DLN: Keep It Simple Solution For Dividend Investors

Summary

- DLN is WisdomTree's well-diversified dividend-focused ETF with over $3.5 billion in assets. The ETF has a moderate 2.53% trailing dividend yield and a consistent track record over 17 years.

- Consistency is the main reason to own DLN. As this article demonstrates, well-diversified ETFs with low concentration of assets in the top 50 tend to be better long-term performers.

- While dividend growth and profitability aren't screens, DLN's 9.18/10 Profit Score is excellent. High quality is ensured because of its dividend-dollar weighting scheme, which assigns higher allocations to large companies.

- DLN is a solid dividend ETF, but iShares' DGRO looks better. It trades at a slightly cheaper valuation and has a better dividend growth and total returns track record.

- Income investors may also want to consider VYM and DIVB, which I estimate will yield about 3.20% at current prices. My fundamental analysis also compares all four ETFs on numerous metrics measuring volatility, growth, valuation, earnings momentum, and quality.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

matdesign24

Investment Thesis

Regarding single-fund solutions, the WisdomTree U.S. LargeCap Dividend Fund ETF (NYSEARCA:DLN) is one of the better options available for dividend investors. It's well-diversified with 300+ holdings across all size segments, has a moderate 2.53% estimated dividend yield, and has raised dividend payments by approximately 7% per year over the last five years. Importantly, it's consistent. From 2007-2023, it has never ranked in the bottom quartile in the large/all-cap dividend category. That's crucial, as the odds of you buying DLN at its top, at least relative to its peers, are slim.

While it's possible to design a portfolio of ETFs that can outperform, I've written this article with the single-fund investor in mind. Below, you'll find annual performance rankings for DLN and 19 other large/all-cap dividend ETFs and a detailed fundamental analysis that compares DLN with three additional well-diversified dividend funds. In the end, I hope you'll understand why I believe DLN is a solid, but perhaps not the best, solution for dividend investors.

DLN Overview

Strategy and Top Ten Holdings

According to WisdomTree, DLN is designed to gain exposure to U.S. large-cap dividend-paying stocks, complement or replace large-cap value or dividend-oriented strategies, and satisfy the demand for growth potential and income focus. In addition, dividend investors will appreciate DLN's monthly payments, which can decrease risk and supercharge dividend growth should an investor reinvest. For those with no immediate income needs, the more compounding periods, the better. To illustrate, a $10,000 initial investment in June 2006 would result in $571 in dividends in 2022 if you did not reinvest or $882 if you did. You can run different scenarios at this link by toggling the "Reinvest Dividends" flag between "Yes" and "No."

DLN tracks the WisdomTree U.S. LargeCap Dividend Index, comprised of the 300 largest companies ranked by market capitalization from the WisdomTree U.S. Dividend Index. Companies must meet the following criteria:

- listed on a U.S. stock exchange

- incorporated and headquartered in the U.S.

- pay regular cash dividends on shares of its common stock

- have a market capitalization above $100 million

- have an average daily dollar volume of $100K in the last three months

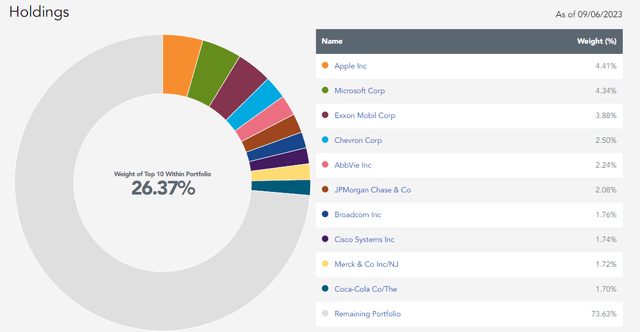

The Index is reconstituted each December, and securities that fall in the bottom 10% of a composite risk factor scored based on quality (trends in return on equity, return on assets, gross profits over assets, and cash flow over assets) and momentum (risk-adjusted total returns over the last six and twelve months) are excluded. While 10% may not seem high, I'm not overly concerned because companies that pay dividends normally can afford to do so. Also, the Index is dividend-dollar weighted, meaning a constituent's weight is determined by the product of its outstanding shares and dividends per share. As a result, larger and highly profitable companies have high weightings. We can see that by looking at DLN's top ten holdings list, which includes blue-chip stocks like Apple (AAPL) and Microsoft (MSFT).

