Nordson Corporation: Continuing Its Acquisition Strategy

Summary

- Nordson Corporation is now reporting declining revenue and earnings per share after being able to report high growth rates in the previous years.

- After acquiring CyberOptics, the company is continuing its acquisition strategy by acquiring ARAG Group.

- We can make the case for Nordson Corporation stock being fairly valued – or even slightly undervalued – but I would still not invest at this point.

Maksim Labkouski

In my last article about Nordson Corporation (NASDAQ:NDSN) I wrote that the company (as well as the stock) is still not a bargain, and I rated the stock as a “Hold”. At the time of publication, the stock was trading close to $200 and lost about 25% from its previous all-time high. But apparently the market saw things different: In line with the climbing overall market – the S&P 500 (SPY) increased 13% in value since the last article was publish – Nordson Corporation could increase its share price 16.5%. It even seems like I hit the temporary bottom with my article.

The market is certainly not always right, but when market participants are seeing things completely different, we can at least take another closer look at our investment thesis and update where updates might be necessary.

Quarterly Results

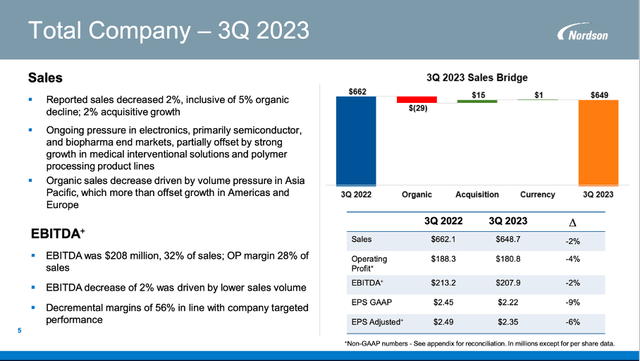

In my opinion, quarterly results could not have been the reason for the optimism in the last few months. While Nordson Corporation could beat earnings per share estimates slightly, it missed revenue expectations. But when looking at the actual results and especially comparing the results to the same quarter last year, the picture is getting worse.

In the third quarter, sales declined from $662 million in the same quarter last year to $649 million this quarter – resulting in 2.0% YoY decline. The decline was driven by 5% organic decrease but offset by the benefit of the CyberOptics acquisition. Operating profit declined 7.6% year-over-year from $185 million in Q3/22 to $171 million in Q3/23 and finally diluted earnings per share declined from $2.45 to $2.22 – resulting in 9.4% YoY decline.

When looking at the nine months ending, sales still increased slightly compared to the same period last year, but operating income as well as earnings per share also declined when looking at the three quarters.

Looking at the different segments, all three had to report declining sales in the third quarter – in reported as well as organic numbers. And while Industrial Precision Solutions (1.5% organic decline) as well as Medical and Fluid Solutions (3.9% organic decline) reported low single digit declines, Advanced Technology Solutions declined 12.8% organically. Decline in Industrial Precision Solutions was driven by the softness in the product assembly and nonwovens product lines in Asia. Decline in the Medical and Fluid Solutions business was driven by destocking in single-use plastic components for biopharma applications and the fluid solutions product lines specifically for electronics assembly. In case of the Advanced Technology Solutions business, CyberOptics contributed to growth, but organic sales volume was down due to the electronics dispense product line which is serving the semiconductor end markets.

We can also look at the different regions and Europe as well as America could report growth, but the Asia-Pacific region reported 20% organic decline. And during the earnings call, management said it will keep a close eye on the region:

Geographically, we are closely monitoring the pressure in Asia Pacific region, specifically in China. The regional sales weakness was largely related to the electronics exposure, though there was weakness in demand across all three segments, some of which was due to the timing of large system orders. Nordson has a well-established footprint in China with long-tenured and knowledgeable employees.

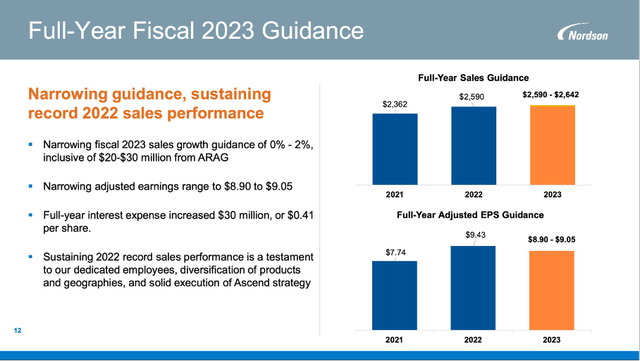

Nordson Corporation also updated its guidance. But despite the reported declines in the third quarter, Nordson did not have to lower its guidance. The guidance however was narrowed, and revenue is now expected to be flat or grow at best 2% (this is including about $20 to $30 million from ARAG – we will get to this). And adjusted earnings per share are now expected to be in a range between $8.90 and $9.05.

