Why I Believe Antero Resources Will More Than Double

Summary

- Antero Resources benefits from strong demand and subdued supply growth in the natural gas market.

- The company has a well-performing midstream network and access to the LNG Fairway, allowing for better prices and export opportunities.

- Antero's commitment to efficiency and capital management positions it for future growth and cash flow generation, with the potential for substantial capital gains.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Sean Pavone/iStock via Getty Images

Introduction

It's time to discuss the Antero Resources Corporation (NYSE:AR). On June 27, I wrote my most recent article, titled Betting Big On Natural Gas With Antero And Tourmaline.

Since then, AR has returned 20%, benefiting from an uptrend in natural gas prices - albeit not a very steep one.

In this article, we'll discuss the progress of the bull case, which continues to benefit from strong demand, subdued supply growth, and AR's peer-beating qualities of deep reserves, pricing benefits, efficient production, and stellar balance sheet health.

Although economic growth fears aren't helping, the company remains on track to add tremendous shareholder value over the next few years.

So, let's dive into the details!

Natural Gas Fundamentals Are Improving

Although I'm bullish on natural gas, it's not a great commodity to trade. Natural gas isn't just extremely volatile, but it is also much more abundant than crude oil and subject to bigger geopolitical influences.

Prior to the current upswing, natural gas was known as the widowmaker.

The good news (for drillers) is that after many years of rapid supply growth, the tide is turning.

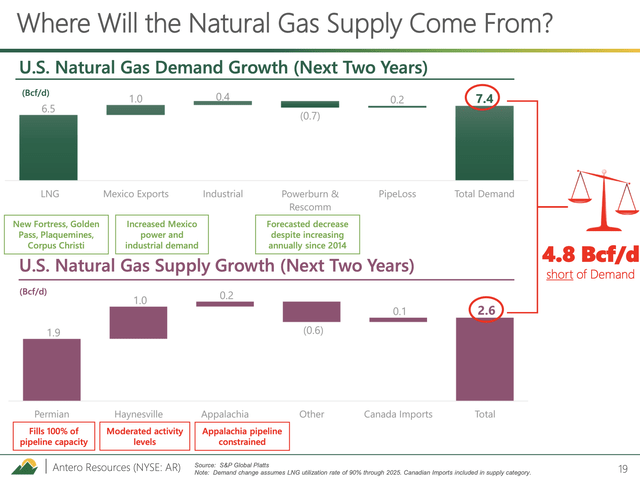

Antero estimates that natural gas demand will outgrow supply by 4.8 billion cubic feet per day over the next two years. This will be almost entirely driven by higher LNG demand, as the U.S. has become the go-to place for natural gas - especially after gas flows from Russia to Europe have been halted almost completely.

On top of that, China is trying to get rid of coal, and other emerging markets are seeing rapid middle-class growth. All of this requires energy.