WisdomTree

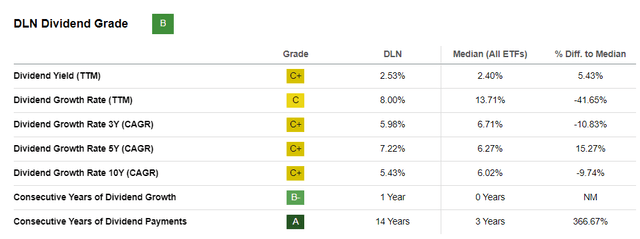

The downside to this weighting scheme is a lower yield. According to its Dividend Scorecard page provided by Seeking Alpha, DLN's trailing yield is just 2.53%. Furthermore, its 7.22% five-year dividend growth rate is just slightly above the median for all ETFs.

Seeking Alpha

In many ways, these average-looking metrics result from DLN's exceptional diversification. For example, it's easy to create a high-yielding portfolio when you only have to select 50 stocks, but DLN's 300 selections make it almost destined to be average. That's good for some investors who want to limit risk and take what the market gives them. However, you'll need a more focused approach if you hope to outperform the market consistently. Naturally, that strategy comes with greater risk.

Performance Analysis

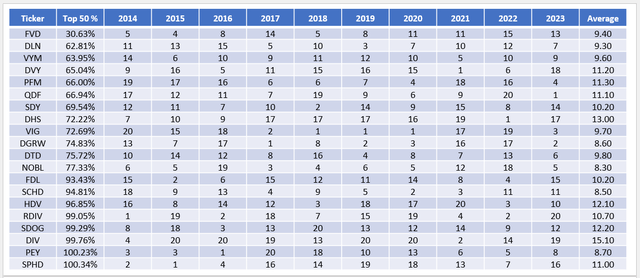

You may be wondering just how much more risk a focused approach entails. To illustrate, I gathered the annual returns from 2014-2023 for DLN and 19 other large/all-cap dividend ETFs and ranked them accordingly. The table below is sorted by the percentage of assets in the top 50 holdings, and as you can see, you're more likely to achieve an average or above-average result with better-diversified funds like DLN.

The Sunday Investor

The First Trust Value Line Dividend ETF (FVD) has only 30.63% of assets in its top 50 holdings and has a 9.40/20 average annual rank between 2014-2023, slightly above average. DLN's 9.30 average rank is marginally better, and notably, its rank range is tight. Its best year was in 2019, when it ranked #3 with a 28.91% gain, and its worst was in 2016 at #15, when it gained 15.51%. The Vanguard High Dividend Yield ETF (VYM) has a similar story.

While the relationship isn't perfect, it's evident you can run into trouble when holding highly concentrated ETFs over the long run. For example, at the bottom of the list, you'll find the iShares Core High Dividend ETF (HDV) with a 12.10/20 rank. While it was the third-best performer last year (predicted here), performance has been only average this year. I downgraded HDV in June 2022, and it has underperformed DLN since.

Seeking Alpha

Other examples are RDIV, SDOG, DIV, and SPHD, all below-average performers with virtually 100% of assets in the top 50. PEY appears to be an exception, but its 8.70 average rank is due to excellent returns from 2014-2016. That's not to say investors should avoid these funds, but they make better short-term tactical plays. In contrast, well-diversified ETFs like DLN are less risky and better for long-term investors.

