Pfizer Vs. Gilead Sciences: COVID-19 Battle Of Pharma Titans

Summary

- Wall Street underestimates the prospects of Pfizer and Gilead Sciences, given their significant role in developing vaccines and medicines against COVID-19.

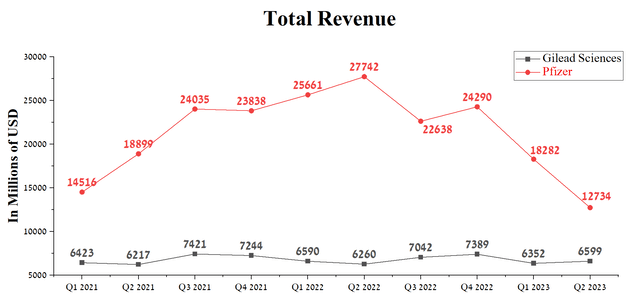

- Gilead Sciences' revenue has remained stable in recent quarters, unlike Pfizer, whose demand for COVID-19 products fell sharply in the first half of 2023.

- Comirnaty sales were $1,488 million in Q2 2023, down 51.4% from the previous quarter, due to declining public interest in vaccinations and a sharp drop in COVID-19 hospitalizations.

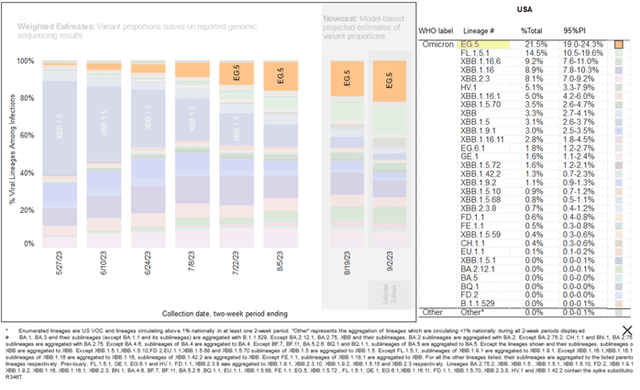

- According to the Centers for Disease Control and Prevention, as of August 19, EG.5 accounts for 21.5% of COVID-19 cases, up 2.9% from a week earlier.

- Unlike Pfizer, Gilead's portfolio of medicines is mainly focused on HIV treatment. As a result, this creates certain risks since its financial position depends on Biktarvy and Genvoya, whose combined sales account for 53.3% of Gilead's total revenue.

bojanstory/E+ via Getty Images

In the rapid spread of COVID-19 and the beginning of a new wave of mass hysteria caused by a sharp increase in hospitalizations, Gilead Sciences (NASDAQ:GILD) and Pfizer (NYSE:PFE) are at the forefront, each playing a pivotal role in the fight against this deadly virus. These two companies continue to play critical roles in transforming the healthcare sector by introducing next-generation medicines and vaccines, saving the lives of millions of patients around the world every year.

Both companies have dividend yields of over 4%, among the highest in the pharmaceutical industry. Furthermore, Gilead Sciences and Pfizer are actively pursuing robust research and development initiatives and engaging in M&A strategies to expand and diversify their pipelines of experimental drugs. Despite the challenges that Gilead Sciences and Pfizer faced in the first half of 2023, it is remarkable that their management maintained their margins at high levels.

At the same time, we believe that despite numerous medicine and vaccine approvals by the FDA and EMA in the first eight months of 2023, only one of these two mastodons is more promising in the long-term.

The financial position of Pfizer vs. Gilead Sciences and their prospects until 2030

Pfizer's revenue was $12.73 billion in the second quarter of 2023, down 30.3% from the prior quarter and missing analysts' consensus estimates by $0.66 billion. At the same time, total sales of Gilead Sciences products continue to remain stable and amounted to approximately $6.6 billion for the three months ended June 30, 2023. Moreover, the company's actual revenue beat analysts' consensus estimates in nine of the last ten quarters, two quarters more than Pfizer. As a result, this is one of the indicators suggesting a more significant underestimation of Gilead's prospects by Wall Street regarding the company whose vaccine and antiviral medicine played a crucial role in saving the world from COVID-19.

