The 5 Best World-Beater Blue Chips For A Super Pandemic

Summary

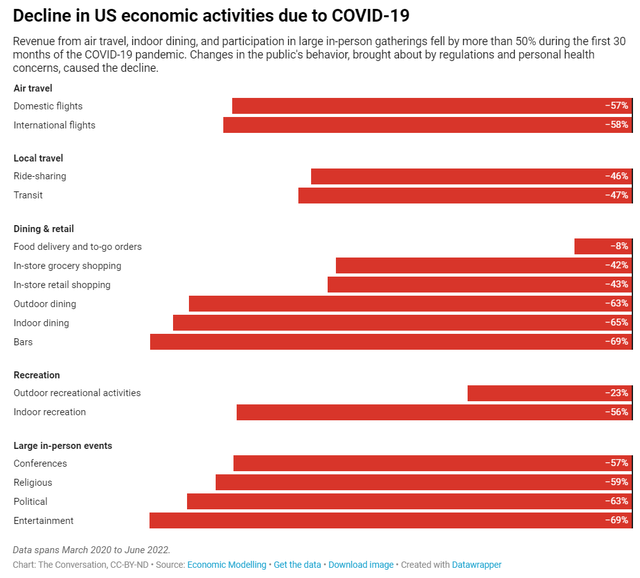

- The COVID-19 pandemic significantly impacted the global economy, costing around $70 trillion, about 10.5 years' income for American workers.

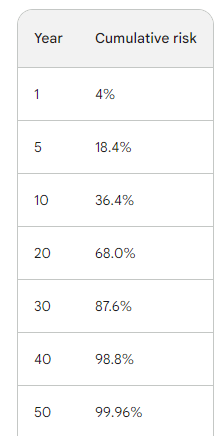

- Science- and evidence-based living is the best way to protect your health and wealth from the inevitable Super flu pandemic that is a 4% risk in any given year.

- Up to 500 million people could die, with some estimates as high as 1 billion deaths in an H5N1 avian super pandemic.

- Since 1996, there have been over 23 outbreaks of H5N1, and none of them triggered a Super Pandemic, or market crash. You can't live in perpetual terror of inevitable but impossible-to-predict risks like this.

- There are ten 100% rated safety and quality companies you can buy that can survive and thrive through a Super Pandemic. Half of them are reasonable or good buys today. They are A-rated fast-growing world-beater Ultra SWANs that have 16% to 17% annual return potential for the next decade, potentially quadrupling your investment, with 3X better return potential than the S&P 500.

- Looking for more investing ideas like this one? Get them exclusively at The Dividend Kings. Learn More »

lucadp

The COVID-19 pandemic was the worst in over 100 years, with nearly 800 million confirmed cases and 7 million deaths. And those are underestimating the true horrors of the virus, which experts believe was significantly higher, just underreported.

The cost to the global economy was staggering, with the University of California estimating it will cost the U.S. economy around $14 trillion in cumulative reduced output by the end of 2023 (potentially as much as $22 trillion).

Globally, the cumulative effect on the economy was approximately 5X that or about $70 trillion.

To give you some idea of how big this is, the global economy is approximately $108 trillion.

$70 trillion represents the median U.S. salary of about $40K for 1.8 billion people.

The U.S. workforce is 168 million, so $70 trillion in pandemic economic impact equals the median salary for all American workers...for 10.5 years.

And do you know what's potentially most shocking about the Pandemic? That could have been so much worse.

So let me tell you a personal story that means a lot to me and might save someone you care about.

And then, I'll tell you how to save your portfolio from the coming super-pandemic (whenever it finally arrives).

Saving My Grandfather's Life Saved My Own

The plural of anecdote is anecdotes, not data." - Brian Dunning.

While personal stories aren't data and can never prove anything on their own, for people, they can make the most impact in remembering what the data shows.