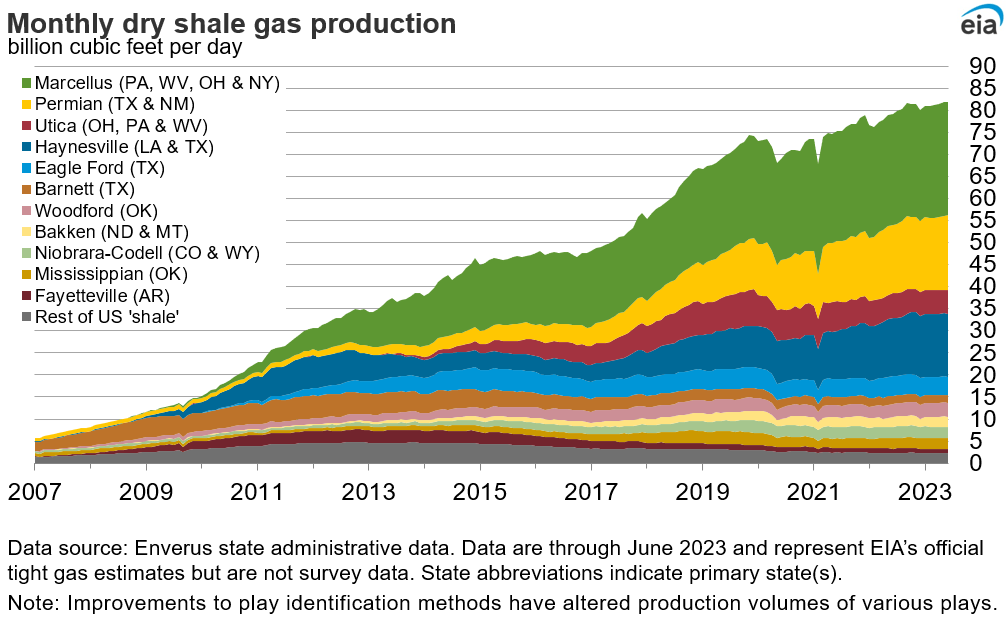

Meanwhile, supply growth continues to be constrained in the U.S. Not only are we currently seeing a decline in natural gas rigs, as companies are dealing with lower prices, but we're also seeing severe pipeline capacity issues in key basins like the Permian, Haynesville, and Appalachia - home of the Marcellus basin, the biggest natural gas basin of all.

