DGRO Vs. SCHD: Which Dividend ETF Is The Better Buy?

Summary

- SCHD and DGRO are the two largest non-Vanguard ETFs focused on dividends in the US.

- Overall, SCHD has lower expenses, a more focused portfolio, a higher yield, and stronger historical dividend growth than DGRO.

- By these metrics, DGRO looks less attractive than iShares' older, smaller, and more expensive DVY, but higher expenses likely drove assets to DGRO.

- I believe iShares has competitive advantages in many categories, but dividend ETFs do not seem to be one of them.

- I do much more than just articles at The Expat Portfolio: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

PM Images

Investors seeking dividend income in the form of a simple ETF, rather than by directly buying dividend stocks, should periodically review the choice of which dividend ETF is the best one to buy with that month's savings. This article continues a series of ETF comparisons this year where I so far reviewed the best Vanguard ETFs to buy, how Vanguard's US vs international dividend ETFs compare, and how Vanguard's flagship S&P 500 ETF compares with the Schwab US Dividend Equity ETF (NYSEARCA:SCHD). In this article, I wanted to step away from Vanguard and instead compare SCHD to the largest dividend ETF from Blackrock iShares: the iShares Core Dividend Growth ETF (NYSEARCA:DGRO). SCHD and DGRO are now the two largest non-Vanguard ETFs focused on dividend stocks. This article compares SCHD vs DGRO on N metrics:

SCHD vs DGRO: Expenses

SCHD is slightly cheaper than DGRO, but this is a relatively minor difference at 0.06%/year versus 0.08%/year. The SeekingAlpha Quant Ratings of both SCHD and DGRO currently give both ETFs an "A+" for expenses.

Round 1 Winner: SCHD, but only by 2 basis points

SCHD vs DGRO: Relative Popularity

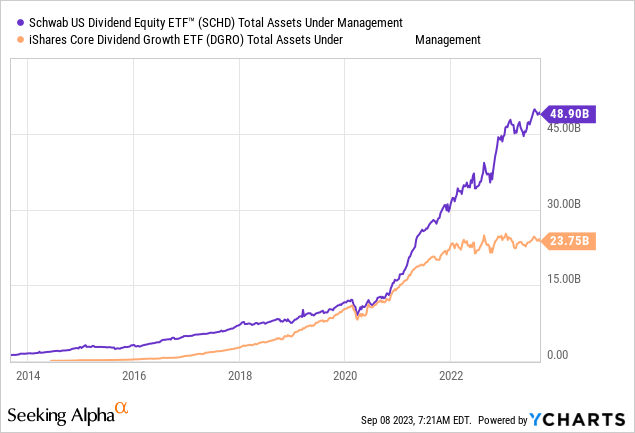

A second factor many ETF buyers consider in choosing one ETF over another is which one "everyone else" is buying. Here, it is worth noting how aggressively DGRO's assets under management was catching up with SCHD's up until 2020, but since 2020, SCHD has raced ahead to now holding more than double DGRO's assets. It is difficult to tell how much of this is due to the relative distribution capabilities of Schwab versus iShares, but I think the next point about portfolio construction was significant in making SCHD a relative favorite. Another statistic I would point out is that as of this writing, SCHD has over 70,000 followers on SeekingAlpha, while DGRO only has around 17,000.

