Coca-Cola Europacific Partners: Outlook Just Got Brighter With The CCBPI Acquisition

Summary

- CCEP delivered impressive 2Q results, reflecting resilient consumer demand and improved cost environment.

- CCEP's acquisition of CCBPI positions it for long-term growth in a rapidly expanding market.

- The transaction is expected to enhance earnings immediately and create synergies through knowledge sharing and best practices, justifying a "buy" rating.

Chinnachart Martmoh

Investment action

I recommended a buy rating for Coca-Cola Europacific Partners (NASDAQ:CCEP) when I wrote about it the last time as I expected the start of Europe's crucial summer selling season to drive positive performance, and if elasticities hold, there may be room for better-than-expect revenue and profit growth. Based on my current outlook and analysis on CCEP, I recommend a buy rating. CCEP has delivered impressive 2Q results, reflecting resilient underlying consumer demand. The commodity inflation environment has improved, which translates to moderating COGS/unit case growth and achieving greater operating leverage in 2H. In addition, by acquiring Coca-Cola Beverages Philippines [CCBPI], CCEP will expand and extend its reach into the Philippines, which is a fast-growing market with large total addressable market [TAM].

Review

CCEP delivered impressive 2Q results with a 5.5% growth in revenue, exceeding consensus estimates both in terms of top-line and bottom-line performance. This achievement reflects robust underlying consumer demand, particularly in developed markets, echoing similar positive trends observed in Coca-Cola's (KO) recent reports. Additionally, an improved cost of goods sold [COGS] environment played a role in this success.

On the cost side, there has been a notable improvement in the commodity inflation environment, with expectations for commodity inflation in FY23 reduced from around 10% to approximately 8%. This reduction should lead to a slowdown in COGS per unit case growth. Combining this with CCEP's continued commitment to productivity and cost efficiencies, I expect CCEP to experience greater operating leverage 2H compared to 1H. This is facilitated by the low elasticity of demand for CCEP's products, allowing for price adjustments without significant impacts on sales volume.

CCEP also announced that it, in partnership with Aboitiz Equity Ventures Inc. (OTCPK:ABOIF), has entered into a letter of intent to jointly acquire 100% of KO's ownership of CCBPI. This aligns with KO's strategy to divest its bottling operations. If finalized, this transaction is expected to close by year-end and is anticipated to immediately enhance earnings.

Considering CCEP's strong financial position, characterized by robust free cash flow (with a CAGR of approximately 45% over the past two years) and a substantial cash reserve of $1,819 million, the acquisition is not anticipated to have a significant adverse impact on CCEP's balance sheet. This confidence stems from the company's ability to generate healthy cash flows and management's expectation that they will return to their targeted debt-to-EBITDA levels within the next two years. Hence, the acquisition is unlikely to pose any significant risk to CCEP's financial standing.

In my opinion, the proposed transaction is strategically beneficial to CCEP. With CCBPI, I believe it positions CCEP for long-term growth by entering a new market with favorable macroeconomic and category trends. The Philippines' non-alcoholic ready-to-drink [NARTD] market is large and rapidly expanding, with an expected annual growth rate of 5.62% (CAGR 2023-2027). For comparative sake, the 5.62% is higher than the overall historical growth rate of CCEP, hence it is growth accretive. The country is also a developing and fast growing one with GDP growth of ~6% historically, driven by a large population (Philippines is the 13th most populous country globally). Hence, the exposure to Philippines offers a compelling growth opportunity. Moreover, CCEP stands to gain from the combined expertise, knowledge sharing, and best practices of both companies, including leveraging insights from the Amatil acquisition, supporting transformation in Indonesia, optimizing digital capabilities, and strengthening its relationship with KO. Overall, I expect the successful transaction will drive substantial top and bottom-line growth.

CCEP's strong momentum in its business, along with its leading position instills confidence in me that it will continue grow. The proposed acquisition of KO's Philippine bottler is strategically sound, potentially creating long-term value and accelerating CCEP's growth and profitability. The transaction appears to have limited downside risk with significant upside potential, given CCEP's track record of successfully integrating KO bottling territories. Consequently, this makes me believe that there is a compelling risk/reward profile, and a "buy" rating is maintained, considering CCEP's increased visibility and strong execution, even in a challenging environment.

Valuation

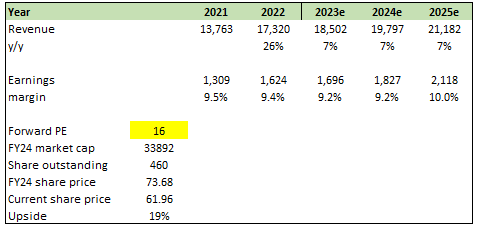

CCEP's impressive second-quarter results, driven by resilient consumer demand, a more favorable commodity inflation environment, the announced acquisition of CCBPI granting access to the rapidly growing API market, and their robust pricing power, have led my model to incorporate more optimistic growth projections and margin expectations compared to the consensus. I firmly believe that these achievements are attainable, given the strengths I've highlighted.

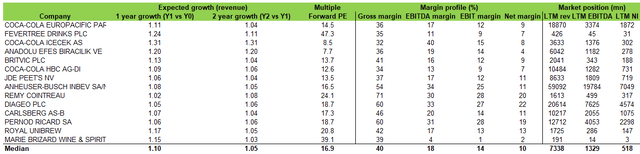

Regarding margins, I anticipate that the price increases will yield substantial incremental margins, with cost inflation growing at a slower rate. This is expected to result in a net margin of approximately 10%. In terms of valuation, I believe if CCEP delivers the results I've forecasted, the market will assign a higher forward PE multiple to the company due to its outstanding execution. When compared against other beverage players in the EU, CCEP is trading below its peers. This further strengthens my belief that CCEP will trade at higher PE (closing the gap vs peers) if it exceeds future expectations.

Risk & final thoughts

CCEP faces several significant risks that could impact on its operations and financial performance.

- Input Cost Volatility: CCEP relies on raw materials, packaging, and energy, and any significant cost increases could erode profit margins, even if price adjustments and cost-saving measures are implemented.

- Product Innovation Uncertainty: While CCEP continually introduces new products to meet consumer demands, there's no guarantee of success. If innovations fail to gain market traction, it may struggle to offset rising input costs.

- Pandemic Uncertainty: CCEP is susceptible to the ongoing pandemic's effects, especially if COVID-19 resurges, leading to extended closures of bars and restaurants - key distribution points for its products.

- Economic Recessionary Pressures: Economic downturns often result in reduced consumer spending. If consumers cut back on non-essential purchases during recessions, CCEP's products may see decreased demand, impacting its revenue.

- M&A Integration Challenges: Acquisitions, like CCBPI, bring integration risks. Ineffective merging of operations and cultures can disrupt efficiency and profitability.

I maintain a buy rating. The company has delivered impressive 2Q results, driven by robust consumer demand and an improved cost environment, suggesting a positive outlook for FY23. CCEP's strategic acquisition of CCBPI positions it for growth in a large and rapidly expanding market. The Philippines' non-alcoholic ready-to-drink market offers substantial growth potential, complementing CCEP's expansion strategy. The transaction is expected to enhance earnings immediately and create synergies through knowledge sharing and best practices. CCEP's strong business momentum, coupled with its leading position, instills confidence in its continued growth. With increased visibility and a favorable outlook, a "buy" rating is justified, especially if CCEP exceeds future expectations and narrows the valuation gap with its peers in the beverage industry.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.