Energy Information Administration

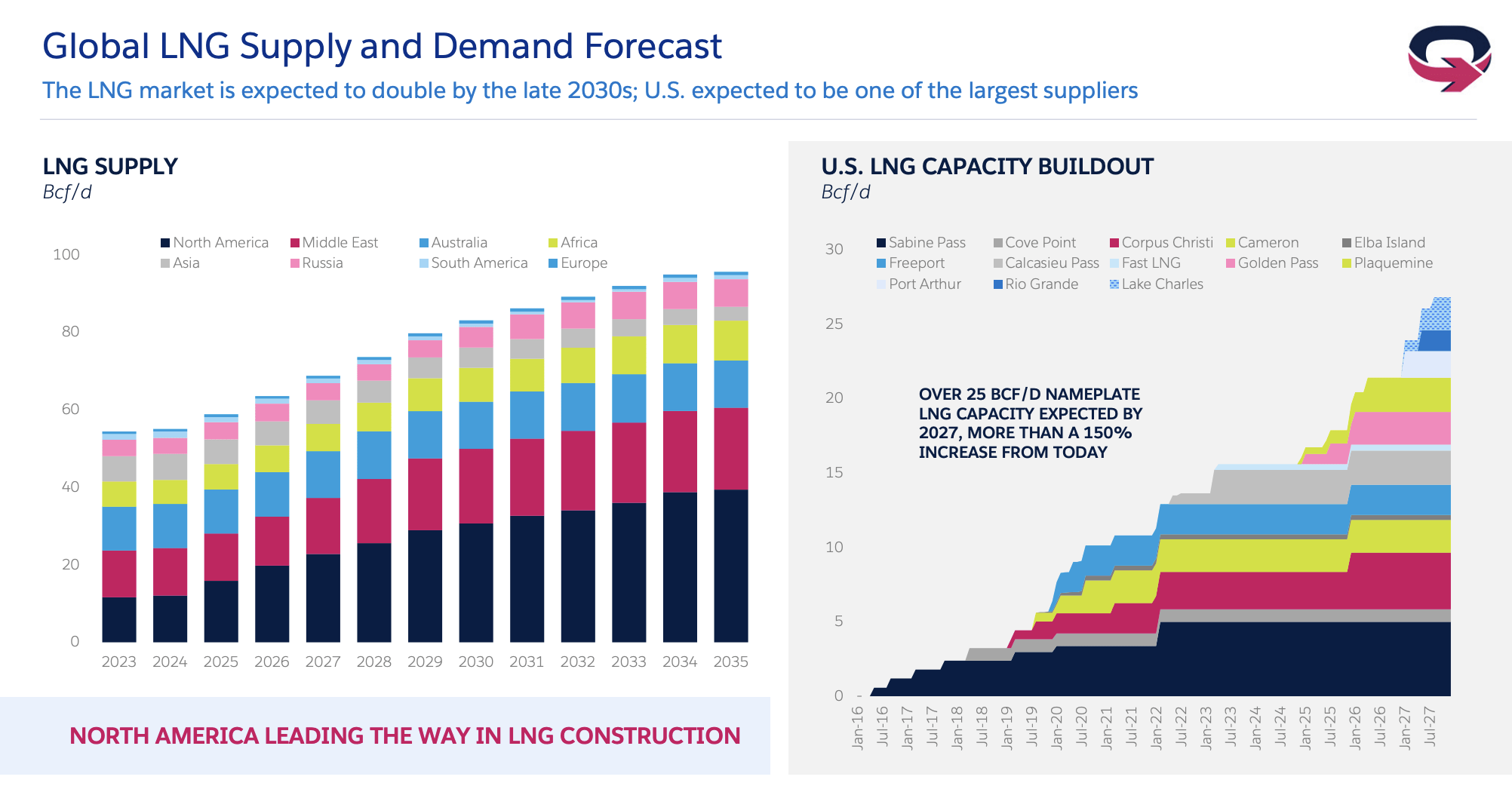

Using EQT Corporation (EQT) data, we see that LNG supply is expected to double by the late-2030s. Growth is mainly expected to come from U.S. operations.

EQT Corp.

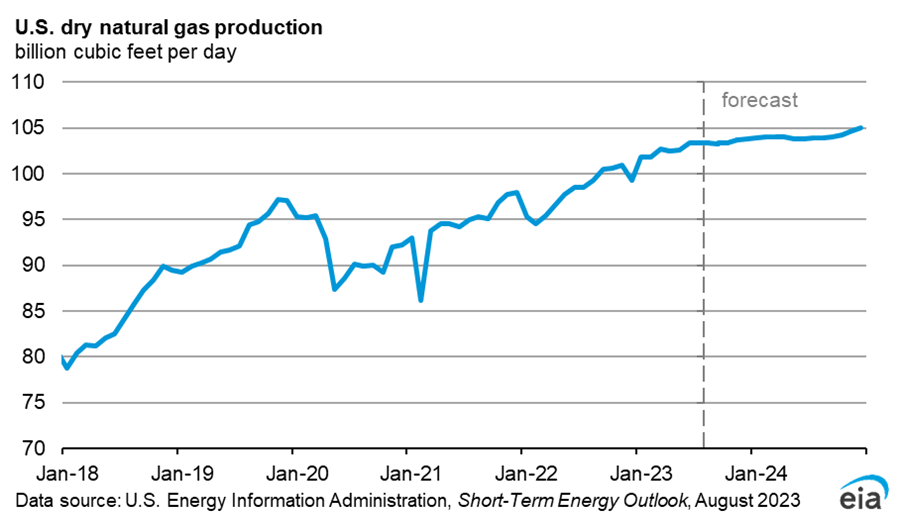

Furthermore, the Energy Information Administration ("EIA") anticipates that U.S. dry natural gas production will remain relatively constant over the next year.

Subsequently, production is expected to climb in the fourth quarter of 2024, primarily driven by the commissioning of new pipeline capacity and augmented demand for liquefied natural gas feed gas. Developers anticipate the inauguration of two new facilities by the end of 2024, which will further boost production.

While this is weakening the bull case a bit, the core of the thesis is weakening production growth, not declining production. If that were to happen, we would be in tremendous trouble - inflation-wise.

Looking at the chart below, we see that the EIA expects an end to the natural gas supply growth trend of the past decade.

Energy Information Administration

While current economic challenges are weakening demand growth a bit, Antero Resources is in a great spot to benefit from the favorable bigger picture.

The Antero Bull Case Remains Strong

Antero Resources has a few things going in its favor - besides the improving natural gas bull case.