Source: Author's elaboration, based on Seeking Alpha

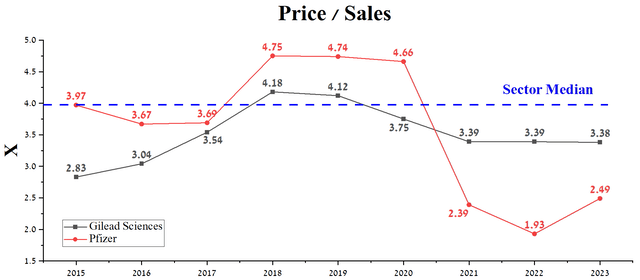

On the other hand, Pfizer's price/sales ratio is 2.49x, which is not only significantly less than the median for the healthcare sector but also 33.55% less than the average over the past five years. At the same time, financial market participants assess Gilead's business prospects more favorably, which is reflected in the higher value of this valuation metric relative to Pfizer. Some of the main factors that led to this situation are the relatively minor contribution of sales of COVID-19 products in Gilead's total revenue and the lack of pressure to update its portfolio of drugs and vaccines.

Source: Author's elaboration, based on Seeking Alpha

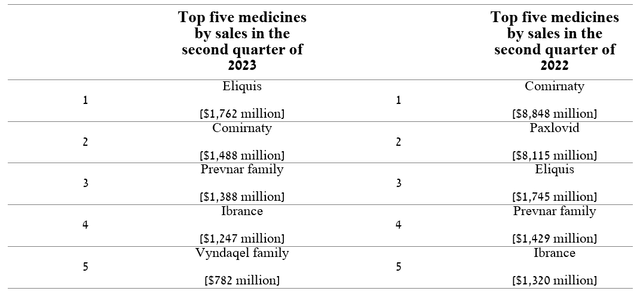

Pfizer and Gilead Sciences have extensive and well-diversified portfolios of medicines and vaccines, but not all of them are critical to the future growth of their businesses and increasing their market share in the highly competitive pharmaceutical industry. Thus, Pfizer's best-selling drugs in 2022 and 2023 were as follows.

Author's elaboration, based on quarterly securities reports

High rates of growth in sales of medicines such as Nurtec ODT/Vydura, Xeljanz, Zavicefta, and Bavencio were overshadowed by a temporary sharp decline in demand for COVID-19 products of the company in the first half of 2023.

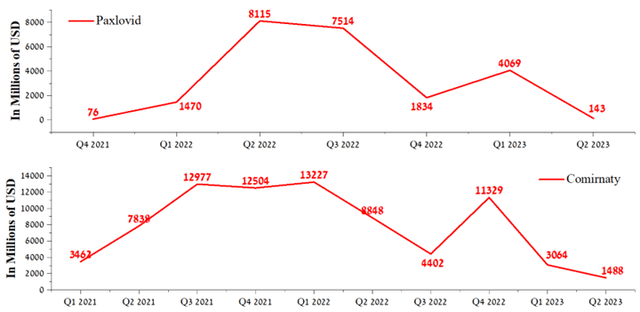

Comirnaty sales were $1,488 million in the second quarter of 2023, down 51.4% from the previous quarter due to declining public interest in vaccinations and a sharp drop in deaths from COVID-19. Paxlovid, which dominates the global COVID-19 therapeutics market, is facing weaker demand due to lower testing, resulting in fewer patients being identified with the deadly virus.

Author's elaboration, based on quarterly securities reports

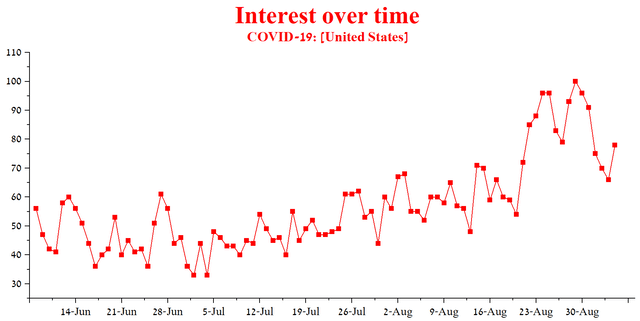

Recent weeks have seen an increase in Google searches for information about COVID-19, reflecting increased levels of fear and concern among Americans about spreading a new variant called EG.5, especially the imminent start of a new season of acute respiratory illnesses. We believe that people are starting to feel less comfortable and urgently need more information about the virus, which will trigger a new round of vaccinations, particularly among the older population.

Author's elaboration, based on Google Trends

According to the Centers for Disease Control and Prevention, as of August 19, EG.5 accounts for 21.5% of COVID-19 cases, up 2.9% from a week earlier.

