Intel: Fallacies That An Incumbent Can't Bridge The Gap Fast

Summary

- Intel may not be capitalizing on the increased capital expenditure in the cloud sector, but its ability to pivot and capture opportunities should not be underestimated.

- Despite skepticism about Intel's AI roadmap, the broader trend in AI adoption can still work in the company's favor and expand the compute market significantly.

- Intel's recent performance has shown strong revenue growth and margin improvement, positioning the company for future growth.

- By applying a ~15X multiple, this stock should trade around $48 per share (providing investors ~25% upside from current trading price).

Intel,AI,AMD,NVDA 4kodiak

In the ever-evolving landscape of technology and artificial intelligence (AI), Intel Corporation (NASDAQ:INTC) finds itself at a crossroads, facing both challenges and opportunities. Amid concerns of being "crowded out" by the surging AI investments in the industry, in this article I am going to explain why it's a misconception that an established player like Intel cannot bridge the gap fast enough. Let's delve deeper into Intel recent performance and what's in store for future:

Missing Out on Cloud Capex Surge:

It's worth noting that Intel might not be capitalizing on a substantial portion of the increased capital expenditure (capex) in the cloud sector expected in the latter half of 2023 and throughout 2024. While this might raise immediate concerns, it's crucial to remember that the cloud market is highly dynamic and competitive. Market dynamics can shift rapidly, and Intel has historically shown its ability to pivot and capture opportunities.

Skepticism About the AI Roadmap:

Acknowledging skepticism about Intel's AI roadmap through 2025 is a valid concern. Competitors like NVIDIA (NVDA) and Advanced Micro Devices (AMD) may appear to have more robust strategies in this domain. However, here's where the narrative takes an intriguing turn. The recognition that compute is highly elastic and that AI has the potential to drive down compute costs is a profound insight. It suggests that even if Intel's AI roadmap lags behind in the short term, the broader trend in AI adoption can still work in the company's favor.

Expanding the Compute Pie:

At the heart of this narrative is the understanding that the increasing demand for AI applications will expand the compute market significantly. AI, with its insatiable appetite for computational power, will be a driving force behind this expansion. Importantly, this narrative underscores the belief that AI will ultimately reduce compute costs. This dynamic not only secures Intel's role in the evolving landscape but also positions the company as a beneficiary of the expanding compute pie.

Recent performance:

Strong Revenue Growth and Margin Improvement: Intel's recent performance has been impressive, driven by significant revenue growth in key segments such as Client Computing (CCG), Data Center and AI (DCAI), and Intel Foundry Services (IFS). What's even more promising is the improvement in gross margins, which is particularly noteworthy when considering the starting point was relatively low. Intel's revenue guidance also suggests that they are slightly ahead of Wall Street's expectations. This is partly due to CCG's success in catering to growing consumption demands and the expansion into adjacent businesses. These strategic moves are effectively countering the challenges faced in DCAI. It's worth noting that DCAI has encountered some headwinds, including ongoing enterprise weaknesses, a slower market in China, and competition in the US cloud sector. Despite these challenges, Intel is maintaining optimism by backing quarter-over-quarter growth in revenue and margins. Although substantial margin increases are not anticipated, this is due to the strategic decision to introduce higher-cost products. These new products will help offset the lower pre-product qualification costs and leverage increased factory utilization.

Foundry Business and Technological Innovation: Intel's position in the foundry business is attracting attention, even though no new customers have been announced recently. The partnership with Ericsson, as part of the New Foundry, Expansion, and Acceleration (NEX) initiative, is significant. This collaboration is built on Intel's advanced 18A process, showcasing the company's commitment to innovation. It's worth noting that even industry giants like NVIDIA (NVDA) are expressing interest in utilizing Intel's 18A process if Intel decides to spin off its foundry business. This not only validates Intel's technological prowess but also highlights the potential for future growth in this segment.

Operational Efficiency and Inflation Management: Intel is efficiently managing its operating expenses (opex), in line with prior guidance. While some inflation in opex is expected in the second half of the year, it's crucial to understand that this is a result of the company's rising profitability. As Intel's profitability increases, some costs naturally follow suit. This is a testament to Intel's ability to adapt and manage its resources effectively in response to changing market dynamics.

What's in store for future:

In the ever-evolving landscape of artificial intelligence (AI) and the rapid expansion of the accelerator market, Intel finds itself at a pivotal juncture. With a $1 billion revenue "pipeline" related predominantly to products inherited from Habana Labs, namely Gaudi, Gaudi2, and Gaudi3, Intel stands on the cusp of a substantial opportunity. However, it's crucial to clarify that this pipeline does not constitute a guaranteed backlog, and as such, we must exercise caution in assuming that all of this revenue will materialize in 2024.

One of the key challenges facing Intel in this realm is the current state of adoption. Despite the promise and potential of their accelerator offerings, it appears that actual adoption remains relatively low. This phenomenon could be attributed to several factors, including the fiercely competitive nature of the AI accelerator market, rapidly evolving customer preferences, and the intricacies of integrating new technologies into existing AI workflows.