The company has more than 20 years' worth of high-quality drilling inventory. It has a well-performing midstream network managed by Antero Midstream (AM) and access to the LNG Fairway, allowing the company to get better prices for its products.

With regard to its inventory, the company has more than years' worth of drilling locations that are breakeven below $2/Mcf.

This is more than any of its peers.

The company is also the sixth-largest producer of natural gas in the U.S. and the fourth-largest producer of natural gas liquids. This also comes with pricing benefits.

It produces all of its natural gas in the Appalachian basin. Hence, I went with a picture of that region as a header, as I believe it's one of the most beautiful areas of the U.S. (that I still need to visit).

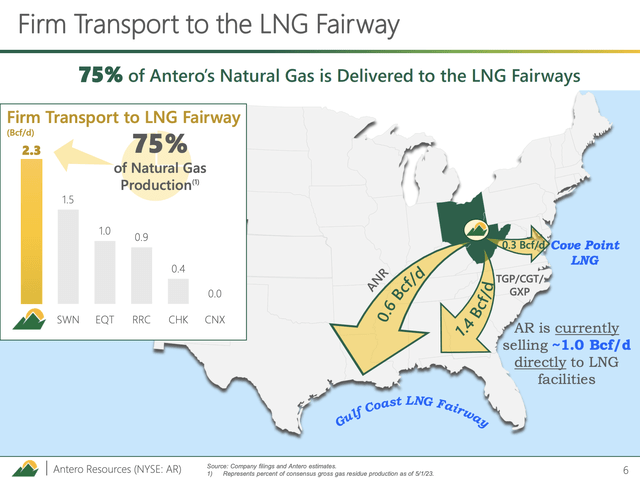

With regard to the aforementioned LNG benefits, 75% of AR's natural gas is delivered to the LNG Fairways. Every single day, the company sends 2.3 billion cubic feet of natural gas to major LNG export terminals, where it is processed and shipped to customers in Europe, China, and elsewhere.

Moreover, roughly 30% of its daily production of natural gas liquids is being exported.

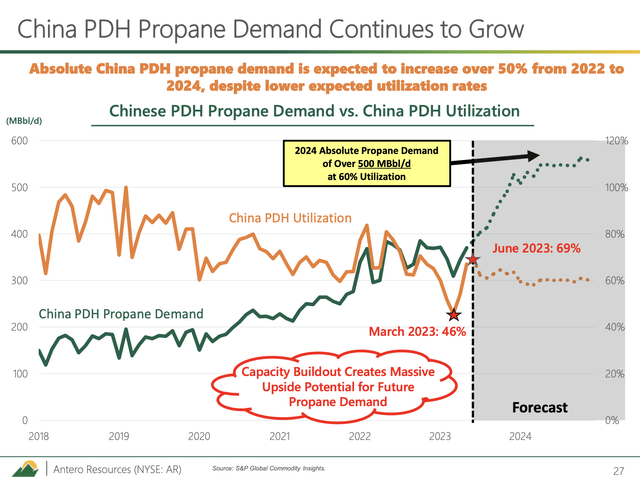

During its second-quarter earnings call, the company provided insights into its end markets and operations, emphasizing that C3+ (iso-propane) prices as a percentage of WTI are currently low.

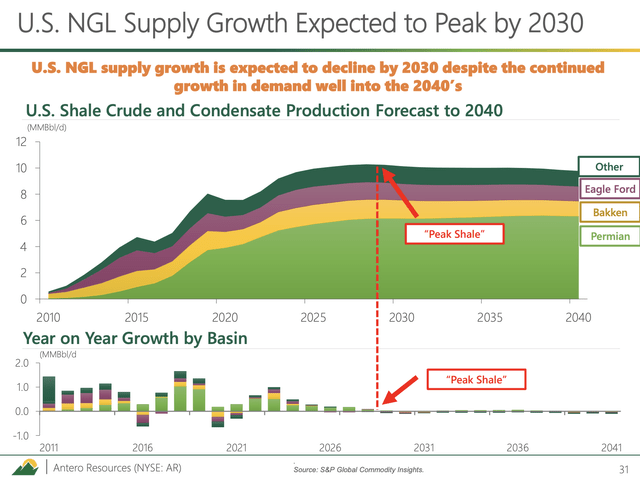

However, the company highlighted the historical weakness of NGL prices during this period. Looking ahead to the second half of 2023 and into 2024, the company sees several positive factors, including normal seasonal demand drivers, growth in the Chinese petrochemical market, and supply moderation due to rig reductions in liquids-rich basins.

