It's Raining Dividends With AGNC, Yield +14%

Summary

- As an income investor, I look for dividends that are paid from sources that consumers consider to be essential living expenses.

- A recession is looming on the horizon, and yet mortgage payments are still expected to be paid.

- Creating a retirement portfolio should be based on buying and holding investments that generate reliable income.

- Looking for a portfolio of ideas like this one? Members of High Dividend Opportunities get exclusive access to our subscriber-only portfolios. Learn More »

ronstik

Co-authored by Treading Softly

Whenever family and friends talk about downsizing, they're usually not talking about their home.

Many Americans are looking towards a coming recession – one that seems to be on everybody's mind for the last 12 months but has yet to actually occur. They talk about downsizing their expenses. They're talking about cutting off multiple streaming services like Netflix (NFLX) and Disney Plus (DIS) and keeping just one. They're talking about buying less expensive luxury goods or taking their more efficient car when they run errands instead of their larger one.

This is why a lot of companies are negatively impacted by recessions. However, there is one sector that is positively impacted by recessions. Agency mortgage-backed securities. These investments don't carry credit risk, so during recessions they are sought after by investors.

As part of being a professional income investor, I look to own essential income, which I also sometimes refer to as boring income. I want to hold companies that pay me dividends that are also paid revenue from sources that people don't think twice about paying. It's part of the reason I own the gas pump. That's part of the reason I own utilities. That's part of the reason that I own mortgage-holding investments.

Today I want to look at one company that is often misunderstood but offers a massive yield for your portfolio today. And when a recession comes, will see investor demand increase.

Owning Mortgages For Income

AGNC Investment Corp. (NASDAQ:AGNC), yielding 14.8%, is a mortgage REIT that invests in "agency" Mortgage-Backed Securities. These unique securities are guaranteed by the "agencies" Fannie Mae or Freddie Mac. If a borrower defaults, the agency buys the mortgage back at par value. As a result, agency MBS has no credit risk.

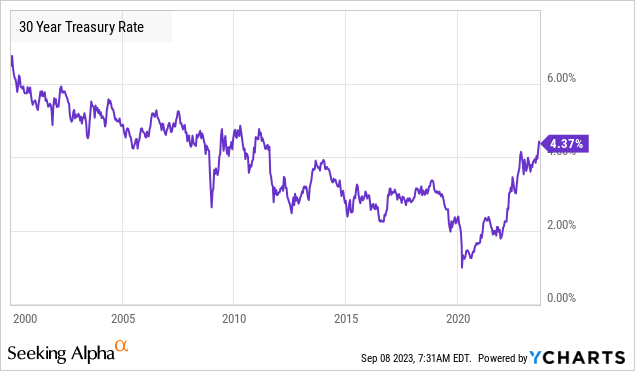

This is confusing for a lot of investors, as they assume that without credit risk, prices will always remain high – this isn't true. Even zero-risk assets will see their prices move. This is why Bill Ackman shorted 30-year US Treasuries. He doesn't believe that the U.S. government will default on Treasuries; he believes that the price of 30-year Treasuries will decline.

The 30-year Treasury Rate has gone from an all-time low of 0.99% in March 2020 to 4.37%.

A higher Treasury rate means lower prices. Why? Well, consider you bought a 30-year Treasury in March 2020 at 1%. You will collect a 1% yield for 30 years with about as close to a guarantee as you can get with investing. However, today, you could buy a 30-year US Treasury bond and receive a 4.3% yield.

Is anyone going to buy a 30-year Treasury bond at a 1% yield today? No. The price of that bond from March 2020 will have to come down significantly to reflect that investors today can go buy a 30-year bond paying 4.3%. When interest rates rise, the price of all fixed-rate debt comes down to reflect the reality that any new investor has a choice between buying new debt issued at current yields or buying previously issued debt that has a lower coupon.

AGNC owns agency mortgages, which have a similar risk profile. Nobody is seriously concerned about default risk for agency MBS. Yet agency MBS has a more fluid duration. If you buy a 30-year Treasury Bond, you know the day you buy it, the precise date you will get your principal back – not one penny will be prepaid, and your coupon payments will be identical for 30 years.

On their face, mortgages have a 30-year term, but in practice, the vast majority of mortgages are repaid much earlier. Most home buyers refinance or sell their home before 30 years. Even when interest rates are higher, some homeowners will refinance to pay off other debt, lower their monthly payments, or tap into the equity of their home. And even in the slowest real estate market, people are selling their homes for a wide variety of reasons. Some fiscally responsible buyers make oversized payments, and those homebuyers who default and go into foreclosure result in prepayments for agency MBS investors. Investors in agency MBS have to deal with the uncertainty of not knowing exactly when their principal will be repaid.

