Steelcase: Near-Term Revenue Headwinds Keep Me On The Sidelines

Summary

- Steelcase Inc. is facing near-term headwinds from a slowdown in orders from large corporates due to a slower-than-expected return to in-office work post-pandemic.

- The company's medium- to long-term revenue growth plans are attractive as it increases focus on markets like healthcare and education.

- Margins are expected to improve with price increases, easing supply chain constraints, and cost-saving measures, but caution is advised due to near-term revenue headwinds.

mesh cube

Investment Thesis

Steelcase Inc. (NYSE:SCS) faces near-term headwinds from a slowdown in orders from large corporates in the near term. While the company is taking initiatives like increasing its presence in SME, healthcare, consumer, and education markets to offset its impact, the revenues are expected to be down Y/Y in FY24. On the margin front, benefits from price increases, easing supply chain constraints, and cost-saving measures should help margins. The valuation is cheap, but I believe it is prudent to wait on the sidelines for the order rates and revenues to bottom before becoming more positive on the stock. For now, I prefer to be on the sidelines and have a neutral rating.

Revenue Analysis and Outlook

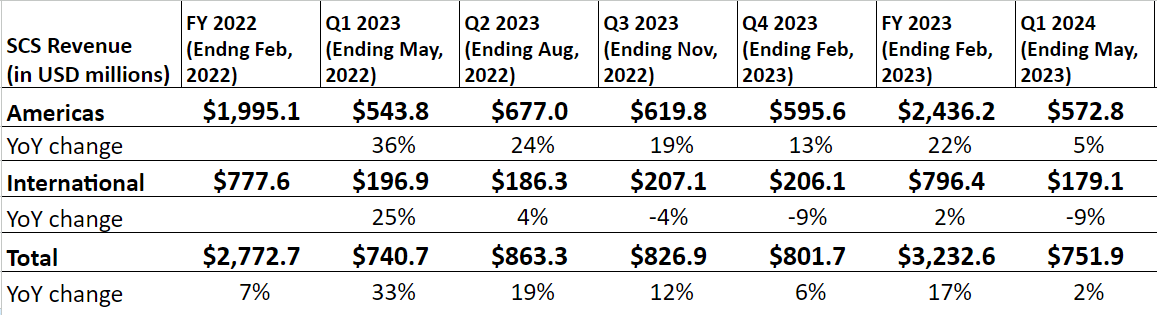

In recent quarters, the company has benefitted from a healthy backlog, which helped it post revenue growth despite declining order rates. In the first quarter of 2024, the Americas segment revenue increased 5% YoY and 2% YoY organically to $572.8 million, driven by a healthy backlog, faster order fulfillment patterns, and higher pricing benefits. In the International segment, revenue decreased 9% YoY on a reported basis and 7% YoY organically due to persisting macroeconomic uncertainty in EMEA and Asia Pacific. On a consolidated basis, revenue of $752 million was up 2% YoY on a reported basis and flat YoY on an organic basis.

SCS’ Revenue Growth (Company Data, GS Analytics Research)

The orders in the first quarter declined 7% YoY on an organic basis. Order rate also weakened as the quarter progressed, with April and May being slower than March. In the Americas segment, orders declined 6% YoY organically due to lower project business. On the international side, the majority of EMEA and Chinese markets experienced a significant order decline, which more than offset the double-digit growth across all other Asia-Pacific markets. As a result, the International segment orders declined 11% YoY organically.

Looking ahead, the company's revenue outlook is mixed. It faces near-term challenges due to a slowdown in large corporate orders, but management's efforts to diversify its customer base offer promise in the medium to long term.

Following the post-pandemic reopening, many large corporations were optimistic about employees returning to the office, resulting in good order growth last year. Further, the supply chain issues in the past year also led to customers placing orders earlier than usual, bolstering the company's orders and backlog. However, the return to the office has been slower than anticipated, with many employees resisting the change. While I understand the argument for increased efficiency in the office environment and agree with most corporate leaders on the importance of bringing employees back, I believe this transition will take longer than expected. Many large corporations are now realizing this, leading to a decline in order rates for Steelcase. Although the company achieved revenue growth last quarter, it was primarily driven by past backlog orders. As orders have been declining for the past two quarters, I anticipate that this decline should begin to impact the company's revenues in the coming quarters. Furthermore, management has noted that the order decline worsened as the last quarter progressed, with order rates in April and May worse than in March. Consequently, I believe that Q2 may perform even worse than Q1. Overall, I expect the company's revenue to decline in the near term.