Centers for Disease Control and Prevention

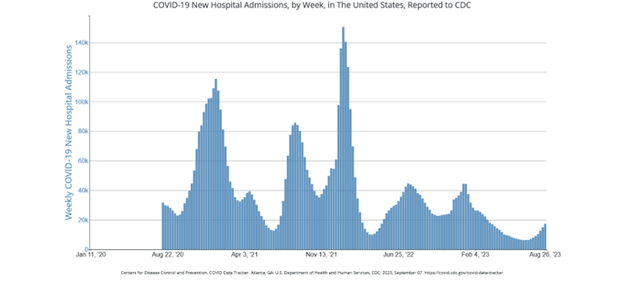

On August 26, 2023, the number of hospitalizations due to COVID-19 was 17,418, an increase of 15.7% from the previous week. Ultimately, this will not only lead to a rise in demand for Pfizer and Gilead products but also to a gain in the investment interest of financial market participants in these companies.

Centers for Disease Control and Prevention

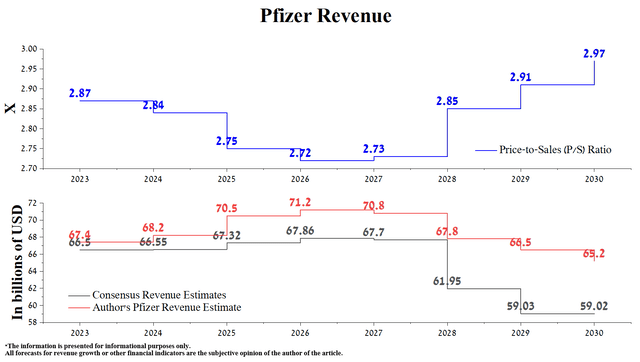

According to Seeking Alpha, Pfizer's revenue for 2023 is expected to be $61.9-$70.28 billion, which is 33.7% less than analysts' expectations for 2022. However, following our model, the company's total revenue will be slightly above the median value of this range and will be $67.4 billion, mainly due to stronger sales of the COVID-19 vaccine, OPKO Health's Ngenla (OPK) and Abrysvo.

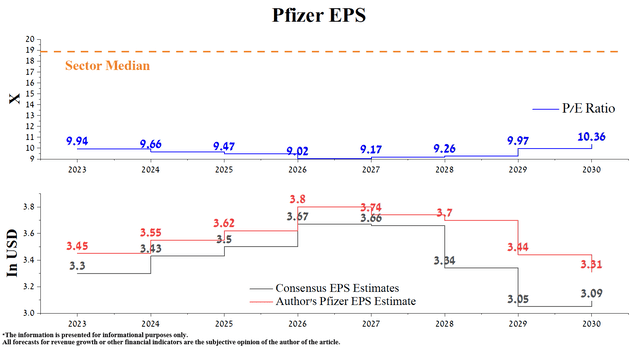

At the same time, Pfizer's earnings per share (EPS) for 2023 are expected to be $3.3, a decrease of 49.3% compared to the previous year. While we believe these are slightly lower expectations, our model predicts that Pfizer's 2023 EPS will reach the upper end of the company's financial guidance of $3.25-$3.45. Moreover, we expect the company's net income to continue to grow over the next three years, driven by synergistic effects following the anticipated closing of the $43 billion takeover of Seagen (SGEN) and the launch of next-generation medicines to combat cancer and immunological disorders.

Pfizer's Non-GAAP P/E [TTM] is 7.13x, which is 61.56% below the sector average and 38.57% below the average over the past 5 years. Additionally, the company's Non-GAAP P/E [FWD] is 10.41x, which is one of the factors indicating that the company is significantly undervalued relative to major competitors such as Merck (MRK), AbbVie (ABBV), and Gilead Sciences.

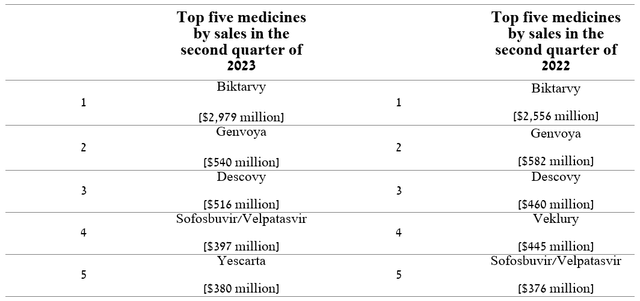

The period 2021-2022 has been marked as a remarkable and prosperous era for both Pfizer and Gilead, thanks to the massive chaos caused by the COVID-19 pandemic. On the other hand, Gilead Sciences' top-selling medicines in 2022 and 2023 were as follows.

