Formula One Group: Valuation May Be Full Here

Summary

- Formula One Group beat revenue but missed EPS consensus estimates in its Q2 2023 financial results.

- The company operates the global Formula 1 motor racing series and is a subsidiary of Liberty Media.

- My questions about valuation, future growth potential, and difficulty in adding new teams make the outlook for Formula One Group uncertain.

- I'm Neutral [Hold] on FWONK for the near term.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

bluebeat76/iStock Editorial via Getty Images

A Quick Take On Formula One Group

Formula One Group (NASDAQ:FWONK) reported its Q2 2023 financial results on August 4, 2023, beating revenue but missing EPS consensus estimates.

The firm operates the global Formula 1 motor racing series.

Given questions about a current pricey valuation, uncertain future growth potential with an already crowded calendar and apparent difficulty in adding new teams, I’m Neutral [Hold] on Formula One Group for the near term.

Formula One Group Overview And Market

Englewood, Colorado-based Formula One Group was acquired by parent firm Liberty Media (LMCK) in 2017 at a then enterprise value of around $8 billion.

The firm is headed by President and CEO Stefano Domenicali in collaboration with Liberty Media President and CEO Greg Maffei.

The company operates the Formula 1 racing series, but is subject to the sporting oversight of the Federation Internationale de l’Automobile, or FIA.

Formula One is a global racing series featuring arguably the most advanced open-wheel racing cars in the world.

The company generates revenue from the following sources:

Media rights, selling broadcasting rights to Formula One races to broadcasters around the world.

Licensing the Formula One brand to companies that want to produce merchandise or other products and services.

Sponsorships sold to companies that want to be associated with Formula One.

Event fees from charging teams and circuits fees to participate in Formula One races.

According to a market research report by IndustryARC, the global market for motorsports of all classes was estimated at $8 billion in 2022 and is projected to reach $12.9 billion by 2027.

This represents a forecast CAGR of 10.2% from 2023 to 2027.

The main drivers for this expected growth are the rising popularity of Formula 1 racing and the continued launch of additional racing classes in numerous regions.

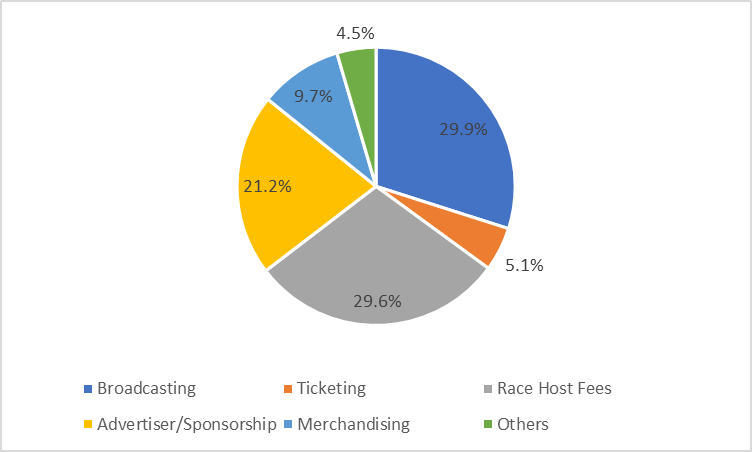

Also, the chart below shows a breakdown of the industry’s various revenue streams by type, as of 2021:

Global Motorsports Market (IndustryARC)

Major competitive or other industry participants include:

NASCAR

NHRA

MotoGP

Indycar

ARCA

WRC

WTCC

WEC

Superbike

Supercross

Motocross

Supercar

Formula One Group’s Recent Financial Trends

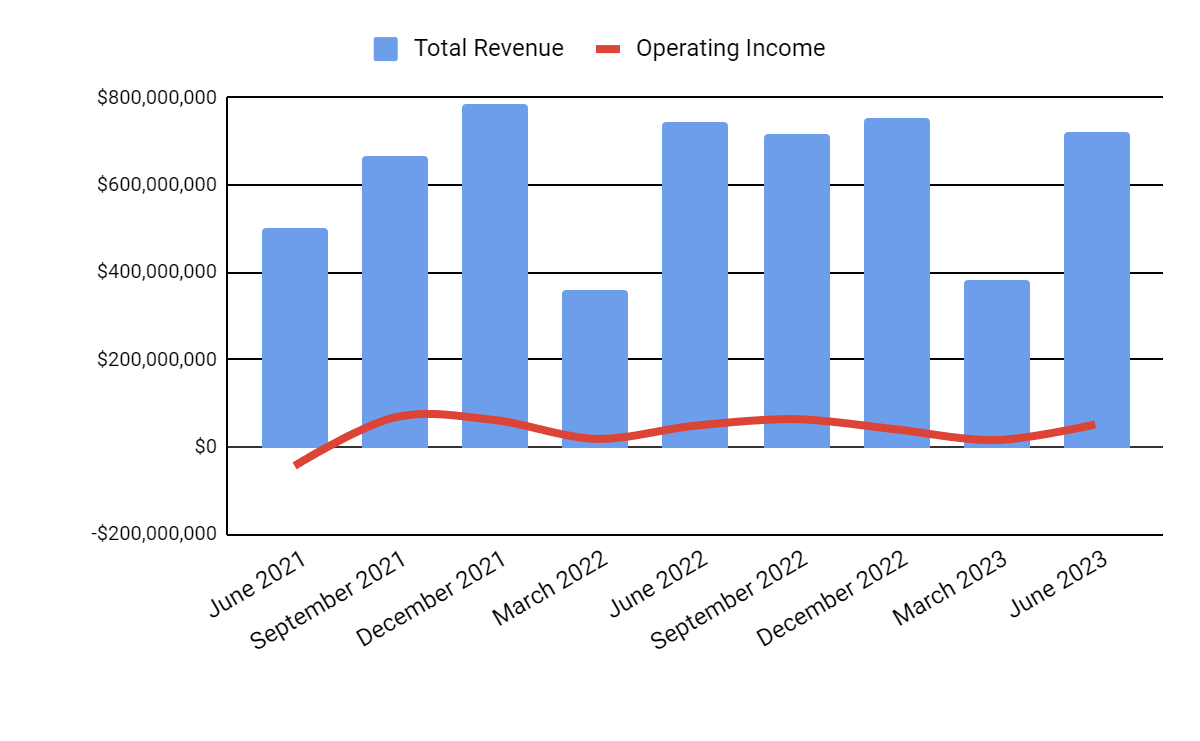

Total revenue by quarter has fluctuated unevenly and shows seasonal variations; Operating income by quarter has also varied within a range:

Total Revenue and Operating Income (Seeking Alpha)