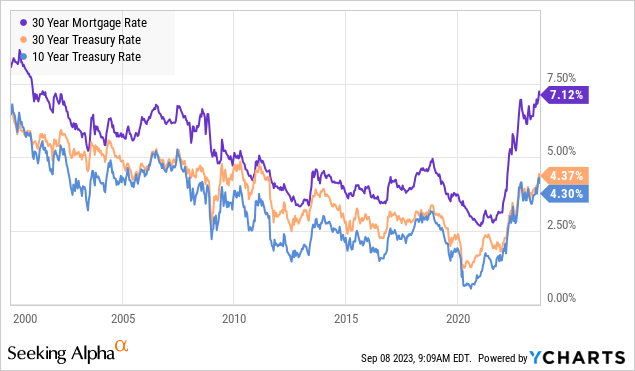

As a result, 30-year mortgage rates tend to be higher than U.S. Treasuries. Certain buyers of zero-risk assets prioritize extreme certainty of cash flows; they don't want their principal back early.

However, as we've seen interest rates rising, we have seen mortgage rates climb a lot faster than Treasury rates.

Treasury rates are at the highest they have been in over a decade, yet mortgage rates are the highest they have been in over two decades. The last time mortgage rates were over 7.1% was in 2001, and both the 10-year and 30-year Treasury Bonds were yielding over 5.5%.

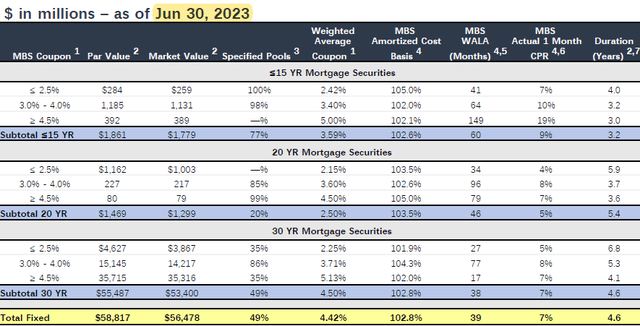

For bonds, higher yields today mean lower prices on all previously issued debt. AGNC owns $58.8 billion in agency MBS par value. This is the amount that AGNC will receive when the mortgages are repaid. However, the fair value of those MBS was only $56.5 billion at the end of Q2. Source

Since book value reflects the mark-to-market value of AGNC's mortgages, not the par value, that is a $3.83/share impact that is driven by price changes in mortgages alone. If all of AGNC's mortgages were repaid overnight, it would add $3.83 to book value.

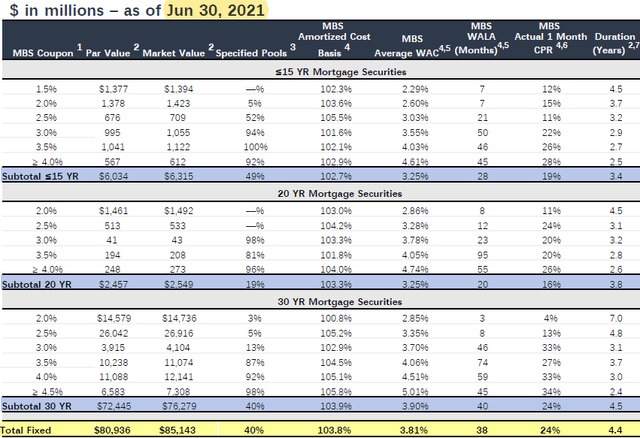

If you go back two years, AGNC had $80.9 billion in par value, but it was carried at a market value of $85.1 billion. Source

If all of AGNC's mortgages were repaid overnight, that would be a negative $4.2 billion impact on book value, about $7.97/share.

So as investors look at AGNC's book value over the past two years, they should keep this in mind.

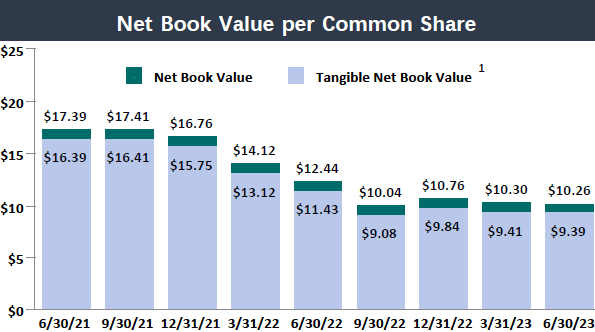

AGNC Q2 2023 Presentation

In 2021, AGNC had a net book value of $17.39, but if you subtract the premium to par built into that book value it would have been $17.39 - $7.97 = $9.42/share. The $17.39 was only a measure of how much others were willing to overpay for mortgages at that time. AGNC's purpose for existing is to hold agency MBS, so the sales value is academic. If the U.S. Government announced it was paying off everyone's mortgage, AGNC would have had $9.42 in book value.

