DocGo: Preventing Onboarding Problem From Turning Into A Crisis (Rating Downgrade)

Summary

- DocGo was rewarded a no-bid contract by the NYC to provide medical care for the migrants, but this large contract is facing the risk of being revoked as of late.

- The management took the direction to be deeply involved in the contracts related to migrants and border control, leading to more uncertainty about its costs and cash flow.

- The current market price of DocGo's stock is bearish, approaching the bottom of the bearish scenario.

Anne Czichos/iStock Editorial via Getty Images

Investment Thesis

DocGo's recently declared pursuit of large contracts in relation to the migrant situation and border control has deep implications for its revenue and costs in the next few years. Should it succeed or not, the path is not going to be smooth or straightforward. We believe the company has much to do in preparing itself to take up the task, while in the meantime, there are a lot of details that are unclear with uncertainty hanging above. After examining some of the pros and cons, we recommend a hold at the moment.

Review

We initially covered DocGo (NASDAQ:DCGO) in September last year, recommending a buy at $9.48, and then at $6.64 after a sell-off prompted by the lower cash flow due to the redemption of its convertible bonds, and in March this year, we again recommended a buy at $8.09, being optimistic about its upside potential. The underlying thesis behind the recommendations is two pillars: stable municipal contracts providing long-term cash flow visibility, plus innovative native technological platforms helping to exert cost and expense control during rapid expansion. Since our coverage, the stock has gone up to as high as $11.45, and a low of $6.46. We caught the bottom while the top range has given tactical investors chances to take profits. But is this stock a long-term investment?

Update

Fast forward five months, DocGo's work with New York City has almost become the "ground zero" of its migrant crisis ongoing at the moment. A New York Times article gave a recap of the chaos in migrant and asylum seekers' accommodation. To be fair, we think that New York City has the responsibility to provide a systematically managed platform to handle the migrant situation, without which gives ground for problems to occur, disregarding which vendor it chooses to handle it. With that said, how deeply DocGo's getting involved in the situation also caught us by surprise.

In our last coverage, we highlighted two risks. One is the cash flow and cost control from rapid expansion, another is there was no mention of the current status of the municipal contract at the earnings call at the time. We will revisit each of them.

It turned out that DocGo was initially rewarded a no-bid mobile health contract valued at $432 million with the NYC Housing Preservation & Development (HPD) program under the city's emergency authorization to waive the usual competitive bidding process. In comparison, its annual revenue on a TTM basis was $453 million. The contract was intended for 12 months from May 2023 to May 2024. However, this contract was recently revoked by the controller of the City's comptroller's office, citing multiple concerns in the company's proposal.

The rapid growth of DocGo's revenue in the near term, as its CEO Anthony Capone put it, is going to come from mostly two venues:

The rapid acceleration of revenue growth is driven by multiple factors, including the continued rollout of our medical transportation contract with health and hospitals, and the new mobile health contract with the housing and preservation department to provide primary care, urgent care, behavioral health, social work and other supporting services to migrant populations in New York.

We don't want to get too much into the politics here. But from a high-level glance, there could be three options. As the New York Times pointed out, New York City has come to rely on large medical care providers to share the gap in cash flow as sometimes it could have irregularities between projects. Given DocGo's successful track record in handling the challenging times during Covid, it still stands a chance to be part of the $432 million contract. But it could potentially need to either provide more implementation details and more cost coverage out-of-pocket, or receive a smaller contract, or both.

DocGo also has a backlog of $325 million over about 3 years, but "it does include a lot of" the HPD contract plus "a dozen different items", according to its CFO Norman Rosenberg. Back in May, this backlog was $205 million. If we assume back then, this backlog did not include the HPD contract, then we could probably roll back and expect in the worst case in the near term will be a $205 million backlog in revenue in the next year or so.

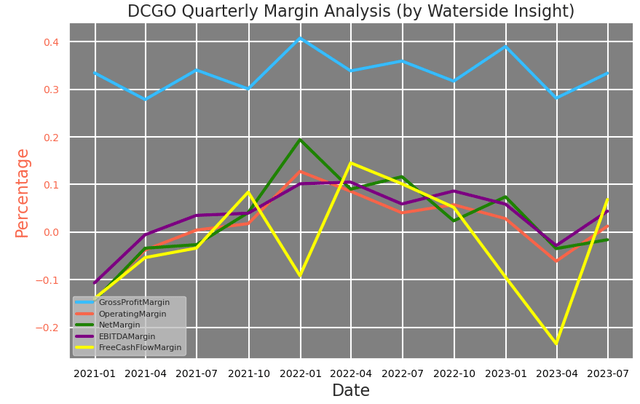

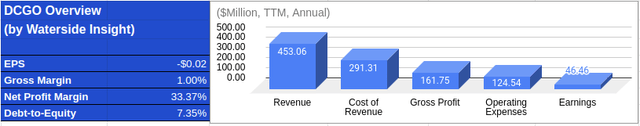

Currently, most of its margins have improved with only the net margin slightly below zero.

