AT&T: Interest Rates Could Take A Bite

Summary

- AT&T stock faces risks stemming from its large amount of debt in a period of rising rates.

- Rising interest rates pose a significant risk to AT&T's balance sheet and profitability.

- While AT&T's revenue has been declining, there are early signs of a potential reversal, but interest rates remain a key factor.

AT&T To Merge Warner Media With Discovery Justin Sullivan

As a value investor, I'm exactly the type of person who you would think would be interested in AT&T (NYSE:T) stock. I like low multiples, high yields, and out-of-favor names. Nevertheless, throughout the entire period in which AT&T has been popular in the value community, I have never bought a single share.

Why is that?

It comes down to leverage. Telcos, like utilities, are highly leveraged by their very nature. All of that infrastructure (e.g., cell towers, base stations, networking components, etc.) costs money, so much so that Telcos can rarely rely on "bootstrapping" their operations. Instead, they borrow money and tend to have very large amounts of debt.

In today's economy, all of that debt is a big problem. The Federal Reserve has been hiking interest rates since 2022. Lately, the pace of hikes has slowed down, but the Fed continues to warn that more hikes may be needed. With oil prices creeping upward again, more hikes may indeed come to pass. The Fed's goal is to get inflation down to 2%, and high oil prices create a problem there, because fuel is a big part of the consumer price index ("CPI"). Additionally, higher fuel prices can indirectly cause inflation in other goods by increasing transportation costs.

So, interest rates are very likely to stay high, and they may even go higher.

It's for this reason that I am still not interested in AT&T stock, despite the apparently cheap valuation. Although the company has a fairly stable customer base that allows it to lock in recurring revenue, it also has a lot of variable costs like interest. For this reason, the company's profitability is generally shaky and is likely to be that way for the foreseeable future.

AT&T: Financial Structure

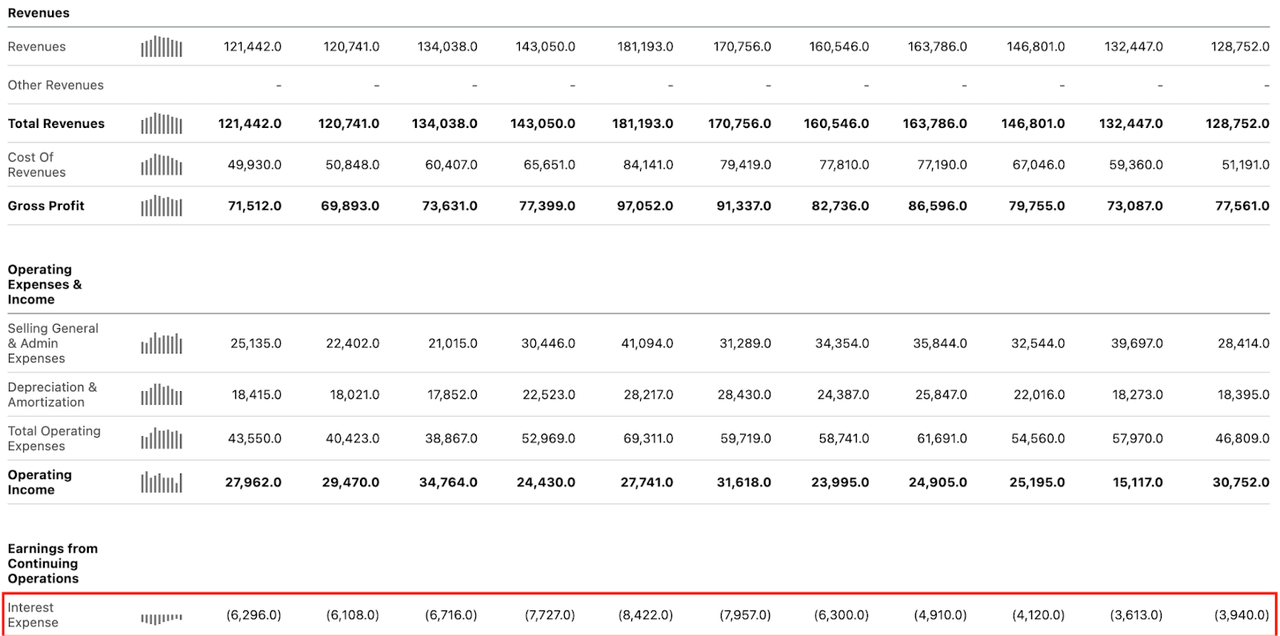

As I mentioned in the introduction, AT&T's cost structure is a major risk factor for the company. It has $127.6 billion in long-term debt to $101 billion in equity, for a 1.26 debt-to-equity ratio. Normally it's considered ideal for this ratio to be below one, so AT&T isn't scoring well here. The current ratio of 0.67 is also not ideal - with that ratio, it's better for the multiple to be above one.

The real problem with AT&T's debt load is not the debt itself but rather the rising amount of interest it produces. Interest rates have been rising over the last year and a half. Interest rate hikes tend to have the following effects:

Instantaneously making variable-rate debt more expensive.

Eventually making fixed-rate debt more expensive when the maturity date arrives (assuming the company has to borrow again to pay off the previous loan).