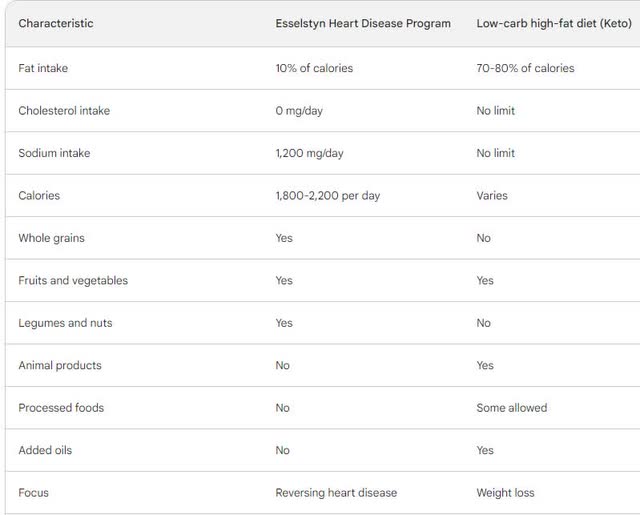

Last year, my grandfather and I tried to lose weight on the popular Keto diet, low carb, high meat, and high fat.

He lost 60 lbs, and I lost 80 lbs, eating like "real men" on meat, butter, and bacon! My grandfather didn't exercise (he was bedridden for five years), and I only pumped iron. No cardio for me, thanks! That's for wussies and lettuce-munching vegan hippies!

To heck with "expert" advice about fruits, vegetables, and cardio, 80 lbs on meat and weight training, baby! That's all the proof I need of a healthy lifestyle!

My grandfather and I lost weight, felt great, looked great, and all doing the caveman carnivore diet! Paleo forever, baby! Tell the vegetarians to go shove it!

Looking Under The Hood To Find The Shocking Truth

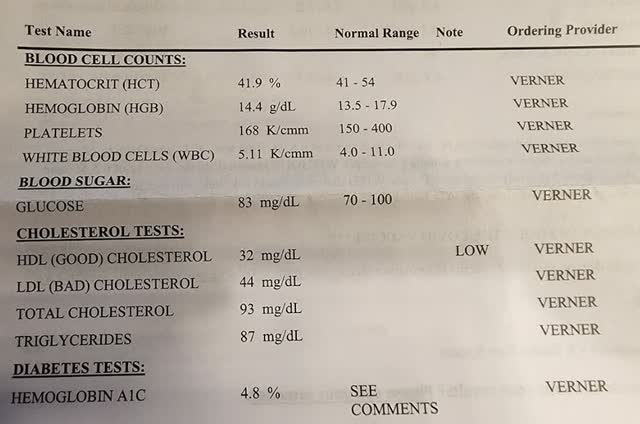

My grandfather and I underwent our blood tests with a swagger of champions. We had done so well on this low-carb, meat-heavy diet rich in bacon and animal fats; how could our numbers not be amazing?

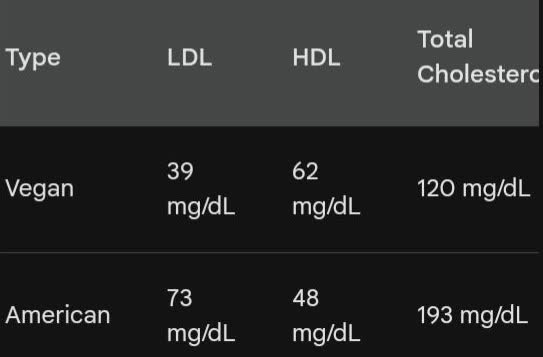

Our cholesterol had soared; mine was up about 50% in a year.

My blood pressure was up despite having lost 80 lbs of fat. My liver was fatty, my kidneys were starting to shut down, and my C-reactive protein, a marker for inflammation, heart disease, and cancer risk, had approximately doubled.

My doctor told me I was about one year away from infertility and two years from a potential heart attack. And I just turned 37!

After being shown proof that the experts weren't full of crap, here is what our doctors advised.

The Cure To The Greatest Killer In The World

To save my Grandfather's life after three heart attacks and one stroke, his doctor asked him and me (he lives with me) to try the Esselstyn diet, the only one ever proven to reverse heart disease in humans.

The Cleveland Clinic has used this since 1996, and has been proven through about half a dozen clinic studies to slow and reverse heart disease.

- the only known cure for the largest killer in the world.