DCGO: Quarterly Margin (Calculated and Charted by Waterside Insight with data from company)

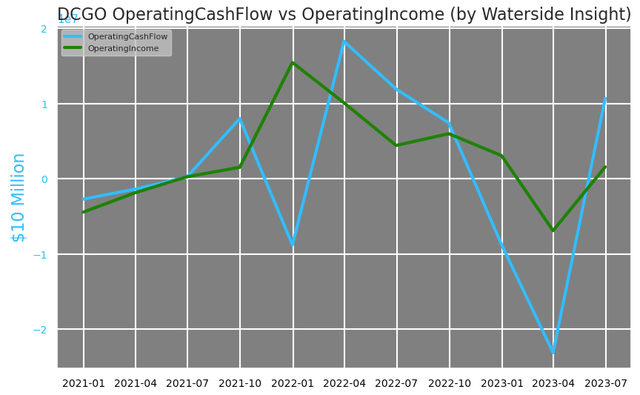

DocGo's operating cash flow and operating income have jumped back into positive after a brief dip in Q1 this year.

DCGO: Operating Cash Flow vs Operating Income (Calculated and Charted by Waterside Insight with data from company)

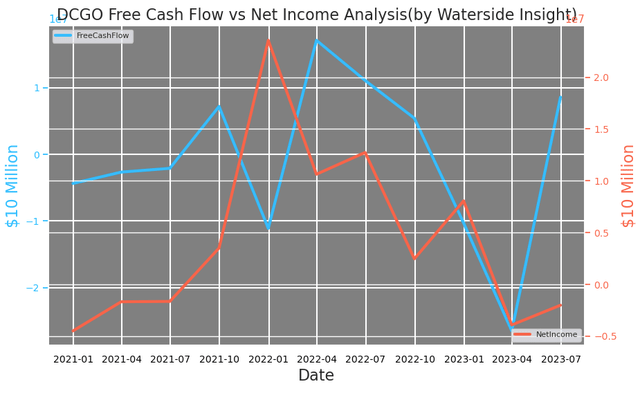

As a result, its free cash flow has bounced back as well. But its net income has stayed twice as low as in Q1.

DCGO: Free Cash Flow vs Net Income (Calculated and Charted by Waterside Insight with data from company)

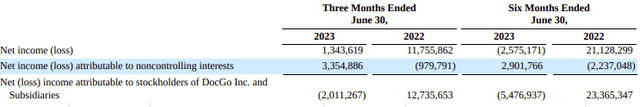

The negative net income is not only the result of the lower net income attributable to the parent company's shareholders but also due to positive income from non-controlling interest. The non-controlling interests were reporting losses in the past two years, reflecting an investment in the new markets by the company. Now that they have reported positive income, that was taken out from the total net income.

DCGO (DCGO)

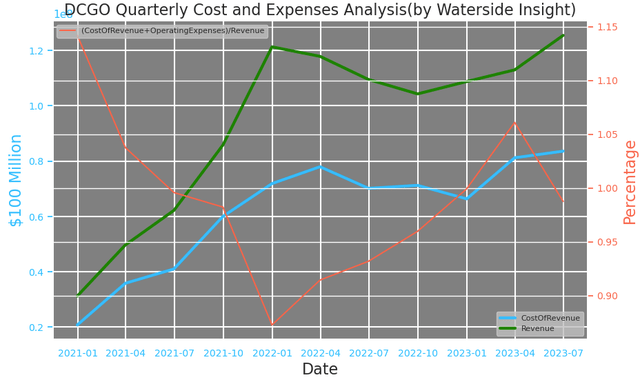

With its revenue returned to and exceeded the previous peak, DocGo's cost of revenue did not rise along with it. It shows the strength of the company's technological platform for operation efficiency. After reaching a peak in Q1, which coincides with the start of the migrant wave, its costs of revenue and operating expenses as a percentage of the revenue have come down since. But overall, they stay at an elevated level that shows some of the expenses even technology cannot help offset.

DCGO: Quarterly Cost and Expenses Analysis (Calculated and Charted by Waterside Insight with data from company)