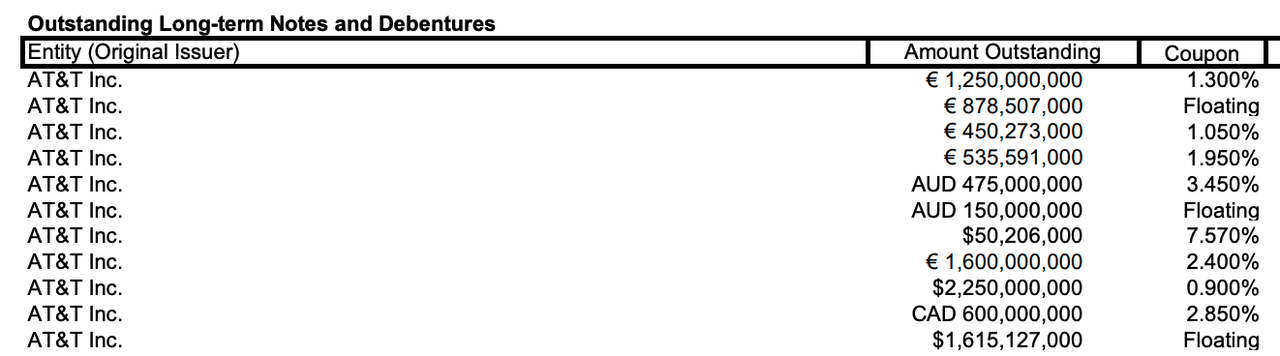

If we look at AT&T's long-term financial statements, we can see a clear pattern toward higher and higher interest payments at the company. As the table below shows, AT&T's interest payments went from $3.9 billion in 2013 to $6.2 billion in the trailing 12-month period ("TTM"). At the same time, the company's revenue declined over that period, resulting in gross profit and EBIT both shrinking over the last 10 years.

AT&T income statements (Seeking Alpha Quant)

Will AT&T's interest expenses continue to rise?

Quite possibly, yes.

As the table below shows, at least some of AT&T's debt is floating-rate. If the Fed keeps hiking interest rates, then the cost of this debt will increase. It's not a foregone conclusion that the Fed will actually keep hiking, but given the rising price of oil observed in recent weeks, it's not impossible. High oil prices kicked inflation into overdrive in 2022, the same could happen in 2023 or 2024.

If you look at the table above, you'll notice that while the majority of AT&T's debt is fixed rate, a percentage of it is floating rate. One particularly large $1.6 billion bond, for example, is floating rate. If the Fed hikes again, the interest on that bond and a few others will increase. So, rate hikes are a major risk for AT&T investors to watch out for.

The Business Decline: Is It Reversing?

Another fact about AT&T that I consider a red flag - although this one may be reversing - is the long-term decline in revenue. If you look at the historical income statements on Seeking Alpha Quant, you'll see that T's revenue is currently down by $7 billion over 10 years. According to Seeking Alpha's "growth" page for AT&T, the company's revenue and profit metrics have declined at the following rates over the last five years:

Revenue: -5.17%

EBITDA: -2.3%

EBIT: -0.65%

Normalized earnings: A 2.5% CAGR increase

The only metric that increased in the last five years was normalized earnings. Free cash flow declined by 25.71% CAGR over the last three.

These numbers are quite poor, but there are some early signs that they may be set to reverse. For example, in the second quarter, the company's earnings came in at:

$29.9 billion in revenue, up 0.9%.

$9.9 billion in cash from operations, up 29%.

$4.2 billion in first half free cash flow, up from a loss.

These results were ahead of analyst estimates and trended in a positive direction. AT&T gained many new subscribers in the quarter and did a good job retaining existing ones. This would tend to indicate that, as long as interest rates don't increase too much, the company may be able to turn its downward trajectory around.

Dividend Safety

Since AT&T's dividend is one of the things that investors like about the company, it would make sense to explore it in some detail.

At today's prices, AT&T yields 7.7%, which is about six times the S&P 500's yield. The payout ratio is 44%, which indicates that the dividend can continue being paid as long as earnings don't decline dramatically. With positive earnings growth, AT&T may even be able to start hiking its dividend. Historically, dividend growth has not been T's strong suit. The dividend declined 30% last year, and 11% over the last three years. I wouldn't expect this company to start hiking its dividend any time soon. However, with the signs we've been seeing on the earnings front, there's a reasonably good chance that the company will at least keep its dividend going steady. So, if you're buying T just for the dividend, you're probably reasonably safe.

Valuation

Last but not least, we have to look at AT&T's valuation. This is the stock's strongest suit, it boasts some impressively low multiples, such as:

A 5.7 P/E ratio.

A 6.2 forward P/E ratio.

A 0.85 price/sales ratio.

A 1.01 price/book ratio.

A 2.8 price/operating cash flow ratio.

A 5.6 price/free cash flow ratio (this multiple calculated by the author).

Going by multiples, AT&T stock is very cheap. A discounted cash flow analysis yields the same result. The stock has an upside even if you assume that the company never grows again. If you take the company's $2.54 in TTM free cash flow per share, and discount it at 10% (the 4% 10-year treasury yield plus a 6% risk premium), you get a $25.40 price target. That's 76% upside!

The Bottom Line

The bottom line on AT&T is that it's a very cheap, high-yielding stock that unfortunately is just a little bit too sensitive to interest rates. It's so cheap that it appears to have a massive upside even in a 0% growth scenario, but on the other hand, the company has several billion dollars' worth of floating-rate debt. If the Fed starts hiking rates again, it could be thesis-busting for AT&T bulls. It's for this reason that, despite having studied AT&T for a long time, I've never bought it. Just one big jump in variable expenses could blow the entire story in my view.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (7)

glta