Capital Southwest: 11% Yield, Strong Growth On Rising Rates

Summary

- Rising interest rates benefit the BDC industry, as most BDCs have a majority of floating rate investments.

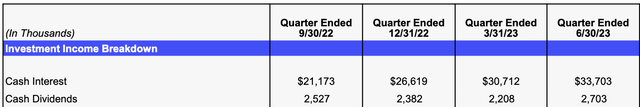

- Capital Southwest has seen a significant increase in cash interest investment income.

- CSWC has a strong dividend growth rate and has outperformed the BDC industry and financial sector.

- Looking for more investing ideas like this one? Get them exclusively at Hidden Dividend Stocks Plus. Learn More »

8vFanI

While rising interest rates have brought on higher interest expenses, the BDC industry has benefited from this trend, as most BDC's have a big majority of floating rate investments, and a smaller amount of floating debt.

One such BDC is Capital Southwest (NASDAQ:CSWC), which has seen its cash interest investment income rise by ~59% since the quarter ending 9/30/22:

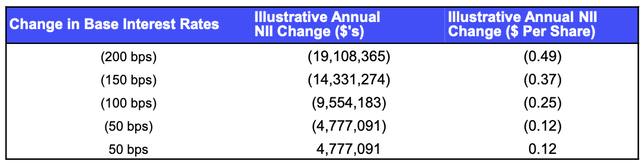

Management estimates that for every 50 basis point rise in interest rates, CSWC will earn $.12/share in annual NII:

Company Profile:

Capital Southwest Corporation is an internally managed business development company specializing in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, recapitalizations and growth capital investments. (CSWC site)

CSWC's internal management structure has resulted in lower than average operating expenses, which have fallen from 3% in 2019, to 1.9%, as of 6/30/23.

Holdings:

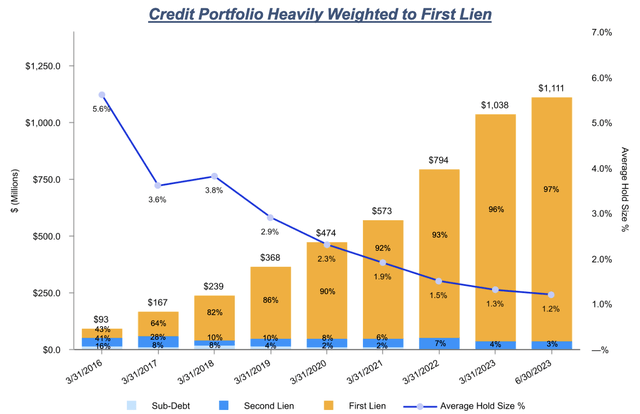

Management has been steadily increasing the % of 1st Lien investments, which stood at 97% as of 6/30/23. It also held 3% in 2nd Lien investments.

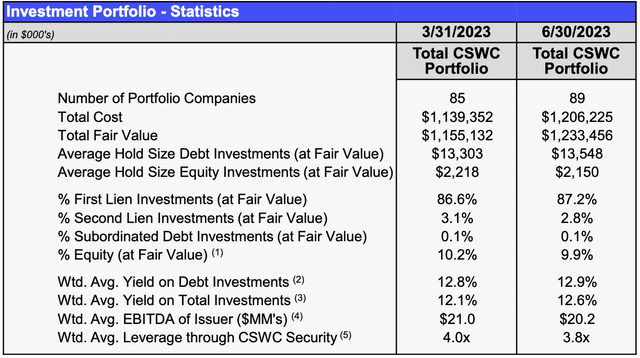

CSWC's portfolio increased to 89 companies in the period ending 6/30/23, with a total fair value of $1.23B. Its average yield on debt investments is 12.9%, with issuer EBITDA averaging ~$20M:

