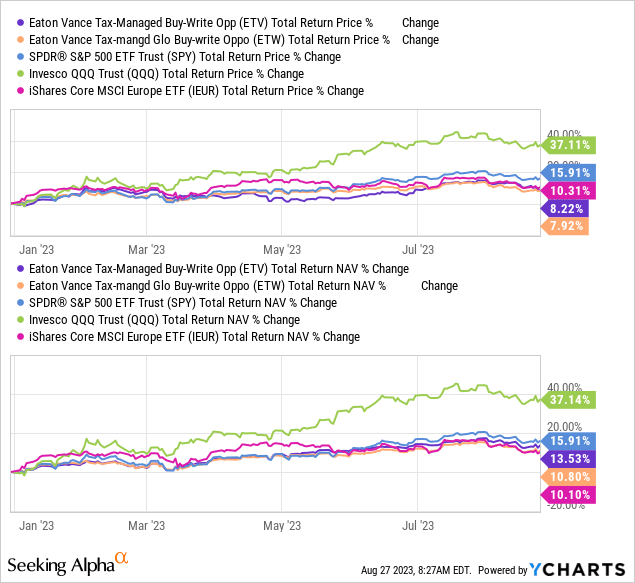

One of the benefits of a call-writing strategy is that during a down year, these funds can offer some downside protection. This happens because whatever options premium they bring in offsets some of the declines. However, the overall positioning of the portfolio will play a greater role as call writing is only a slightly defensive strategy.

2022 is actually a good year to look at due to it being such a tough year for most equities. What we can see is that despite being incredibly overweight tech, on a total NAV return basis, ETV was able to mitigate the downside to what the Nasdaq 100 tracker fund, Invesco QQQ Trust (QQQ), produced. That being said, it only slightly offset the losses of what we saw in the SPDR S&P 500 Index (SPY).

Ycharts

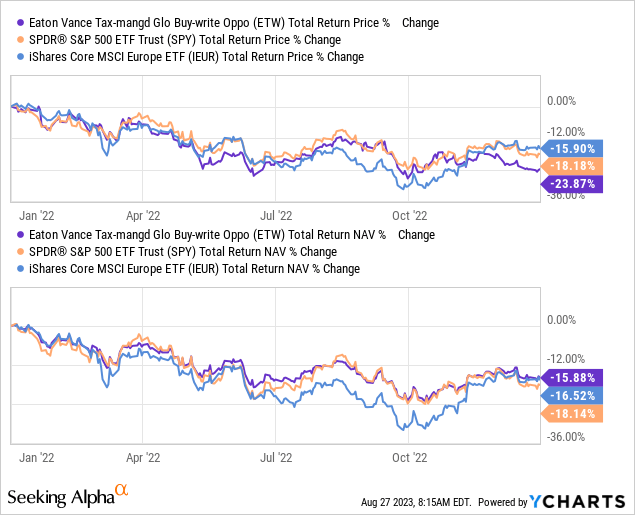

For ETW, we can see that on a total NAV return basis, the downside was only offset to a fairly negligible degree. So, unfortunately, I wouldn't say they necessarily had the best 2022 to represent how a call-writing strategy can benefit the fund.

Ycharts

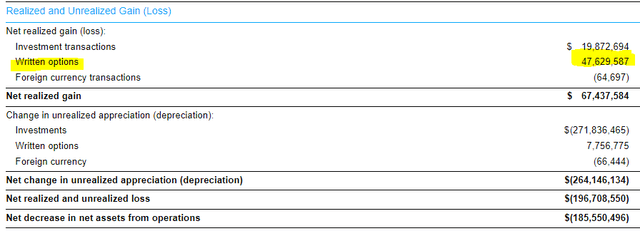

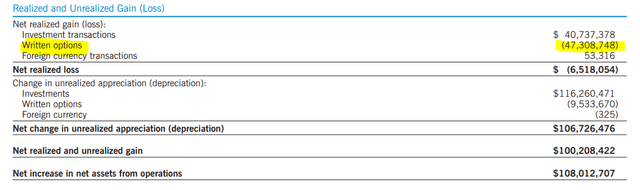

This is despite the fact that the fund pulled in what seemed like a fairly material level of capital gains through its options writing strategy in the prior year. The below is from ETW's annual report, where we can see the fund pulled in roughly $47.63 million for realized gains on their option writing.

ETW Realized/Unrealized Gains/Losses 2022 (ETW Annual Report 2022)

Of course, the idea here is that if the fund wasn't writing options, then that $47.63 million gain wouldn't have taken place. The fund's NAV would have dropped by roughly $240.937 million when including the unrealized gains from the options writing.

