STAG Industrial: Dip Presents Long-Term Opportunity

Summary

- STAG Industrial shares have pulled back and could be creating a long-term opportunity.

- The rise of e-commerce is a positive factor for STAG as an industrial REIT, which has been back on a rising trend.

- Rising interest rates and earnings growth headwinds pose challenges for STAG, and we saw that in the latest quarterly results.

- This idea was discussed in more depth with members of my private investing community, Cash Builder Opportunities. Learn More »

PM Images

Written by Nick Ackerman.

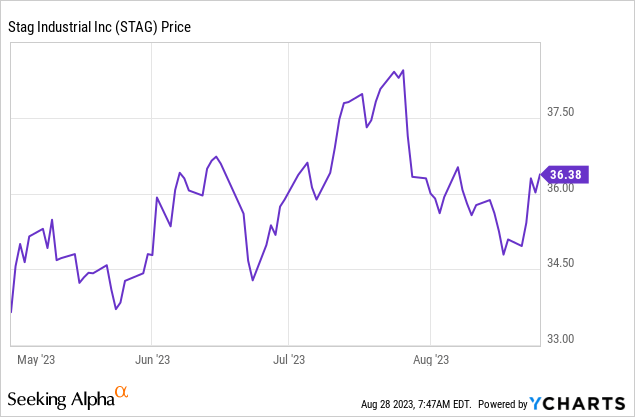

Shares of STAG Industrial (NYSE:STAG) have recently started to pullback just as it was looking richly valued. That being said, it isn't necessarily a screaming deal today, either.

I've been watching STAG a bit more closely, as I've had the dividend reinvestment turned on my position for well over a year now. I was considering turning that off as shares headed higher, but the latest dip has put me on hold with turning it off. Over the longer term, I suspect this is still a decent price to make small additional purchases at. Yields seem to be the primary driver of the dip that's being created for this attractive industrial REIT.

Since earlier this year, which was the last time I provided an update on STAG, they've been added to the S&P MidCap 400 Index. This was initially met with a pop, and overall the market had headed higher through most of this period anyway, which no doubt helped bring STAG to the higher levels we were seeing.

Ycharts

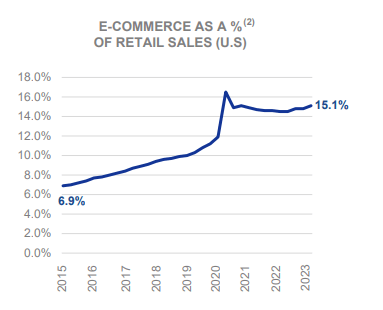

One of the main benefits noted for an industrial warehouse REIT such as STAG is that the rise of e-commerce has continued to trend higher. We had a lot of pull forward during COVID-19, which then did come down from its spike. However, their latest presentation shows us that the trend of e-commerce as a percentage of retail sales is once again heading higher. It also never really gave up the whole Covid spike, as it never went back to pre-2020 levels.

E-Commerce as a % of Retail Sales (STAG Industrial)

The Risk-Free Yield Headwind

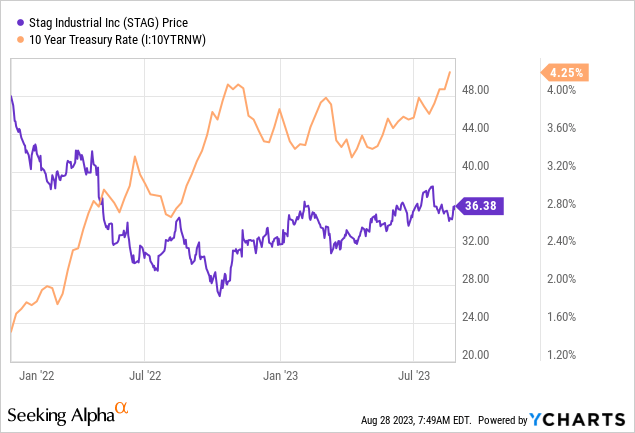

As rates on Treasuries and CDs rise, being influenced by the Fed raising rates, that can put pressure on income-oriented investments. The inverse correlation here between STAG and the 10-year Treasury Rate is pretty strong, and was even perfectly inversely correlated on occasion through 2022 to today.

With that being said, through a period of 2023, STAG began to rebound despite yields still slowly inching their way higher. Being added to the MidCap 400 Index could have been one catalyst to help this be the case. The slower pace of increases with the hopes of even seeing interest rate cuts before too long could have also been a factor.

However, in the last month or so, when the overall market began to look shakier, the inverse correlation showed up once again. The pace of the risk-free rate more recently also likely played a role as it hit a new 52-week peak. This was after it receded after its October 2022 peak.

Ycharts

Early 2022 is when the Fed began to take inflation more seriously, as it remained stubbornly persistent. They then started to raise pretty aggressively, with a serious 75 basis point increase through 2022. The pace of increases has slowed into 2023, but they have still been rising.

Most are expecting us to be near the end of this rate hiking cycle. The expectations of the FOMC back this outlook with expectations for cuts in 2024 and 2025. However, it's important to keep in mind that anything can happen as data comes in. This is for rates being higher for longer than expected or even being cut abruptly on any black swan event.

Earnings Growth Headwinds

STAG is impacted by these rates in two different ways, it isn't simply that the risk-free yields are rising, but also that its costs to grow are also rising. This is seen in the company trying to issue new debt for growth or issuing new shares. Those are the two primary ways that REITs grow over time, since they pay out a large portion of their earnings to investors.

