Morgan Stanley: Prospects Still Uncertain

Summary

- Morgan Stanley's stock has underperformed the S&P 500 this year, something underlined by the fact that its net earnings figures have been declining y/y for six consecutive quarters.

- The company has shown some positive signs, such as growth in assets under management and a reversal of revenue declines, but overall, its financials are still in flux.

- The stock is not particularly cheap, and further selling-off is possible on the basis of its valuation.

- While it does have what I consider to be a reliable 4% yield, this isn't enough to make the stock an interesting purchase at this time.

- All of this nets out to a Hold rating at best.

Nikada

Overview

Morgan Stanley (NYSE:MS) stock has had a rough ride this year and continues to trail the S&P 500 YTD. This tepid performance has been playing out against the backdrop of the company’s board having to decide on a new CEO to replace its storied Chief Executive, James P. Gorman. Morgan Stanley has also been posting weak net earnings figures, with its Q2 (ending June ’23) results extending what is now a six-quarter streak of declining y/y net income figures.

Notably, the firm has been outperforming consensus expectations on its earnings per share results, which appear to have been over-revised into bearish territory for the last few quarters. Given the pattern of declining y/y earnings, however, this outperformance has not yielded durable share price appreciation. This pattern was made especially clear in the latest quarter’s results, released July 18th. The stock surged and then sold-off back to where it had been for most of the year. Clearly, investors aren’t convinced that things have been patched up for the long term.

Overall, it appears fair to say that Morgan Stanley is on its back foot. There is material uncertainty here, and the stock reflects that. We must also keep in mind the significantly altered operating environment that the firm finds itself in, one in which the cost of capital is significantly higher due to the altered federal funds rate and (thus) the prime rate. In this article, I’ll evaluate how things look for the next few quarters ahead, with a particular focus on results from the latest quarter as well as early-stage indicators of a potential turnaround in the firm’s prospects.

Q2 2023 Results and Leading Indicators

The uncertainty playing across the markets and the banking sector was a theme on Morgan Stanley’s latest conference call, with the CEO explicitly mentioning various elements of this, including the shifting rates picture, the banking sector, regulatory tests, and ongoing tensions between the US and China. I won’t reiterate these comments in detail here but am mentioning it for context. Certainly, Morgan Stanley’s leadership appears aware of the situation that they’re in.

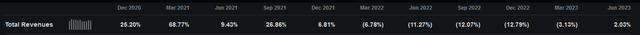

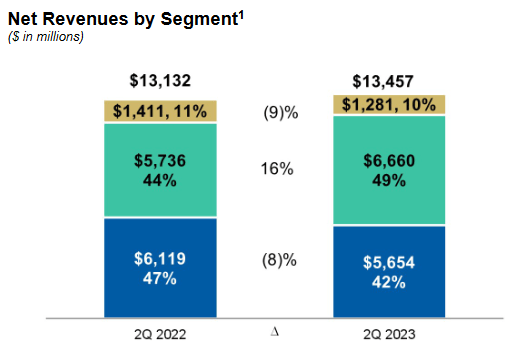

That being said, management painted the picture as one in which the tide looks to be turning. Gorman struck an optimistic note that was then matched by the CFO. The first highlight here is continued growth in assets under management; Morgan Stanley has now gained $200B in net new assets YTD. The firm has also reversed a 5 quarter streak of y/y revenue declines, posting y/y revenue growth of 2.03% for Q2 ’23. While admittedly meager, it’s still a positive figure. This was primarily driven by performance in the Wealth Management segment.

Worth noting, however, is that this revenue figure is still flat y/y when we consider it cumulatively YTD.

