Inflation, The Sequel

Summary

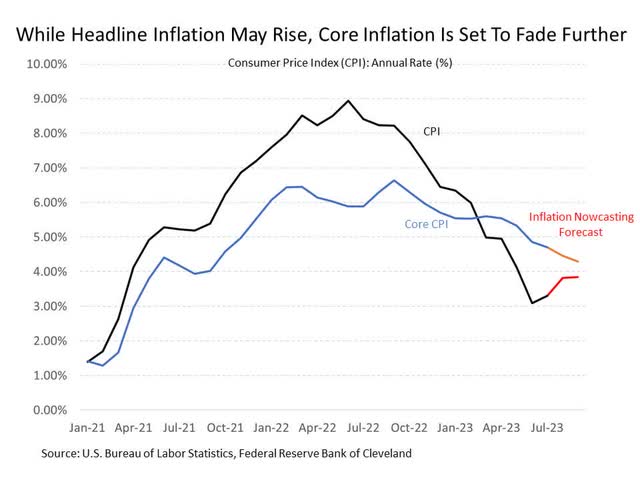

- Inflation is rising again, posing a downside risk to capital markets in the second half of 2023.

- The Cleveland Fed predicts a further increase in the annual headline inflation rate in August and September.

- Despite potential inflation concerns, the core inflation rate is expected to continue fading, limiting the impact on capital markets.

MicroStockHub

It was a blockbuster forty years in the making. Following its first breakout hit since the late 1970s, the burst of inflation that has defined the early 2020s has increasingly been coming down the other side of the mountain. Stocks have found comfort throughout this year as the pricing craze has increasingly faded into the background. But reminiscent of so many 1970s blockbusters, an inflation sequel may be coming to a capital market near you in the months ahead. Are you ready?

Inflation Rises Again. A renewed rise in inflation is the greatest downside risk facing capital markets in the second half of 2023 at least in the view of this Chief Market Strategist. And for the first time since peaking in June 2022, the annual inflation rate according to the headline Consumer Price Index ticked higher by +0.21 percentage points in July 2023 from 3.09% to 3.30%. Despite this initial change in direction, markets looked at the bright side of the news, and for good reason. For while the annual inflation rate marginally increased, the month-over-month change in inflation not only came in meaningfully below expectations at 0.17% (estimates were closer to a much hotter 0.4%), but even better it came in slightly below an already cool reading for June. “Tis but a scratch,” the Black Knight might say, for inflation has already come down so far and overall things continue in the right direction.

U.S. Bureau of Labor Statistics

Inflation 2. Is it still safe to go back into the capital market waters? Perhaps, but we may have another inflation problem to deal with before it’s all said and done. Consider the latest forecast from the Cleveland Fed Inflation Nowcasting, which has a fairly solid track record of predicting monthly inflation readings. For the month of August, a reading that is set to be released next Wednesday, the Cleveland Fed is predicting that the annual headline inflation rate is set to jump another 52 basis points over the previous month to 3.82%. And looking ahead one month further to the September reading that is set to be released in mid-October, Inflation Nowcasting is predicting a further marginal increase to 3.84%.

U.S. Bureau of Labor Statistics, Federal Reserve Bank of Cleveland

Putting this all together, while investors may still be spending the last days of summer relaxing on the beach with fading memories of inflationary turmoil, by mid-October they may find themselves increasingly worried that the pricing beast they thought had been eradicated may be returning to wreak more havoc for capital markets.

Inflation Part 2. If capital markets have taught us anything over the years, it’s to keep your headlines close, but your underlying data and research closer. Indeed, capital markets may start to increasingly tremble if and when inflation data rises anew in the months ahead. But for those investors that are anticipating it, such an outcome is likely to bring opportunity.

So as we move through the month ahead, it is worthwhile to keep the following points in mind.

First, while current forecasts are projecting a renewed rise in inflation, it may ultimately not come to pass. For example, the Cleveland Fed Inflation Nowcasting was predicting a far more meaningful rise in headline inflation for the month of July with projected readings that were similar to what they are now forecasting for August and September, and the official reading came in much cooler than expected. This continued a trend we have seen throughout much of 2023. While I am reluctant to assume that these recent forecasting errors will continue going forward, it remains a point to watch when the official data hits the headlines next week.