Intel Mar 2023 Data Center and AI Investor Webinar

Notably, Intel has recently made a strategic decision to merge its GPU and Habana roadmaps, giving rise to the exciting Falcon Shores product. However, this fusion comes with a caveat-Falcon Shores isn't slated for release until 2025. While this move showcases Intel's commitment to innovation and integration, the timing of this release raises concerns within the context of the frenzied growth in the AI accelerator market. The risk here is that by 2025, the landscape may have evolved significantly, potentially making it more challenging for Falcon Shores to secure a dominant position.

Despite these challenges, there are positive indicators to consider. Intel has suggested that there was very little rebate activity in the client business. This suggests that CPU shipments are poised to closely align with PC consumption in the near future. This strategic shift not only streamlines operations but also demonstrates Intel's adaptability in response to market dynamics, positioning the company for a more responsive and efficient approach.

Intel Data Center and AI Investor Webinar

Compared to AMD:

Commentary on the server market and FPGA (Field-Programmable Gate Array) from AMD appears to have a measured tone, but several positive aspects stand out. Let's delve into the key points and provide some context:

Server Market and FPGA:

Cautious Tone: The commentary on the server market and FPGA segment suggests a degree of caution. This caution might stem from the inherent uncertainties in the technology market, where rapid changes can impact performance and market share.

Server Share Gains: Despite the cautious tone, it's highlighted that AMD is making notable gains in the server market. Server market share gains are a significant positive indicator for AMD. This suggests that AMD's server products are gaining traction and competitiveness, which can translate into increased revenue and profitability.

Capex:

Neutral Stance on Capex: The commentary on capital expenditures (capex) appears to be neutral. There doesn't seem to be any overly optimistic or pessimistic sentiment regarding AMD's spending plans. This could indicate that AMD is taking a balanced approach to capital allocation, ensuring that it invests in areas critical for growth while maintaining fiscal responsibility.

Limited Impact on WFE View: Despite a slight increase in gross capex for 2024, it's noted that this change is not substantial enough to significantly alter the overall view on WFE (Wafer Fabrication Equipment). This suggests that AMD's capital expenditure decisions are in line with expectations and industry standards, and they are not expected to disrupt the broader market dynamics.

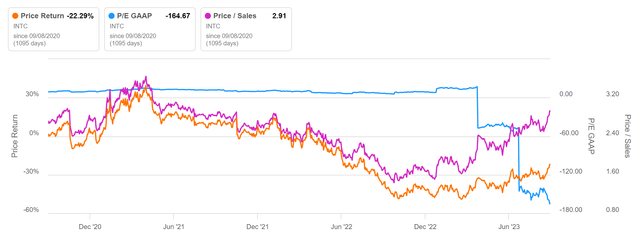

Valuation:

By applying a ~15X multiple, this stock should trade around $48 per share. (Providing investors ~25% upside from current trading price). Let's break down the key components of this valuation:

Historical Median P/E Multiple: The valuation begins by considering Intel's historical price-to-earnings (P/E) multiple over the past ten years. In this case, the historical median P/E multiple is approximately 15x. This multiple reflects the market's willingness to pay a certain price for each dollar of earnings generated by Intel in the past.

C2025E Non-GAAP EPS: The valuation then looks at Intel's estimated non-GAAP earnings per share (EPS) for the year 2025. The estimated EPS for 2025 is projected to be $3.2

Rolling Valuation Forward: To arrive at the price target, this valuation methodology rolls forward to the year 2025. This means applying the historical median P/E multiple to the estimated EPS for 2025, projecting what Intel's market capitalization might be based on expected earnings five years into the future.

Price Target = Historical Median P/E Multiple x Estimated C2025E Non-GAAP EPS Price Target = 15x x $3.20 = $48.00

Conclusion:

While Intel faces challenges and may lag behind competitors in certain aspects of the AI market, its ability to provide solid guidance, measured commentary, and adapt to evolving market dynamics is commendable. The narrative's emphasis on the elasticity of compute and AI's potential to drive down costs highlights a bright outlook. Despite the headwinds, Intel stands to gain from the ever-growing demand for compute power, setting the stage for a positive trajectory in the coming years.

While Intel boasts a substantial revenue pipeline in the AI accelerator market, the level of actual adoption remains a point of concern due to competitive forces and changing market dynamics. The merger of GPU and Habana roadmaps into Falcon Shores presents exciting opportunities for the future, but the timing of its release must be carefully managed to stay competitive in this fast-paced market. Intel's alignment of CPU shipments with PC consumption reflects a strategic pivot in response to evolving market trends. As the AI and accelerator market continues to surge, Intel's ability to navigate these challenges and seize opportunities will be pivotal to its sustained success.

Risk Statement:

It's important to note that this valuation approach relies on historical averages and does not take into account potential changes in Intel's competitive landscape, market sentiment, or macroeconomic factors. As with any valuation, it's just one tool in assessing a company's stock price, and investors should consider a comprehensive analysis that incorporates various factors before making investment decisions.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.