Acquisitions

Nordson Corporation is continuing its acquisitions. In my last article I wrote about the acquisition of CyberOptics (which is already contributing to results and was completed in November 2022). And now Nordson Corporation announced its next big acquisition. But we should not be too surprised: As already pointed out in my last article, acquisitions are one of the three major capital allocation strategies of the business.

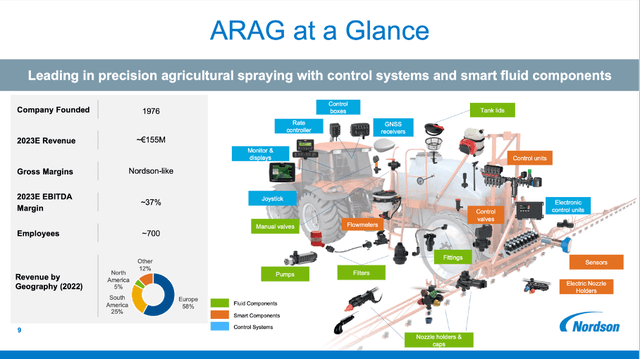

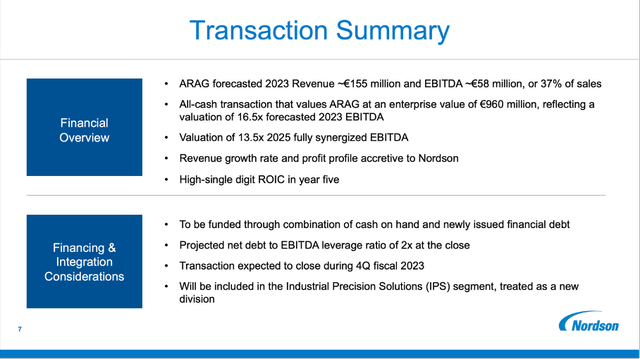

Now Nordson Corporation announced the acquisition of ARAG Group for €960 million in June 2023. And when quoting from the news release:

Headquartered in Rubiera, Italy, ARAG is a global market and innovation leader in the development, production and supply of precision control systems and smart fluid components for agricultural spraying. Its portfolio consists of three key product families: fluid components, such as nozzles, pumps and filters; smart components that measure and control the flow, quantity and location of the dispensed fluid; and control systems that provide a greater variety of input and functionality to the customer. ARAG’s broad product portfolio is further supported by differentiated software and data capabilities. Established in 1976, ARAG supports its customers through seven manufacturing and distribution locations globally and a sales network serving more than 80 countries.

Nordson ARAG Acquisition Presentation

On August 24, 2023, the acquisition was completed, and ARAG will add about €155 million in sales (about $166 million in current exchange rates) and about €58 million in EBITDA (about $62 million in current exchange rates).

Nordson ARAG Acquisition Presentation

The transaction will be funded in parts by cash Nordson had already on its balance sheet and by newly issued debt. And in the last three quarters, Nordson Corporation issued rather high amounts of new debt (at least when compared to previous quarters). In Q1/23 $567 million new debt was issued, in Q2/23 the amount was $218.8 million and in the last quarter an additional $493.4 million in new debt was issued.

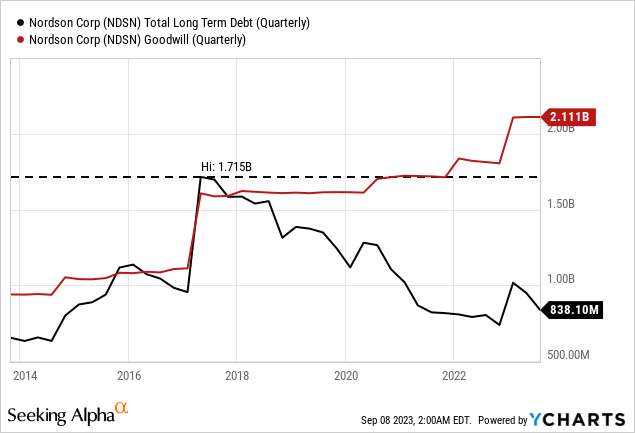

At this point we might be under the impression that Nordson Corporation has rather high debt levels and a messy balance sheet. But on July 31, 2023, Nordson Corporation only had $111 million in short-term debt as well as $727 million in long-term debt. When comparing the total debt to the total shareholders’ equity of $2,580 million, we get a debt-equity ratio of 0.32. And when comparing the total debt to the operating income Nordson Corporation can generate annually ($674 million in the last twelve months), it would take a little over a year to repay the outstanding debt. The picture is similar when taking the free cash flow of $615 million. The company also has $143 million in cash and cash equivalents on its balance sheet, which it can use to repay debt. The only red flag on the balance sheet is $2,111 million in goodwill and this accounts for 50% of Nordson’s total assets right now.