The latest report shows us that STAG provided core FFO per share that was in line with expectations and revenue that missed expectations. That being said, FFO didn't move year-over-year, as Q2 2022 saw core FFO at $0.56 as well. Cash available for distributions or CAFD also didn't see any increase year-over-year either.

However, revenue did grow year-over-year. The company also saw same-store cash NOI increase 4.5% year-over-year. Core FFO even rose 1.7%, from $101.759 million to $103.497 million.

One of the reasons for no growth on several per-share metrics would be dampened by the fact that the company has issued shares through its at-the-market offering. This isn't anything unusual, but it is just one way that REITs grow, and with lower share prices, it means less is being raised as each share is issued relative to what they could raise in 2021 when share prices were higher.

In the latest quarter, they sold 249,016 shares, raising about $8.9 million. The latest total share count was 179,660,771 from 179,211,738 last year. So, they raised the share count by 449,033 year-over-year. That would mean that, unfortunately, the latest quarter saw CAFD per share come in at $0.4852 from $0.4864.

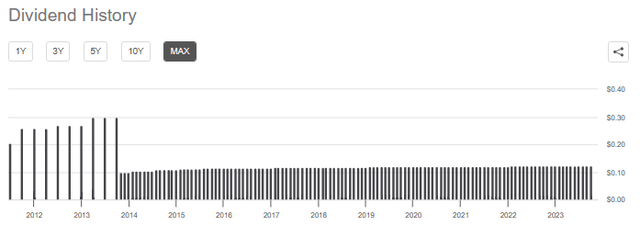

Now, that's still plenty to cover their distribution, which works out to $0.3675 per quarter, paid $0.1225 monthly. It even leaves them enough room to continue to raise their fractional cent annual increases.

STAG Dividend History (Seeking Alpha)

However, despite them anticipating faster distribution growth in the future, I think it is quite clear that isn't necessarily going to be the case in this environment. This is what they had said back in Q1 2022.

So, our first quarter payout ratio is 80%. We communicated a couple of years ago that we wanted to bring that payout ratio to the 80% level. We would like to be there for this year.

We will continue to evaluate it, but we are getting close to the point where we think that we can begin growing the dividend distribution in line with our CAD per share growth. It may not be this year, but we are getting close to the moderation level that we had communicated.

Since they saw CAFD decline and FFO stay flat with the latest quarter, which doesn't bode well. Unless they expect that to turn around before next year's increase is announced, they should remain conservative to keep a healthy balance sheet.

Of course, this is only one quarter. If we look at the first six months of 2023, we see that CAFD per share is at $0.9867. Compared to the year-ago period at a CAFD per share of $0.9464, which means we have seen an increase when taking a look back at the six-month periods. Similarly, the core FFO for the latest six-month report came in at $1.12 compared to $1.09 in the previous year.

Conclusion

STAG shares have dipped once again; they aren't necessarily a screaming deal. This is especially true if an investor believes that yields will continue to rise or the economy will slow down. That could easily send shares of STAG even lower.

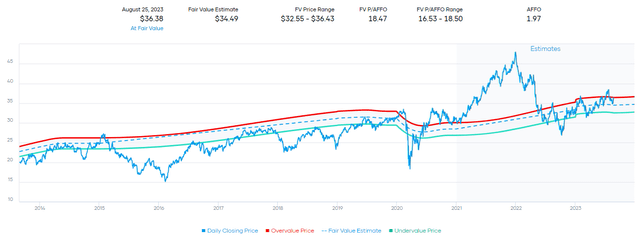

STAG Historical Fair Value Range (Portfolio Insight)

However, they are at a level where I feel comfortable enough to add slowly every month through the DRIP to my long-term position. At least through this, my dividend growth is a bit more reasonable as we wait to get to a better environment for STAG.

Interested in more income ideas?

Check out Cash Builder Opportunities where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor's income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.

This article was written by

Cash Builder Opportunities provides high-quality and reliable dividend growth ideas to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor's income even further.

-----

Who are we?

Nick Ackerman is the lead author for Cash Builder Opportunities. Nick is an avid student of the markets and has been investing in his own accounts for over 12 years. He is a former Financial Advisor and has previously qualified for holding Series 7 and Series 66 licenses. These licenses also specifically qualified him for the role of Registered Investment Adviser (RIA), i.e., he was registered as a fiduciary and could manage assets for a fee and give advice. His specific focus is on closed-end funds, dividend growth stocks and option writing as an attractive way to achieve income as well as general financial planning strategies towards achieving one’s long-term financial goals.

Stanford Chemist is a scientific researcher by training who has taken up a strong and passionate interest in investing. His members appreciate the analytical and agenda-free insight and analysis that he brings to investments. He has developed his own metrics and tools for understanding closed-end funds and exchange-traded funds and how to profit from them and will seek to apply the same logical principles to Cash Builder Opportunities.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STAG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (8)

Still have not seen any divi cuts.

I bought a few more shares of O and WPC last Friday.

They somehow managed to get through the GFC intact.

It is now at a 2-year low. (same with O)

6.75% yield, unbelievable it appears to me.

Honestly not sure I've seen any real pullback in Stag... unlike O, ADC, NNN, WPC and many other reits that are down YTD -10% or so and continually seemly to slide even more Stag is UP + 16.25% for the year..

No real deal on Stag in my view