NRG Energy: Vivint Now A Major Contributor, Eyeing Further Upsides From Here

Summary

- Electric utilities in the SMID-cap space have seen a strong bid in the backend of the year, with differentiated business models being the most appealing.

- NRG Energy is one such differentiated name, pulling off solid Q2 numbers and robust economic growth levers.

- Multiples are compressed opening up the risk/reward asymmetry going forward.

- Net-net, rate buy.

naphtalina/iStock via Getty Images

Investment briefing

Electric utilities in the SMID-cap space have curled up off FY'23 lows and caught a strong bid in the backend of the year. Those with differentiated business models look to have the most appealing economics, given:

(i). The difficulties of companies in separating from their peers in utilities/energy (they all sell roughly the same 'product');

(ii). The fact most are price takers in some shape or form, and

(iii). Capital intensity in the industry is tremendously high among some players, with little to no cash flows to show for it.

NRG Energy (NYSE:NRG) is one such differentiated name in my view. Its Vivint acquisition was penalized heavily earlier in the year, catching plenty of criticisms from asset managers who own the stock. But the company has caught a bid in H2 FY'23, backed by strong Q2 numbers and a set of robust economic growth levers - many of which are tied to its Vivint contributions. Net-net, I rate NRG a buy due to the reasons outlined here today.

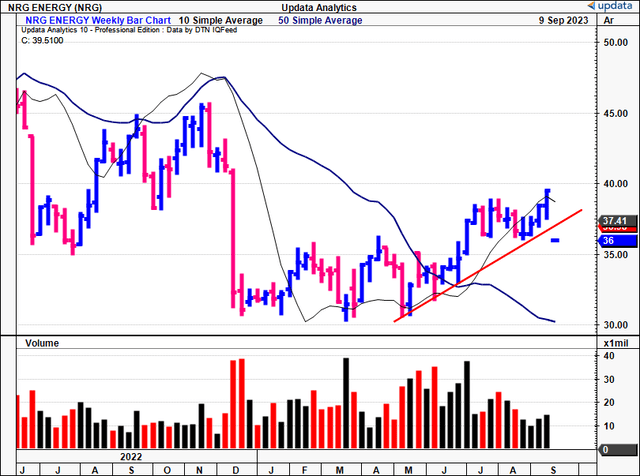

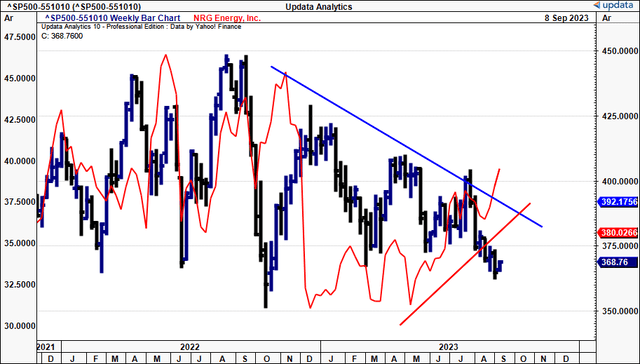

Figure 1.

Figure 1(a). NRG convergence/divergence from S&P 500 Electric Utilities Index

Key risks to thesis:

Investors need to know these key risks that could impact the strategy:

- Energy markets are volatile and largely driven by exogenous factors, especially those tied to electricity supply. These factors are sporadic at times and could hurt NRG's equity stock valuation.

- Macroeconomic factors cannot be discounted especially the inflation/rates access that hinders project financing and increases replacement costs.

- The Vivint acquisition may yet to show its full potential, but there's a chance it may stop pulling its economic weight as well.

These factors must be realized in full before proceeding.

Critical facts underlining the buy rating

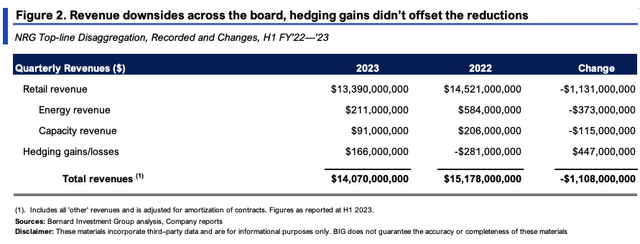

1. Q2 FY'23 numbers—Vivint already contributing

NRG's Q2 top-line revenue of $6.35Bn was down 12.8% YoY, as average peak prices across all areas were down double-digits. Hedging gains weren't enough to offset the downsides, as seen in Figure 2. This was balanced by a strong adj. EBITDA clip of $819 million for the quarter, up from $433 million last year. Growth was underscored by upsides in NRG's core Energy business, with lower supply costs and plant productivity growing its legacy energy segment by $186 million YoY. It's important to consider that NRG also booked a $60 million benefit from the reversal of transitory items like coal constraints and ancillary expenses which inflected positively during Q2. I'd also point out its underlying business continues to be impacted by asset sales and retirements that tallied $30 million in Q2. So you've got $90mm in 'non-operating' revenues driving the Q2 clip, something I'd urge investors to factor in to the broader picture.