The company also highlighted the strength of U.S. propane exports, which have averaged 1.6 million barrels per day year-to-date, representing a 25% increase compared to the previous year.

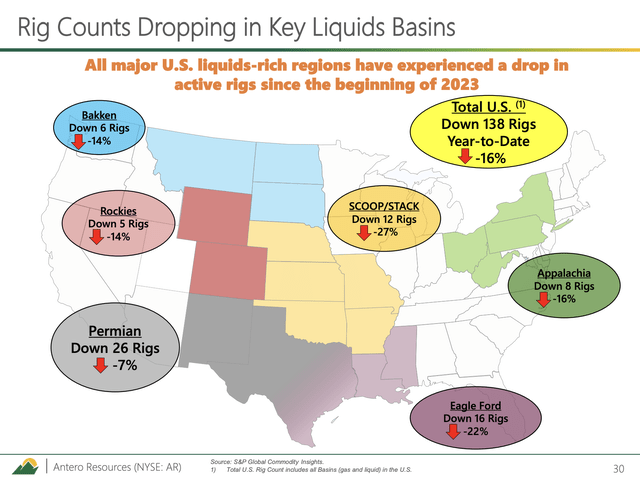

With regard to supply issues, the company also discussed the impact of rig count reductions in key liquids-rich basins. It highlighted the substantial year-to-date declines in rig counts in regions such as the Eagle Ford (-26%), SCOOP/STACK (-30%), and the Bakken (-20%).

Despite overall growth in the US C3+ supply, the rate of growth has been tempered by the drilling slowdown. This trend presents potential upside for C3+ pricing in 2024 and beyond as the effects of rig count reductions play out.

AR even expects NGL supply to DECLINE going into the 2030s, which comes with tremendous long-term pricing benefits.

Moreover, the company is highly efficient and uses this to its advantage.

The overview below shows the results of Antero's peer group under their respective maintenance capital programs. Antero achieved a 5% growth in volumes compared to the year-ago period, while peers targeting maintenance capital programs experienced a 3% decline in volumes year-over-year.

The chart at the bottom of the slide compares capital required per Mcfe of production. It shows Antero's significant efficiency benefits, with a capital program 40% below natural gas peers.

Antero expects to maintain 2024 production at raised guidance levels with a capital program at least 10% lower than 2023, thanks to improved capital efficiency.

Furthermore, the company anticipates substantial free cash flow in 2024 and beyond, with a commitment to returning 50% of free cash flow to shareholders. These returns will be indirect through buybacks.

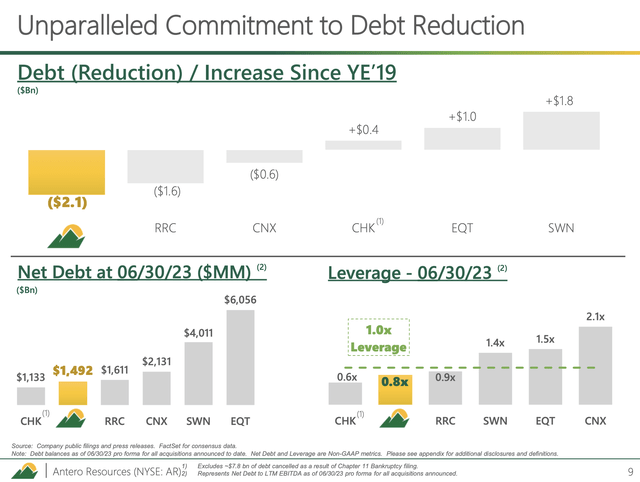

As of June 30, it has just $1.5 billion in net debt, which implies a sub-1x EBITDA leverage ratio. This allows the company to focus on shareholder distributions over debt reduction.

