What I Wish I Knew Before Investing In REITs

Summary

- REITs can be very rewarding investments.

- But they can also lead to large losses if you pick the wrong ones.

- I highlight 5 mistakes to avoid at all costs.

- High Yield Landlord members get exclusive access to our real-world portfolio. See all our investments here »

DNY59

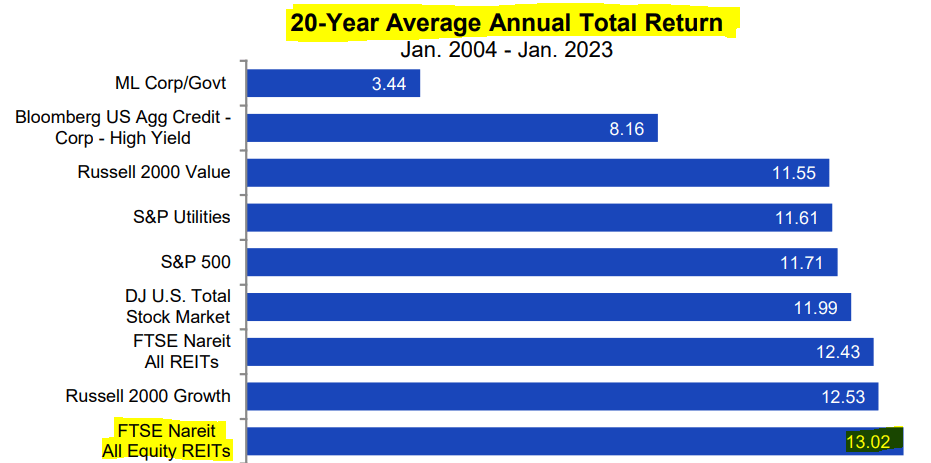

Over the long run, REITs have been some of the most rewarding investments in the entire stock market. They have generated a 14% average annual total return over the past few decades, outperforming the S&P 500 (SPY) and even growth stocks (IWM):

NAREIT

Moreover, that's just the average performance of the sector, which includes, the good, the average, and the bad REITs. If you actually knew how to sort out the good from the bad, you could have earned even better returns.

I have been a REIT investor for a long time and while I have made my fair share of mistakes and suffered occasional losses, I have still managed to beat the sector averages (VNQ) over time:

I would like to think that I have learned some valuable lessons along the way and in today's article, I am going to share with you what I wish I knew before I started investing in REITs.

Some of these lessons were learned the hard way. Don't make the same mistakes.

Mistake #1 - Chasing a high dividend yield

This is the biggest and most important mistake that REIT investors keep on making.

They see REITs as "income vehicles" and therefore, they will select their investments based on their dividend yield.

In their mind, the higher the better.

But in reality, the dividend is just a capital allocation decision. It says nothing about the underlying business or even the valuation of a company.

A REIT could offer a very high yield simply because it is overpaying and heavily leveraged. Another REIT with similar properties may offer a much lower dividend yield simply because it wants to retain some cash flow to reinvest in growth.

9 times out of 10, the more conservative dividend policy is preferable and will result in better total returns over time, but most investors will still favor the REIT with the higher dividend yield.

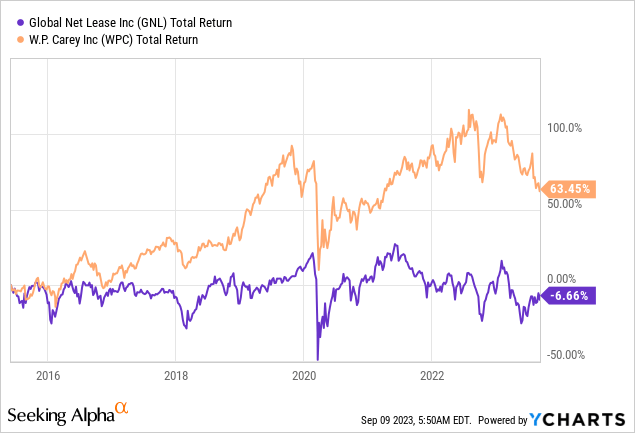

Let me give you an example: Global Net Lease (GNL) is a net lease REIT that has offered a ~10% dividend yield throughout its history. It has consistently overpaid and used too much leverage to pay a high dividend and this has attracted unsophisticated yield-hungry investors.

Against it, we have W. P. Carey (WPC), which is a close peer of GNL. It follows a similar strategy, but it retains a greater portion of its cash flow and uses less leverage. As a result, it has typically traded closer to a ~5% dividend yield.

Here is how they have both performed over time:

The lower-yielding REIT generated far higher returns.

GNL suffered large losses because it was overpaying and used too much leverage. This then pushed the management to issue a bunch of equity at dilutive prices. The dividend was cut during the pandemic and it will likely be cut again because they are still overpaying.

So never select your REITs based on their dividend yield. The dividend yield should be just an afterthought.

Much more important are the cash flow yield, the payout ratio, the leverage, the quality of the assets, the growth prospects, the management alignment, etc.

