Fortinet: A Top Growth Stock That's No Longer Overvalued - Here's Why

Summary

- Fortinet stock has experienced a massive battering due to disappointing forward guidance and a deceleration in growth. However, you would have sold at its lows if you sold then.

- Buyers have returned to stem the recent slide, helping FTNT to recover remarkably well.

- FTNT boasts a best-in-class "A" growth grade, supported by its wide economic moat in networking and cybersecurity solutions.

- Its valuation has normalized below its 10Y average, offering investors who didn't chase its recent upside another opportunity to get in.

- I argue why growth investors shouldn't overlook the current entry levels as FTNT progresses toward a further recovery. Upgrade to Buy.

- I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

hapabapa

Fortinet Stock's Massive Share Plunge

It has been nearly a year since I initiated my coverage of leading cybersecurity solutions company Fortinet, Inc. (NASDAQ:FTNT). I assigned a Hold rating on FTNT in October 2022, broadly equivalent to a market-perform thesis. Accordingly, FTNT has performed largely in line, but still came in below the S&P 500's (SP500) recovery since my previous update.

To be clear, FTNT's recent massive battering with its disappointing forward guidance at its recent second-quarter or FQ2 earnings release contributed significantly to its recent underperformance. Despite that, I believe my previous thesis of FTNT as "far from being undervalued" makes sense, after all, suggesting that the market was overly optimistic. I cautioned investors that Fortinet's "growth could peak in 2022," corroborated by the company's updated guidance.

As such, the amended outlook suggests Fortinet expects to report revenue of between $5.35B and $5.45B for a midpoint guidance of about $5.4B. The revised consensus estimates align with the company's outlook as analysts penciled in an average projection of $5.4B, indicating a YoY revenue increase of 22.3%. While still remarkable for Fortinet, it indicates a substantial deceleration from FY22's 32.2% increase, justifying the recent battering.

Some cybersecurity investors have likely bailed out with FTNT's steepest decline in recent memory as they rotated to other "higher-growth" opportunities. The pessimism could also have spooked late buyers, as FTNT lost nearly 30% in that single fateful week in early August. As a result, FTNT fell back toward its early February 2023 lows in one week, knocking back about six months of meticulous buildup.

However, that's where dip buyers like me are interested in assessing an opportunity to turn more bullish, with "blood flowing in the street." Does it make sense? Let's take a look.

Fortinet's growth deceleration is not unexpected, as I had already cautioned it last year. As a result, buyers who didn't heed FTNT's valuation metrics likely didn't reflect such a possibility as they continued to chase its upward momentum. However, price action investors know that chasing momentum can be a dangerous game. It feels good when it's in your favor. However, when it swings hard and fast, the pain could be "unbearable," as seen in FTNT's hammering, causing a capitulation in its price action.

However, that capitulation has helped resolve its overvaluation over the past six months, returning it into a more reasonable zone. Accordingly, FTNT last traded at a forward EBITDA multiple of 29.1x, slightly below its 10Y average of 30.4x. It's also broadly in line with Palo Alto Networks (PANW) stock's 31.9x. Seeking Alpha's Quant valuation grade of "D-" suggests a premium valuation, in line with my expectations. I don't expect FTNT to generally trade in line with its SaaS peers, given its robust growth drivers, supported by the Quant's best-in-class "A" growth grade.

As such, I believe it makes sense for Fortinet's wide economic moat business model to deserve a premium grade as companies continue consolidating their vendors, given tighter enterprise budgets. Fortinet's ability to leverage networking and cybersecurity solutions places it in an enviable position compared to its non-networking or pure-play peers, affording it a sustainable competitive advantage. Even though Microsoft (MSFT) has attempted to disrupt the zero-trust space with its recent entry, it is not expected to create a dent against Fortinet's well-diversified hardware and software platform moat. Analysts' estimates remain confident of the company's growth drivers, underscored by the "A' growth grade relative to its peers.

Furthermore, I gleaned robust buying support at FTNT's recent August lows, indicating dip buyers have returned progressively to stem a further slide toward lower levels.

Is FTNT A Buy?

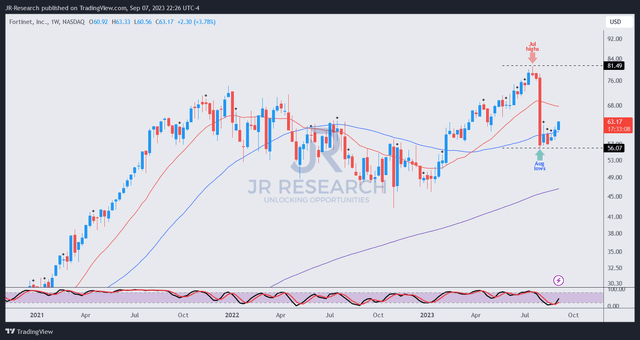

FTNT price chart (weekly) (TradingView)

As seen above, FTNT formed its early August lows after the post-earnings hammering and has not looked back. I assessed buying sentiment as robust, validating a bear trap (false downside breakdown).

As such, FTNT has continued to gain momentum on its upward recovery despite the volatility over the past week, suggesting robust buying support. Therefore, investors looking to add more exposure should consider capitalizing on FTNT's recovery before it moves higher (note that the current entry-level is no longer optimal but still constructive).

As such, I'm ready to turn bullish on FTNT, as I expect it to outperform the market from here.

Rating: Upgraded to Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn't? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Wang of JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore (NUS). NUS is also ranked among the top ten universities globally. I currently hold the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PANW, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (9)

Thanks as always