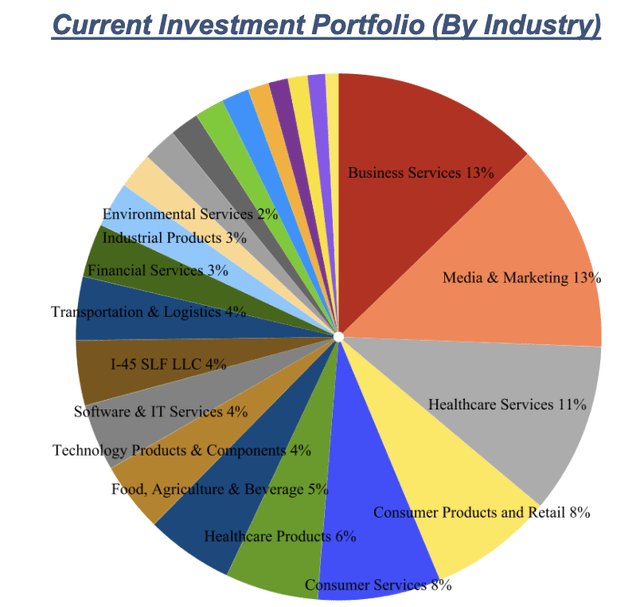

Business Services, and Media & Marketing, remained the largest industry exposure in the quarter ending 6/30/23, rising from 12% to 13%. Healthcare Services were steady, at 11%. The 2 Consumer categories totaled 16%:

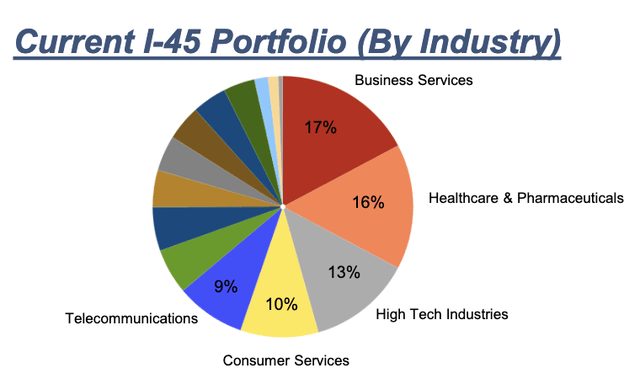

CSWC also has a JV, - its I-45 Senior Loan Fund (“I-45 SLF”), in partnership with Main Street Capital. As of 6/30/23, 95% of that portfolio's investments remained in Senior Loans. There were ~$132M in debt investments in 33 companies, with an average issuer EBITDA of ~$71M, and a 6.4% LIBOR spread, up from 6.3% in the 3 previous quarters.

As of 6/30/23, the top 5 industries comprised 65% of this portfolio, vs. 57% as of 3/31/23, led by Business Services at 17%, up from 15%, and Healthcare at 16%, up from 14%. The average investment size was 3% of the portfolio, vs. 2.6% as of 3/31/23.

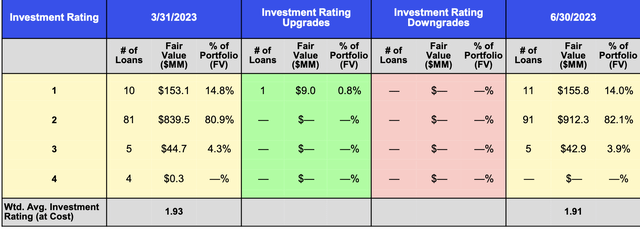

Portfolio Companies' Ratings:

As with other BDC's, CSWC's management reevaluates its portfolio companies each quarter. It uses a 4-tier system, with 1 being the top tier, and 4 being the lowest. There were $9M in upgrades in the latest quarter, with no downgrades. The average investment rating was 1.91, vs. 1.93 at 3/31/23, with 96% of the investments in the top 2 tiers.

Earnings:

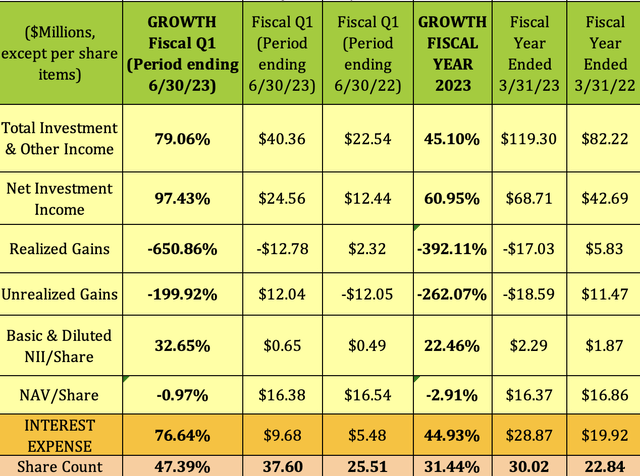

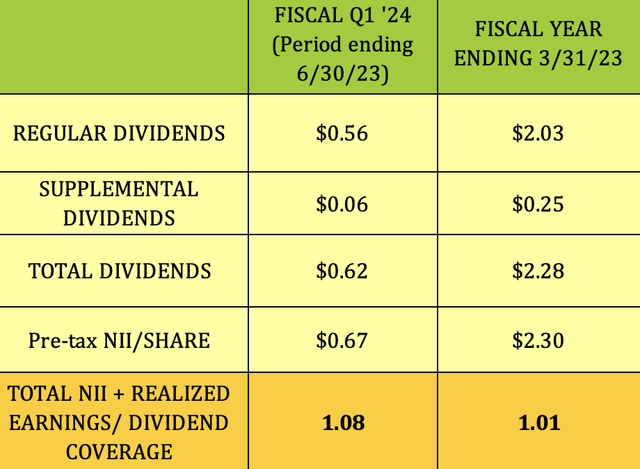

CSWC's fiscal year ends on 3/30. Fiscal Q1 '24 had major growth in total and Net Investment Income, of 79% and 97% respectively. NII/Share rose 32.7%, due to a 47% rise in the share count vs. a year ago. As with other BDC's, Interest expense was up, rising $4M, but was surpassed by NII.

Fiscal Year ending 3/31/23 also had strong growth, with Total Investment Income up 45%, and NII up 61%. NII/share rose 22%, and Interest expense rose 45% for the year.

New Business:

CSWC originated $111.9M in new commitments in the quarter ending 6/30/23, consisting of investments in 6 new portfolio companies totaling $98.6M, and add-on commitments in 7 portfolio companies totaling $13.3M. CSWC received proceeds from the sale of 1 equity investment totaling $3.4M.

Dividends:

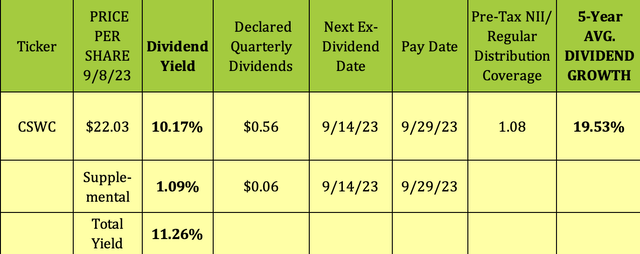

At its 9/8/23 price of $22.03, CSWC had a regular dividend yield of 10.17%, and supplemental dividend yield of 1.09%, for a total yield of 11.26%. It'll go ex-dividend this week, on 9/14/23, with a 9/29/23 pay date.

Management raised the quarterly regular dividend for the 5th straight quarter, from $.54 to $.56, and also raised the supplemental dividend from $.05 to $.06. CSWC has one of the highest 5-year dividend growth rates in the BDC industry, at 19.5%.

Dividend coverage was 1.08X on a Pre-Tax basis in the quarter ending 6/30/23, and 1.01X for the latest fiscal year, ending 3/31/23. That includes both regular and supplemental dividends. As of 6/30/23, management estimated that undistributed taxable income was $0.34/share.

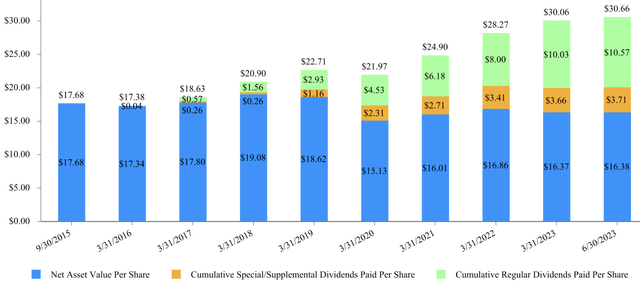

Management has delivered a total value of $30.66/share, since the 9/30/15 IPO at $17.68, comprised of $10.57 in regular dividends, and $3.71 in special/supplemental dividends:

Profitability & Liquidity:

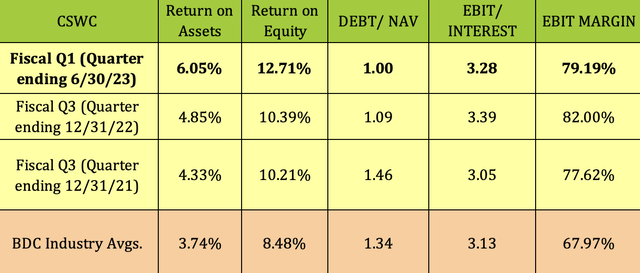

ROA and ROE both increased in the 1st half of 2023, moving higher above BDC industry averages, while EBIT Margin was a bit lower, but remained above average. Debt/NAV eased, and was much more conservative than the BDC industry average, while EBIT/Interest was slightly lower, but somewhat higher than average.