Author's elaboration, based on quarterly securities reports

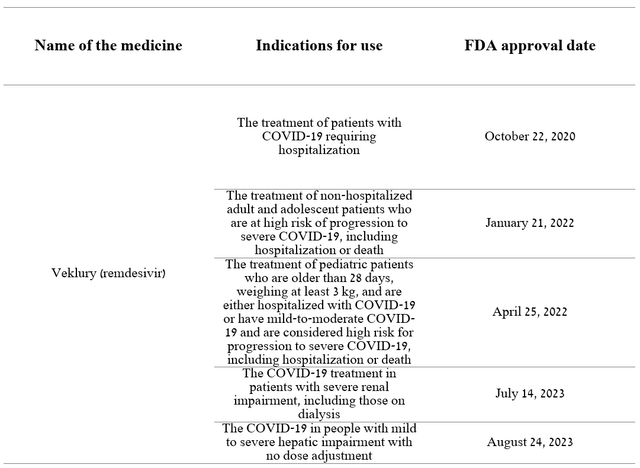

One of the company's best-selling drugs in 2022 was Veklury (remdesivir), approved by regulatory authorities in most countries worldwide for treating coronavirus disease 2019. However, sales of this Gilead product amounted to $256 million for the three months ended June 30, 2023, down 42.5% from the previous year.

Author's elaboration, based on quarterly securities reports

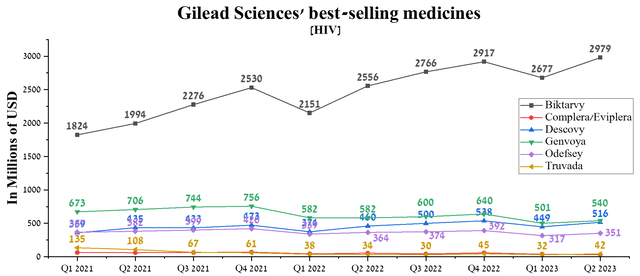

Since 2023, the situation has changed, and once again, the company's top-selling medications are those aimed at combating HIV, despite increased competition in the global market and declining sales of Truvada due to the launch of its generic versions. Gilead Sciences' flagship medicine continues to be Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide), whose sales totaled approximately $2.98 billion, an increase of 16.5% compared to the previous year.

Author's elaboration, based on quarterly securities reports

Unlike Pfizer, Gilead's portfolio of medicines is mainly focused on HIV treatment. As a result, this creates certain risks since its financial position depends on Biktarvy and Genvoya, whose combined sales account for 53.3% of Gilead's total revenue.

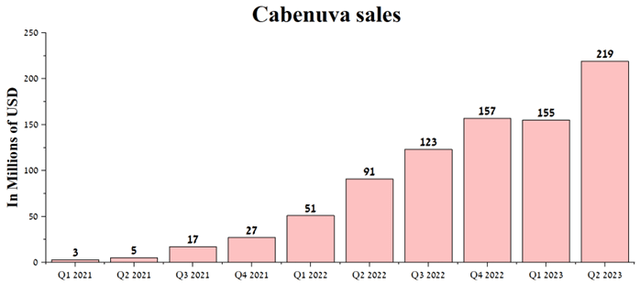

Despite the launch of Gilead Sciences' Sunlenca, a drug approved by the FDA and EMA for treating adults infected with human immunodeficiency virus type 1 and administered twice yearly, GSK's Cabenuva (GSK) remains Biktarvy's key competitor. This GSK product is a long-acting drug administered every two months and, like Biktarvy, significantly reduces the virus in the patient's body. However, due to less frequent injections and Cabenuva's better safety profile relative to Gilead's flagship, its sales have maintained a positive trend since its launch in early 2021.

Author's elaboration, based on quarterly securities reports

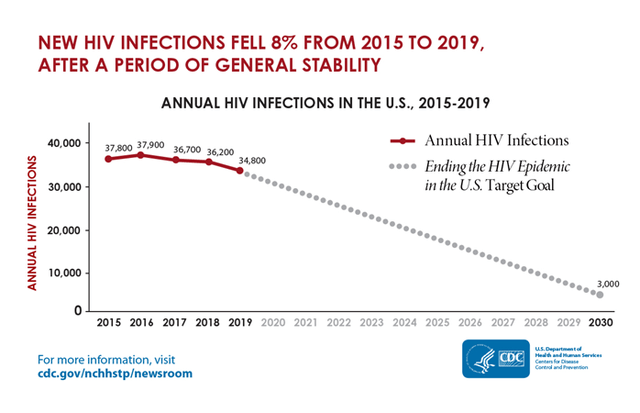

Another critical risk that could slow down Gilead's revenue growth is the reduction in the number of HIV infections in the United States. According to the Centers for Disease Control and Prevention, about 34,800 new cases of infection with this virus were identified in 2019, which is 3.9% less than in 2018.