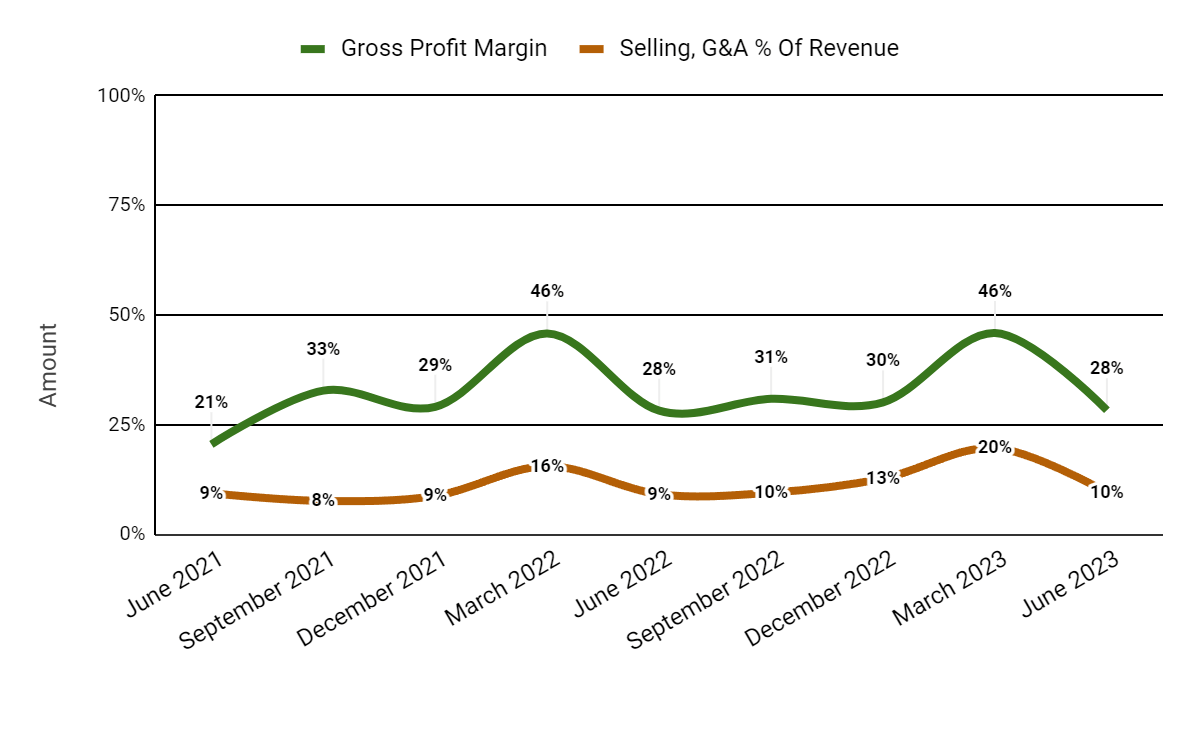

Gross profit margin by quarter has produced no clear trend; Selling and G&A expenses as a percentage of total revenue by quarter have trended slightly higher in recent quarters:

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

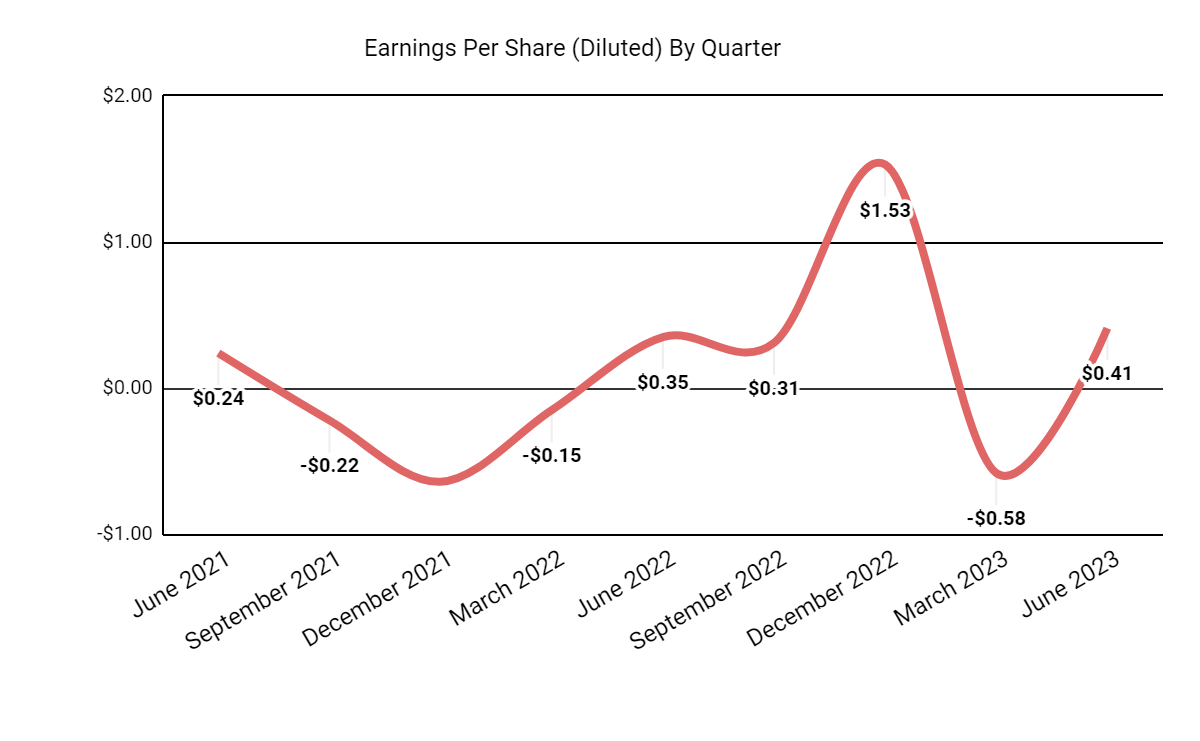

Earnings per share (Diluted) have produced greater volatility in recent reporting periods, as the chart shows below:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