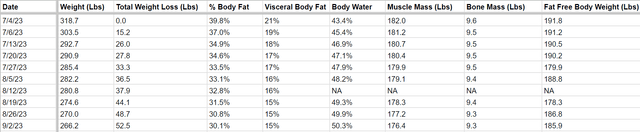

Of course, weight loss isn't everything. But there's been plenty of that.

7 Weeks Of A Plant-Based Diet: Jaw Dropping Results Including 53 Lbs Lost

I've never lost weight this fast, but my nutrition is nearly perfect this time.

I'm not eating 1,000 calories per day and in the gym for hours per day like the biggest loser; I'm eating 2,000 calories on average, just the right foods.

And the blood work?

7 Weeks Of A Plant-Based Diet: My Doctor Has Never Seen Anything Like This Kind Of Improvement

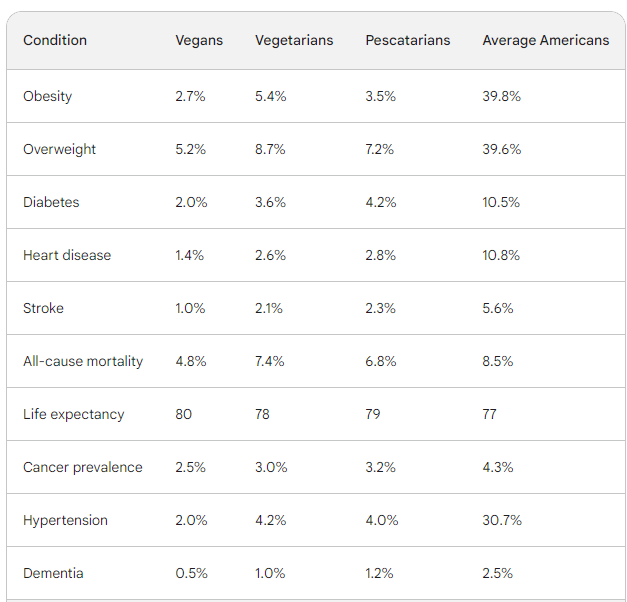

The average cholesterol for infants is 125 mg/dl, and under 150 has been shown by numerous studies, including the Framingham Heart Study, to eliminate the risk of heart attacks and strokes.

My cholesterol cratered well over 100 points, my diabetes is gone, and my blood pressure is normal. My kidney function is 50% above normal, and my vital signs are all healthy for the first time in 12 years!

I have not been this healthy since I was in Army Medical School training to be a surgeon! And my cholesterol has never been this low...ever. Granted, that's because I was on Atorvastatin during this time, and my doctor says it's what's causing my HDL good cholesterol to be low.

I'm now off all medications...for the first time in about a decade.

And I'm hardly alone.

Craig, W. J., Mangels, A. R., Peel, J. L., & Masse, L. C. (2019). Position of the Academy of Nutrition and Dietetics: Vegetarian diets. Nutrition Reviews, 77(10), 1037-1056.

Of course, as important as cholesterol levels are, what we care about is chronic disease, the standard of living, and living our best and healthiest lives.

Plant-Based Diets and Cardiovascular Disease Risk Factors: A Systematic Review and Meta-Analysis of Observational Studies, Francesco Sofi, Giulia Cesari, Luca Abbate, et al., Journal of the American Heart Association, 18(11):e010368 2019

During this life-changing transformation, one man has changed my life more than any other.

I recently listened to all of Dr. Michael Gregor's life-changing audiobooks:

- How Not to Die: Discover the Foods Scientifically Proven to Prevent and Reverse Disease

- How Not to Diet: The Groundbreaking Science of Healthy, Permanent Weight Loss.

I also watched his amazing YouTube channel, NutritionFact.Org.

I'm also listening to his weekly podcast, the NutritionFacts Podcast, on my 40 weekly walks (Grandfather is up to 7 hours after being bedridden for years).

And I'm very much looking forward to his upcoming book, "How Not To Age."

You could say that Dr. Gregor is one of my most trusted health gurus, given his dedication to science-based medicine and living.

- "How Not To Diet" used nine fact-checkers and had 5,000 scientific study citations

And now he's warning about something pretty grim and terrifying.

