Dominion Energy: Enbridge Deal Sets The Table

Summary

- Dominion Energy is in the midst of asset sales and restructuring. Meanwhile, YTD, the stock has fallen by 25%.

- On September 5, the company entered into a $14 billion deal with Enbridge to sell three gas distribution businesses.

- In this article, I attempt to model the financial outcome to see how the asset sales may affect the company and its investors. I was surprised at the results.

- The dividend appears sustainable, but that doesn't guarantee it.

JHVEPhoto

Introduction

Dominion Energy stock (NYSE:D) has seen better days. After peaking at around $80 a year ago, the stock began a series of asset sales, restructuring work, and cut the dividend. Management has been heavily criticized over the dividend reduction and initiating the Coastal Virginia Offshore Wind project.

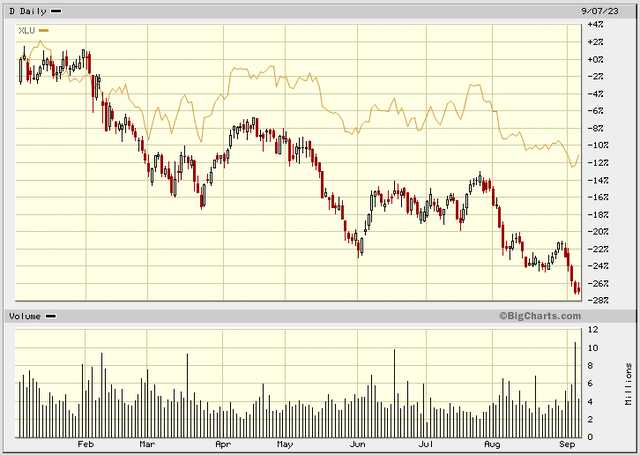

I was constructive on the shares in January. Since then, the stock has fallen from ~$60 to $45. The 25% plunge is greater than the Utilities Select Sector SPDR Fund (XLU) 11% dive.

Dominion Energy and SPDR Utilities Fund -- YTD prices

No bueno.

Nonetheless, I remain constructive on D shares. My view is we are near the point of maximum investment pessimism / capitulation. For those with dry powder, it may be a significant opportunity in a stock sector that tends to be dry and sleepy.

Purpose of This Article

The focus of this article is the $14 billion Dominion Energy/Enbridge Inc (ENB) deal whereby Dominion agreed to sell three gas distribution businesses to Enbridge. An announcement was made on September 5.

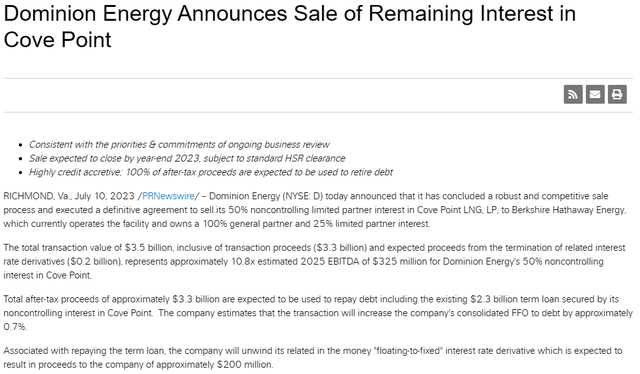

This transaction comes on the heels of a $3.5 billion deal enacted on July 10 whereby Dominion sold its remaining interest in the Cove Point LNG facility to Berkshire Hathaway. That deal closed on September 1. In addition to $3.3 billion post-tax cash, Dominion received another $0.2 billion on the settlement of interest rate derivatives associated with Cove Point.

Using available data, I seek to perform a "cold eyes" review to determine these asset sales impact upon Dominion Energy financials.

2023 Dominion Asset Sales: A Catalyst?

On September 5, Dominion Energy and Enbridge Inc agreed to a $14 billion natural gas asset deal that changed the face of both companies. A July 10, $3.5 billion agreement with Berkshire Hathaway sold Dominion's interest in Cove Point LNG.

Upon closing, these deals impact Dominion Energy's:

debt leverage

earnings and cash flow

cash dividend

Management telegraphed these asset sales in conjunction with a strategy to simplify the business, concentrate upon the regulated electric business, and improve the balance sheet.

Could these major moves become a catalyst for Dominion shares to stabilize?

Divestiture Overview

Before delving into the numbers, I encourage readers to familiarize themselves with the basics of gas distribution companies and Cove Point LNG transactions.