ETV is a larger fund, but it also similarly pulled in a meaningful amount of realized gains from its option writing last year, at around $120.305 million.

ETV Realized/Unrealized Gains/Losses 2022 (ETV Annual Report 2022)

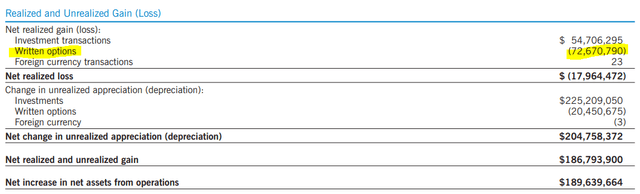

However, one of the downsides is as we touched on above. Losses can be created when indexes are rising. This is a good time to point out that this is taking place, as 2023 has been a pretty strong year for these tech-heavy indexes. What we see in the latest semi-annual reports is the sorts of losses that can be generated.

Here is from ETW's semi-annual report.

ETW Realized/Unrealized Gains/Losses (ETW Semi-Annual Report)

What we see is that basically, everything the fund realized in gains for last year showed up in realized losses this year. However, the fund is still performing strongly this year due to its underlying portfolio showing a considerable amount of unrealized gains and even realized gains come into a fairly substantial amount.

For ETV, we see this similarly playing out where they see significant realized losses from writing options, but it is nearly offset by the realized gains in its underlying portfolio. Then it is completely offset by the unrealized appreciation in the underlying portfolio to create a situation where the fund is showing strong performance despite these losses.

ETV Realized/Unrealized Gains Losses (ETV Semi-Annual Report)

It is this type of situation that results in call-writing funds generally underperforming their straight equity (non-call-writing) type peers. The upside is limited in covered call writing funds, and for index writing funds, the same thing plays out where the upside is limited, but it's also easier to create a situation where losses can occur for index writing funds due to being cash-settled.

2023 is a good year as an example of this playing out since the indexes were running so strongly, which created the losses we saw above from the options writing strategy in the first half of the year.

Ycharts

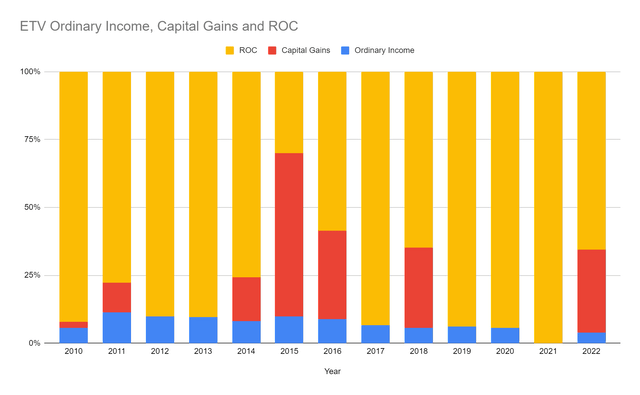

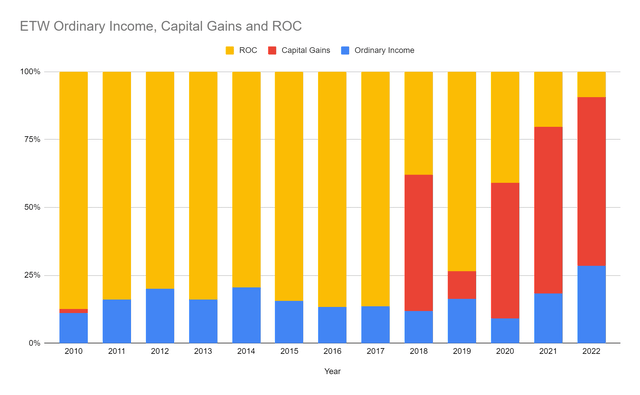

Impact On Tax Classifications For Distributions

These losses generated in strong years aren't all in vain, though; these losses help to keep these funds "tax-managed," as each of their names implies. This comes from the fact that return of capital distributions show up in their tax classifications fairly regularly. This ends up being one of the main benefits of the call-writing options strategy that these funds choose to employ.

ETV has historically been the more reliable fund in this regard, with ROC distributions coming in more regularly. This happens because if the fund isn't realizing gains from its portfolio too heavily and instead is just showing realized losses, then return of capital ends up being most of the tax classification instead of gains.

Net investment income is really low on these funds, so ordinary income doesn't tend to be a problem. When it is, they hold portfolio positions that generally pay qualified dividends anyway in their equity funds. For 2022, ETV's ordinary income came to 3.95% of the total distributions; however, 100% was qualified. For ETW, the 28.51% that was classified of the total distribution as ordinary income had 90.31% of that portion being qualified.