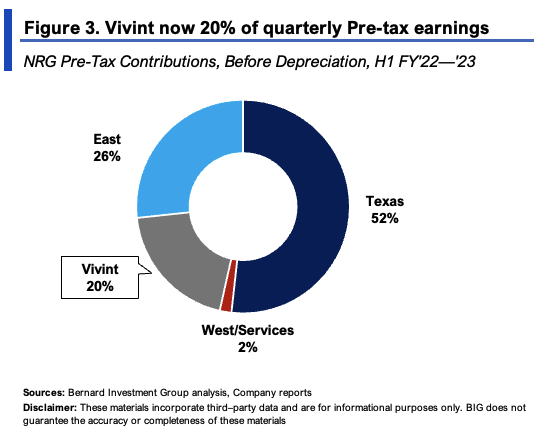

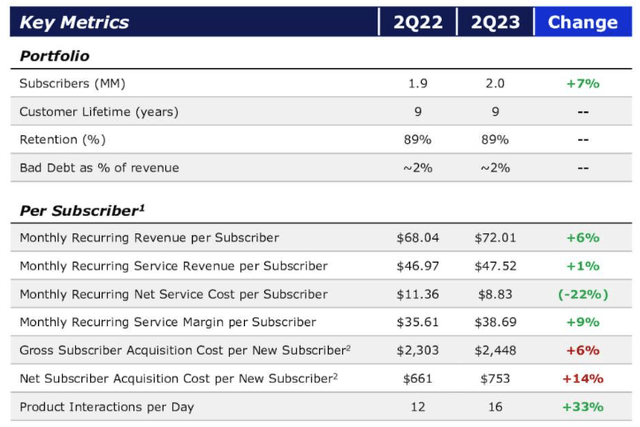

Regarding Vivint's quarterly numbers, consider the following:

- It's no secret the $2.8Bn acquisition of Vivint in May has stirred the feathers of some of NRG's key investors. Elliot Management labelled the deal as the power industry's worst of the last decade. As a reminder, Vivint is a 'smart home' company, that offers security and home automation products.

- Thing is, Vivint is now a significant part of NRG's operations having been folded in this year, and played a crucial role in the quarter's results. Revenues were up 12% thanks to favourable retention and higher recurring monthly revenue per subscriber, growing 14% in adj. EBITDA as well [Figure 4].

- It also booked average subscriber growth of 7% YoY, surpassing 2 million customers in doing so. As shown in Figure 3, it contributed $217 million or ~20% of NRG's Q2 pre-tax income (shown before depreciation).

BIG Insights

Figure 4. Vivint Key Performance Drivers

Source: NRG Q2 FY'23 Investor Presentation

- NRG had previously detailed its $300 million growth program at the Investor Day held earlier in the year. It wants to hit 50% of this target organically, while the remaining 50% is slated to come from cross-selling activities stemming from the Vivint integration. Management reported seeing early successes cross-selling opportunities so far. It therefore doubled the growth target for FY'23 up from $30 million to $60 million. This shouldn't be overlooked in my view.

- Critically, it would appear the Energy and Smart Home segments are starting to communicate effectively. Customer conversion rates were reported at ~6% on NRG's qualified leads during the quarter. It also introduced a DIY system to upsell in these adjacent markets, aiming to push the conversion rates higher, around the 10% mark.

Moving throughout the P&L and cash flows, I'd also highlight NRG threw off $425mm in FCF to the firm in Q2, before considering any growth investment. Interestingly enough, the company labels this "free cash flow before growth investment", or FCFbg for short. Most of the FCFbg upside stemmed from a decrease in cash outflows related to its gas inventory. It now eyes $1.6Bn in FCFbg by yearend. NRG also authorized a $2.7 billion share repurchase plan and a $2.6 billion debt reduction plan. As of July, $50 million of share buybacks and ~$200 million of debt reduction have already been carried out. It left the quarter guiding 3.1x leverage (net debt do adj. EBITDA).

