Jury Is Still Out On NBXG

Summary

- Neuberger Berman Next Generation Connectivity Fund is a technology-based ETF that has been underperforming since its inception.

- The fund invests in over 70 technology companies, including both publicly traded and privately held companies.

- The fund writes covered calls against 25% of its holdings to generate income but doesn't provide a lot of up-to-date details on its strategy.

- It's probably too early to invest in this fund until it proves it can deliver.

MicroStockHub

Neuberger Berman Next Generation Connectivity Fund Inc (NYSE:NBXG) is a technology based ETF. This is a relatively new fund that's been underperforming since its inception and I'd wait for a better entry point after the fund proves its worth over time.

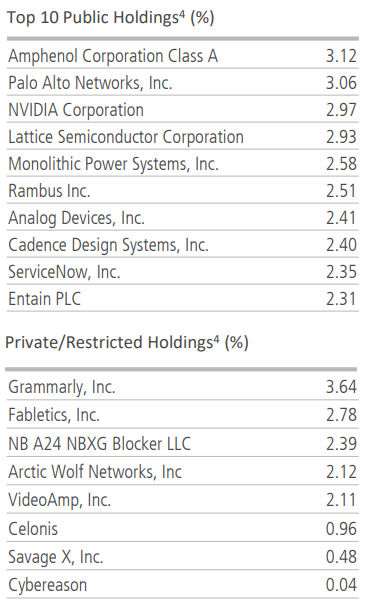

The fund invests in more than 70 technology companies across the world including some private companies that are related to the connectivity sector such as cloud, the internet and related industries. The fund's top holdings include publicly traded companies such as Nvidia (NVDA), Amphenol Corporation (APH), Palo Alto Networks (PANW) as well as privately held companies such as Grammarly, Fabletics and Arctic Wolf Networks. The fund's top 10 stocks claim about 25% of its total weight which tells me that it's slightly top-heavy but not by much.

Top holdings of the fund (Neuberger Berman )

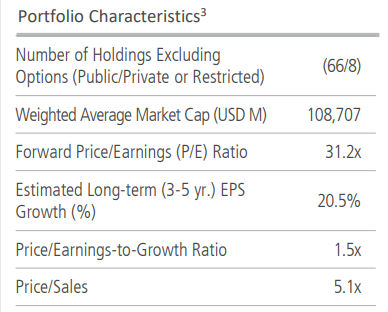

The fund's holdings have an average forward P/E of 31 which may look very high but its PEG ratio is only 1.5 which indicates that the fund's holdings have high growth rates which may justify this high valuation. PEG refers to a stock's P/E ratio adjusted for its growth and it's a good way of looking at high growth stocks to see if their P/E is justified or not. Technically PEG ratios can go from 0.1 to infinity but most PEG ratios will be within 0.5 to 5 range. Anything below 1.5 is considered cheap, anything around 1.5 to 2 is considered fairly valued and anything above 2 might be considered expensive for these types of companies. This fund's PEG ratio of 1.5 is neither expensive nor cheap. Another interesting metric is that the fund's holdings' average expected EPS growth for the next 3-5 years is 20.5% which is very aggressive. This type of growth might justify a high P/E indeed, however, we also need to realize that interest rates aren't 0% anymore and these valuations might still reflect a 0% rate environment.

NBXG Portfolio Characteristics (Neuberger Berman)

The fund hasn't been around for long but it has a distribution policy. The fund distributes 10 cents per share every month regardless of how its holdings performed. So far the fund has made 27 such distributions in the last 27 months, which is basically its entire existence in this form. The fund's fixed distribution policy results in an annual distribution of $1.20 which gives us a yield of 11.1% on the current share price of $10.80 as of the time of writing this article. Since the fund seems to make these distributions regardless of its monthly performance, we will likely to see a mix of capital gains and return of capital in these distributions.

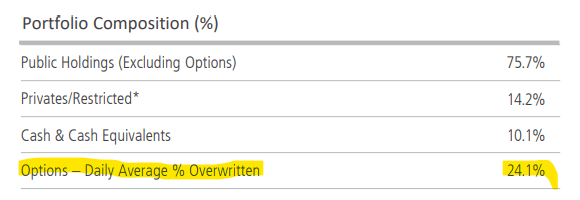

Some of these distributions come from covered calls. The fund's basic description and summary documents don't mention this in detail, but the fund seems to write covered calls against ~25% of its total holdings. The fund's documents don't specify much information about it though. For example, we are not told if the fund writes calls against an index or individual stocks, whether those calls are out of money or at the money and whether those are monthly, quarterly or annual options.

Portfolio Characteristics (Neuberger Berman)

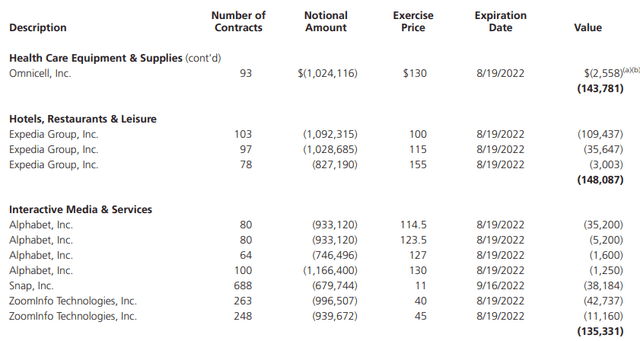

When I went to dig further to learn more specifics about the fund's options writing strategy I found a list of fund's full list of holdings and it actually lists the options it writes in more detail, but this document hasn't been updated since last year so it still shows options with expiration dates in 2022. Still, it should give us at least some idea about what strategy the fund uses for its call writing. We see that they write against individual stocks, a month or two out and at a variety of strike prices, some being at the money and some slightly out of money. It would have been better from an accountability and credibility standpoint if the fund updated this document more often and gave us more specifics about its covered call strategy in its other documents.