ROC can be beneficial due to the fact that it isn't taxed in the year it is received. Instead, it lowers your cost basis, and that means taxes would be deferred until you sell, and that's only if you sell above your cost basis, as then you'd be realizing the gains at that point.

Additionally, under current tax law, if you choose never to sell and pass it on to your heirs, they'll receive a stepped-up basis. Therefore, you would have received all the cash flows it produced during your life, never paying taxes on the ROC portion. The next generation can start the process all over again.

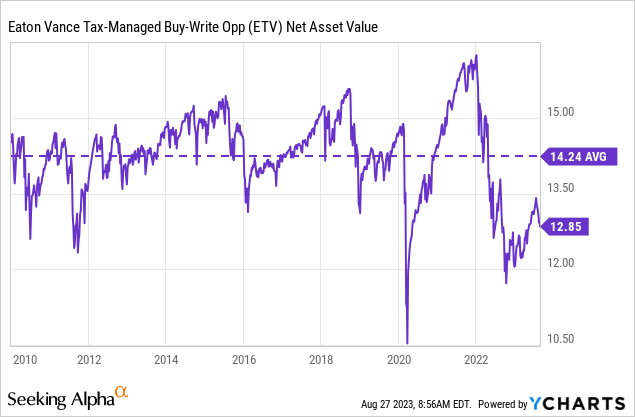

Here is the history of the distribution classifications for ETV over more than the last decade.

ETV Annual Distribution Tax Classifications (Eaton Vance reports compiled by author)

Despite all these ROC distributions, some investors might expect that the fund would be down drastically. After all, during this period, the fund paid out $18.1545 in distributions, and most of it was ROC.

However, most of this ROC wouldn't have technically been destructive ROC. Again, due to the options writing strategy as we outlined above and how it can generate losses, the losses can then be offset by the underlying portfolio. In a down year when the options writing does create gains, it can actually lead to more capital gains distributions, but those can be offset if they realize losses in their underlying portfolio, too.

To be fair, ETV is in a down period, but throughout most of the period, it has averaged right around the same NAV per share. This helps highlight that most of the distributions of ROC haven't been overly destructive.

Ycharts

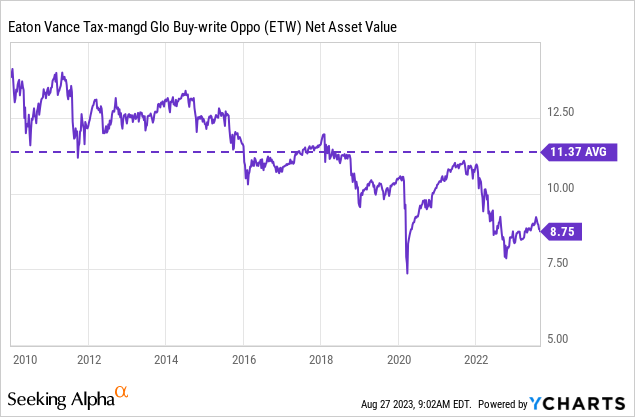

For ETW, there was a period of time when ROC was fairly consistent, but in the last several years, it has become more mixed.

ETW Annual Distribution Tax Classifications (Eaton Vance reports compiled by author)

This is despite the fact that ETW's underperformance during this period has been quite substantial. That translates into more of ETW's ROC distribution really being destructive to the fund. In total, they paid $14.6432 in distributions during this period.

Ycharts

It's this underperformance that also has led to ETW, of course, being the one to cut its distribution five times during this period, while ETV experienced only two cuts during this time.

Conclusion

ETW and ETV share a lot of similarities, but ETV tilts towards a heavy tech allocation, and ETW has a global focus. This translates into the funds writing calls against different indexes. It has also meant that ETV's historical performance has been much stronger. However, ETW's discount is the most attractive at this time, but one needs to be more optimistic about global equities going forward.

Overall, their options strategies have played out similarly. During down years, they will see strong capital gains that can offset some of the declines in the funds. Unfortunately, portfolio positioning heavy into tech for both of these funds last year meant the loss mitigation was fairly muted for 2022.

During strong performing years, this strategy will generate losses, and that's what can help these funds with the "tax-managed" strategies in their portfolios to throw off return of capital distributions. ROC distributions then defer tax obligations until an investor sells out of the fund and, at that time, could potentially face capital gains taxes.

At the CEF/ETF Income Laboratory, we manage closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ETW, ETV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (9)

most charts are not a good way took look at high yield monthly payout funds.

They are usually tracking per share pricing, but to be fair one should track all the shares that were added with the DRIP on. DRIP on is how you track total performance- and compounding.The company/CEF decides how much to pay out or reinvest in itself- why punish the ones that pay you and then you decide what to do with the cash?