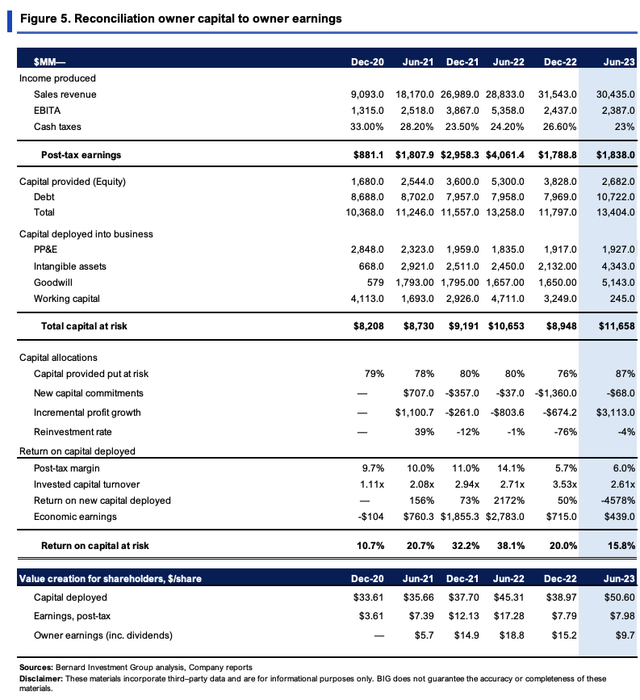

2. Economic leverage on capital at risk

For all its perceived challenges, the Vivint transaction certainly hasn't dented the profits NRG is producing on capital employed in the business.

Figure 5 reconciles the capital attributed to NRG's owners to the economics earnings produced on these assets on a rolling TTM basis since 2020. Pre-tax earnings are adjusted for hedging gains/losses. Around $11.65Bn of capital is required to run the business, equating to $50.60/share, and 87% of what's been provided by investors (debt issued, earnings retained). Mind you, this includes all the goodwill booked with the Vivint deal.

The $50.60/share in capital produces $7.98/share in NOPAT, a c.16% rate of return on the investments. This is down off FY'21—'22 highs, but reasonably attractive nonetheless. The economic earnings produced from this, considering a 12% hurdle rate (long term market averages) is $439mm, 3.7% on the capital deployed. NRG therefore spun off $9.70/share in cash to its shareholders in the last 12 months (owner earnings + dividends).

The returns on capital are efficiency-driven. Margins are anemic, but capital turns are tremendously high at 2.61x sales last period. It therefore employs a cost leadership strategy vs. a differentiation strategy. This squares off with the economics of the business. A is the case in utilities—all competitors sell the same 'product', so it's nearly impossible to differentiate on price or offering. But efficiency wise—that's the major insulator (pardon the pun). Getting more inventories/services out the door, whilst increasing the sales per 1 unit of capital invested. By Q2, every $1 of NRG's core assets produced $2.60 in trailing revenues, just to highlight this point.

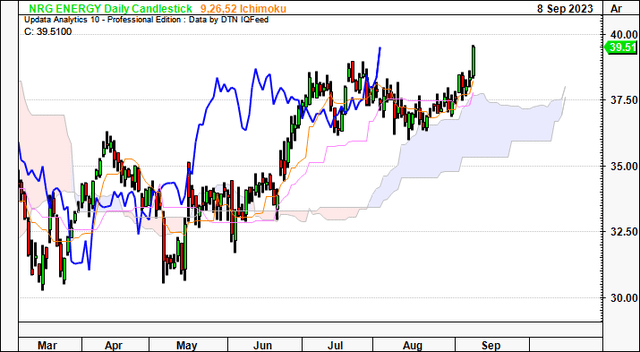

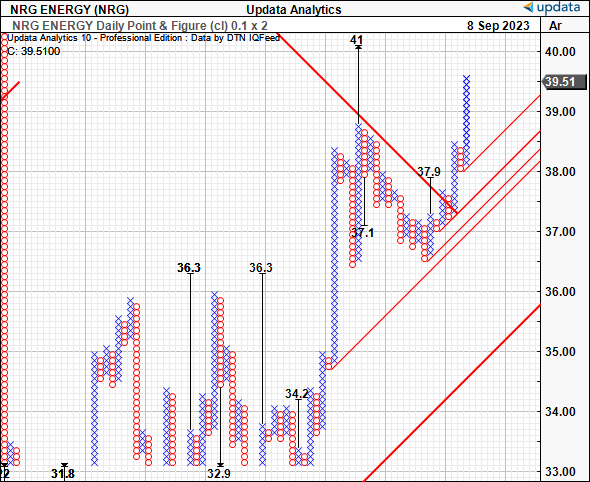

3. Market-generated data

Price structure starts to corroborate the underlying numbers here. On the daily cloud chart below, the stock is trading well above the cloud. Both price and lagging lines crossed back in May.