Moreover, thanks to the intensive work of physicians and other healthcare workers, there are encouraging signs of progress in the fight against HIV over the past decades, and by 2030, their number may drop to 3,000 new cases. As a result, this will require Gilead's management to pursue a more aggressive M&A policy to reduce the share of HIV medicines in its portfolio, which could also increase the company's debt.

Centers for Disease Control and Prevention

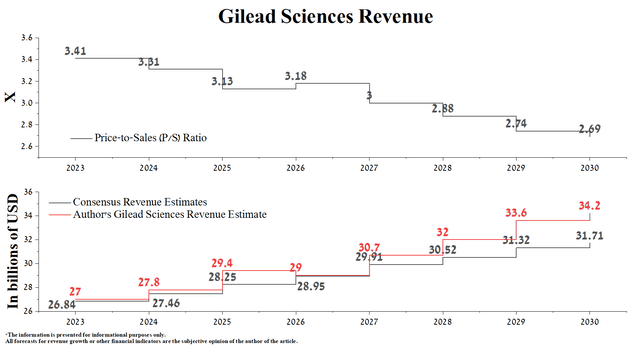

According to Seeking Alpha, Gilead's revenue for 2023 is expected to be $26.44-$27.27 billion, which is 1.2% more than analysts' expectations for 2022. At the same time, under our model, the total revenue of the leader in the treatment of HIV will be slightly higher than the median value of this range and will be $27 billion, mainly due to stronger sales of medicines for the treatment of chronic hepatitis C virus.

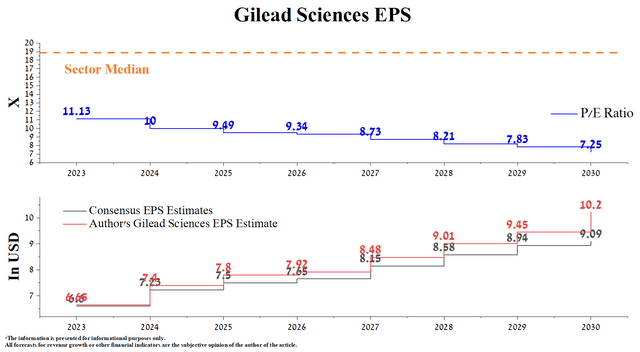

Simultaneously, Gilead Sciences' EPS for 2023 is expected to be in the range of $5.82-$6.8, down 7.7% from the previous year. On the other hand, we expect the company's 2023 Non-GAAP EPS to be slightly above the median of its guidance of $6.45-$6.8. Moreover, we expect Gilead's operating profit to grow in the coming years, driven by more robust demand for cancer drugs such as Tecartus, Yescarta, and Trodelvy.

Gilead Sciences' Non-GAAP P/E [TTM] is 11.82x, which is 36.27% below the sector average and 18.24% below the average over the past five years. Given the company's current share price of $73.94, our expected net income growth, and Daniel O'Day's use of a share repurchase program, its Non-GAAP P/E is expected to fall below 7.5x by 2030. As with Pfizer, this represents one of many indicators that Gilead is significantly undervalued during the pharmaceutical companies' fight against President Biden's Inflation Reduction Act.

Conclusion

As a new variant of COVID-19 spreads rapidly and global fears begin to rise due to a sharp increase in hospitalizations, Gilead Sciences and Pfizer have emerged as critical players in the battle against this lethal virus. These two titans remain among the key companies involved in transforming the healthcare sector by introducing next-generation medicines and vaccines, saving the lives of millions of patients around the world every year.

At the same time, the continued pessimism of financial market participants regarding the pharmaceutical industry after some of the parts of the Inflation Reduction Act began to enter into force creates conditions for considering Pfizer and Gilead Sciences as long-term investments. However, with a higher success rate in Phase 3 clinical trials, a more diversified drug portfolio, and the onset of a new wave of COVID-19, we believe Pfizer is a more promising asset for conservative investors.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OPK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)