A Warning About The Coming Super Pandemic: Avian Flu Could Kill Hundreds Of Millions

After listening to Dr. Gregor's life-changing books on nutrition, I listened to:

And guess what I learned? The COVID-19 Pandemic was a dress rehearsal for the true Super Pandemic that is coming eventually.

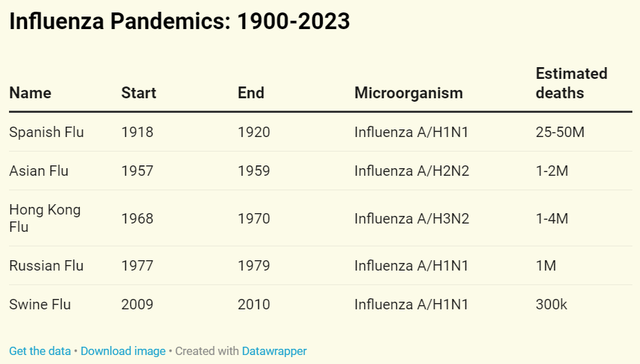

- The 1918 flu pandemic killed approximately 5% of humanity.

The fatality rate for H5N1 is 56% since the virus first appeared.

- Approximately 110X deadlier than COVID.

This Avian flu appeared in Hong Kong in 1996, likely originally from wild ducks but spreading rapidly through chickens used for eggs and food.

It liquified Chicken organs, much like Ebola does in humans (A frightening virus is killing a massive number of wild birds mortality rate in Chickens). It also kills almost all chickens, much like Ebola does. It is one of the most lethal viruses to humans, much like Ebola.

- 4% odds of an Avian Flu pandemic in any given year

- 2.5% odds of nuclear war with Russia, according to Goldman.

Humans only get it from Chickens and don't pass it on to other humans. If that ever changes? Then, we could potentially have the equivalent of airborne Ebola.

How bad could things get? The likely fatality rate of Avian Flu will not be 52% (WHO estimates 56%) but likely closer to 10% when it eventually jumps to humans. That's still about 20 years deadlier than COVID and could kill

If you thought COVID triggered panic and lockdowns, imagine what a 10X or even 100X deadlier virus would have done?

Since the total harms of COVID-19 to the U.S. are about $16 trillion, the expected cost of H5N1 is at least $640 billion - though it is probably far greater, since the mortality rate would probably be much higher than that of COVID-19." - Institute For Progress (emphasis added).

The NIH estimates that if the 1918 flu's infectivity were repeated in a new Avian flu Pandemic, it would potentially kill between 3% and 6% of humanity.

- 240 million to 480 million people.

Russian models show up to 1 billion might die in the first six months.

- It's estimated to take 6 to 8 months to develop a vaccine

- and within one year, about 14% of humanity could be vaccinated.

So, the point is that things could get very bad.

How To Protect Your Portfolio From A Super Pandemic

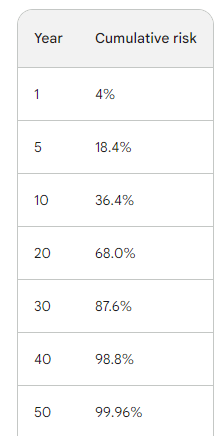

Remember, the risk of an Avian Flu pandemic is about 4% in any given year.

Google

It's not a question of if a flu pandemic is coming, just a matter of when.

If you plan to live 30 years? You will likely have to live through the coming Super Pandemic and its effects on your portfolio. Are you 30 years old or younger, or do you plan to live 40 to 50 years? It's a virtual certainty you will face this coming plague.

We can no more stop this coming (Avian flu) pandemic than we could put a shower curtain around Minnesota and keep out the winter". - Dr. Michael T. Osterholm, Director Center For Infectious Disease Research And Policy, University of Minnesota.

Experts like Dr. Osterholm are stockpiling 3 to 6 months' worth of food for their families because this coming Pandemic might make lockdowns necessary. It might be too dangerous to journey out for groceries or even have them delivered.

- I'm stockpiling beans, seeds, and nuts for my family.

- Calorie and nutrient-dense, non-perishables.

Why Sitting In Cash Isn't A Good Idea

But what about your portfolio? You can't sell everything you own whenever there is news of an Avian flu outbreak.