Critically, the price line tested the cloud all throughout August, but found support at each step higher in the staircase. It has now broken out from this level, and this looks bullish to me.

Figure 6.

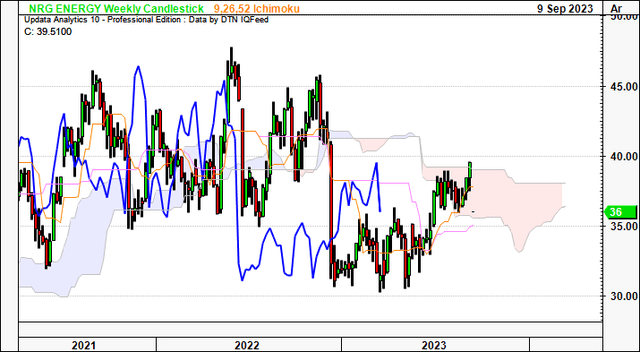

The weekly isn't quite there yet. But it is turning far more constructive. Price has poked its head above the cloud and this was a critical juncture given where NRG was trading for around 8 weeks. The lagging line needs to cross to be bullish on the long-term frame. If it continues at the current trend, it could get there by October. We therefore have upsides to $41 as the next near-term price objective (as shown in Figure 8), after investors took out the $37/$38 levels in the last few weeks. The cross above the 45 degree resistance line clearly activates this target, in my view.

Figure 7.

Figure 8.

Data: Updata

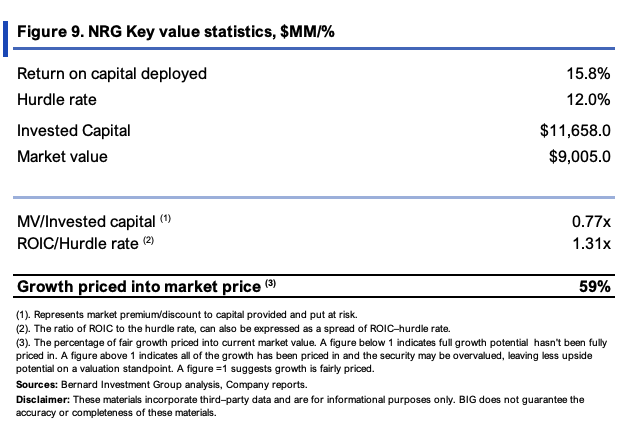

4. Valuation and conclusion

The stock sells at 6x forward earnings and ~8.7x forward EBIT, and has created >$2 in market value for every $1 net asset value on its books. The former are quite the discounts. These discounts are unsupported economically in my view.

Figure 9 outlines the company's market value added, that is, at what market value it trades to relative to the capital invested in the business. Market cap is used here as cash is included in the calculus of invested capital (if it were removed, we'd use EV). NRG is in a rare situation where it has more invested capital than market value. Stripping the accounting goodwill out from the framework shows a different story, and this should be considered. But then you'd have to calculate the returns on capital at risk this way, too, which isn't a clean result.

Considering the returns NRG is producing on its capital my view is the market has only priced in ~60% of the earnings power it can generate in the next 12 months or so.

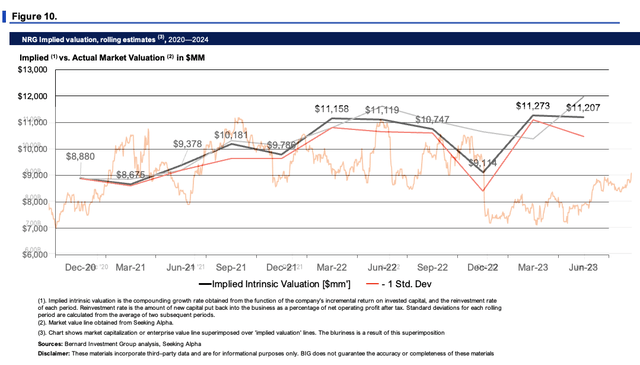

BIG Insights

A firm can compound its intrinsic value at the function of its return on investments and at what amount it reinvests at these rates. Applying the calculus to NRG's equity line implies an intrinsic value of $11.2Bn or $49/share, a ~24% value gap and margin of safety. Each of these factors supports a buy rating in my view.

In short, NRG is caught a bid these last few months and there are multiple catalysts to be considered in the investment debate. Its Vivint transaction, whilst penalized heavily by major investors, hasn't done the damage most thought it would. Quite the contrary, actually, so it would seem. Its Q2 numbers were strong enough and underlying fundamentals in its core markets appear to be robust enough to see it growing beyond FY'23. Net-net, I am looking at a value of ~$49/share going forward. Rate buy.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NRG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.