Morgan Stanley Revenue

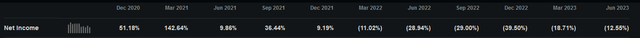

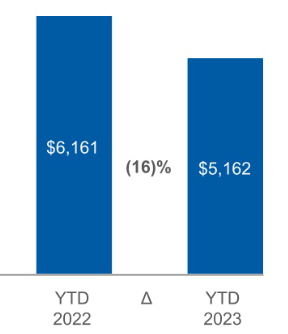

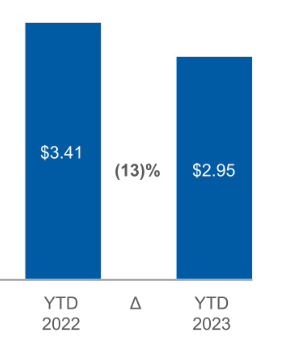

Unfortunately, this flat YTD revenue comparable becomes even worse when it comes to net income or EPS; these numbers continue to be significantly lower than they were for the comparable periods in 2022.

Morgan Stanley Net Income Morgan Stanley EPS

On the basis of these cumulative metrics, there isn’t much cause for optimism as of yet. To reiterate quarterly metrics, we can note that net income is still down 12.6% y/y for the past quarter, even though revenues were up 2%.

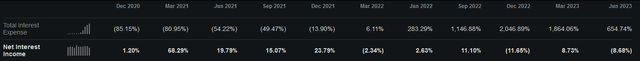

Earnings on interest, always a critical barometer for bank stocks, also declined y/y. Interest expenses continued their strong upward climb in the wake of higher rates. There still does not appear to be a clear trendline on net interest income for Morgan Stanley, with the number fluctuating significantly over the last few quarters.

Considering these results as a whole, Morgan Stanley’s financials are evidently still in flux. The only bright spot here is ongoing AUM and revenue growth in wealth management, a silver lining that is still being counteracted by deteriorating performance across other business lines. Simply put, Morgan Stanley is a worse business than it was last year. Given the disconcerting trendline in interest income, I am also not convinced that this is set to reverse. We can now contextualize this by looking at how valuation metrics have evolved to reflect this poor fundamental trajectory.

Valuation and Yield

The YTD situation here is a roughly flat stock price and a deterioration in both top and bottom line fundamental metrics. We can see how that has translated into Morgan Stanley's valuation by looking at the trailing price/earnings metric for the stock. I prefer this metric for this security due to the high volatility in its EPS at present (and in general); forward earnings are less predictive and are thus less reliable for valuation considerations.

Looking at the trailing twelve months P/E multiple for MS, we see that the stock is not particularly cheap at the moment. While a 15x P/E multiple isn’t exceptionally high as to the overall market, this isn’t a technology stock – it is a financial one. We can note that this trailing twelve month P/E multiple is still in the upper part of its range over the last 3 years for the stock; this stock isn’t trading cheaply.

This leads me to believe that further selling-off is possible, particularly so when we consider that the fundamental picture is not trending in the right direction. Morgan Stanley is still trading at a 61% premium to the financial sector overall.

The counterpoint to this is the roughly 4% yield that the stock is currently providing. This yield will obviously increase if the stock declines further. With the 10-year Treasury yield at 4.26%, however, I wouldn’t consider this to be a game-changer. Since Morgan Stanley has a robust balance sheet, I am confident that they can continue to pay this yield even if its fundamentals continue to fluctuate. In a way, this provides a floor to its valuation. On the flip side, investors getting in at this price could experience depreciation and get locked in to this yield at current prices. Looking at the overall picture, I don’t find 4% to be very attractive here and ultimately an auxiliary factor for those considering picking up shares.

Conclusion

Morgan Stanley has a lot of uncertainty around it, but the stock still isn’t too cheap. While it will continue to be a going concern, there is no clear indication that its fundamental performance will revert to growth in the immediate. This is compounded by the fact that the firm has not yet chosen a successor to James Gorman, implicit in which is the lack of a new strategy.

When we consider this in light of the added uncertainty around the rates environment, along with the firm’s inconsistent capacity to generate earnings on interest in the new economic context, the picture is even more problematic. The 4% yield is solid, but far from enough to make this an interesting buy. While I wouldn’t call this a hard sell, I certainly wouldn’t call it a buy. This stock’s still a hold for the time being.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.