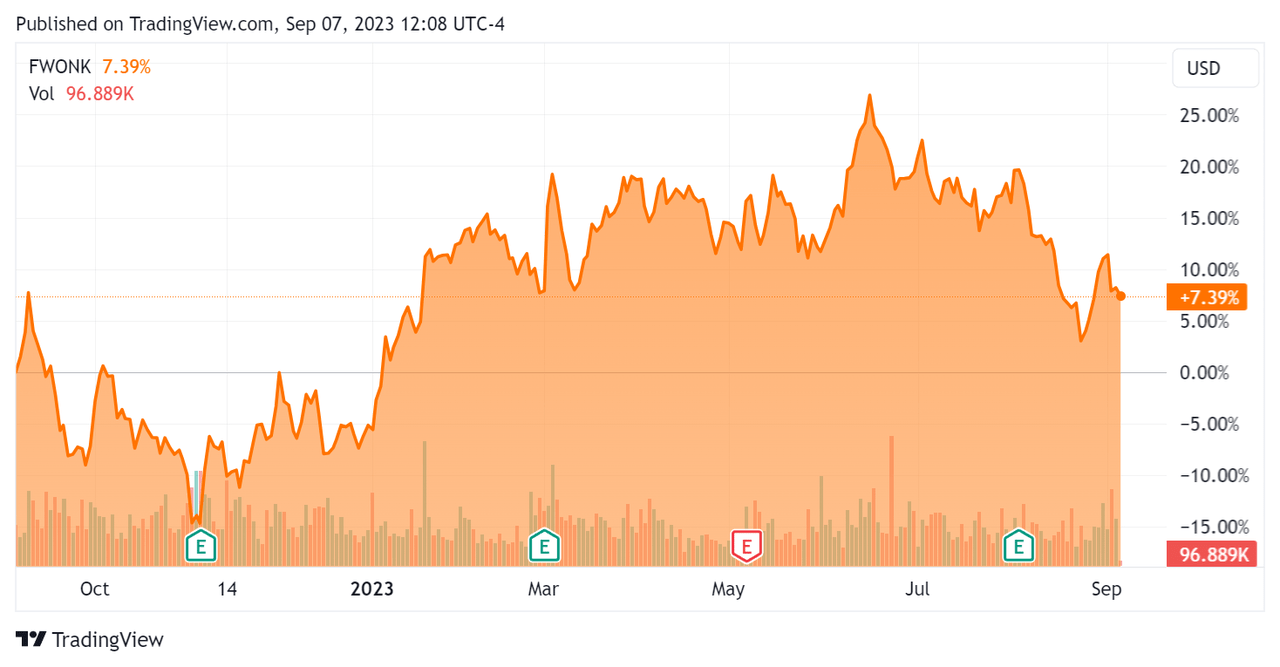

In the past 12 months, FWONK’s stock price has risen approximately 7.39%:

52-Week Stock Price (Seeking Alpha)

For balance sheet results, the firm ended the quarter with $1.49 billion in cash and equivalents and $2.95 billion in total debt, of which $27.0 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was an impressive $388.0 million, or $1.66 per share, during which capital expenditures were $220.0 million. The company paid $19.0 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Formula One Group

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 6.7 |

Enterprise Value / EBITDA | 33.1 |

Price / Sales | 6.2 |

Revenue Growth Rate | 59.0% |

Net Income Margin | 19.0% |

EBITDA % | 20.2% |

Market Capitalization | $15,730,000,000 |

Enterprise Value | $17,220,000,000 |

Operating Cash Flow | $608,000,000 |

Earnings Per Share (Fully Diluted) | $1.67 |

(Source - Seeking Alpha)