Today, AGNC reports a book value of $10.26, but there is a $3.83/share discount between the market value and par value. $10.26 + $3.83 = $14.09/share.

The market price has changed in a way that is very negative for AGNC's book value. The price of mortgages has come down considerably. However, the amount that AGNC will receive when those mortgages are repaid has increased considerably.

What does this tell us? Quite simply, the decline in AGNC's share price and book value is not permanently lost capital. In fact, if MBS prices went up to what they were in June 2021, AGNC's book value would be substantially higher than it was back then.

There is a lot of noise in market prices, and agency MBS has seen a dramatic decline in prices from all-time highs to the lowest prices seen since 2001. AGNC has navigated this environment, maintaining earnings that cover its generous dividend while increasing the upside potential for when MBS prices recover. When will MBS prices recover? That is a huge unknown, but when they do, I definitely want to be holding on to AGNC. And AGNC is paying a healthy income while I wait!

Conclusion

With AGNC, I can buy discounted mortgages in bulk and allow someone else to manage that portfolio while receiving strong income. While I could easily go out and buy MBS myself, I probably could only buy one or two before my capital is spent. Likewise, you probably are unable to go out and purchase millions of mortgages simply because of your own personal capital restraints.

This means that by using AGNC, I can get a wide diversification; having ownership of millions of different American homes, millions of different Americans' economic situations will come to bear on them. Borrowers pay their mortgage? AGNC collects the interest and passes it along to me through dividends. A borrower doesn't pay the mortgage? AGNC is repaid at par by the agency that guarantees it, realizing a gain, and again passing that along to me through dividends. I am able to enjoy a strong, steady, reliable income stream month after month.

When it comes to retirement, the last thing you want is to be wondering how you're going to pay your bills. This is why I created my Income Method, which allows my readers and my followers to be able to develop a massive flow of income pouring into their account month after month – an income that allows them to have an abundance of excess money after their bills are paid to enjoy their retirement.

That's the beauty of my Income Method. That's the beauty of income investing.

If you want full access to our Model Portfolio and our current Top Picks, join us at High Dividend Opportunities for a 2-week free trial.

We are the largest income investor and retiree community on Seeking Alpha with +6000 members actively working together to make amazing retirements happen. With over 45 picks and a +9% overall yield, you can supercharge your retirement portfolio right away.

We are offering a limited-time sale for 28% off your first year. Get started!

Start Your 2-Week Free Trial Today!

This article was written by

I am a former Investment and Commercial Banker with over 35 years of experience in the field. I have been advising both individuals and institutional clients on high-yield investment strategies since 1991. I am the lead analyst at High Dividend Opportunities, the #1 service on Seeking Alpha for 6 years running.

Our unique Income Method fuels our portfolio and generates yields of +9% alongside steady capital gains. We have generated 16% average annual returns for our 7,500+ members, so they see their portfolios grow even while living off of their income! Join us for a 2-week free trial and get access to our model portfolio targeting 9-10% overall yield. Our motto is: No one needs to invest alone!

In addition to being a former Certified Public Accountant ("CPA") from the State of Arizona (License # 8693-E), I hold a BS Degree from Indiana University, Bloomington, and a Masters degree from Thunderbird School of Global Management (Arizona). I currently serve as a CEO of Aiko Capital Ltd, an investment research company incorporated in the UK. My Research and Articles have been featured on Forbes, Yahoo Finance, TheStreet, Investing.com, ETFdailynews, NASDAQ.Com, FXEmpire, and of course, on Seeking Alpha. Follow me on this page to get alerts whenever I publish new articles.

The service is supported by a large team of seasoned income authors who specialize in all sub-sectors of the high-yield space to bring you the best available opportunities. By having 6 experts on your side, each of whom invest in our own recommendations, you can count on the best advice. (We wouldn't follow it ourselves if we didn't truly believe it!)

In addition to myself, our experts include:

3) Philip Mause

4) PendragonY

We cover all aspects and sectors in the high yield space including dividend stocks, CEFs, baby bonds, preferreds, REITs, and more! To learn more about “High Dividend Opportunities” and see if you qualify for a free trial, please check out our landing page:

High Dividend Opportunities ('HDO') is a service by Aiko Capital Ltd, a limited company - All rights are reserved.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, PendragonY, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (16)

Mortgage REITs provide funding for mortgage credit for both homeowners and businesses. They bring private capital to buy residential mortgages and mortgage-backed securities, thereby providing much-needed liquidity and credit to home mortgage markets. The American mortgage market is worth over $12 trillion and mREIT financing activities have helped provide mortgage loans for 1 million homebuyers (and similar facilitation on the commercial real estate side as well). The value they bring may not be as flashy as those by NVDA or TSLA, but they are a critical player in the mortgage industry.

Thanks for the article.