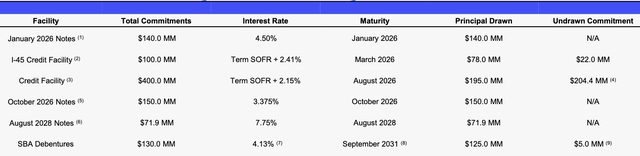

Debt & Liquidity:

CSWC's earliest maturity isn't until January 2026, when its $140M in 2026 Notes come due. It had ~$227M in liquidity as of 6/30/23, consisting of $12M in cash and ~$22^m in undrawn capacity.

During the quarter ending 6/3023, CSWC received investment grade ratings from both Moody's and Fitch.

Performance:

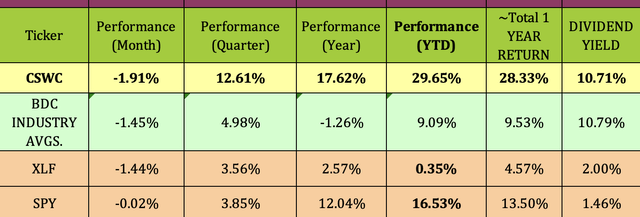

CSWC has outperformed the BDC industry, the Financial sector, and the S&P 500 by wide margins over the past quarter, the past year, and so far in 2023.

Analysts' Price Targets:

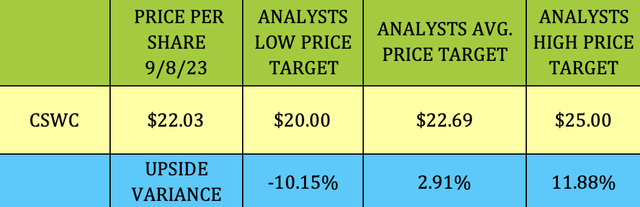

With all of that outperformance, it's not surprising that CSWC only a bit higher than analysts' average price target. At $22.03, it is ~3% below their $22.69 average price target.

Valuations:

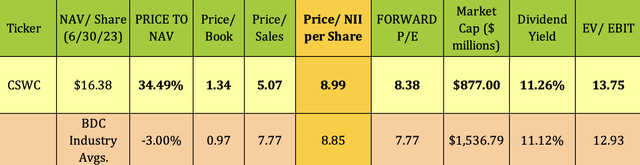

At its 9/8/23 intraday price of $22.03, CSWC was selling at a 34.5% premium to its $16.38 Price/NAV, much higher than the 3% average BDC industry discount to NAV/Share. It generally sells at a premium/NAV - it peaked at over 1.6X in late 2021. It did however, dip into negative territory in the 2020 pullback.

Its trailing NII/Share of 8.99X is in line with the BDC average, while its forward P/E of 8.38X is a bit higher than the 7.77X average.

Its 11.26% total dividend yield is in line with the BDC average, while it EV/EBIT is a bit higher than average.

Parting Thoughts:

CSWC stock is 3.75% off of its 52-week high of $22.92. We rate it a HOLD. It's a good long term income holding, if you can manage to buy it at a much lower premium.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations. Our portfolio's average yield is over 9%.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

We offer a range of high yield income vehicles, and there's currently a 20% off sale on our service.

This article was written by

Robert Hauver, MBA, was VP of Finance for an industry-leading corporation for 18 years, and publishes SA articles under the name DoubleDividendStocks. TipRanks rates DoubleDividendStocks in the Top 25 of all financial bloggers, and Seeking Alpha rates us in the Top 5 of several categories, including Dividend Ideas, Basic Materials, and Utilities.

"Hidden Dividend Stocks Plus", a Seeking Alpha Marketplace service, which focuses on undercovered and undervalued income vehicles. HDS+ scours the world's markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSWC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (14)

I do however do not recommend any stock as investing is a personal decision and I do not tell others what to do with their money .Allday

Well said. Falling rates can also be countered with portfolio growth.

Thanks for your input.

DDS