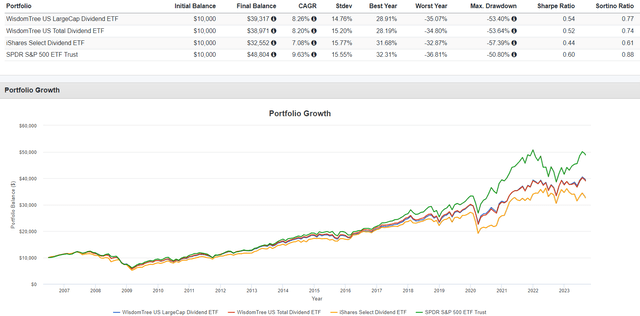

Since its June 2006 launch, DLN has gained an annualized 8.26% compared to 8.20% and 7.08% for the WisdomTree U.S. Total Dividend ETF (DTD) and the iShares Select Dividend ETF (DVY). DLN also had better risk-adjusted returns (Sharpe and Sortino Ratios). However, like most funds in the category, it underperformed the SPDR S&P 500 Trust ETF (SPY) by a sizable amount. Over the 17+ years, SPY outperformed by 95%.

Portfolio Visualizer

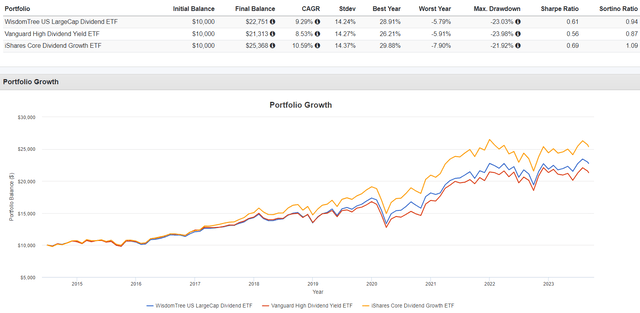

More recently, DLN has been reasonably competitive with other similarly well-diversified funds noted in the earlier table, including VYM. However, it's lagged behind the iShares Core Dividend Growth ETF (DGRO) by an annualized 1.30%, which includes about a 5% outperformance in 2017 and 2020. As shown below, its risk-adjusted returns were also stronger, and it offers a similar 2.39% trailing dividend yield. With 427 and a low 0.08% expense ratio, it's the most obvious alternative to DLN.

Portfolio Visualizer

DLN Analysis

Sector and Industry Exposures

The following table highlights sector exposure differences for DLN, DGRO, VYM, and the iShares Core Dividend ETF (DIVB). I have yet to mention DIVB, as its strategy substantially changed in December 2022. Like VYM, it's well-diversified and has a low expense ratio, so I included it for those looking for more yield.

Morningstar

One advantage of DLN and DGRO is that no sector accounts for more than 20% of the fund. DLN has 4.39% exposure to Real Estate, so not all distributed income is qualified. Still, as mentioned several times, the added diversification may attract investors looking for a single-fund solution. Compared to DGRO and VYM, DLN also overweights Technology (18.95%), though it's not excessive.

Fundamentals

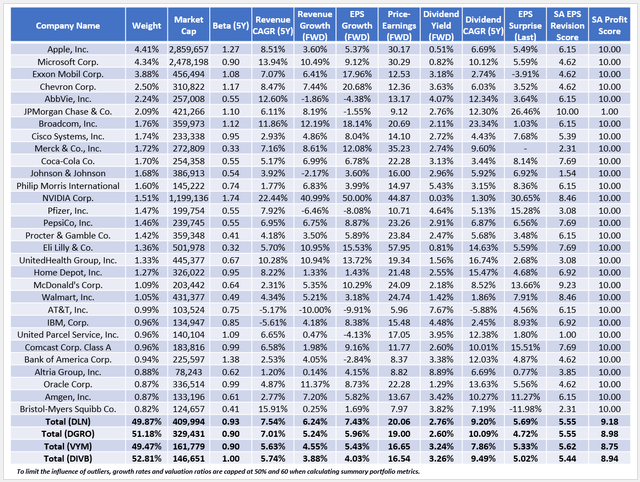

The next table highlights selected fundamental metrics for DLN's top 30 holdings, totaling 50% of the portfolio. DGRO, VYM, and DIVB have similar concentration levels, so all three are potentially good solutions.

The Sunday Investor

A few observations:

1. High weightings assigned to Apple and Microsoft drive DLN's valuation up, as the two stocks trade at 30x forward earnings. On a weighted average basis, DLN trades at 20.06x forward earnings compared to 19.00x, 16.65x, and 16.54x for DGRO, VYM, and DIVB. Notably, VYM and DIVB exclude these two stocks. Instead, VYM includes more exposure to Diversified Banks, which tend to trade at cheaper valuations, and DIVB overweights the Semiconductors industry at 13.29%. I downgraded the industry in June, reasoning the risk-reward was excessive.