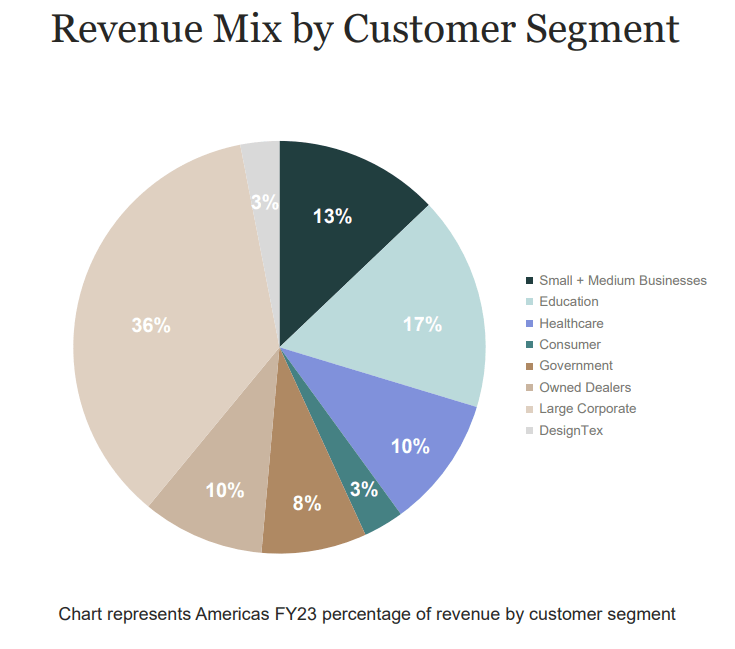

In the medium to long term, management has shifted its focus towards increasing sales in other markets such as healthcare, education, SMEs, and consumers to reduce reliance on large corporations. These markets represent significant opportunities for growth, especially considering the company's current low market share in these sectors.

To achieve this diversification, management is reallocating sales resources away from large corporations. Additionally, the large corporate business end-market still holds potential for recovery in the long run. The company is also emphasizing innovation and is actively working on solutions to facilitate collaboration among its clients' employees in a hybrid work environment. Collaborations with technology companies to integrate their products into its furniture are also underway.

While I appreciate management's strategy of diversification, market share expansion, and product innovation, I would prefer to see the company gain more traction in these areas before becoming more optimistic about its long-term prospects. For now, I am monitoring the company's order rates, waiting for them to stabilize before forming a more positive outlook on its revenue growth prospects.

SCS’ Revenue Mix by Customer Segment (Investor Presentation)