According to the information provided in the earnings call, Nordson Corporation will most likely issue bonds later this year. Management is assuming a weighted average interest rate of approximately 5.5% for total Nordson debt in 2024.But when looking at the chart above, Nordson Corporation was always able to repay debt rather quickly and keep its debt levels under control so we can remain optimistic about the company’s financial health in the years to come.

Strategy

Considering the current balance sheet and financial health of Nordson Corporation, management can – in theory – continue its strategy to grow top (and bottom) line by making acquisitions. As long as management is acquiring businesses meeting the high-quality standards, it seems like a solid strategy – and the balance sheet is allowing for more debt without investors starting to worry. And during the last earnings call, management gave an update on the company’s Ascend Strategy:

Finally, I'd like to share an update on the Ascend strategy. Acquisitions are a very important part of our goal to achieve $3 billion in revenue by 2025. Of the $500 million acquired revenue target we set at our 2021 Investor Day, we are now nearly 80% of the way there.

As long as the company is not messing with its high and stable margins and exceptional return on invested capital metrics it could report in the past, acquisitions can be a good strategy. And I trust management not just to acquire businesses to grow its top line. The acquisition of ARAG seems to fit these criteria and Nordson Corporation picked a business being able to report high margins.

Nordson Corporation Margins and RoIC (Author's work)

When looking at the company’s gross margin we see high levels of stability and operating margin could even improve in the last two years (after being very consistent in the years before). Additionally, Nordson Corporation could report an average RoIC of 14.44% in the last decade.

Intrinsic Value Calculation

When looking at the simple valuation metrics, Nordson Corporation apparently got cheaper over the last few quarters. In late 2020 and early 2021, the price-earnings ratio was extremely high and the valuation multiple peaked close to 50. In the meantime, the P/E ratio declined and now it is close to its 10-year average again and is trading for 27.12 times earnings at this point.

Nordson is trading for 22 times free cash flow and that is actually below the 10-year average which was 23.99. These are acceptable valuation multiples, and we could neither make the argument for Nordson Corporation being overvalued or undervalued based on these numbers.

When using a discount cash flow calculation to determine an intrinsic value, we must make several assumptions. As basis for the calculation we can take the free cash flow of the last four quarters (which was $615 million). Additionally, we calculate with a 10% discount rate and 57.5 million outstanding shares. A realistic growth assumption for the years to come might be 6% which is leading to an intrinsic value of $267.39 for Nordson Corporation and is making the stock slightly undervalued at this point.

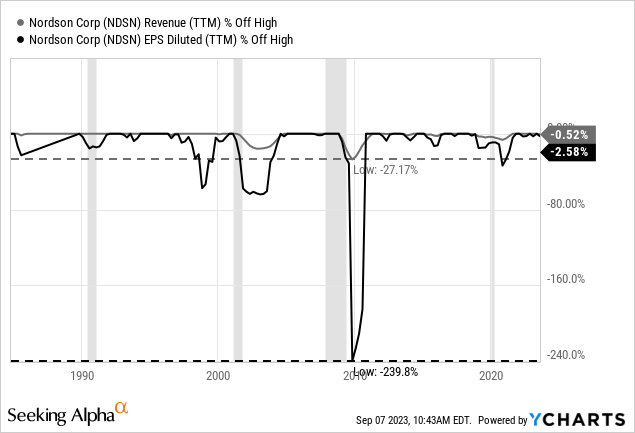

Analysts are expecting earnings per share to grow with a CAGR of 6.42% between fiscal 2022 and fiscal 2027 and when looking at the reported growth rates in the last ten years, 6% growth also seems like a reasonable assumption. Revenue increased with a CAGR of 6.27% in the last ten years, operating income increased with a CAGR of 7.59% and earnings per share could even grow 9.83% on average in the last ten years. And when looking at the last few decades, we can make the argument that low double digit growth is a realistic assumption.

On the other hand, we also must keep in mind the risk for a recession in the quarters to come. And when looking at the last few recessions, we must expect declining revenue and earnings per share. We don’t have to assume that we see a similar performance as during the Great Financial Crisis. But revenue declining in the high single digits or even double digits is not an unlikely scenario at this point.

Conclusion

Nordson Corporation is neither a bargain nor is it extremely overvalued. If we like, we can make the case for Nordson Corporation being slightly undervalued at this point because 6% growth seems like a growth target Nordson Corporation should be able to achieve. But for me personally it is not a stock I would buy now. I would wait at least for another (not unrealistic) drop to the lower end of the range in which the stock is correcting right now (around $200) before thinking about opening a position.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.