Over 23 outbreaks of H5N1 have occurred since 2003 alone, and more since it first appeared in 1996.

How many Super Pandemic have occurred? None. How many stock market crashes? Two, though those were unrelated to bird Flu.

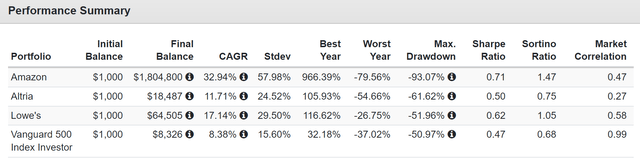

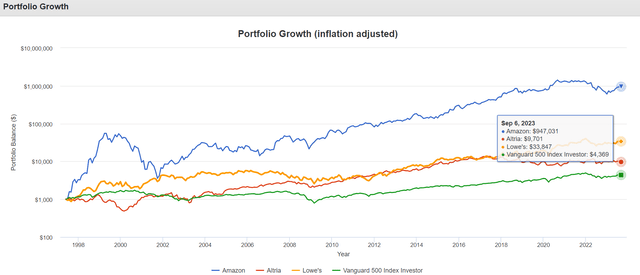

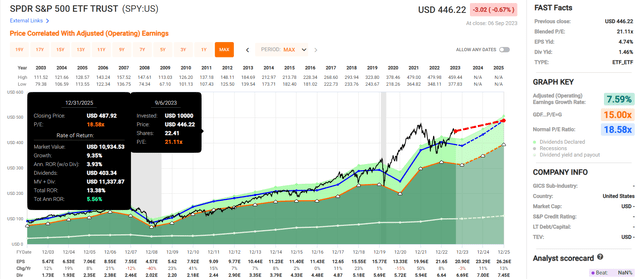

What The Stock Market Has Done Since H5N1 First Appeared (1996)

No matter what kind of investor you are, hiding under the bed, fearing the inevitable bird flu pandemic, is not a good strategy.

Since H5N1 first appeared 27 years ago, the S&P (SP500) has turned $1 into $8.33 despite two market crashes, six bear markets, three recessions, and one killer Pandemic.

Investors in hyper-growth stocks like Amazon (AMZN), or ultra-yield Ultra SWANs like Altria (MO), or dividend kings like Lowe's (LOW) have done even better, enjoying 18.5X to 1805X returns.

| Stock | Ticker | Total Return Since 1996 (Multiple Of Your Investment) | Annual Inflation-Adjusted Total Return Since 1996 |

| Amazon | AMZN | 947.0 | 30.2% |

| Lowe's | LOW | 33.8 | 14.5% |

| Altria | MO | 9.7 | 9.1% |

| S&P 500 | VOO | 4.4 | 5.8% |

(Source: Portfolio Visualizer.)

Even the S&P 500, despite all manner of craziness in the last 26 years, managed to deliver 5.8% annual real returns, slightly below its historical 7% since 1800 (according to BlackRock).

Pandemics are no excuse to sit in cash. I promise the world won't end due to this coming bird flu pandemic. If I'm wrong, we'll be too dead to care;)

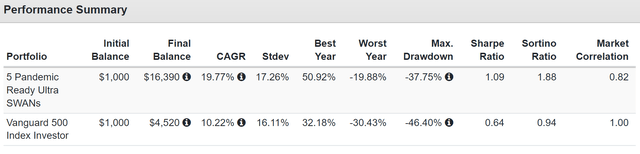

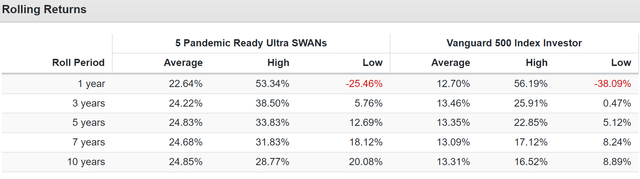

The World-Beater Ultra SWANs To Own During A Super Pandemic

Our safety and quality model is based on around 3000 points on over 1000 metrics designed to catch 95% of dividend cuts before they happen.

