SP Plus: Still Appealing Despite Mixed Results

Summary

- SP Plus, a facilities services company, has shown mixed financial performance but remains fundamentally attractive.

- Despite the stock's 6.5% growth matching the S&P 500, it has outperformed the broader market with a 32.1% increase since April 2022.

- While net income slightly dropped recently, other profitability metrics such as operating cash flow and EBITDA have improved for SP Plus.

- Management is optimistic about the company's future performance and shares look cheap enough to warrant further upside from here.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

martin-dm

One of the core tenets of my investment philosophy is that it is wise for investors to keep a close eye on the companies that they own shares of. Whenever new data becomes available, we get the opportunity to see how the companies that we own shares in are performing. And when we notice the picture change, whether for the better or worse, it gives us the chance to re-evaluate matters. Instead of being swayed by emotion, we need to incorporate this data and use it to determine whether the firm that we bought still makes sense to own. If it doesn't, we should sell our holdings irrespective of where shares are priced. And if it does, it may be logical to add onto a position.

Just last month, new data came out regarding one of the companies that I have been bullish on. That firm happens to be SP Plus (NASDAQ:SP), an enterprise that's engaged in a variety of facilities services such as parking enforcement services, parking meter collection services, and more. In that quarterly release, we saw some mixed financial performance that certainly complicates matters. But when we factor in the guidance provided by management, it becomes clear to me that, even though shares are more expensive than they were earlier this year, the stock is still fundamentally attractive and offers upside from here.

Focus on the big picture

Even though I don't own stock in it, SP Plus is one of my favorite companies to write about. This is because I enjoy firms that have interesting business models that you don't find elsewhere. And what could be more interesting than a company that engages in activities like parking meter collection and parking enforcement? In the last article that I wrote about the firm, I talked about how the share price of the business had suffered for some time, even as sales growth came in strong. The stock looked fundamentally undervalued to the point where I could not rate the business anything worse than a ‘buy’ even in spite of the jaundiced view that the investment community took on it.

Since the publication of that article, the company has seen its share price grow by 6.5%. This actually matches the 6.5% rise seen by the S&P 500. Usually, when I rate a company that highly, it is my statement that the stock should outperform the broader market. But while the firm has not done that since my last time visiting it, it has outperformed since I first wrote about it in April of last year. Since that time, shares are up 32.1% compared to the 1.5% experienced by the broader market. I can definitely call that a win.

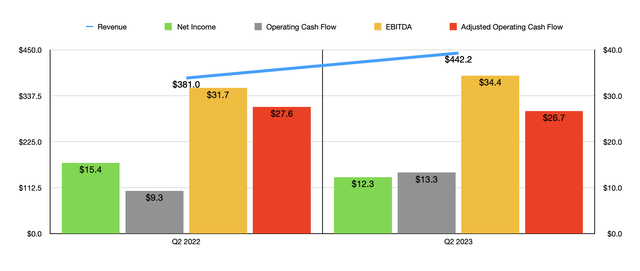

It is my belief that the recent financial performance of SP Plus has been largely responsible for the company only matching the performance of the broader market. But it's not exactly like the performance of the company has been subpar, either. Rather, it has been mixed. In the second quarter of 2023, for instance, revenue actually came in strong at $442.2 million. That's a 16.1% increase over the $381 million generated one year earlier. An 8.1% rise in sales associated with service revenue for lease type contracts was primarily thanks to an increase in transient and monthly parking revenue as the travel industry recovered and as restrictions on mobility reduced in response to the COVID-19 pandemic largely winding down. However, services revenue for management type contracts performed even better, skyrocketing 15.2% thanks to higher volume related to the company's baggage delivery businesses and because of volume based management type contracts that benefited from greater travel.

All of this is great to see, but there have been some weaknesses. Net income, for instance, actually dropped from $15.4 million to $12.3 million. Most cost categories for the company increased, not only on an absolute basis, but also relative to sales. Cost of services, for instance, jumped from 84.6% of sales to 85.1% Because of higher operating costs that stemmed from the revenue increase. Lower cost concessions related to rent also played a role, as did other miscellaneous factors. General and administrative costs, meanwhile, grew from 7% of sales to 7.2%, largely because of higher compensation costs and additional investments in technologies aimed at improving results in the long run. And lastly, interest expense more than doubled from $3.5 million to $7.3 million because of higher interest rates.