Sentiment Analysis

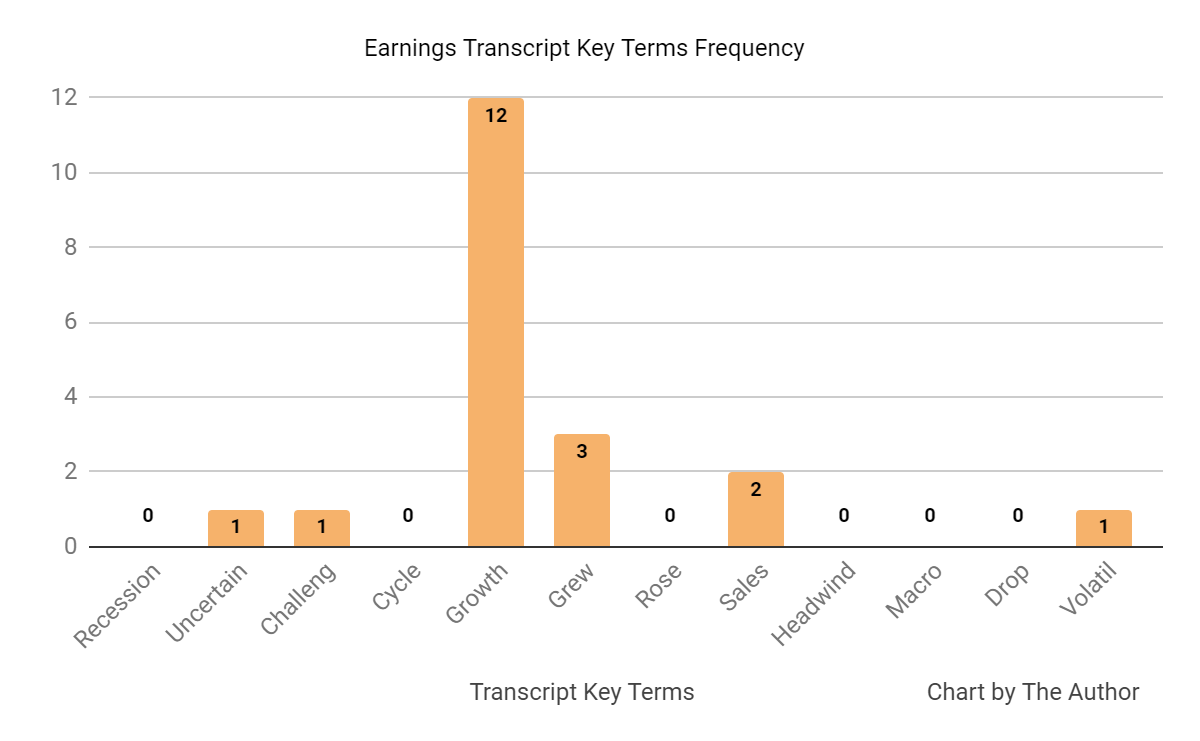

Below is a word count chart showing the incidence of positive and negative words in management’s most recent earnings call:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

The chart above shows a relatively benign sentiment from analysts and management.

Analysts on the call asked about the usage of the Las Vegas Paddock building for other purposes throughout the year and about the prospects for adding another team to the series.

Details were scant on Paddock building usage. It appears, at least publicly, that management is cool to the idea of adding a new team to the series.

The new team in question is the putative Andretti/Cadillac team that wants to become the eleventh team in the series.

The issues are related to a division of the existing pot of money and whether the new team would simply reduce other teams’ money while not adding enough new interest to the series to offset the reduction on a per team basis.

Commentary On Formula One Group

In its last earnings call (Source - Seeking Alpha), covering Q2 2023’s results, management highlighted their hopes for the Las Vegas Grand Prix, which represents a major investment by the company in the American market.

Leadership also noted growth in viewership and said that four of the races through the first half of 2023 had been sold out.

Online viewership has increased by 29% in the first half of 2023 versus the same period in 2022.

Total revenue for Q2 2023 fell 2.7% YoY on one fewer race due to the cancellation of the Imola race. Gross profit margin remained essentially flat.

Selling and G&A expenses as a percentage of revenue rose by 0.4% year-over-year, while operating income increased by 6.1% to $52 million.

The company's financial position is reasonably strong, with ample liquidity, nearly $3 billion in long-term debt and substantial free cash flow.

Looking ahead, consensus revenue growth estimates for 2023 are at 26.7% over 2022.

If achieved, this would represent an increase in revenue growth rate versus 2022’s growth rate of 20.46% over 2021.

