Huawei News Suggests Anti-China Tech Containment Failed, Consequences For Our Tech Sector

Summary

- Chinese efforts to become technologically self-sufficient are coming to fruition, potentially leading to the birth of a new global tech ecosystem led by China.

- The Western-led global alliance responded to China's ambitions with market access denial, tech transfer restrictions, and trade restrictions.

- Huawei's recent release of the Mate 60 Pro suggests that China can rely on domestic supply chains to produce cutting-edge tech products, posing a threat to Western tech companies.

Michael M. Santiago/Getty Images News

Investment thesis:

At the beginning of the year, I predicted that despite many other potential contenders for investment story of the year, the Chinese efforts to become more technologically self-sufficient in the face of technology being withheld from use in its industry will become the investment story of the year. With four months to go, the coming fruition of my prediction is starting to take shape, with ongoing events suggesting that China's 2025 strategy is on track, as evidenced by Huawei's return as a player in the mobile phone market. This all happened arguably, at least in part thanks to our policy of attempted technological containment. It seems that withholding of technological inputs for China's tech industry has only potentially slowed down its progress in the short-term, while it may have stimulated domestic input replacement, leading to an acceleration in China's domestic tech development for the long term. The prospect of the birth of an entirely new global tech ecosystem, led by China, which will likely be joined by others poses a significant risk to the global market share of the Western-centered, currently dominant global tech ecosystem. The longer-term prospects of the tech-heavy Nasdaq (COMP.IND), as well as many of its components, are therefore put into doubt.

The logic behind the Western tech squeeze against China

The first alarm bells went off soon after the "Made in China 2025" government strategy came out. It quickly dawned on the Western-led global alliance of developed countries that China has ambitions that go beyond being the factory of the world, with our multinationals pocketing most of the profits while controlling much of the capital, tech inputs, and so on. Beyond just ambitions, China has all the necessary attributes needed to make it happen. Its domestic market is large enough to support the emergence of new products with a globally significant presence. Its population has the necessary skills to innovate. Most importantly, once the technological breakthrough happens, it can mass-produce in higher volumes, and at a lower price than we can. Its growing economic and geopolitical weight also ensures access to many other markets as more and more nations perceive their economic relations with China as crucial.

The US-led response started soon after the 2015 unveiling of the China 2025 plan, with the Trump administration resorting to market access denial to companies like Huawei, tech transfer restrictions, as well as trade restrictions on Chinese imports on a broad scale. The Biden administration continued with the policy of containment and it is looking more and more like the policy will be intensified going forward, with efforts being coordinated with most of the developed world allies.

Huawei may have fired China's first shot in an escalating global tech war

The Chinese response was surprisingly tame at the beginning. It focused on mostly weathering the storm, with few punitive countermeasures being taken, at least until recently. Huawei recently released the Mate 60, then the Mate 60 Pro, which recent reports suggest has the performance needed to be a viable alternative to Apple's (AAPL) iPhone15. China's move to ban government officials from using iPhones seems to be somewhat coordinated with Huawei's surprise return to the high-end phone market, as a means to perhaps amplify the hit that Apple is set to suffer in the Chinese market. It seems that the market is already reacting to the more immediate implications for Apple in particular.

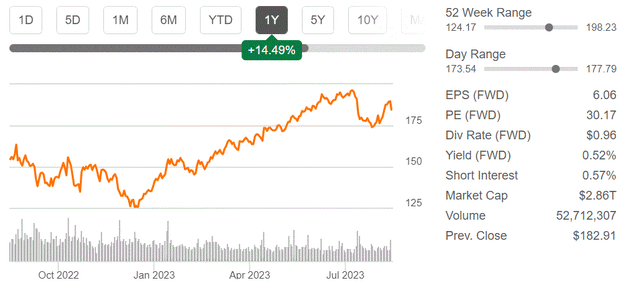

Apple stock chart and other financial metrics (Seeking Alpha)

China tends to match the US consumer market in terms of importance for iPhone sales. The prospect of Apple facing a coordinated squeeze, with Huawei eating into its market share, while the Chinese government engages in measures meant to push Chinese consumers to Huawei's new phone offer can in theory mean that America's most important tech company is now exposed to suffering from China's first counter-punch in the emerging tech war.

The implications of what we saw unfold in the past few weeks, with China's Huawei seemingly proving that it can now rely on China's domestic supply chains to produce cutting-edge tech products, with seemingly few foreign inputs, suggests that the attempts at containment failed. There may still be a few levers that can be pulled in this regard to withholding foreign technology inputs, but those will prove to be just minor bumps in the road, at most.

Tech supply bans may lead to an acceleration of alternative domestic supplies in China and elsewhere, and the weaponization of our technological and financial dominance may stimulate global interest in alternatives

The logic behind weaponizing the Developed World's global finance, as well as our dominant technological advantage, is rooted in past experiences such as the isolation of North Korea or Iraq, where such punitive measures led to those relatively small countries falling behind technologically and economically. These measures seem to have had a less than conclusive effect on Iran, which is a larger country, with a larger population and a more developed industrial base. It seems that trying to replicate similar measures against larger countries with more capabilities, may have a similar short-term effect to what we see with smaller countries, but it could stimulate the opposite effect in the long term. The best example is arguably Russia, where the post-2014 economic rupture between Russia and the Western alliance led Russia to go from a major net importer of food a decade ago to a major net exporter in the past few years. Sanctions on its aircraft industry also seem to have led to a viable, almost purely domestic industry, with the entire supply chain now mostly immune to any external sanctions.