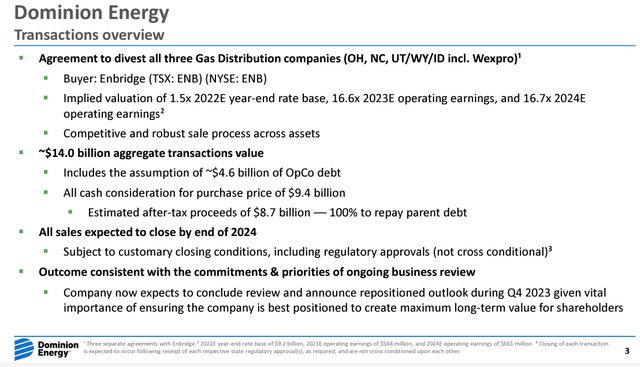

The following slide highlights the September 5 gas distribution asset sale:

Dominion Energy investor website

Here are the highlights of the July 10 Cove Point LNG sale:

Dominion Energy investor website

For info, input figures used to calculate FFO / debt may be found via the Dominion Energy investor website or associated SEC filings.

Let's get to work.

Impact Upon the Balance Sheet

A key tenant of Dominion Energy's management strategy seeks to shore up the business's credit profile. The current BBB+ rating is stable.

When measuring debt leverage, Dominion management highlights FFO / debt.

FFO is "Funds From Operations," a cousin to Operating Cash Flow. FFO highlights cash generated from core operations. FFO is a non-GAAP measure. It may be determined several ways. A typical calculation starts with operating earnings, adds back depreciation / amortization, then subtracts non-operating income and losses. I followed this prescription.

At year-end 2022, I calculated D had a 12.6% FFO / debt ratio.

Management targets a ~14 percent ratio.

Let's check 2023. Per the news release, the Cove Point asset sale was expected to close by the end of 2023. It ended up closing on September 1. The proceeds will be used to reduce debt by $3.3 billion and is expected to improve YE 2023 FFO / debt by 0.7 percent.

Through the first half of 2023, Dominion generated $1.97 billion FFO. For the second half of the year, I expect the company to record another $2.28 billion. This is based upon the company recording $3.26 operating EPS. Estimated full-year FFO is $4.25 billion.

Current total debt is $48.6 billion. The Cove Point LNG close permits $3.3 billion debt reduction, leaving $45.3 billion left by the end of 2023.

Therefore,

YE 2023 FFO / debt = 4.83 / 45.3 = 10.6%

Note: management indicated the ratio would be improved by ~0.7 percent post-Cove Point. Without adjusting for Cove Point, the FFO / debt ratio would be 9.9 percent. Indeed, the asset sale appears to improve the ratio by 0.7 percent.

Looking ahead to FY2024, Dominion's press release offered some clues about the years' FFO.

We know the $8.7 billion after-tax proceeds from the gas distribution facilities will be used to pay down debt. We also know Enbridge will assume an additional $4.6 billion OpCo debt. Therefore, Dominion plans to reduce total debt by $13.3 billion. Total 2023 debt should settle around $45.3 billion; in turn, 2024 total debt should be reduced to $32.0 billion flat.

In addition, management indicated FFO / debt would improve by 3.4% post-closing. Pegging 9.4% at YE 2023 and adding the expected improvement, investors may see the YE 2024 ratio rise to 12.6 percent.

Therefore,

Forward 2024 FFO / debt = 12.6%;

total debt is expected to be $32.0 billion;

Solving for FFO, we get $4.1 billion.

Bottom line:

I estimate 2024 FFO should ease by ~$150 million versus 2023, while total debt is reduced by a third to $32.0 billion. After the dust settles, the FFO / debt ratio is likely to approach management's 14% target.

Impact to Cash Flow and Earnings

Operating Cash Flow

At the end of 2022, Dominion Energy recorded $3.70 billion GAAP operating cash flow.

Through mid-year 2023, the company recorded $3.19 billion OCF. By year-end, I expect D to generate about $5.0 billion cash flow. Most of the YoY improvement is due to a significant rise in non-operating income. Strong interest income and investment returns versus 2022 may create upwards of a $1.2 billion delta by the end of the year.

In 2024, operating cash flow should ease as a result of the asset sales. While I do not have a detailed model for 2024 results, I may hazard a $4.5 billion OCF forecast.

Earnings

Turning to earnings, in FY2022 D recorded $4.11 EPS. Dominion management hasn't provided 2023 earnings guidance. Recent Street estimates suggest D operating earnings will be $3.26. Next year, forecasts call for $3.53 EPS. Management will provide guidance at the 4Q 2023 investor conference. The event date has not been announced yet.

Impact to the Dividend

Where is the cash dividend going to land?

Currently, the question is unanswerable, but the data paints a picture.

In the previous section of this article, defensible operating cash flow estimates were provided. Converting the 2023 and 2024 estimates into OCF / share, we obtain $5.95 and $5.35, respectively. I presumed the number of diluted shares outstanding remains constant. However, these are just reference points. Given the economics of regulated utilities, nearly all operating cash flow is consumed by capital expenditures.