In addition to the usual things like payout ratios, debt metrics, and dividend streaks, we incorporate things like credit ratings, real-time bond market default risk estimates, and long-term risk management models from S&P that cover things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- occupational health & safety

- customer relationship management

- business ethics

- climate strategy adaptation

- sustainable agricultural practices

- corporate governance

- brand management

- interest rate risk management.

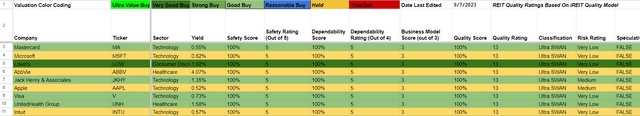

The 10 Companies with 100% Perfect Quality Scores: As Close To God's Own Companies As Exist

Dividend Kings Safety And Quality Tool

Here are the ten companies that score perfectly, wide-moat world-beaters that are most likely to survive not just a super pandemic but pretty much anything short of the actual apocalypse.

Of those, here are the ones that are a potentially reasonable buy today. I've linked to articles with more information about each company's investment thesis and risk profile.

- Mastercard (MA)

- Lowe's (LOW)

- Jack Henry & Associates (JKHY)

- Visa (V)

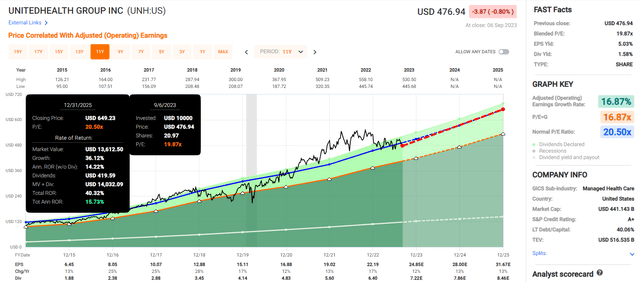

- UnitedHealth (UNH).

Fundamentals Summary

Dividend Kings Zen Research Terminal

- Yield: 1.2%

- Dividend safety: 100% (1% risk of cut during Severe Recession)

- Overall quality: 100% very low risk 13/13 Ultra SWAN

- Credit rating: A stable (1.45% 30-year bankruptcy risk)

- valuation: 12% discount vs. 15% S&P overvaluation

- growth consensus: 14.4%

- Long-term return potential: 15.6%

- 10-year valuation boost: 1.3% CAGR

- 10-year consensus total return potential: 16.9% CAGR = 377% vs 8.7% S&P = 130%.

Almost 3X the return potential of the S&P 500 and far superior valuation, dividend safety, and overall quality.

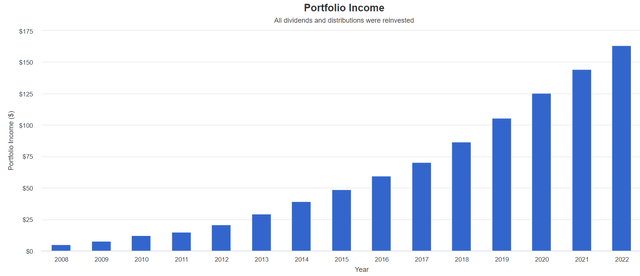

Total Returns Since 2008

Portfolio Visualizer Premium Portfolio Visualizer Premium Portfolio Visualizer Premium

26% annual income growth over the last 13 years.

2025 Consensus Total Return Potential

- If each company grows as expected

- and returns to market-determined historical fair value by the end of 2025.

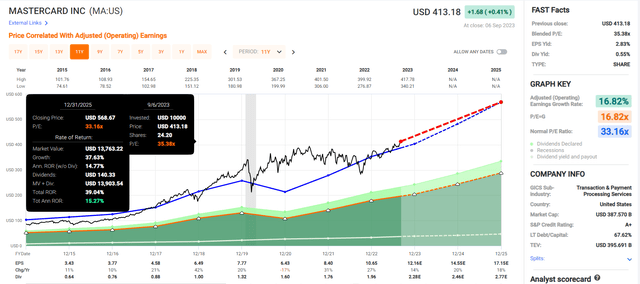

Mastercard Incorporated (MA)