2. DLN features a higher estimated sales growth rate (7.54%) and a higher estimated earnings growth rate (7.43%) than the three peers. The sources are numerous, but surprisingly, they aren't from industries with high P/E ratios. Instead, it's mainly Integrated Oil & Gas stocks like Exxon Mobil (XOM) and Chevron (CVX), which trade at about 12.5x forward earnings and offer about 20% estimated earnings growth. Given the volatile nature of oil prices, I don't know how reliable these forecasts are. DLN's 10.91% exposure to the broader Energy sector may be slightly too high, but it depends on your risk tolerance. For reference, DGRO offers the least exposure at 7.34%.

3. DLN's gross dividend yield is 2.76%, but after subtracting the ETF's 0.28% expense ratio, a 2.48% net yield is the best estimate. The net estimated yields for DGRO, VYM, and DIVB are 2.52%, 3.18%, and 3.21%, respectively. Therefore, DLN is the weakest on this metric because of its higher fee. On dividend growth, DLN's constituents have raised by an annualized 9.20% over the last five years, which is excellent. However, DGRO's growth is better at 10.20%, and the ETF has delivered better dividend growth over the previous five years (10.64% vs. 7.22%).

4. All four ETFs are of similar high quality, though DLN's 9.18/10 Profit Score is leading. Except for JPMorgan Chase (JPM), all top 30 holdings have perfect "A+" Seeking Alpha Profitability Grades. DLN's constituents also had the best earnings season last quarter, delivering a weighted average 5.69% earnings surprise. However, I caution all dividend investors that these figures are relatively low. SPY had an 8.56% weighted average earnings surprise and 8.00% in aggregate. By selecting dividend ETFs, you avoid the stocks that are powering markets lately, like Amazon (AMZN), which surprised Wall Street by 89.54% on earnings last quarter.

Investment Recommendation

I like many things about DLN, mainly that it's a consistent performer unlikely to perform in the bottom quartile in any given year. That feature makes it less risky from a market timing perspective, and over the last ten years, it has resulted in above-average performance. In contrast, it's the highly concentrated ETFs that tend to do poorly over the long run. With these ETFs, you have a chance at outperformance if your analysis proves correct, but that requires extra work and trading that might not be attractive for passive investors. DLN avoids that potential issue.

The main downside is that DGRO looks more attractive today. It's cheaper on forward earnings despite less Energy sector exposure and has a better dividend growth and total returns track record. As far as single-fund solutions go, that's my recommended route. Alternatively, you might find it beneficial to hold a portfolio of ETFs that score well on multiple factors. I've written on the benefits of combining Schwab's SCHD and SCHG here and Vanguard's VUG and VTV here. After doing some research, I think you'll find that two-ETF solutions like these are easy to customize and can offer even greater benefits than well-diversified funds like DLN. I hope this article was of some value to you, and as always, I look forward to answering your questions below.

The Sunday Investor Joins Income Builder

The Sunday Investor has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I perform independent fundamental analysis for over 850 U.S. Equity ETFs and aim to provide you with the most comprehensive ETF coverage on Seeking Alpha. My insights into how ETFs are constructed at the industry level are unique rather than surface-level reviews that’s standard on other investment platforms. My deep-dive articles always include a set of alternative funds, and I am active in the comments section and ready to answer your questions about the ETFs you own or are considering.

My qualifications include a Certificate in Advanced Investment Advice from the Canadian Securities Institute, the completion of all educational requirements for the Chartered Investment Manager (CIM) designation, and a Bachelor of Commerce degree with a major in Accounting. In addition, I passed the CFA Level 1 Exam and am on track to become licensed to advise on options and derivatives in 2023. In November 2021, I became a contributor for the Hoya Capital Income Builder Marketplace Service and manage the "Active Equity ETF Model Portfolio", which as a total return objective. Sign up for a free trial today! Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

He answered all of them.

I will let him know about you