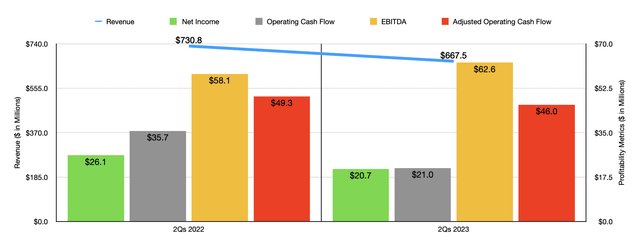

Even though net income for the company pulled back slightly, some other profitability metrics for the firm came in stronger. Operating cash flow, for instance, went from $9.3 million to $13.3 million. If we adjust for changes in working capital, however, we would get a modest decrease from $27.6 million to $26.7 million. On the other hand, EBITDA for the business managed to grow from $31.7 million to $34.4 million. For context, I also, in the chart above, showed performance for the first half of this year relative to the same time last year. My takeaway from that is that the second quarter of this year was particularly helpful in boosting performance for the first half of the year as a whole. Even so, revenue is still down year over year while almost every profitability metric, the sole exception being EBITDA, is down.

While financial performance has been quite lumpy this year, management seems optimistic about the year as a whole. Their current expectation is for net profits of between $43 million and $53 million. Adjusted profits, meanwhile, should come in at between $54 million and $64 million. They are also forecasting EBITDA of between $125 million and $135 million. Based on these estimates, I believe that adjusted operating cash flow should be somewhere around $110.8 million.

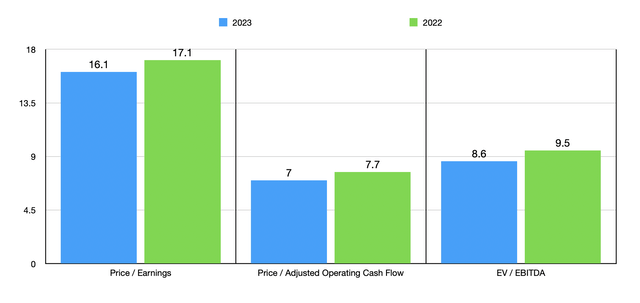

Using these figures, it becomes quite easy to value the company. In the chart above, I priced the company using forward estimates for 2023 and using historical results for 2022. Relative to GAAP earnings, shares don't look particularly attractive. But when it comes to the other profitability metrics, the stock looks cheap. To be clear, it's not as cheap as when I last wrote about the business. But cheap is cheap nonetheless. In the table below, meanwhile, I also compared SP Plus to five similar firms. On a price to earnings basis, I found that only one of the companies was cheaper than it. And when it comes to the price to operating cash flow approach and the EV to EBITDA approach, it ends up being the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| SP Plus | 16.1 | 7.0 | 8.6 |

| Heritage-Crystal Clean (HCCI) | 14.1 | 10.7 | 7.4 |

| Clean Harbors (CLH) | 23.2 | 12.9 | 11.3 |

| CECO Environmental Corp (CECO) | 29.7 | 47.3 | 14.0 |

| BrightView Holdings (BV) | 59.9 | 5.8 | 8.7 |

| Aris Water Solutions (ARIS) | 30.7 | 2.3 | 7.8 |

Outside of the financial picture, I think another thing that is worth mentioning is that management continues to make interesting investments and that it continues to make other interesting maneuvers. Most notably, on August 29th, management announced that the company had reached an agreement for a five-year parking and shuttle operations contract at the Eppley Airport in Omaha. No details were provided when it comes to revenue this should generate. However, this is a rather sizable airport, with over 4.5 million passengers passing through it in 2022 alone.

On the technology side, in late July, SP Plus acquired the assets of Roker Inc for an undisclosed sum. Roker operates as a provider of fully integrated parking solutions that simplify the permit, violation, and enforcement management for organizations, both public and private, that it works with. Management pointed out that this technology can open up some opportunities on the municipal side of the aisle, particularly with municipalities that are open to using smart city applications. Healthcare firms and university clients might also benefit from some of these offerings, such as those involving permitting. And while SP Plus has been focused on this avenue for some time, they claim that the acquisition of this platform will ‘accelerate’ their go-to market for many of these solutions while simultaneously strengthening the company's Sphere platform.

Takeaway

All things considered, I must say that I am still quite bullish on SP Plus. The company has faced some issues regarding consistency when it comes to revenue and profits. That includes issues this year. But on the whole, we have a fundamentally attractive company that's trading at a discount. Relative to similar companies, it is also slightly cheap. Given these factors and the non-financial picture of additional investments being made by management, I do believe that a ‘buy’ rating for the company is still appropriate at this time.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.