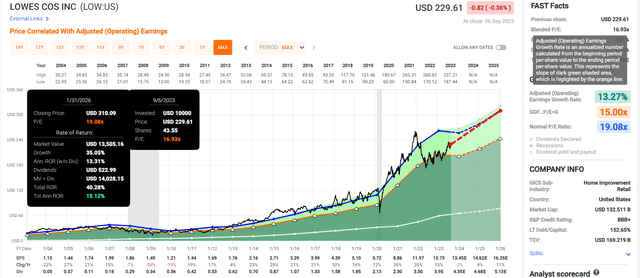

Lowe's Companies, Inc. (LOW)

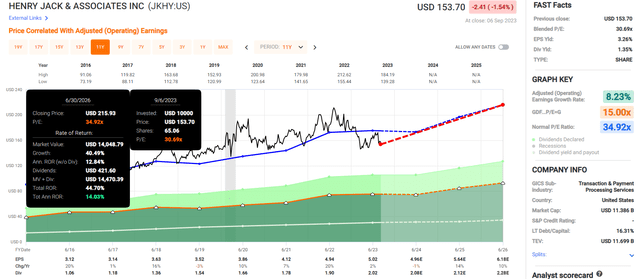

Jack Henry & Associates, Inc. (JKHY)

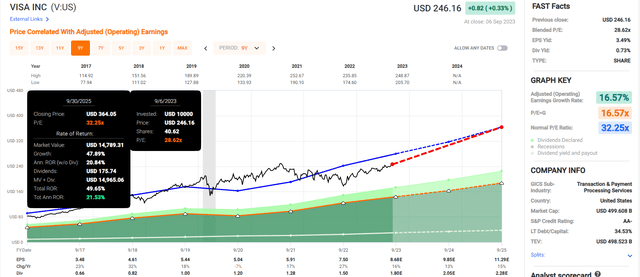

Visa Inc. (V)

UnitedHealth Group Incorporated (UNH)

SPDR® S&P 500 ETF Trust (SPY)

Bottom Line: Don't Fear The Reaper; Trust The World's Best Blue Chips To Protect Your Portfolio From The Coming Super Pandemic

It is only a matter of time before an avian flu virus-most likely H5N1-acquires the ability to be transmitted from human to human, sparking the outbreak of human pandemic influenza." - WHO.

Google

This is what Pandemic statistics look like. It could begin tomorrow; it could take 100 years. The actual virus might be half as deadly as the 1918 one (also thought to be Avian flu coming from ducks) or twice as deadly (WHO base-case).

We don't know many things, but we do know that tens of millions will die, possibly hundreds of millions.

Fear, terror, and panic will grip the world, and the stock market will likely crash into a Pandemic-style plunge.

While you can't count on any stock going up during such a panic (bonds and managed futures are your best bet for hedging), here is what I can tell you about protecting your portfolio from the inevitable avian flu pandemic.

- It may be swing flu that hits first.

The best Ultra SWANs, like MA, LOW, JKHY, V, and UNH today, will be fine in the coming super-pandemic.

These companies have the strongest balance sheets, best management, rock-solid risk-management plans, and often A, AA, or AAA-rated balance sheets.

Baring the actual apocalypse, a 2.5% probability according to Goldman's models, a diversified portfolio of world-beaters like these has nothing to fear.

Not from H5N1 or any other crisis that is surely lurking ahead of us in the coming years or decades.

When you trust the world's best companies with your money, you have the world's smartest people working hard for you so that one day you don't have to.

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my family's $2.5 million charity hedge fund

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MA, LOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (12)

The improvement in health is remarkable.

While you may not have been hours in the gym, you clearly continued to exercise.

Having already lost a large amount of weight and built muscle, a 2000 calorie a day diet is going to make a man lose weight.

When you switched diets to include vegetables and fruits, it continued your weight loss and improved the health of both of you greatly.

All this was worth writing about.

Thanks for the information.

However, linking it to a deliberately panic inducing article, that segued into which stocks will hold up in a pandemic…

Oh my….

Can u provide more details on starting weight, starting cholesterol, glucose, etc. Also, what "heart helth measure" where u and Dr. Using to suggest u were unhealthy after losing the 80 lbs on keto?I am health nut who uses keto/low carb... and swear by it

Thx