Margin Analysis and Outlook

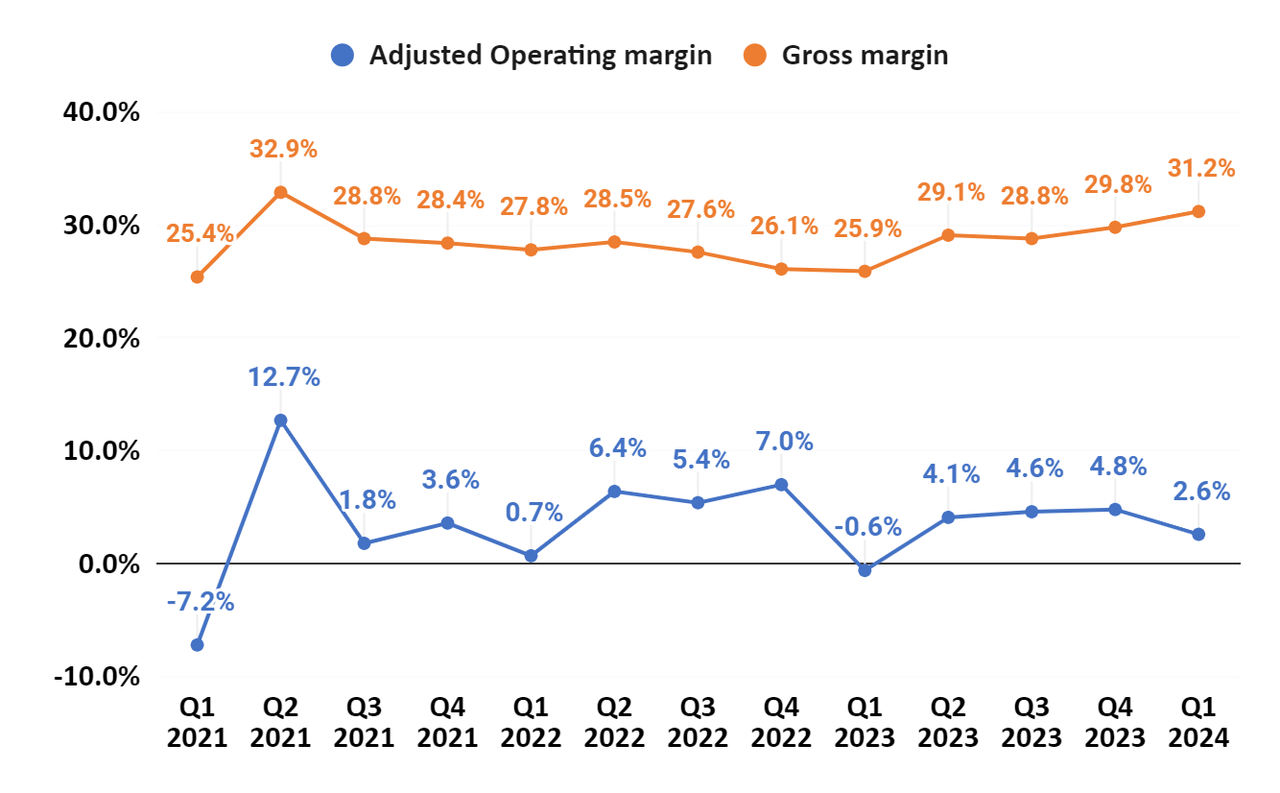

In Q1 2024, the gross margin increased 530 bps YoY to 31.2% driven by improved operational efficiencies and favorable pricing benefits which more than offset the volume deleverage in the International segment. The sales leverage in the Americas and improved gross margin outweighed the higher operating expenses and resulted in an adjusted operating margin of 2.6%, which is a good improvement compared to a negative 0.6% in Q1 2023.

SCS’ Gross margin and Adjusted Operating margin (Company Data, GS Analytics Research)

Looking forward, I expect the company's margins to improve, helped by price increases, improving supply chain issues, and cost-saving initiatives.

The inflationary headwinds over the last couple of years have negatively impacted the company's margins, and the company has implemented price increases to offset these headwinds and plans further hikes. This should benefit margins.

Further, the supply chain constraints also adversely impacted margins across the industrial sector last year and with these constraints easing, margins should improve.

The company is also implementing cost-reduction initiatives and workforce rightsizing in response to volume decline. On its investor day in May, management shared their target of structural cost savings of over $50 mn through initiatives like footprint optimization, complexity reduction, improving procurement and sourcing, etc.

While these initiatives should be partially offset by the company's growth investments to diversify in new markets, I believe most of the growth investment should come from reallocating resources from large corporate clients rather than incremental expenses. Hence, I believe the margins should improve looking forward.

Valuation and Conclusion

Steelcase is currently trading at 12.87x FY24 consensus EPS estimates of $0.67 which isn't pricey. However, I would like to wait for orders from large corporates to bottom before becoming more positive on the stock. While the management’s strategy to diversify sales from large corporates is a step in the right direction, it is too early to gauge the success of these initiatives. Further, the company doesn't have a very strong track record of growth, with its revenue growing only modestly from ~$3 bn in FY14 to $3.2 bn in FY23 in the last decade. So, I believe the investors will have a "see it to believe it" approach when it comes to the company's long-term growth plans and will continue to focus on near-term revenue, which is unlikely to bottom unless the order decline ends. Hence, I prefer being on the sidelines for now and have a neutral rating on the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Ashish S.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.