Mistake #2 - Seeking a low valuation over everything else

This is a mistake that I have made myself.

We are value investors and so we want to pay the lowest price possible, but from my experience, deep value plays rarely work out well in the REIT sector, and it is typically worthwhile to pay a premium for quality because good real estate that's conservatively financed has time on its side.

Let me again illustrate this with an example:

Back in 2019, mall REITs appeared to be extremely cheap. Some of them, including CBL (CBL), were priced at just 4x their cash flow.

Put differently, they were priced at 25% cash flow yield, out of which they paid about half in dividend income and retained the rest to reinvest in their assets to make them more desirable.

Therefore, the investment thesis was that the price is so low that even if these malls never experience any growth from here, investors should earn strong returns over time.

But a few years later, CBL filed for bankruptcy. It had to heavily reinvest in its properties to keep them desirable and this was draining its cash flow even as it also had to deleverage its balance sheet.

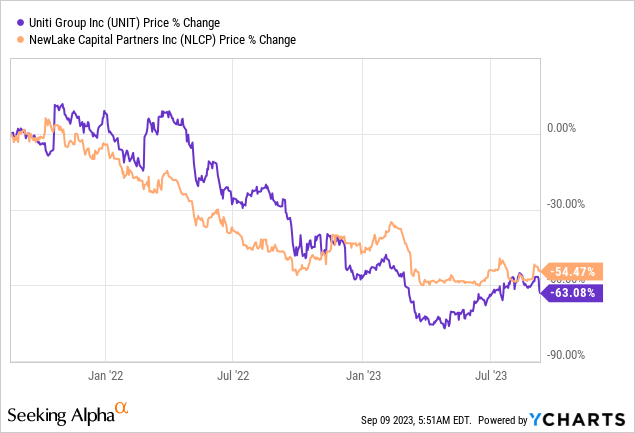

We have seen similar cases with other "deep value" opportunities. Those that come to my mind right now are Uniti Group (UNIT) and Industrial Logistics Properties Trust (ILPT).

The lesson is that a very low valuation does not equal high total returns.

More often than that, the market knows something and the valuation is so low for a good reason.

Mistake #3 - Not paying enough attention to the NAV

But at the same time, you shouldn't overpay either.

It may be the best REIT, but if you pay too much for its shares, you will still likely underperform over the long run.

Therefore, you still want to keep an eye on the price tag.

For this purpose, most investors will look at the P/FFO multiple, which is a cash flow multiple. The lower the better of course.

But the issue here is that FFO does not adjust for capex and on top of that, leverage can also have a large impact on this valuation multiple.

For this reason, I think that investors should also keep an eye on P/NAV, which measures the value of the assets, net of debt, relative to the market cap of the company.

This metric gives you a better sense of how much you are really paying for the real estate. Yet, most investors are ignoring it simply because it is more difficult to obtain and end up not really knowing how much they are paying.

Mistake #4 - Suffering from home bias

This is a particularly big mistake for US-based investors.

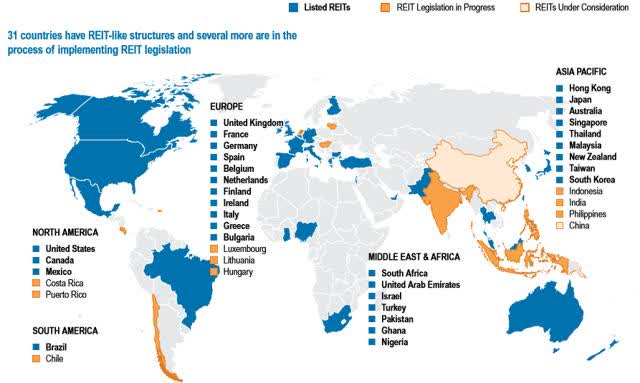

They will only consider American REITs and overlook anything outside of the US. That's despite the US being just one out of 30+ REIT markets:

NAREIT

REITs are all over the place these days and the best opportunities are often abroad. Simply buying American REITs due to laziness won't get you the best results.

To give you an example: Today, residential REITs like Equity Residential (EQR) are cheap in the US, but similar REITs are even cheaper in Europe. Some of them are priced at discounts of up to 70%!

#5 - Thinking like a trader, not like a landlord

I kept the best one for the last.

Most REIT investors are investing as if they were traders when they really should invest like landlords instead.

REITs are real estate investments so you need to have a long-term horizon and realize that quarterly results really aren't that important.

Yet, most investors will trade in and out of REITs based on short-term results/news and are very quick to lose patience if their thesis isn't playing out within a few quarters.

I can't count how many times I have invested in a REIT, then seen its share price drop a lot lower, before eventually earning very good returns because I was patient and had the courage to buy more.

This is why you should think like a landlord, not like a trader.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Landlord for a 2-week free trial

We are the largest and best-rated real estate investor community on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WPC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (14)

Not so sure using a poorly externally managed reit GNL as a close peer to WPC a high quality internally managed dividend aristocrats was a wise choice. For comparison these two are not close by any stretch

I didn't realize GNL was that heavy into industrial, I thought mainly office ...

Cheers