Round 2 Winner: SCHD

Portfolio Balance

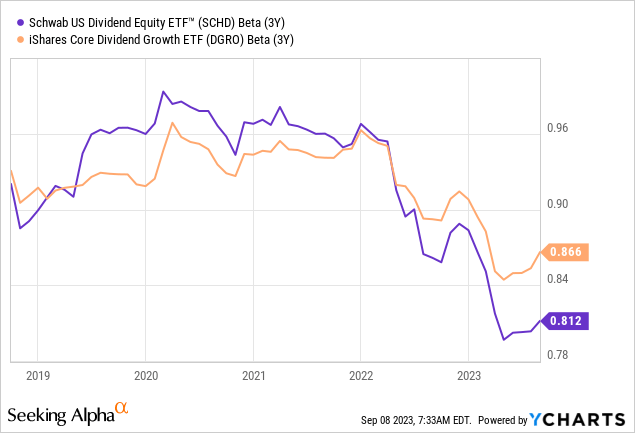

The factors of expenses and fund size mostly matter to me just so that I can make sure I'm not paying too much, and that I don't face too much of a risk of a fund closing on me. The next, and arguably most important, factor I believe investors should look at when deciding whether one ETF is better than another is what the ETF actually holds. Here my comparison starts to get a bit more subjective, since I am comparing each of these dividend stock portfolios to what my ideal dividend stock portfolio looks like, which is an equally-weighted portfolio of 25-50 dividend stocks balanced across industries and countries. Both SCHD and DGRO are focused only on US large caps, with SCHD's largest holding being 4.5% in Cisco Systems, while DGRO's largest holding is 3% in Microsoft (MSFT). This makes both ETFs less top-heavy than the S&P 500, which currently has over 7% in Apple (AAPL), though still more concentrated in these top names than an equal-weighted portfolio of 50 or fewer stocks. This top-heaviness is despite SCHD holding about 100 names, and DGRO more than 400, which is more diversification than I believe most dividend investors need. The below chart compares the relative diversification of SCHD vs DGRO using a simple 3-year rolling beta, which I am glad to see remain below 1.0, but does not clearly show one as being consistently more diversifying than the other.

While this round could be considered a tie, or even a slight win for DGRO given the lower weight of its top holding, I'll actually give this round to SCHD for its choice to limit its portfolio to just 100 stocks. DGRO's advantage in holding 400 stocks might be better realized if it capped the weight of each holding to around 1% or so.

Round 3 Winner: SCHD

SCHD vs DGRO: Yield

Since SCHD and DGRO are ETFs investors mostly buy for dividends, one important metric for comparing the two would of course be their relative dividend yields. Here, SCHD again comes out a clear winner, with its current dividend yield over 3.5% being more than a full percentage point more than DGRO's 2.4%.

Round 4 Winner: SCHD

SCHD vs DGRO: Dividend Growth

DGRO's lower dividend yield might be justified by investors buying it with the expectation that DGRO's dividend may grow at a faster rate than SCHD's in the future. So far, it has been SCHD that has delivered the higher historic dividend growth, with CAGRs on its dividends for each year from 2012 to 2022 being over 11% per year, while similar CAGRs on DGRO's dividend since 2015 have all been below 11%. This is of course the past, and looking at the top two holdings, an investor might prefer Microsoft's 0.8% yield over Cisco's 2.7% yield with the expectation that Microsoft might have better growth prospects. I tend to be a bit more cautious about paying up (=accepting a lower yield) for hopes of higher growth, especially on a portfolio that has delivered lower growth so far, so I'll declare SCHD the winner in the dividend growth category.

Round 5 Winner: SCHD

Conclusion

This may have been a relatively boring 5-round comparison to read given that SCHD won every round, but even if you disagree with my judgement on one or two of the categories, I see it hard to find enough factors to tilt the balance in DGRO's favor. Between these two ETFs, SCHD is simply cheaper, more popular, more focused, higher yielding, and has shown it can deliver higher dividend growth. The bigger question in my mind is not why SCHD is so much better, but rather, how DGRO managed to raise and maintain over $23 billion in assets under management versus alternatives that seem so clearly better. I attribute some of this to iShares much more extensive product line, model portfolios, and informative website, which all go a long way in making DGRO a good enough choice for dividend growth for investors already familiar with the iShares ecosystem. According to the parameters I chose above, a better competitor against SCHD might have been iShares's 2nd largest dividend ETF: the iShares Select Dividend ETF (DVY). DVY is a more focused and better balanced portfolio of only around 100 stocks, like SCHD but with an even lower top holding weight of 2.5% in Altria, and would compete better in these rounds with a 3.8% dividend yield. The main reason I didn't compare DVY here is because of its much higher expense ratio of 0.38%, which was likely a main reason DGRO surpassed DVY in assets under management to become iShare's biggest dividend ETF in 2020. So in the category of US dividend ETFs with low expense ratios, I declare SCHD the clear winner over DGRO.

Join The Expat Portfolio, where we apply lessons from decades of market history across global markets to better identify companies more likely to sustain high rates of dividend growth well into the future. Start your free trial today!

This article was written by

Tariq Dennison TEP runs a registered investment adviser focused on helping global citizens invest internationally. His marketplace service "The Expat Portfolio" shares his on-the-ground experience as an expat investing in diverse foreign markets. Tariq is the author of the book "Invest Outside the Box" and soon-to-be-released "10 Ways To Invest". He lives in Switzerland, and has worked in Hong Kong, Singapore, Finland, the UK and Canada.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.