So, let's turn to earnings.

CFRA (S&P) 2023 consensus EPS estimates call for ~$3.26. For 2024, the estimate is $3.53 a share. CFRA put out these earnings forecasts on September 6. The asset sales are baked in.

The current cash dividend requires about $2.25 billion a year. The current dividend payout is $2.67 a share annualized.

Management stated their commitment to the current 2023 payout. But what about 2024?

On one hand, presuming the CFRA estimate is reasonably accurate, the 2024 dividend payout ratio would be ~74 percent. This is elevated, but not unreasonable for a utility stock.

On the other hand, the Street is indicating the dividend is at risk. The current 5.75% yield is a yellow flag.

Management has not offered comments about the dividend beyond 2023, though I expect this will be addressed during the 4Q investor conference.

My take is there is a reasonable probability the payout may be reduced (reset) but only modestly. The data appears to suggest Dominion management could sustain the current dividend, but I cannot state with confidence they will.

A large cut is likely to tank the stock altogether. That would surprise me. A small "reset" cut may chase away some investors; however, the removal of the uncertainty swirling around the shares should attract others. If the dividend is simply maintained, I expect Dominion stock to rise.

A Word About ESG

This article's discussion has to do with Dominion Energy's pending asset sales, cash flow, debt profile, and the dividend.

However, I would like to add a few words about the ESG (Environmental, Social, and Governance) issues and Dominion management.

When it comes to regulated utilities, I am ambivalent about ESG. I'm interested in earnings, cash flow, and the balance sheet. IMHO, good investors don't mix their politics and investing. They're bad bedfellows.

Regulated utilities are permitted stipulated rates of return by Public Utility Commissions or other such regulatory bodies in consideration for operating an effective monopoly. Typically, PUC commissioners are appointed by the State, meaning politicians appoint them. Utility management must present information supporting ratemaking requests to the Commission. Rates are not market-based, since there's no free and open market: for customers, the utility is often the only game in town.

I don't much care by what means a regulated utility generates electric. Whether it be natural gas, nuclear, or a windmill, I just want to know if the PUC approves the project and what return is allowed.

It's not clear to me how it's in a utility management's interest to argue with the State's legislature and PUC appointees about what form of energy generation should be built. If State elected officials choose to move towards renewables, then electric utility management teams are wise to lean towards renewable energy sources. For what purpose would management cut against the grain and propose hydrocarbon projects (or reject renewable power generation) when elected political officials of the State seek otherwise? How would that be in the interests of the company or its shareholders?

It seems to me management should be focused upon public and employee safety, provide reliable service, and obtaining rates acceptable to produce adequate capital returns to shareholders.

Conclusion

Presuming the aforementioned figures are reasonably accurate, the resultant of Dominion Energy's recent asset sales appears to be a net positive.

Cash from the divestitures should lower total debt by a third: from $48.6 billion to $32.0 billion. This strengthens the balance sheet materially and has the propensity to lead to a credit rating upgrade. It may also reduce current interest expense by as much as $0.75 billion.

Asset sales are likely to impact net operating cash flow, but only modestly.

Operating EPS may be expected to decline from $4.11 in 2022, to $3.26 this year, and rebound to $3.53 in 2024.

The current $2.67 annualized cash dividend is covered at 74% by 2024 estimated earnings per share; though management has not confirmed the payout will be maintained past 2023.

At $45 a share, D stock is interesting. For those without a position and a constructive interest in the company, it may be a good time to start one. For those with a partial position, adding to it may be considered. I plan to watch events and trading volume leading up to the 3Q 2023 earnings release. For those with a full position already, my inclination would be to hold.

I believe the stock is likely to experience a pronounced move after management offers a strategy update and forward guidance during the anticipated 4Q 2023 investor conference.

Hedging strategies may work best for those expecting price volatility; either up or down. I have a half-position in D shares and purchased October puts to protect against a downside move.

Please do your own careful due diligence before making any investment decision. This article is not a recommendation to buy or sell any stock. Good luck with all your 2023 investments.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of D either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (7)

I sold D at about the peak (a little above $80, as I remember) after they sold the pipeline and announced the dividend cut. Selling a pipeline and adding offshore wind? And a divvie cut? The company’s foray into wokeness was unlikely to end well for either the company or shareholders. Seemed pretty obvious at the time.My mantra is : “companies go woke, shareholders go broke.” You might think that makes me a “bad investor”, yet, I walked away with a gain, and you’ve probably got a significant paper loss, and are wondering about ANOTHER Dividend cut.Considering a company’s politics is very important to my investing strategy, and it seems to be working pretty well. Good luck with your strategy of remaining (carbon) neutral.