Next, many may point to oil prices as evidence that inflation is set to return with a vengeance in the months ahead. Indeed, oil prices as measured by West Texas Intermediate Crude have popped by more than +30% since the beginning of June.

But it is important to remember two things. One, while oil prices are a key driver of the headline inflation rate and we’re certainly not getting around town without having to fill up our tanks at the gas pump, energy prices are notoriously volatile and are not part of the Core CPI that is a much more stable and useful measure of the actual sustained inflation that we are experiencing in the economy. Two, while a jump in oil prices from the mid-$60s to the high-$80s is a lot and may head substantially higher still, we should recall that these same prices were consistently well above $100 per barrel throughout a good portion of the post Great Financial Crisis to pre-COVID period, and the Fed struggled throughout this period to bring the annual inflation rate back up to 2%. In short, we’ve been here before with oil prices, and a lot of other inputs play a big role in determining the overall inflation rate.

Lastly, an additional point about the core inflation rate that matters arguably quite a bit more. While the Cleveland Fed is predicting a measurable increase in the headline CPI annual rate, it is at the same time forecasting that the annual rate of inflation on the Core CPI will continue to fade for August and September. While the core rate is still relatively high at over 4%, the fact that it continues to steadily move in the right direction remains an underlying positive and highlights that any renewed inflationary concerns in the months ahead are likely limited on the most part to an oil price issue.

Inflation II. There was one thing investors wanted the Fed to do for them coming out of 2022. WIN. WIN. For those that remember the 1970s, you’ll recall President Gerald Ford’s WIN buttons, which was a rallying cry to “Whip Inflation Now” (check them out on Google – they are Staples “Easy Button” inspiring). Of course, inflation was not whipped then, as pricing pressures persisted through the Carter administration into the early 1980s. And in the end, it took the now legendary Paul Volcker jacking the Fed funds rate up into the high teens and keeping interest rates higher for longer before the inflation beast was finally eradicated (quick digression – could you imagine Fed Chair Jay Powell blazing up a fat stogie 1970s Paul Volcker style during his Congressional testimony today? Now back to our regularly scheduled article . . .).

U.S. Bureau of Labor Statistics, Federal Reserve Bank of Cleveland

While times may have changed from the 1970s to today, a key point that investors should not overlook as we look ahead through the rest of 2023 and into 2024 is that the Fed more than learned its lessons from the stagflationary wars of the 1970s. The key lesson – the Fed not only needs to raise interest rates aggressively to fight inflation (today: check), they also need to keep interest rates high well after inflation comes back down to make sure that inflation is soundly defeated. For much like the villains and monsters that graced our 1970s cinema screens, you’ve got to kill inflation and make sure it’s really dead to make sure it doesn’t rise back up again.

So while the markets and many investors are banking on the fact that the Fed will be cutting interest rates sometime in 2024, take these predictions with a gigantic block of salt. Today, capital markets as measured by the CME FedWatch Tool are predicting a more than 75% probability for at least three-quarter point rate cuts from the Fed rate cuts between now and the end of next year. Already ignoring the fact that 2024 is likely to be a highly contentious presidential election year in the U.S. – does the Fed really want to be cutting interest rates next summer and fall amid what could be a political maelstrom? – I would suggest that these probabilities are maybe 65 percentage points too high – this Chief Market Strategist would assign maybe a 10% probability to this outcome, if not less. For unless we get one heck of a recession between now and the middle of next year, which is far from most everyone’s base case at this point, the Fed is not likely to cut interest rates at all next year unless absolutely necessary.

Bottom line. Signs of inflation pressures may rise again in the coming months, and this may serve to rattle capital markets at a time of year from mid-August to mid-November when stocks have had a checkered history of getting rattled. Don’t get caught up in the inflation sequel headlines. Instead, keep your eyes on the underlying data, for underlying inflation pressures are expected to remain in check. And even if inflation flares anew, know that the Fed remains on the case and is likely to stay higher for longer, as they have promised and despite what the markets may think otherwise.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.