PubMatic: Debt-Free, With $170 Million In Cash, But Little Else

Summary

- PubMatic faces challenges with declining growth rates in a competitive advertising market.

- The company maintains a strong cash position and operates debt-free, but its valuation may not justify its lack of competitive advantage.

- Turbulence in the digital advertising market due to economic uncertainties and supply-demand imbalances further clouds PubMatic's near-term prospects.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

Shutthiphong Chandaeng

Investment Thesis

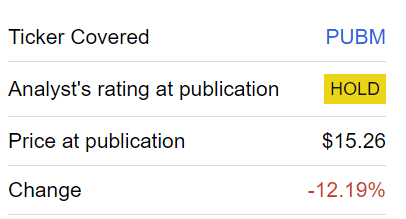

PubMatic (NASDAQ:PUBM) is a challenging investment. Back in May, I wrote an analysis titled, PubMatic, Time to Buy? I Don't Think So, where I said,

Putting asides any narrative about PubMatic's prospects as an independent global operator with no debt, I don't believe investors will clamor for this business any time soon.

Since I wrote those words, PUBM's performance is shown below.

Author's performance

On the surface, the stock looks cheaply valued.

And indeed, it is cheap, particularly when we observe that nearly a quarter of its market cap valuation is made up of cash. A strong cash position on its balance sheet, with no debt. Sounds awesome, right?

On the other side of the equation, the business' growth rates appear to be pointed in the wrong direction. What's more, I don't believe there's enough that distinguishes PubMatic from its competitors. This means that this business operates in a commodity-like environment, where its main service competes on price and little else.

After weighing up these considerations, I remain neutral on this name.

PubMatic's Near-Term Prospects In a Challenging Environment

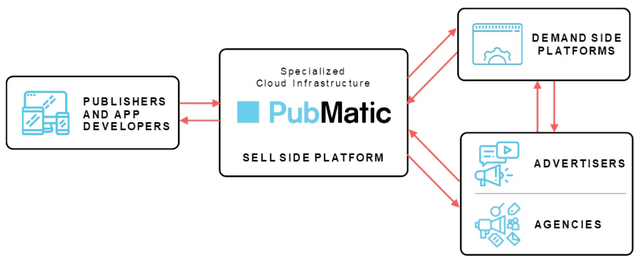

PubMatic is an independent sell-side advertising company. This means that they allow digital content creators, meaning an app, game, CTV, or website, to monetize their assets.

They are similar to a stockbrokerage firm but for advertising. On the one side, there are the content creators, while on the other side, there are demand-side platforms ("DSPs") like the Trade Desk (TTD) or Alphabet's Google DV360 (GOOG), meaning that PubMatic is the middleman for advertising demand aggregators.

PubMatic lands in the middle to support the needs of publishers, advertisers, agencies, and demand side platforms.

PubMatic's value proposition lies in its ability to provide transparency, control, and access to audiences while aiming to deliver high ROI for marketers and digital asset publishers, as a way to optimize their advertising revenues.

Meanwhile, its near-term prospects are being weighed down by a less-than-favorable market environment. Here's a quote from its earnings call,

In the near term, the current digital advertising market continues to be fluid. Many advertisers remain cautious about the economic environment as they closely manage ad budgets in case of a potential recession, particularly around brand advertising. In addition, current supply growth is outpacing ad budget growth. Combined, these two factors are resulting in an industry-wide downward impact on CPMs or ad pricing in the short-term.

In other words, the digital advertising market is currently experiencing challenges due to economic uncertainty and supply growth outpacing ad budget growth. This has resulted in lower CPMs (ad pricing) in the short term, which we can see reflected in its financials, which we'll discuss next.

Revenue Growth Rates Are Pointing in the Wrong Direction, Unfortunately

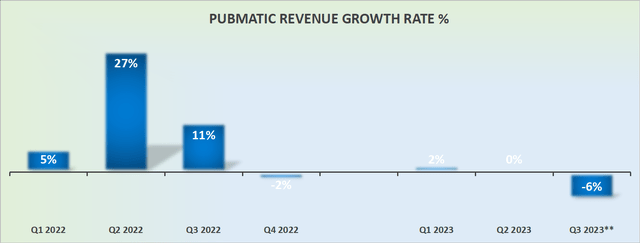

It now feels like a really long time ago when PubMatic could be relied on to deliver 20% CAGR growth. Not only do 20% CAGRs look like a mirage, but its outlook ahead now points to negative y/y revenue growth rates.

And what I find particularly unenticing and unappetizing, is that Q3 should have been up against easier comparables with the prior year. In other words, I would have expected PubMatic's growth rates to be looking increasingly better, not worse, with the passage of time.

A lack of any suitable competitive advantage to distinguish it from its competitors, plus a weak macro environment, makes this too challenging. That's the bad news. Next, we'll discuss the bull case.

A discussion of the Bull Case for PubMatic

PubMatic's balance sheet is undoubtedly from where its bull case can be built. The company operates debt-free and holds approximately $170 million of cash and equivalents. This equates to nearly a quarter of PubMatic's balance sheet being made up of just cash.

This is an incredibly high amount of cash, relative to the price that investors are being asked to pay for the company.

What's more, PubMatic business is clearly making a meaningful amount of free cash flow.

On the other side, even if we normalized for the bankruptcy of certain a customer, I don't believe that PubMatic's free cash flow this year will be higher than $40 million. This means that investors are being asked to pay around 18x this year's free cash flow for PubMatic, a business with minimal to no moat.

I believe that there are more attractive adtech businesses on offer at cheaper valuations.

The Bottom Line

I find PubMatic to be a rather challenging investment at the moment. Despite its seemingly attractive valuation and strong cash position with no debt, the company's growth rates are heading in the wrong direction.

PubMatic operates in a competitive environment where its main service competes primarily on price. Moreover, the current digital advertising market is experiencing turbulence due to economic uncertainties and supply outpacing ad budgets, resulting in lower ad pricing.

While PubMatic's balance sheet is impressive with a substantial cash reserve, it's challenging to overlook the lack of a significant competitive advantage. In light of these factors and the weak macro environment, I remain neutral about PubMatic's near-term prospects as an investment.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

Our Investment Group is focused on value investing as part of the Great Energy Transition. For example, did you know that AI uses thousands of megawatt hours for even small computing tasks? Join our Investment Group and invest in stocks that participate in this future growth trend.

I provide regular updates to our stock picks. Plus we hold a weekly webinar and a hand-holding service for new and experienced investors. Further, Deep Value Returns has an active, vibrant, and kind community. Join our lively community!

We are focused on the confluence of the Decarbonization of energy, Digitalization with AI, and Deglobalization.

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

DEEP VALUE RETURNS: The only Investment Group with real performance. I provide a hand-holding service. Plus regular stock updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.