Based on these numbers, I continue to believe in AR's power to generate significant capital gains for the next few years.

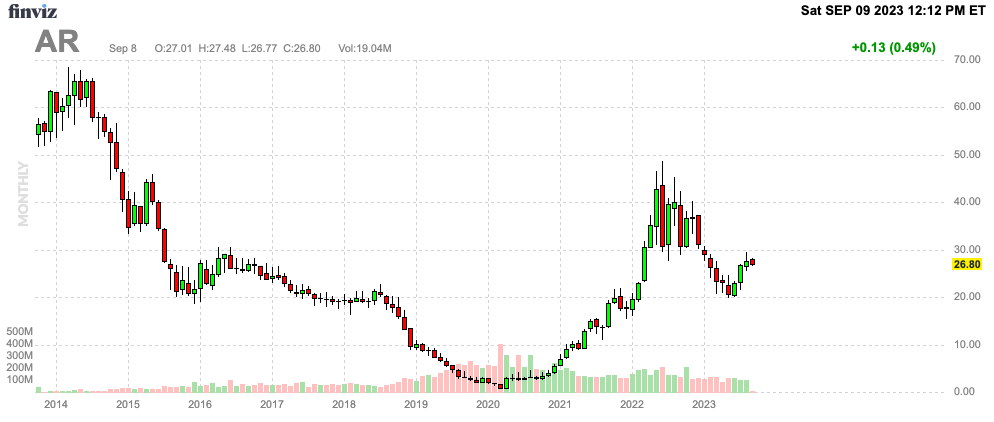

Although AR is currently a bit volatile, as Chinese growth fears are weighing on the stock, I believe that AR is in a good spot to rise to $60-$70 per share once economic growth bottoms.

This is based on my belief that the company can generate $2 billion in free cash flow in a scenario where Henry Hub trades close to $6 with support from elevated NGL prices. In 2022, the company generated more than $2.1 billion in free cash flow.

This number would imply a 25% free cash flow yield. Given that a valuation close to 10x free cash flow is fair, it leaves room for the stock to more than double.

Beyond that, the company would benefit from aggressive buybacks, which improves the per-share production and valuation numbers even more. Hence, I expect AR to remain in a long-term uptrend that could go well beyond my initial targets.

FINVIZ

Needless to say, please be aware of the cyclical nature of AR and its peers. AR is not a holding of my large (relatively speaking) dividend growth portfolio but a part of my trading portfolio. It's the most volatile stock I own.

Takeaway

Antero Resources presents a compelling opportunity in the natural gas sector. Despite some economic uncertainties, the bull case for AR remains robust. Natural gas fundamentals are improving, with higher demand outpacing supply growth, especially in the LNG market.

AR's strengths, including an extensive drilling inventory, a well-performing midstream network, and access to the LNG Fairway, position it for success. The company's commitment to efficiency and capital management bodes well for its future growth and cash flow generation.

While AR may experience volatility due to market fluctuations, it has the potential to deliver substantial capital gains in the coming years, potentially reaching $60-$70 per share as economic growth stabilizes.

In a market where natural gas remains a valuable commodity, Antero Resources stands out as a promising player poised for long-term success.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Welcome to my Seeking Alpha profile!

I'm a buy-side financial markets analyst specializing in dividend opportunities, with a keen focus on major economic developments related to supply chains, infrastructure, and commodities. My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Thank you for visiting my profile!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (21)

another warm winter, given El Niño

And the scorching summer.

I own AR but winter weather will

dictate AR price next 6 months.

At current prices, AM pays a 7.5% dividend.

I sold my $8 basis AM at $11.50. Too expensive up here for both me and AR imo.

I hold AR and am increasing on weakness.

GLTA.