Fund's covered call holdings (2022) (Neuberger Berman)

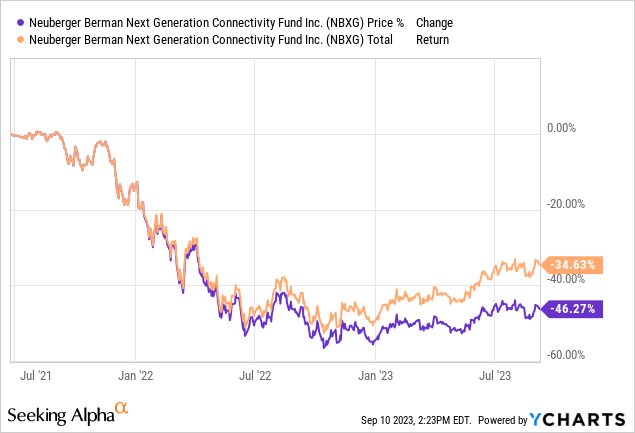

Since inception, the fund didn't perform that well. Its share price is down 46% and its total return is a negative 34% since its inception a couple years ago. Part of the reason could be last year's bear market which decimated a lot of tech and growth stocks, where Nasdaq was down -35% at one point. Then again Nasdaq recovered most of those losses already after having a monster rally this year but this fund didn't recover nearly as much. Part of this could be due to the covered calls it writes.

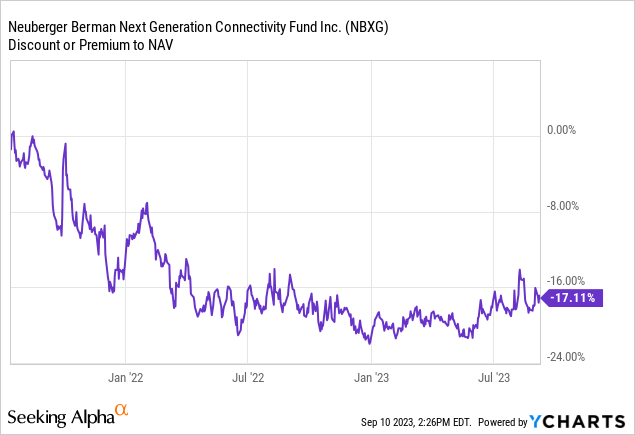

Here is the thing though. The fund trades at a NAV discount of -17% which means that investors are paying 83 cents for each dollar of assets the fund holds. This discount kept getting deeper and deeper during last year's bear market which made the fund's performance worst. If the fund loses 30% value during a bear market and it gets a 20% discount against its NAV value, the share price would actually drop 44% (0.7 x 0.8 = 0.56). Later on, if the fund's NAV recovered most of its losses and climbed back close to original levels, its stock price might still remain low if the NAV discount is still there.

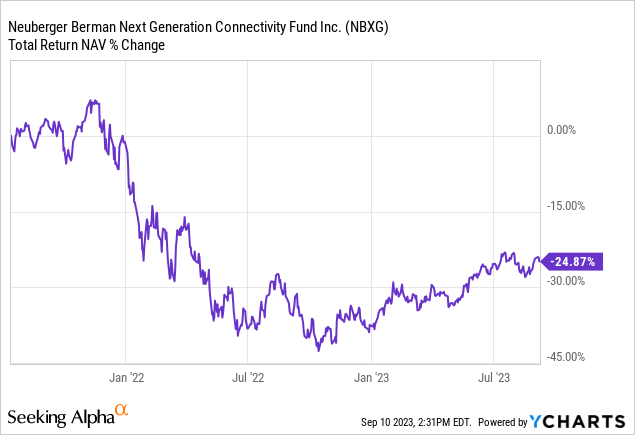

When we look at the fund's NAV value (accounting for distributions) we see that it's only down about -25% since inception, which means a good portion of its underperformance came from its NAV discount. We don't know if this NAV discount will remain there forever or not. Some funds trade at a deep NAV discount forever, others trade at NAV premiums and there are also funds that fluctuate between having a NAV premium and NAV discount over time depending on their performance. This fund has only been around for a couple of years, it's impossible for us to tell where this fund's NAV discount situation will be in the long term. If we knew for sure that it will recover its NAV discount in the near future, it would make this fund a "buy" for sure but we have no way of knowing that.

It's too soon to judge this fund's performance but its early results look poor, even though part of it is due to bad luck since the fund was launched shortly before last year's brutal bear market (especially brutal for tech and growth stocks). I would give it more time and see how the fund performs under different conditions before buying this because we have very little data so far and it's not looking good.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

Long NBXG, small position.