Given China's economic weight, and its capacity to manufacture, innovate, as well as deploy new products on its massive domestic market, it ought to have been logical to assume that it will most likely be able to break through the constraints that it was hoped it would impede its technological progress. Based on prior precedents I built my thesis on, China may have managed to catch up a great deal, assuming that Huawei's phone, using mostly Chinese inputs, is the real deal. It means that China's entire tech industry is now far less constrained regarding producing qualitatively competitive electronic devices that will be able to compete on the global market without the constraints of having to source Western or allied technologies.

Investment implications:

The immediate impact on the Western tech sector is mostly a sentiment-based reaction. Companies like ASML (ASML) are seemingly on the verge of losing their near-monopoly grip in their field of expertise. For instance, SMIC's ability to produce the 7 nm chips that Huawei needs for its phone calls into question ASML's ability to continue selling its semiconductor lithography machines in volumes that the market expected until recently. Its stock price has been down about 4% for the past week.

I already highlighted how Apple may see its global market share shrink, mostly in China initially, but possibly in other markets around the world as a secondary effect. We should not assume that we will be able to keep Chinese tech products off of the global market, because many countries are increasingly tied to China through various forms of economic relations. Just recently, it was revealed that 90 countries intend to participate in a Belt & Road convention that is set to be held next month. The hit to our tech companies can potentially spill over into markets around the world, where China is increasingly influential, while our economic coercion policies are increasingly upsetting nations that end up having to suffer the consequences.

The tech-heavy NASDAQ composite is currently priced for growth, but not more so than the S&P.

Nasdaq composite P/E ratio (Yahoo Charts)

The S&P 500 P/E ratio is currently over 25, therefore the Nasdaq is currently priced for lower growth already comparatively speaking. It will probably be quite a few quarters before the entire Nasdaq composite will be affected by the rise of what seems to be a purely Chinese alternative tech ecosystem in terms of actual earnings.

Some individual companies like Apple are likely to see a more immediate impact, with coming quarters probably set to show a decline in its China sales and then later on, potentially across the world. The big question that remains unanswered is how SMIC managed to produce the 7 nm chips that provide the computing power for Huawei's renewed push into hand-held communication devices. If SMIC made a breakthrough and is already in the mass-production phase, then companies like ASML, AMD (AMD), Intel (INTC), and TSMC (TSM) are all likely to suffer a decline in demand. Given China's capacity to ramp up its supply chains to churn out large volumes of manufactured goods, the above-mentioned examples of companies that may be affected represent just a small sample.

Software companies like Microsoft (MSFT) may not be spared either. China's internal market is large enough to support an entire competing ecosystem in the IT sector, with the potential to spread beyond its borders once it takes root. Given the spirit of the times we live in, I find it difficult to see Microsoft being allowed to participate in that ecosystem, any more than companies involved in semiconductor production will be. Based on the Huawei precedent, where it only announced the arrival of its product on to the market when it was ready to start delivering its phones to consumers, most other developments meant to build a Chinese tech ecosystem will likely only be announced when it is necessary to do so, not before in my opinion. In the meantime, the work toward this ultimate goal will mostly happen with some degree of willful discretion. If the hit comes for a company like Microsoft, it will blindside investors.

When I wrote my 2023 prediction for the biggest investment story of the year, "China's 2025 Strategy Emerges As Top 2023 Investment Story Contender" a few clues were starting to emerge regarding the potential for breakthroughs in China's tech sector. The Huawei story is still a developing one, with still much that remains unknown. Behind it all seems to be a potentially bigger story of SMIC seemingly being able to produce 7 nm chips. There is the very obvious question of just how much of a dependence SMIC still has on non-Chinese inputs along its supply chain that make those chips possible. My best guess is that there is still exposure that allows us to slow down the China 2025 train, but not stop it entirely. Most remaining dependencies on our tech along the emerging Chinese domestic supply chains will probably be eliminated quickly. Our actions ensured that China started coordinating its companies towards this very goal some years ago, and now they are starting to feel comfortable showing their hand.

I believe that the fact that China is now answering the call to engage in a tech confrontation, means that we will probably see Trillions of dollars wiped out in terms of future global economic growth. Stock markets will thus probably perform poorly for the remainder of the decade, at least in real terms, adjusted for inflation. Even before factoring in the just-emerging global tech conflict, global economic prospects looked rather poor, with the IMF forecasting barely 3%/year growth for the world this year and next, while developed world growth is set to average less than 2 %/year this year and next. The tech-heavy Nasdaq composite is set to perform poorly compared to already subdued prospects for the overall stock market, with some of the biggest names comprised within it being potentially heavily impacted by the continued escalation, as I already illustrated. Some companies have already been impacted in the past week by the news coming out of China, with Apple being the obvious example.

The broader effects might only start to be felt a few months down the road. Between now and then, it might be wise to simply try to understand the implications of adjusting one's investment positions for the short term as well as the longer term. My main direct exposure to the tech sector comes in the form of AMD and Intel. I reduced my position in AMD in the spring, taking advantage of the run-up in its stock price it had earlier this year. I bought Intel stock earlier in the year. I intend to reduce my position on any further upside swings in the next few months from current stock price levels. I also have a very small position in Nokia (NOK) stock, which I am just hoping to break even on and move on. Overall, I expect I will be further reducing my exposure to tech companies in the next few months.

I am by no means in favor of completely shunning individual tech stocks. Given current realities as I perceive them, bargain hunting, buying only when circumstances provide for deep stock price discounts that are triggered by general stock market swings, rather than company-specific bad news might be the optimal tech stocks investment strategy. The risk/reward considerations need to be reassessed, as well as a more realistic outlook on growth that needs to be priced in, given that the global market will increasingly see more competition, as well as mutual efforts to undermine each other's tech industry, which will most likely have mutually destructive results. Lower expectations should be answered with lower stock price entry points in the sector.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NOK, AMD INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)