Regarding valuation, in the past twelve months, the firm's EV/EBITDA valuation multiple has risen 14.2%, as the chart from Seeking Alpha shows below:

EV/EBITDA Multiple History (Seeking Alpha)

A potential upside catalyst to the stock could include a successful Las Vegas Grand Prix race later in 2023.

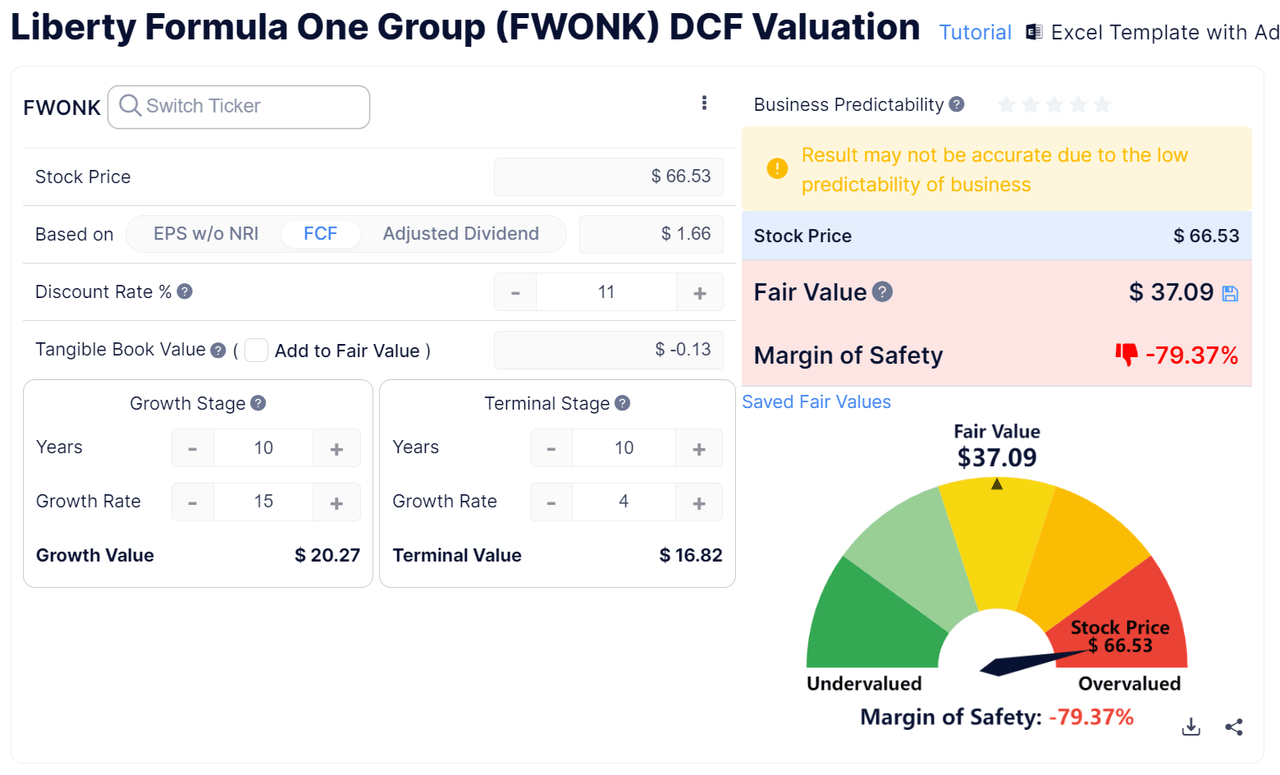

However, the valuation of the stock appears priced for perfection, whether looked at from an earnings or free cash flow basis, as the discounted cash flow calculation shows below:

Discounted Cash Flow - Formula One Group (GuruFocus)

The above chart shows the free cash flow DCF at $1.66 per share and at a generous growth rate assumption. The EPS version is largely the same, indicating the shares appear to be substantially overvalued, given a long-term growth rate of 15% per year.

So, while Formula One is a growing sport, it is unclear whether the governing structure is suited to adding new teams that might bring additional interest to the sport, such as the Andretti/Cadillac effort.

Given the apparently priced-for-perfection stock price and questions about future growth potential with an already crowded calendar and difficulty in adding new teams, I’m Neutral [Hold] on Formula One Group for the near term.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.