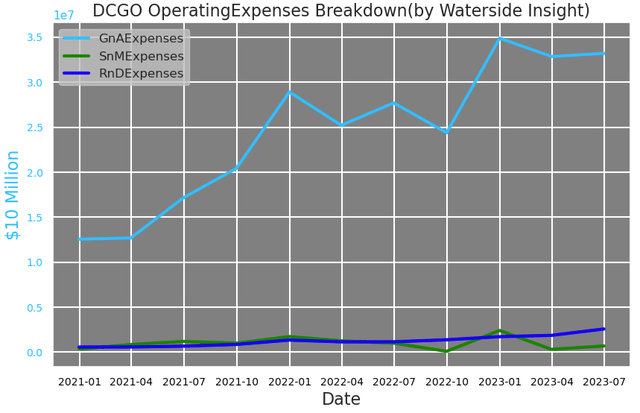

DocGo's operating expenses after depreciation and stock comp expenses in Q2 rose to 26.3% of revenue compared to 25.4% a year ago. In particular, the municipal contracts have locked in the revenue with a period ahead, so they help to keep its sales and marketing expenses(SnMExpenses) by almost half less than a million dollars for the 1H, down from $2.2 million YoY. As the CEO explained DocGo doesn't need to pay to acquire patients, but instead, "the municipality pays us to treat these individuals". However, the company is incurring almost 40% higher general and administrative expenses(GnAExpenses) for the same period, up to $60 million for 1H from $48.5 million YoY. Not to mention its Legal and Regulatory expenses have grown from $4.4 million in Q2 last year to about $6 million this year, a 50% rise, while its revenue has only grown about 5% YoY in the same period. There is no free lunch.

DCGO: Operating Expenses Breakdown (Calculated and Charted by Waterside Insight with data from company)

When handling humanitarian crises, these costs become necessary and DocGo needs to factor them in. On one hand, municipalities lack the kind of technological and logistical power to organize the large-scale care provision, sometimes even a consistent cash flow to stage off gaps, and in this particular case, New York City has come to rely on DocGo to get the job done. The critics were right in the sense that DocGo has no past experience in handling large migrant settlements, but the fact that this is the first real crisis on the North East coast in a long time doesn't help either. DocGo, as a NYC home-grown company, is understandable to lack some experience in this. But it still gives NYC some of the most viable options since it knows the City's ins and outs, proven by its growth history providing care to the homeless and low-income population in the five boroughs and its handling of the Covid situation. On the other hand, if DocGo does indeed set its mind on pursuing the migrant and asylum seeker care contracts, then it must develop a systematic approach with humanitarian concerns at the forefront, along with planning the proper costs associated with it. Those costs include logistics, social services and legal services, etc, albeit some of them could be temporary. Sometimes these costs may not be offset by technological innovation, as it is more of the "last-meter" problem, as DocGo literally needs to provide care of the last meter in the living space for the migrants. This also reflects a broader question beyond the scope of this article, when adopting technological advancements, how do we as a society still put humans first and at the core without compromising our values?

DocGo's superior technological platform is still an advantage and its credibility built through handling multiple large municipal projects shouldn't be canceled out either. But profitability cannot be the only thing DocGo talks about when it comes to its quarterly results, there should also be concrete ESG reports on how it is improving the overall healthcare quality of the patients and the community it serves. Its technologically innovative approach to medical care is still rooted in humans.

Financial Overview

DCGO: Financial Overview (Calculated and Charted by Waterside Insight with data from company)

Valuation

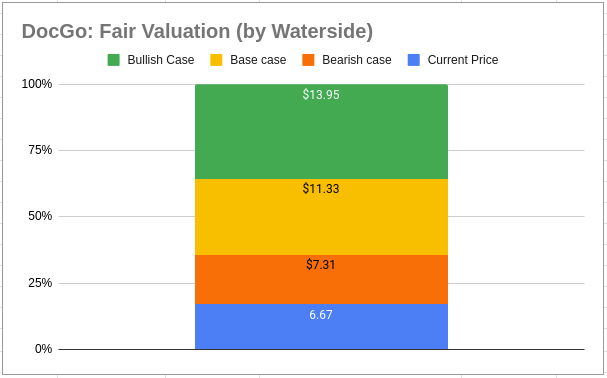

We have revised our fair valuation of the company based on the incoming new development of DocGo. We assume a cost of equity of $6.18 and a WACC of $6.15. In the base case, the company finds some compromise to receive the HPD contract from NYC, and only sees a mild drop in cash flow for this year and a strong rebound for next, incorporating more unpredictability in its future cash flow; it is priced at $11.33. In the bullish case, the full contract was rewarded somehow due to Mayor Adams' overriding power over the comptroller, followed by strong growth next year, while still encountering some future volatility; it is priced at $13.95. In the bearish case, the fight over the contract drags on and more uncertainty kicks in with the risk of losing the contract for the next 12 months, and DocGo grows only slightly in the 2H with still strong rebound due to the revenue from other projects initiated, but large swings become part of the future cash flow; it is priced at $7.31.

The current market price is indeed bearish. Although it is not as bearish to the point of setting the stock on sale, it has dropped to below our bearish scenario.

DocGo: Fair Value (Calculated and Charted by Waterside Insight with data from company)

Conclusion

In reviewing our previous investment thesis, the ground of the two pillars we alluded to still stands, but the direction the management intends to drive leads to more uncertainty. The handling of a large migrant crisis is uncharted territory in the States, especially with the current political climate. The NYC HPD contract is an event that could have a non-trivial outcome for the company's top line. Even with politics aside, DocGo still needs time and experience to hone its skills and with a systematic approach, as it is not solely medical care it is required to provide anymore. It won't come easy or fast. To onboard such contracts and more Federal contracts in border control begs the question of whether DocGo is ready and transparent about the how's. We adopt a wait-and-see attitude towards it. For now, we recommend a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.